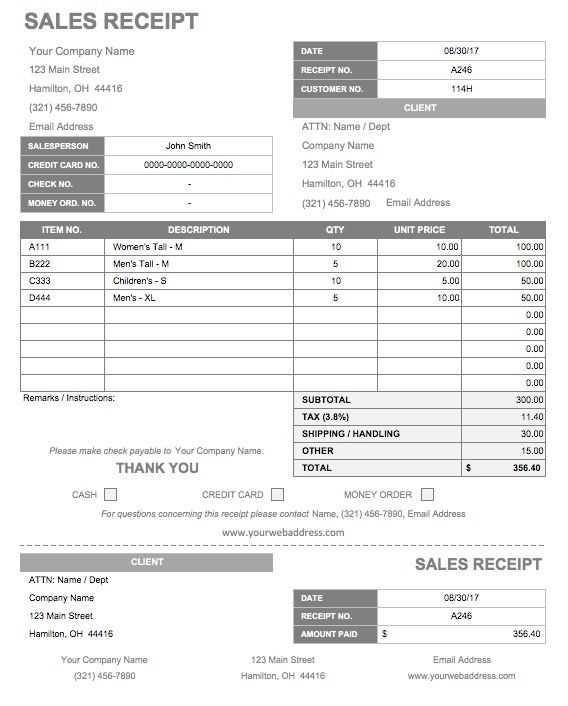

For accurate record-keeping and smooth transactions, a well-structured Alabama auto sales receipt template is crucial. The template should include specific details like the buyer and seller’s full names, vehicle identification number (VIN), make, model, and year of the car. Additionally, including the sale price, taxes, and any applicable fees is necessary to ensure transparency for both parties.

Make sure the date of the sale and the method of payment (whether it’s cash, check, or financing) are clearly outlined. For legal purposes, both the seller and buyer should sign the receipt, confirming their agreement to the terms outlined. Including a brief warranty statement or terms of the sale is also recommended, providing clarity on any post-sale obligations or guarantees.

By using a standardized template, you reduce the likelihood of confusion or disputes after the sale. Customize your receipt based on the specifics of the transaction to avoid overlooking any key details that could be needed for future reference or legal compliance.

Alabama Auto Sales Receipt Template: A Practical Guide

Ensure clarity and legality by using an Alabama auto sales receipt template. Include the date of sale, buyer and seller details, vehicle information (make, model, year, VIN), and purchase amount. The receipt must also list any taxes or fees, as well as payment methods, such as cash, check, or financing details.

Key Elements to Include

In Alabama, a sales receipt should clearly state the sale price, taxes, and any applicable fees. This is required for both private transactions and dealer sales. Always mention the condition of the vehicle and any warranties or disclaimers. If the sale involves a trade-in, include its value as well.

Legal Requirements

Alabama law mandates the inclusion of the buyer’s and seller’s full names and addresses on the receipt. A clear description of the vehicle is also necessary. Make sure the VIN is accurate, as this helps in tracking the vehicle and verifying ownership. Failure to provide accurate details may result in legal complications.

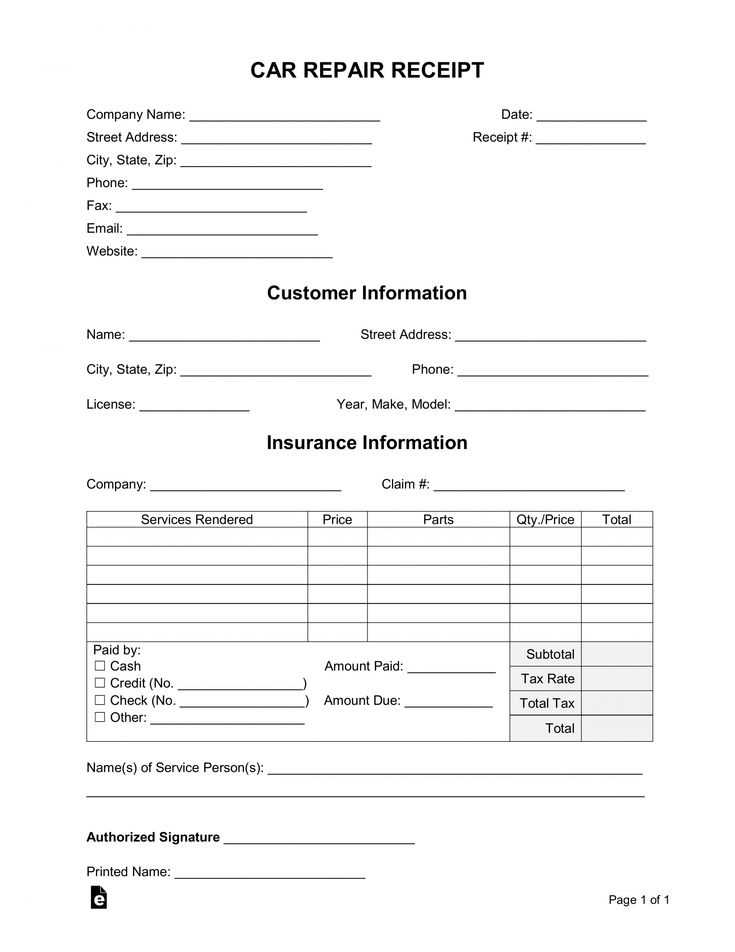

Understanding the Required Fields in an Alabama Auto Sales Receipt

The Alabama auto sales receipt must contain several key pieces of information for both the buyer and seller to ensure compliance with state laws. First, the full names and addresses of both the buyer and the seller are necessary. This helps verify the identities involved in the transaction.

Next, include a clear description of the vehicle being sold. This should include the make, model, year, vehicle identification number (VIN), and any other distinguishing characteristics. Without this detail, the receipt cannot serve its purpose of confirming the vehicle’s identity.

The receipt should also state the total sales price, including any applicable taxes or fees. This breakdown ensures transparency regarding the cost and prevents misunderstandings after the transaction is complete.

A section for the date of sale and the signatures of both parties is required. This formalizes the agreement and marks the official transfer of ownership. Without these, the transaction could be considered incomplete.

Finally, if the vehicle is being sold as-is, it’s important to clearly indicate that no warranties or guarantees are provided. This protects the seller from future claims and ensures the buyer understands the terms of the sale.

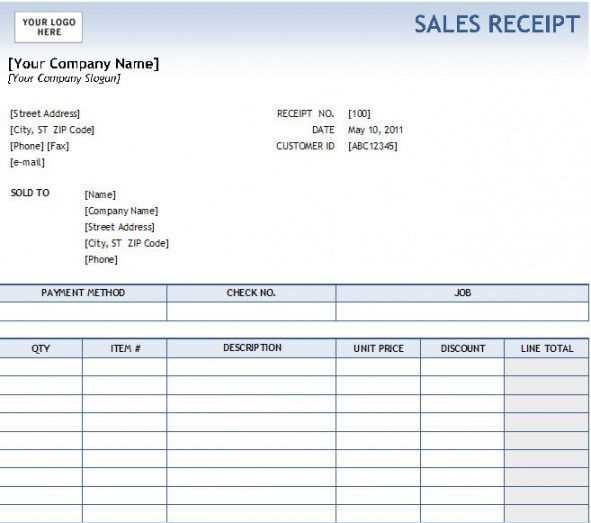

How to Customize the Template for Different Transaction Scenarios

Adjust the receipt template based on the type of transaction to ensure it captures all necessary details. For example, for cash transactions, focus on the amount paid, change given, and the date. If the transaction involves financing, include the loan terms, interest rates, and payment schedule.

- Cash Sales: Highlight the full payment amount and any applicable taxes.

- Financed Transactions: Add fields for down payment, interest rate, loan term, and monthly payments.

- Trade-Ins: Include a section for the vehicle being traded in, its value, and any additional adjustments.

For multiple vehicle purchases, ensure the template can handle more than one item entry, displaying details for each vehicle separately. When a discount is applied, modify the template to clearly show the original price, the discount amount, and the final price after the discount.

- Discounted Sales: Indicate the discount percentage, original price, and discounted price.

- Multiple Vehicle Sales: Add rows for each vehicle with specific pricing details and total them up for a final price.

By customizing the template this way, you can easily adapt it to various transaction scenarios, ensuring accurate documentation for every sale type.

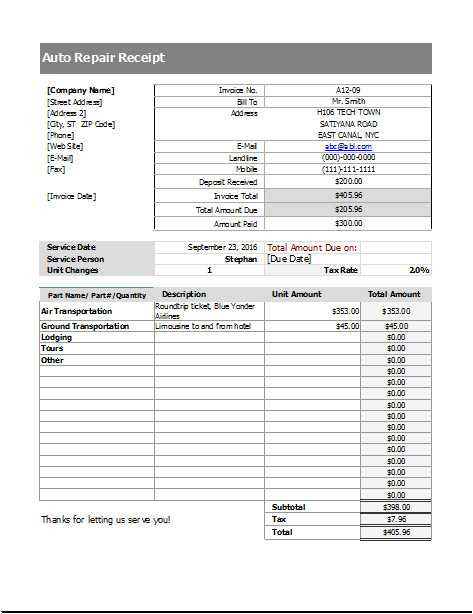

Common Mistakes to Avoid When Using an Auto Sales Receipt Template

One of the most common mistakes is failing to include all necessary vehicle details. Always ensure that the make, model, year, VIN (Vehicle Identification Number), and mileage are clearly listed on the receipt. Missing any of these crucial details can lead to confusion or disputes later.

Another mistake is not specifying the payment method. Clearly stating whether the transaction was completed by cash, credit, check, or financing helps establish a clear record of the transaction. Without this, tracking payments or proving ownership can become difficult.

Incorrect date or incorrect spelling can be easily overlooked but are vital to avoid. Always double-check that the date is accurate and that the buyer’s and seller’s names are correctly spelled. Small errors like these can create complications if the receipt is ever needed for legal or financial purposes.

Omitting signatures is another error that may cause issues. Both the buyer and seller should sign the receipt. This validates the document and ensures both parties acknowledge the details and terms of the sale.

Lastly, do not forget to include the total sale amount, including taxes and any additional fees. Ensure that these are broken down clearly. Hiding or failing to detail extra charges can lead to confusion, especially if a dispute arises later.