Loan Payment Receipt Template: Key Elements

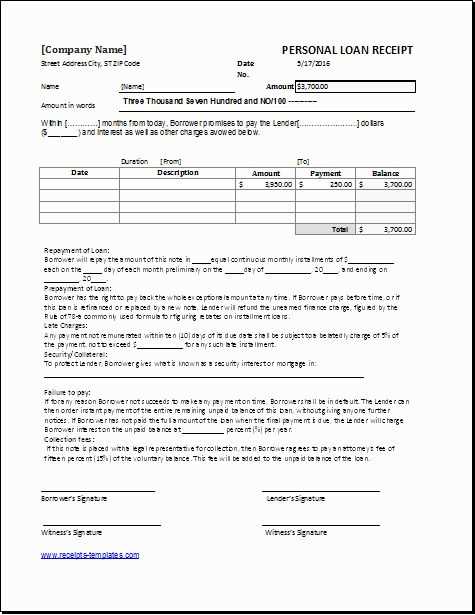

When creating a loan payment receipt, make sure it includes the following key elements:

- Borrower Information: Include the name, address, and contact details of the borrower.

- Lender Information: Provide the lender’s name and contact details.

- Payment Date: Specify the exact date the payment was received.

- Loan Details: Include the loan amount, interest rate, and any outstanding balance.

- Payment Amount: Clearly state the amount paid during this particular transaction.

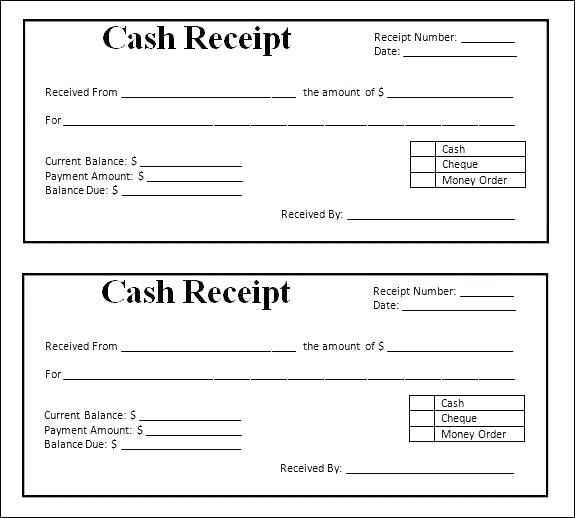

- Payment Method: Mention the payment method (cash, cheque, bank transfer, etc.).

- Remaining Balance: Indicate the current balance remaining on the loan after the payment.

- Signature: Have a space for both the borrower and the lender to sign, confirming the transaction.

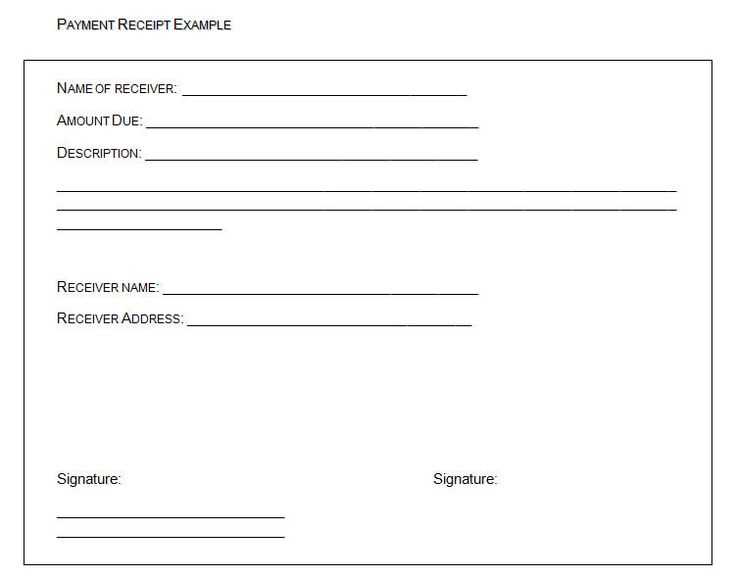

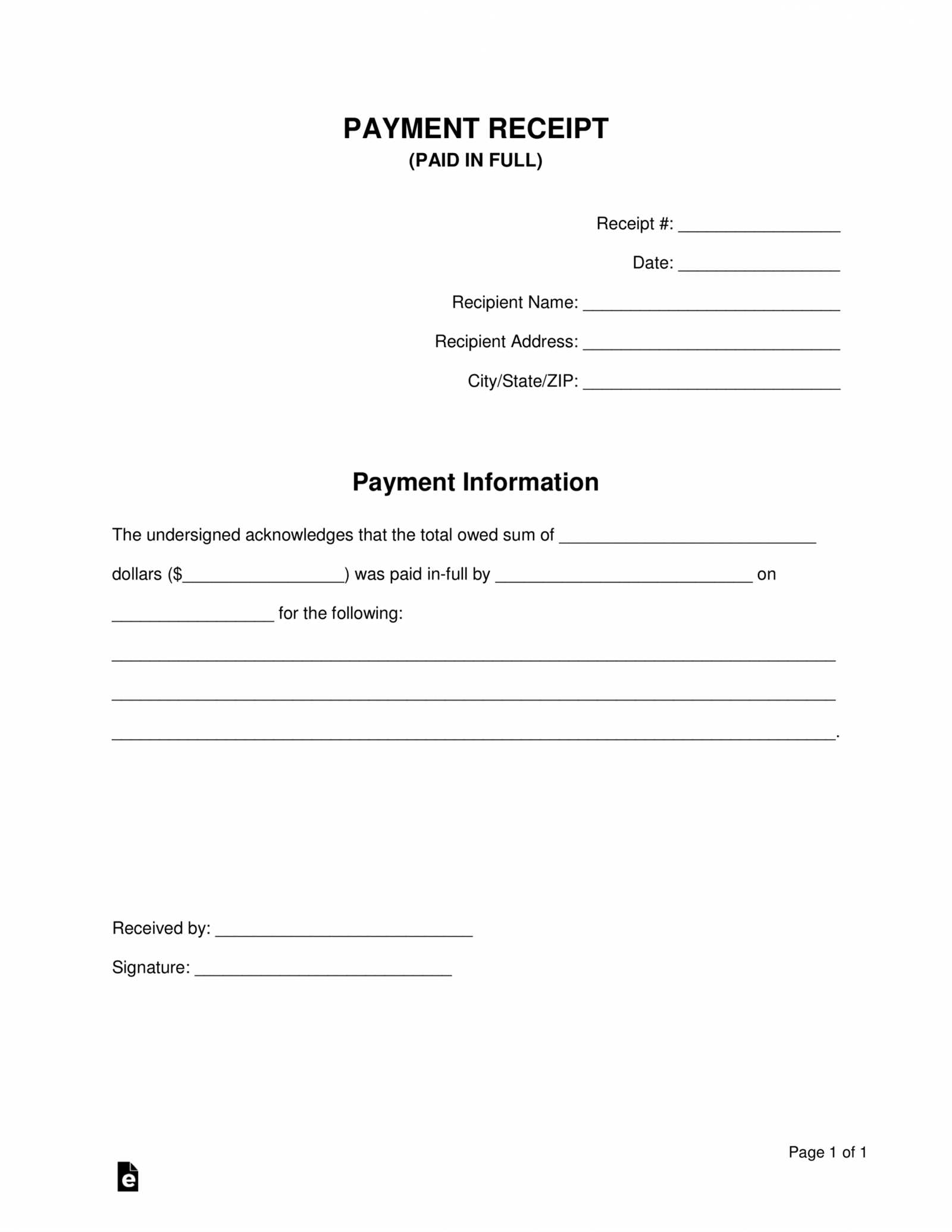

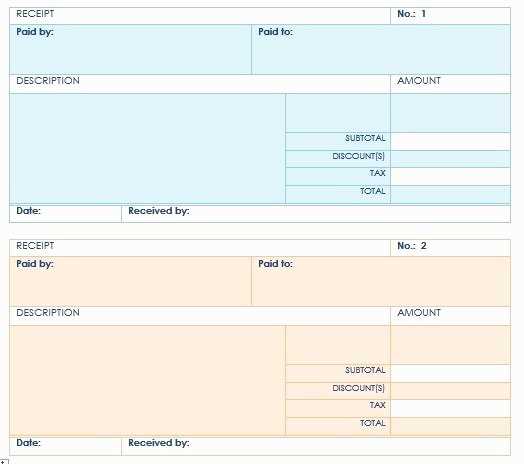

Sample Template

Below is a simple example of a loan payment receipt template:

Loan Payment Receipt Borrower Information: Name: [Borrower's Name] Address: [Borrower's Address] Contact: [Borrower's Phone/Email] Lender Information: Name: [Lender's Name] Address: [Lender's Address] Contact: [Lender's Phone/Email] Payment Date: [DD/MM/YYYY] Payment Method: [Cash/Cheque/Bank Transfer] Amount Paid: $[Amount] Loan Amount: $[Original Loan Amount] Interest Rate: [Interest Rate]% Remaining Balance: $[Remaining Balance] Both parties confirm the payment: Borrower Signature: ________________ Date: ________________ Lender Signature: ________________ Date: ________________

Using the Template

Ensure all fields are completed with accurate and current information. The receipt should be signed by both parties to confirm the transaction. Keeping this receipt for future reference is recommended for both borrower and lender.

Template of Loan Payment Receipt

How to Structure a Loan Payment Receipt

A loan payment receipt should include key information to ensure clarity for both parties. The document must list the borrower’s name, the lender’s name, and the date of the transaction. Clearly state the loan amount being paid, the remaining balance, and the payment method used (e.g., cash, check, or bank transfer). Include a unique receipt number for reference, and ensure the signature of the lender or authorized representative to validate the receipt. Optionally, a brief description of the loan terms and any applicable interest should be noted for full transparency.

Common Loan Payment Formats and Their Uses

There are several common formats for loan payment receipts, including printed and electronic versions. Printed receipts are typically given immediately after the payment is processed, especially for in-person transactions. Electronic receipts, often sent via email or available through online banking systems, are commonly used for digital payments. Each format should retain the essential details mentioned earlier, with the primary distinction being the medium of delivery and record-keeping.

Legal Considerations When Issuing a Payment Receipt

When issuing a loan payment receipt, it’s important to consider local laws regarding documentation and record-keeping. In some jurisdictions, both parties may be required to retain a copy for tax reporting purposes or legal compliance. Ensure that the receipt clearly states the terms of the payment, as this could be used as evidence in case of future disputes. Always check that the document meets any regulatory requirements specific to your region or industry.