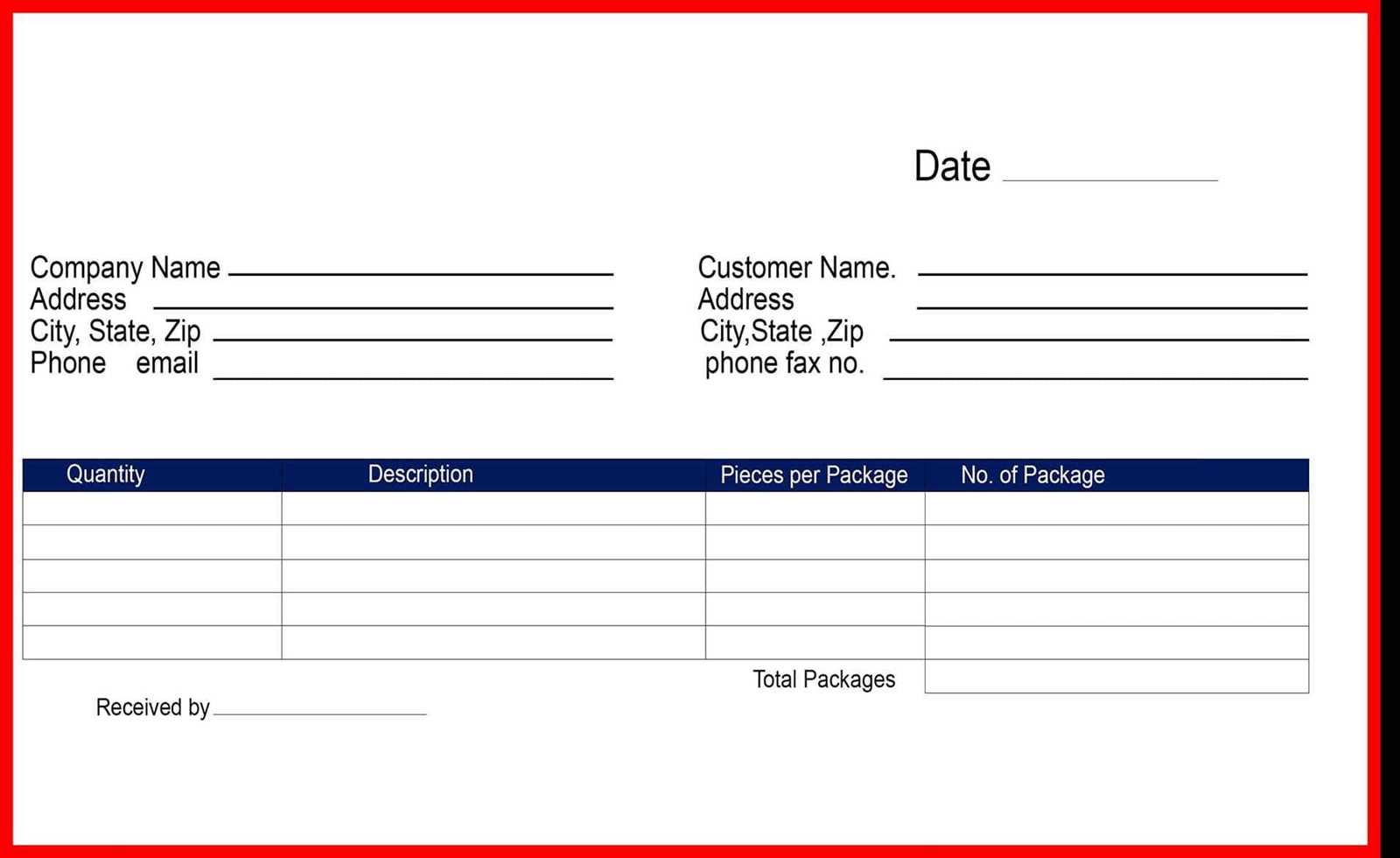

For a clean and accurate record of transactions, a brokerage receipt template can save time and prevent errors. Begin by clearly listing the key details: the buyer and seller’s names, transaction date, and the total amount. These details should always be at the top of the template, ensuring quick access and clarity.

Include a description of the transaction type. Whether it’s a sale of stocks, bonds, or other financial instruments, specify exactly what was traded. Break down the commission or fee charges in a separate section to avoid confusion, and always calculate the net amount received after deductions. This transparency benefits both parties and ensures smooth communication.

Be sure to include any relevant taxes. Depending on your location, taxes could be an important factor in the transaction. Make sure the tax rate applied is clearly shown, alongside the total amount of taxes collected. Having this visible will help both you and the client keep accurate financial records for tax reporting.

Sure, here is a version of the text with reduced repetition while keeping the meaning intact:

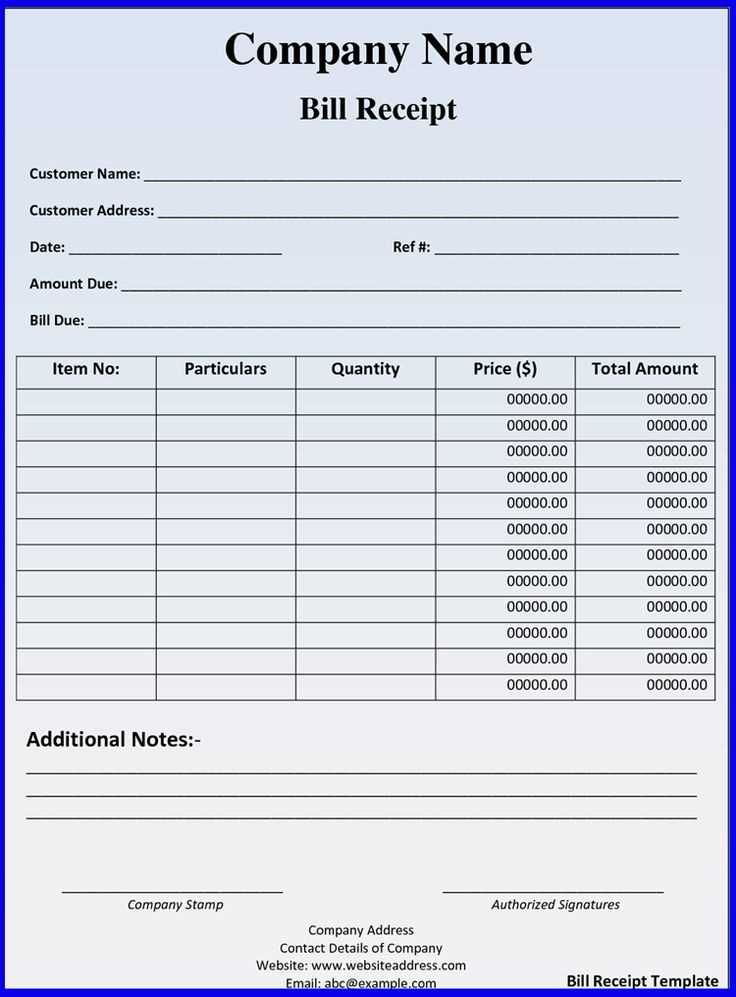

When creating a brokerage receipt, clearly list the transaction details. Include the buyer’s and seller’s names, transaction date, and a description of the assets involved. Indicate the quantity, price, and total amount. Ensure the commission fee is specified and clearly distinguished from other charges. Additionally, note any taxes or regulatory fees that apply. Keep the format simple but detailed enough for transparency and future reference.

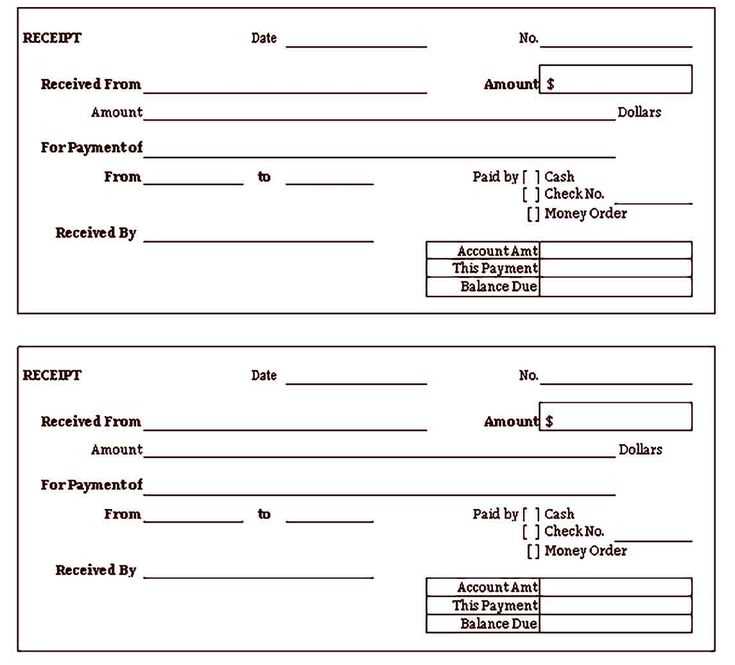

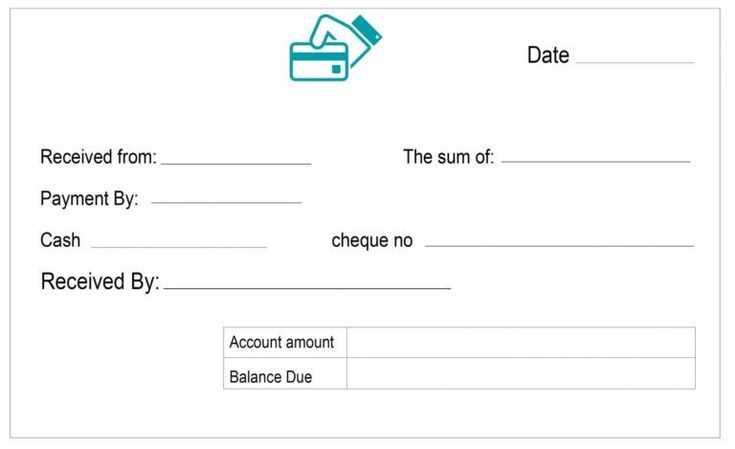

Break down the payment structure, showing how much was paid and by whom. If there are multiple payments or deposits, list them individually with corresponding dates. Attach any relevant identification numbers or account references to verify the transaction. Lastly, include the signature of the broker or authorized person, confirming the authenticity of the transaction.

Brokerage Receipt Template: A Complete Guide

Essential Components of a Brokerage Receipt

How to Personalize Your Receipt Template

Legal Considerations for Brokerage Receipts

Including Transaction Information Correctly

Formatting Tips for Brokerage Receipts

Common Errors to Avoid in Brokerage Receipts

A well-structured brokerage receipt can streamline your record-keeping and ensure you meet all legal and operational requirements. Here’s what you should focus on when creating and customizing your template.

Key Elements of a Brokerage Receipt: Include the broker’s name and contact details, the date of the transaction, the buyer’s or seller’s information, and a description of the transaction (including asset details). Add the transaction type (purchase or sale), the quantity of assets involved, and the agreed-upon price per unit or total price. Also, don’t forget to add any applicable taxes, fees, or commissions.

Personalizing Your Receipt Template: Customizing the template allows you to fit your business needs. Start by adjusting the layout to match your company’s branding, including your logo and any specific company information. You can also modify the receipt fields to include additional details, like payment method or special conditions, depending on what your business requires.

Legal Considerations: Make sure that the receipt complies with relevant financial regulations and taxation laws. Verify that all mandatory information, such as transaction details and fees, is properly disclosed. You may also need to include any disclaimers or terms that are necessary for your legal protection.

Transaction Information Accuracy: Double-check all transaction data, such as the asset name, quantity, and price, to avoid any errors. Incorrect transaction information could lead to disputes or delays, so always ensure the details are clear and precise. It’s also wise to include a unique receipt number for tracking purposes.

Formatting Tips: Keep the layout clean and simple. Use easy-to-read fonts and separate key sections with clear headings. Ensure the receipt is legible, with enough space between text for clarity. Avoid cluttering the receipt with unnecessary information or overly complex formats.

Common Mistakes to Avoid: Common errors include missing transaction data, unclear formatting, or omitting taxes and fees. Always verify the amounts and ensure that the receipt is formatted consistently to avoid confusion. Another mistake is failing to update the template regularly as regulations or your business requirements change.