To make your transactions smooth and transparent, using a free template for a receipt of deposit is a practical solution. This document serves as a written confirmation of a deposit made, providing both the payer and payee with important details, such as the amount, date, and purpose of the deposit.

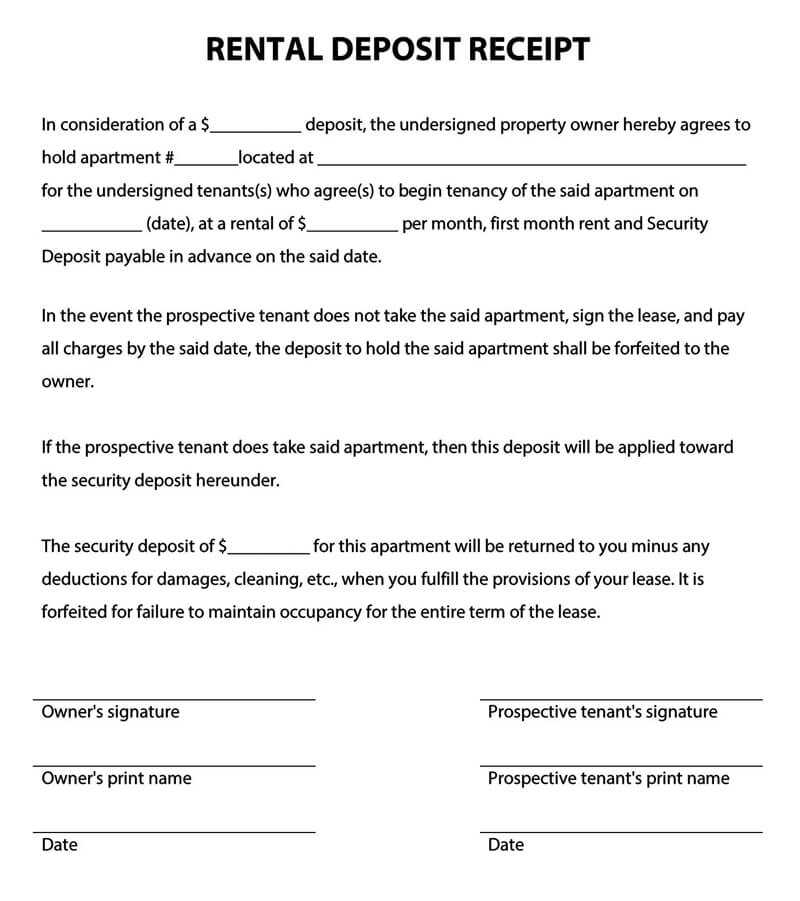

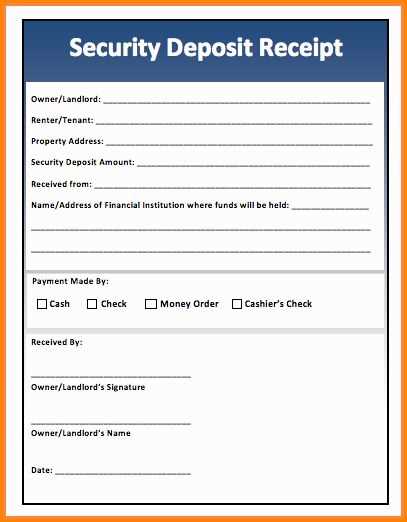

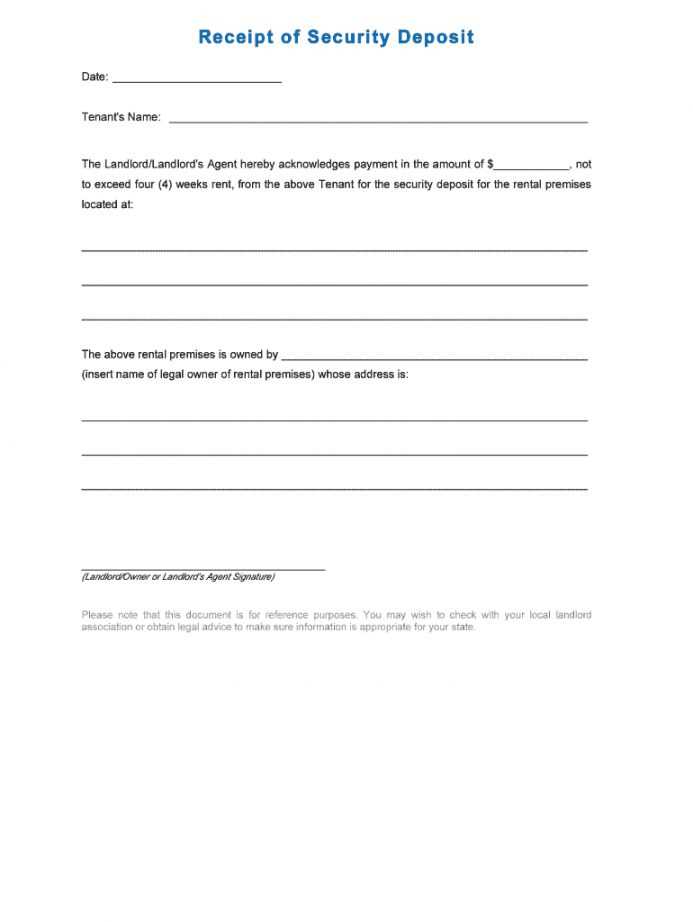

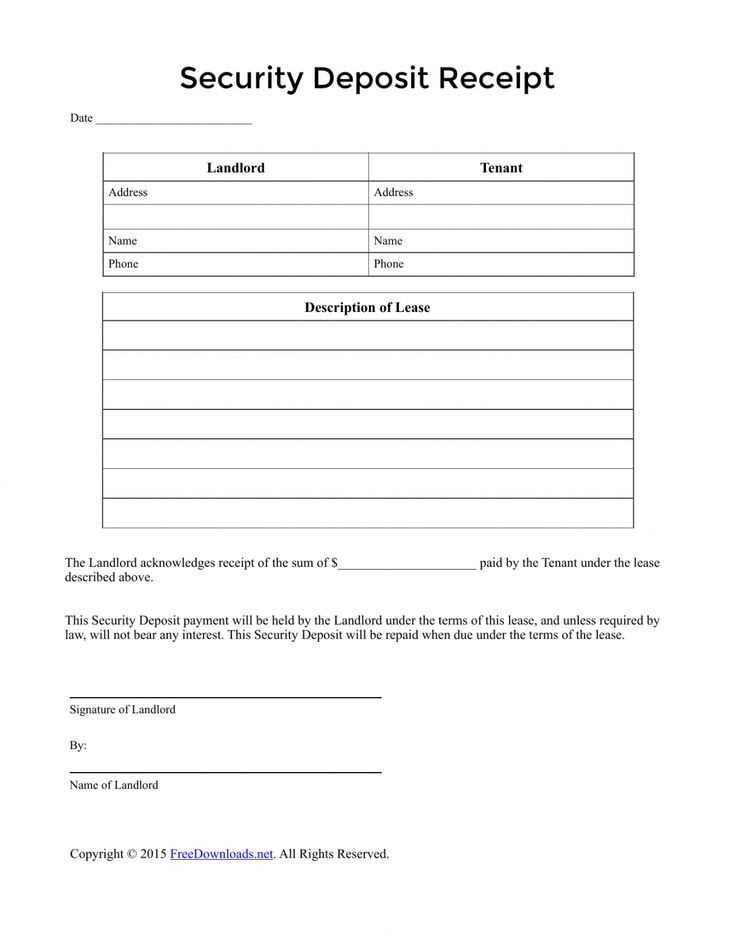

Key details that should be included in the template are the name and contact details of the parties involved, the amount of the deposit, and the method of payment used. The receipt should also indicate any agreed-upon terms, such as whether the deposit is refundable and the deadline for further actions.

Using a free template not only saves time but also ensures that the necessary legal requirements are met. It simplifies record-keeping and adds a layer of professionalism to your financial dealings. With a clear, standardized format, you can confidently handle deposits in any situation, whether for renting property, securing a service, or confirming a loan agreement.

Sure! Here’s the improved version with repetitions minimized:

For a clear and effective receipt of deposit, start by specifying the amount clearly. The receipt should include both the payment method and date. Use a simple structure to avoid confusion. Ensure that the recipient’s name and the purpose of the deposit are explicitly mentioned.

Details to Include

The receipt must show the amount of the deposit, as well as the payment method, such as cash, check, or bank transfer. It’s crucial to specify the date and the terms agreed upon for the deposit. The receipt should also list the full name of the payer and the payee for clarity.

Tips for Clarity

Keep the language simple and direct. Avoid using unnecessary jargon or lengthy explanations. A clear summary of the transaction ensures both parties understand the terms and conditions of the deposit. Make sure the document is easy to store and retrieve for future reference.

- Free Template for Deposit Receipt

Using a free deposit receipt template can save you time and ensure you include all necessary details when documenting a transaction. It eliminates the need to create a document from scratch and helps maintain consistency across your records. Make sure the template includes essential elements like the date, amount, the name of the payer, and the purpose of the deposit.

Key Elements of a Deposit Receipt Template

Ensure the template covers the following details:

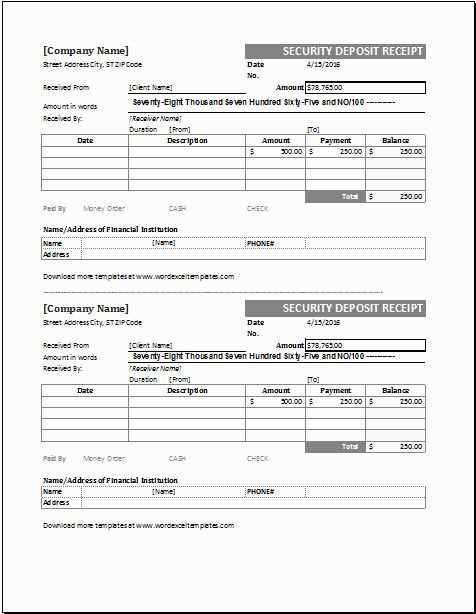

- Receipt Number: A unique identifier for the transaction.

- Date: The date the deposit is received.

- Amount: The exact sum of the deposit.

- Payer’s Information: Full name or business name, address, and contact details.

- Purpose of Deposit: Clear indication of the reason for the deposit (e.g., rental payment, service deposit).

- Method of Payment: Specify whether the payment was made via check, cash, or bank transfer.

- Signature: Both parties’ signatures to validate the transaction.

How to Use the Template

Simply download a free deposit receipt template, fill in the fields with accurate information, and save it for your records. Always ensure that both the payer and the recipient receive a copy of the signed document for their own records. Keep a digital copy for easy access in the future. This approach provides clarity and protects both parties in the event of a dispute.

To make a deposit receipt template work for your business, focus on incorporating specific details that align with your brand and transaction practices. Here’s how:

- Include your business name, address, and contact details at the top. This ensures the receipt is easily identifiable and helps in future reference.

- Add a clear section for the deposit amount, along with the payment method (e.g., cash, credit card, or check). Make sure the amount is prominently displayed for easy verification.

- Include a unique receipt number for tracking purposes. This helps organize records and simplifies the search process when needed.

- Provide a description of the reason for the deposit, such as “Advance Payment for Services” or “Security Deposit.” This reduces confusion for both parties.

- Ensure the date and time of the transaction are recorded to maintain accurate financial records.

- Add your business’s logo and colors for consistency with your other documents and branding. This provides a professional touch to your receipts.

Finally, tailor the template by adding any legal or compliance information required in your location, such as tax details or refund policies. This customization ensures the receipt serves your business’s specific needs and communicates all necessary information to the customer effectively.

List the names and contact information of both the payer and the recipient. Include the amount of the deposit and the exact date of the transaction. Mention the purpose of the deposit, such as a security deposit, advance, or partial payment.

Specify the payment method used, whether it’s cash, check, bank transfer, or credit card. If applicable, provide any specific terms related to the deposit, such as refund conditions or restrictions.

Include a reference number or transaction ID for easy tracking. Lastly, add a section for signatures, where both parties can confirm the details of the deposit and acknowledge the receipt of funds.

Using a receipt template helps ensure clear documentation of transactions, making it easier to verify payments and avoid misunderstandings. It is especially beneficial for legally binding agreements and financial record-keeping. By using a standardized format, you can provide all necessary details without omissions, which safeguards both parties involved.

Steps to Effectively Utilize a Receipt Template

Fill in the essential fields accurately. Include the name of the payer, payee, payment amount, date, and payment method. Specify any terms related to the transaction, such as deposit or installment, as this provides a clear record. Ensure the template includes both signatures, if required, to confirm the legitimacy of the transaction. Always check for any local legal requirements that might affect the format or contents of the receipt.

Why Accuracy in Using a Receipt Template Matters

Providing precise details minimizes confusion and establishes clear financial boundaries. A well-filled receipt ensures that both parties have proof of the transaction, which is useful for disputes, tax purposes, or audits. It can also help in tracking payments across multiple transactions, offering a detailed history for both payer and payee.

Let me know if you’d like any further adjustments!

Ensure the receipt of the deposit is clear and specific. Include the deposit amount, the date it was received, and the purpose of the deposit. Make sure the deposit is properly referenced in your agreement or terms to avoid confusion later. Always include the method of payment, such as cash, check, or bank transfer, to provide clarity. Consider adding a clause on what happens in case of non-payment or if the deposit is refundable. It’s also beneficial to outline the next steps after the deposit is received, such as confirmation of services or delivery.