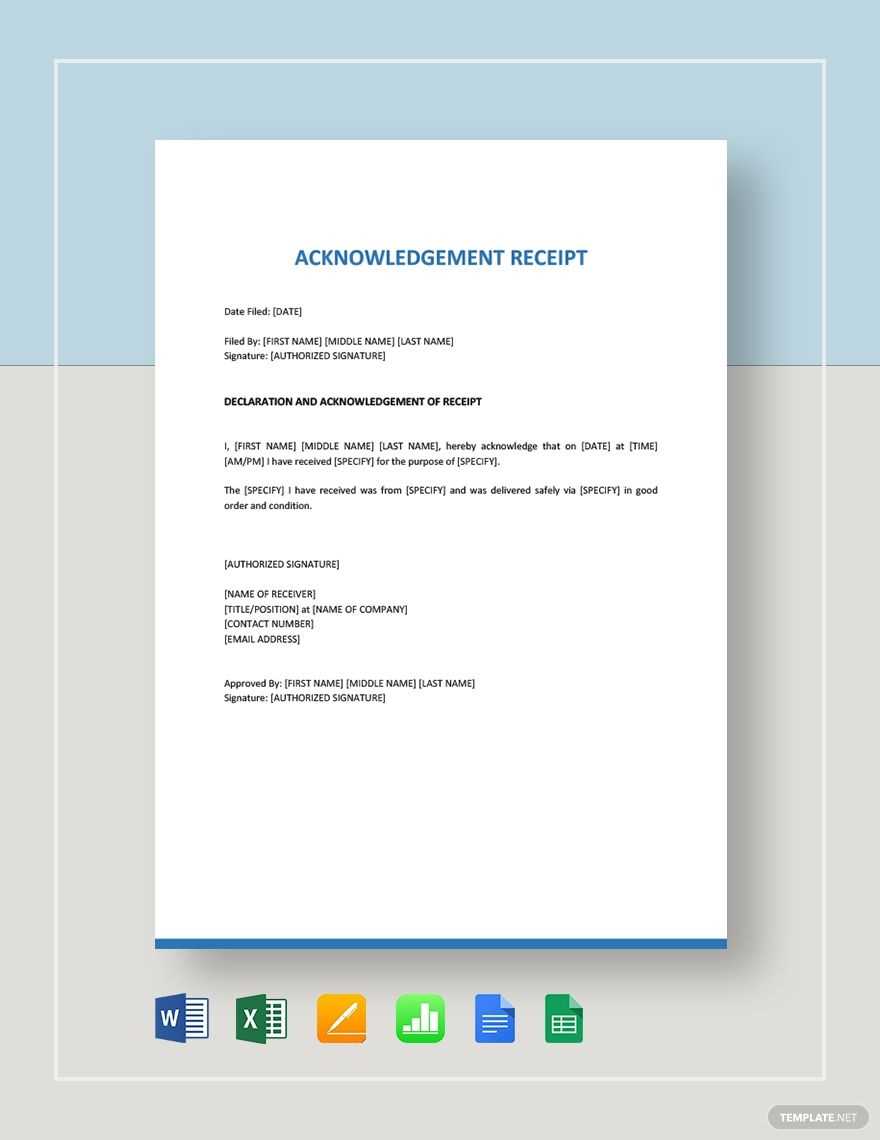

When creating an acknowledgement receipt, clarity and precision are key. This document serves as confirmation that a specific item or service has been received. The template should clearly outline the details of the transaction, ensuring both parties have a shared understanding of what was exchanged.

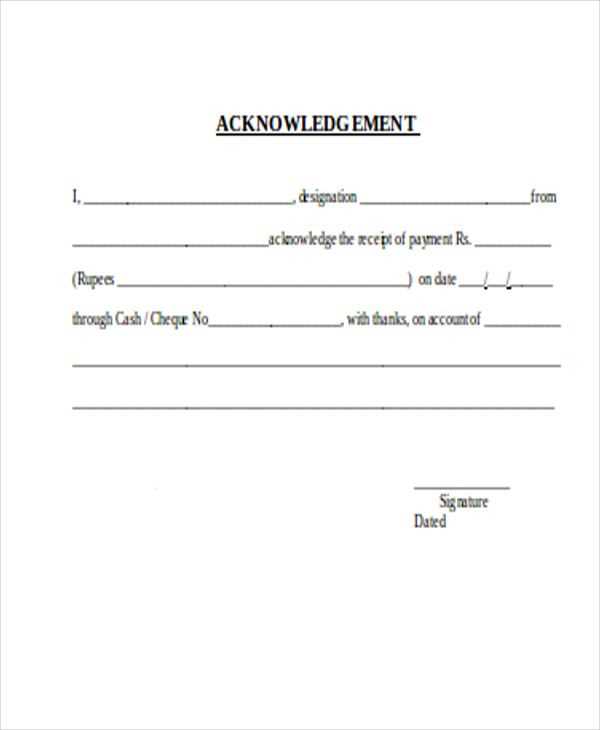

Start with the basic information such as the date, name of the recipient, and the sender. This ensures that both parties know exactly when the receipt was issued. Include a brief description of what has been received, whether it’s a product, document, or payment.

Ensure that the terms are clear. Specify any conditions related to the receipt, such as whether the item is in good condition or if there are any pending actions from the recipient. The signature of the recipient adds a layer of confirmation, making the receipt valid and official.

Lastly, it’s important to keep the format simple and straightforward, focusing on the facts of the exchange. A receipt should leave no room for ambiguity, allowing both parties to refer to the document when necessary.

Here are the revised lines with the repetitions removed:

To streamline your acknowledgment receipt, focus on clarity and simplicity. Avoid redundant statements that don’t add value. Each line should convey its purpose concisely and directly. For instance, instead of repeating phrases like “I have received the following items” and “I confirm receipt of the items,” simplify it to “I confirm receipt of the following items.” This eliminates unnecessary repetition, making the document more professional and easier to read.

Common Mistakes to Avoid

Repetition in acknowledgment receipts can lead to confusion and make the document look unprofessional. Always aim for clear, direct language. If you find yourself repeating ideas or words, consider rephrasing or removing them to ensure the document remains to the point.

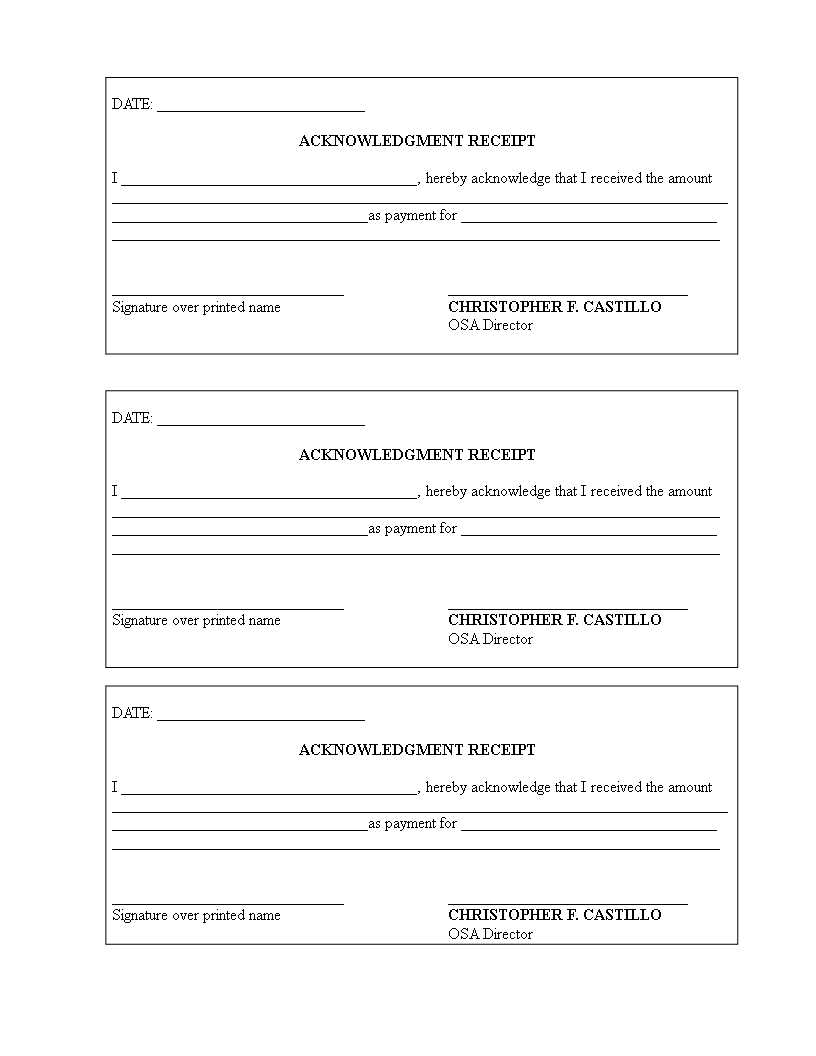

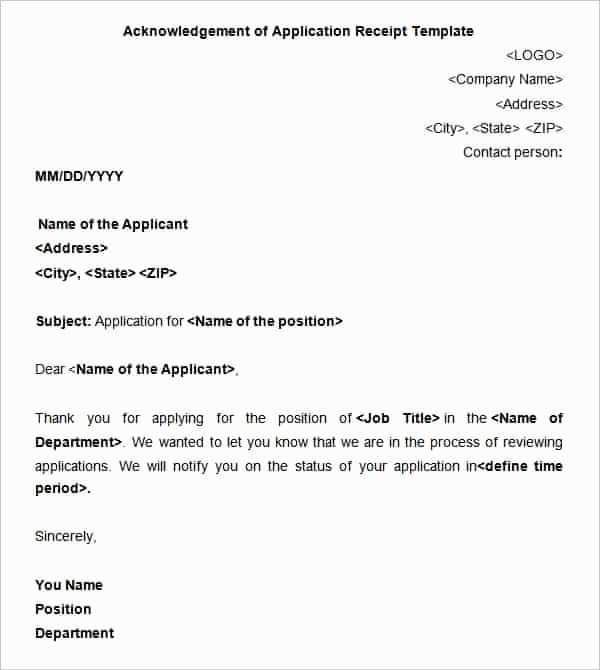

- Sample Template of Acknowledgement Receipt

Use the following template to create a clear and concise acknowledgment receipt. This structure captures all necessary information for the transaction.

| Receipt Number | 001234 |

|---|---|

| Date | February 12, 2025 |

| Received From | John Doe |

| Amount Received | $2,500.00 |

| Payment Method | Bank Transfer |

| Received By | Jane Smith |

| Signature | _____________________ |

| Purpose | Payment for services rendered in January 2025 |

Ensure that all fields are filled out accurately. This template helps keep a clear record of financial transactions, making it easy to track payments and avoid misunderstandings.

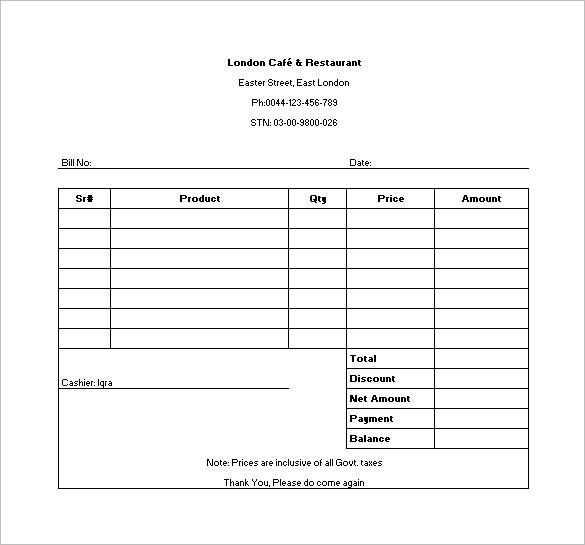

Start by including the transaction date and the names of the parties involved. Clearly describe the item or service exchanged and specify the total amount paid. Mention the payment method, whether it’s cash, check, or any other method, and provide a space to note any remaining balance, if applicable.

Ensure that both parties sign the receipt to confirm agreement to the terms. If relevant, include any additional details, such as warranty or return policies. Keep the format neat and straightforward for easy reference.

Use a clear, concise structure. Acknowledge receipt of goods or services, and if necessary, add conditions or clauses to protect both parties. This helps prevent misunderstandings and provides a simple record of the transaction.

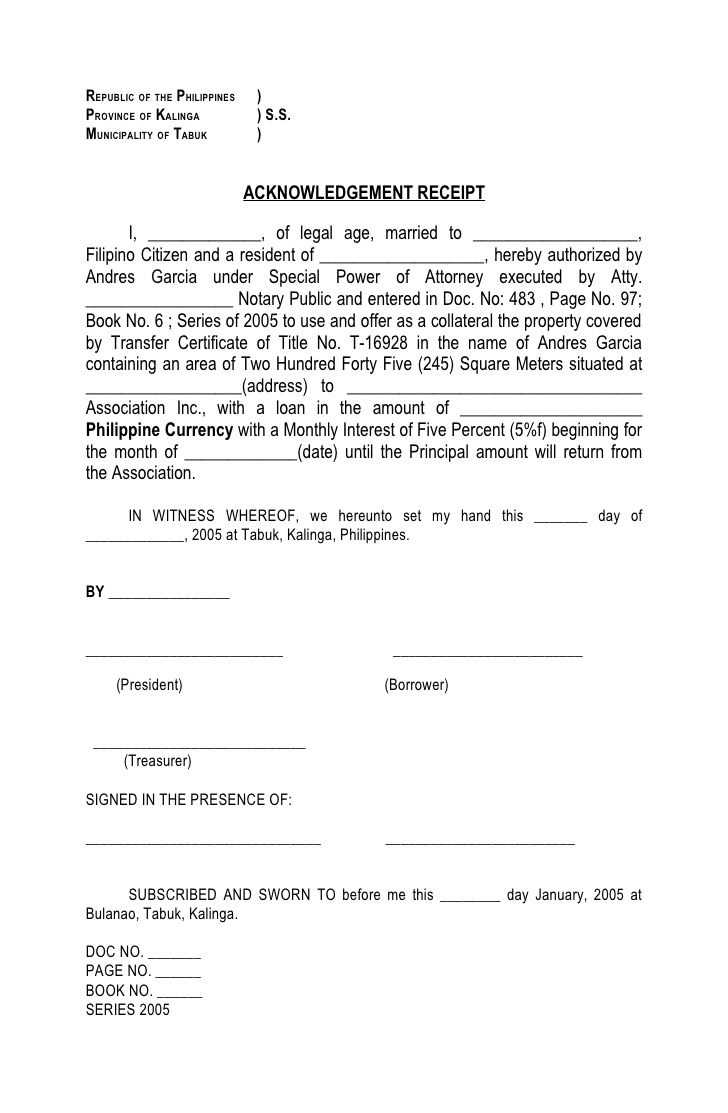

Include the purpose of the receipt. Specify what is being acknowledged, whether it’s payment, a product, or a service, and the date of receipt. Identify both parties involved–the one giving and the one receiving–by full names or legal titles.

Provide a detailed description of the item or service received. This includes quantities, model numbers, or any other relevant identifying information to avoid confusion.

Clearly state the amount or value of the transaction, including the currency. For payments, list the full amount received and any remaining balance if applicable.

Include the method of payment or delivery. Whether it was by cash, check, or electronic transfer, document the payment method for clarity.

Space for signatures from both parties is necessary. Both individuals should sign and date the receipt to confirm mutual agreement and acknowledgement of the transaction.

If there are terms, warranties, or conditions attached to the transaction, mention them. This ensures both parties are aware of their rights and obligations moving forward.

Always double-check the amount. Small errors in numbers can cause significant issues. Ensure all amounts are correct, and remember to include decimals when applicable.

- Don’t forget to specify the transaction date. An incorrect or missing date can lead to confusion in the future, especially if there are any disputes or returns.

- Provide a clear and detailed description of each item or service provided. Avoid vague terms like “goods” or “services.” Be specific so both parties know exactly what was exchanged.

- Include the payment method. Whether it’s cash, credit, or other methods, clearly state how the payment was made.

- Make sure the recipient’s information is accurate. This includes their full name and, if necessary, address. Small errors can lead to complications with future communication or processing.

- Don’t leave out your contact details. Always include a way for the recipient to get in touch with you if they need further clarification.

Correcting these common mistakes will help ensure that your receipts are clear, professional, and dispute-free.

When creating an acknowledgement receipt template, ensure it is clear and simple. Use a standard format that includes the necessary details, such as the name of the receiver, the date of receipt, and a description of the item or service being acknowledged.

Key Elements

Acknowledge the transaction by specifying the item received, including any relevant identifiers like serial numbers or dates. Add a statement that confirms the receipt of the item and provide a space for the receiver’s signature.

Clear Formatting

For readability, organize the content in bullet points or numbered lists. This will make the document more accessible and prevent confusion. A clean layout with clearly defined sections is crucial for easy reference.