A security deposit receipt in Illinois serves as a written acknowledgment from the landlord that they have received a tenant’s deposit. This document is essential for both parties as it sets clear terms for the handling of the deposit throughout the lease period and ensures transparency regarding potential deductions at the end of the tenancy.

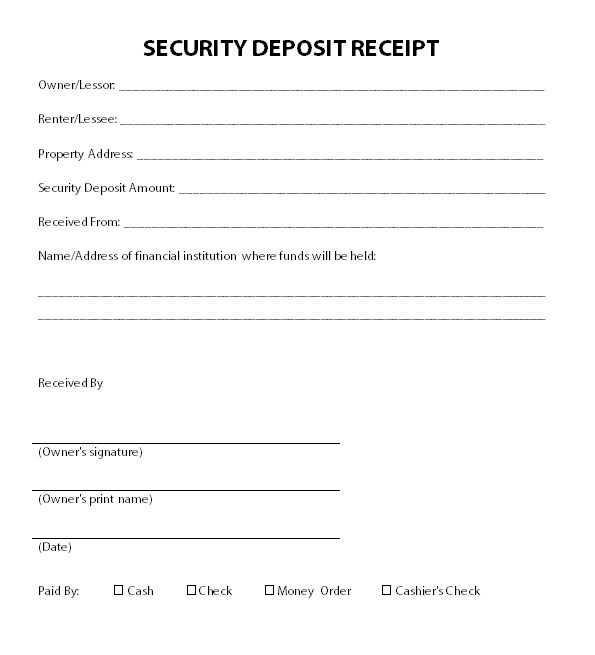

To create an effective security deposit receipt, it’s important to include specific details such as the amount of the deposit, the date it was received, the tenant’s name, and the address of the rental property. Additionally, the receipt should outline any terms related to how the deposit may be used, such as deductions for damages or unpaid rent, in accordance with Illinois law.

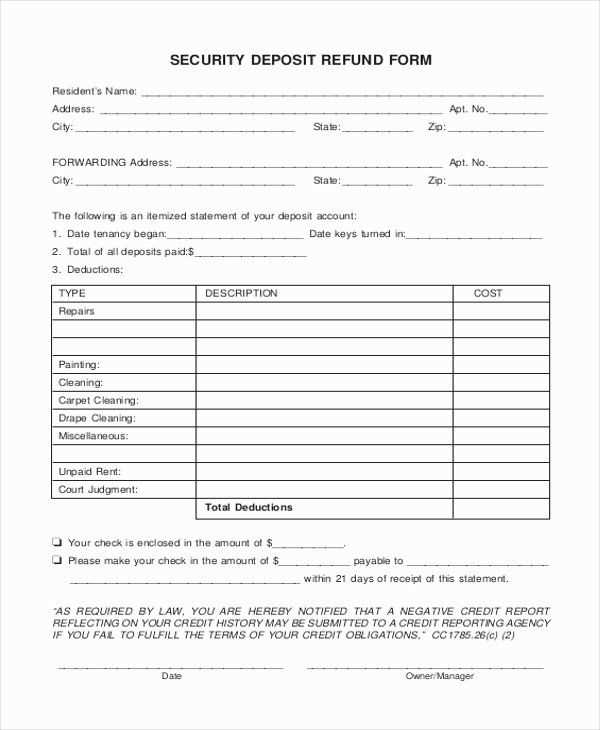

Landlords are required to return the security deposit, minus any lawful deductions, within 30 days after the tenant vacates the rental property. If any deductions are made, a detailed breakdown must be provided to the tenant. This receipt protects both the tenant’s and landlord’s rights, helping to avoid disputes regarding the return of the deposit.

To streamline the process, a well-organized template can ensure all necessary information is covered. It is advisable to provide the tenant with a copy of the receipt immediately upon receipt of the deposit to keep everything on record.

Here’s the revised text with removed word repetitions:

When drafting a security deposit receipt in Illinois, clarity is key. Ensure the receipt includes the following information:

- Tenant’s full name

- Landlord’s or property manager’s name

- Property address

- Amount of the deposit received

- Date the deposit was received

- Purpose of the deposit

Each section should be easy to understand, and any terms that may confuse the tenant should be explained in plain language. The receipt should be signed and dated by both parties. This helps protect the rights of both tenants and landlords.

Security Deposit Terms

The receipt should also include the terms of the deposit, such as whether it will be returned with interest, how deductions for damages will be handled, and the timeline for returning the deposit after the lease ends. Be sure to specify any non-refundable portions.

Additional Tips

- Double-check all information for accuracy.

- Include a clause about any circumstances under which the deposit may not be returned.

- Make sure the tenant receives a copy immediately after payment is made.

Security Deposit Receipt Template for Illinois

In Illinois, a security deposit receipt should include specific details to protect both the landlord and the tenant. Use the following guidelines to ensure your receipt complies with Illinois law:

- Tenant’s Information: Include the tenant’s full name and address. This is crucial for identification purposes.

- Property Details: Clearly list the address of the rental property, including unit number, if applicable.

- Deposit Amount: State the exact amount of the security deposit paid. This helps avoid any future misunderstandings.

- Payment Method: Indicate the method of payment used, such as check, money order, or cash. If applicable, provide a reference number for payment verification.

- Date of Payment: Always include the date the deposit was received. This establishes a clear record of when the payment was made.

- Landlord’s Information: Include the landlord or property manager’s full name and contact information. This ensures that the tenant knows whom to contact for any future inquiries.

- Signatures: Both the landlord and tenant should sign and date the receipt to confirm the transaction. This provides proof of agreement for both parties.

- Statement of Conditions: It’s advisable to include a brief statement about the condition of the property at the time of move-in. This can serve as a reference point when assessing any damages at the end of the lease.

Ensure the receipt is clear and professional, reducing the risk of disputes. The state of Illinois does not require a specific form, but adhering to these guidelines will provide clarity and security for both parties involved.

To create a security deposit receipt in Illinois, include key details: tenant’s name, landlord’s name, property address, amount paid, and date of payment. Clearly specify that the payment is for a security deposit, and ensure the receipt states whether the deposit is refundable or non-refundable. If applicable, note any conditions or deductions that may affect the refund.

Additionally, include a section about the interest rate (if required) on deposits held for over one year. Illinois law mandates that the deposit return must happen within 30 to 45 days after the lease ends, depending on whether deductions are made. Ensure your receipt reflects this timeline, showing the return date or any deductions for damages or unpaid rent.

It’s helpful to have both the tenant and landlord sign the receipt, confirming mutual acknowledgment of the terms and conditions. If the receipt is provided electronically, make sure it is easily accessible and contains all the required information for clarity and legal purposes.

When issuing a receipt for a security deposit in Illinois, include the following legal elements to ensure clarity and compliance with state laws:

1. Tenant and Landlord Information

Clearly list the names and contact information of both the landlord and the tenant. Include the full legal names of both parties and addresses for correspondence. This will help establish the relationship and accountability of both individuals in the event of any disputes.

2. Amount of the Deposit

Specify the exact amount of the security deposit received from the tenant. Make sure the amount matches what was agreed upon in the lease or rental agreement. If the tenant paid any additional fees related to the deposit, such as cleaning fees, itemize them separately.

3. Property Address

Clearly state the full address of the rental property. This ensures there is no confusion about the property for which the security deposit is being held.

4. Date of Deposit

Record the exact date when the security deposit was paid. This helps establish a timeline for return and also ensures compliance with Illinois’ laws regarding the return of deposits within a specific period after the lease ends.

5. Purpose of the Deposit

Note the intended use of the deposit, which is generally for covering damages or unpaid rent. Illinois law requires landlords to return the deposit within 45 days of lease termination, minus any deductions. Including this in the receipt helps clarify the purpose and expectations for both parties.

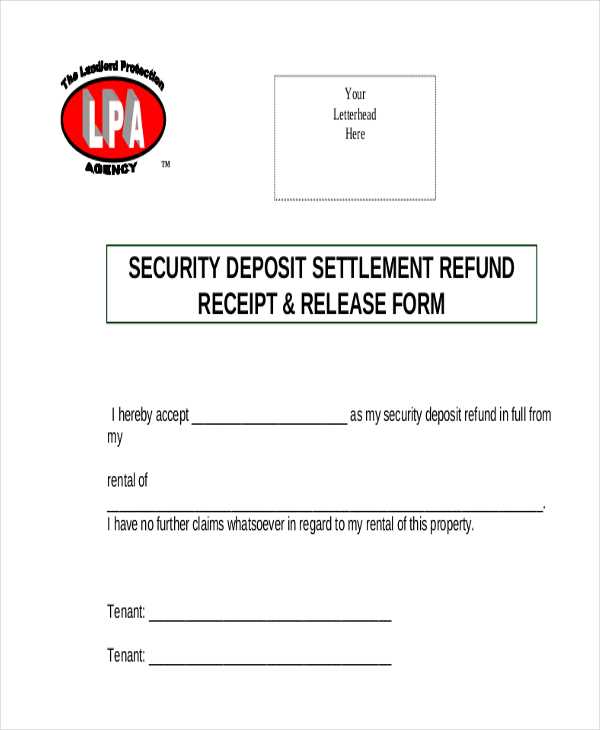

6. Conditions for Return

Outline the conditions under which the deposit will be refunded. For example, indicate that the deposit will be returned if the property is left in good condition with no unpaid rent. Providing this information prevents misunderstandings at the end of the tenancy.

7. Deductions and Documentation

If any part of the deposit will be withheld, note the specific reasons and provide a description of the damages or unpaid rent. Illinois law requires itemized lists of damages and their costs, so keeping this clear is critical to avoiding disputes.

8. Signatures

Both the tenant and landlord should sign the receipt. This confirms that both parties agree to the terms and the amount of the security deposit. Without signatures, the receipt may not hold legal weight in a dispute.

Ensure you include all required details on the security deposit receipt. Missing information, such as the tenant’s full name, the rental property address, or the deposit amount, can lead to confusion or legal disputes. Double-check that these basic facts are clearly stated.

Failure to Specify the Deposit Terms

Don’t forget to clearly state the terms under which the security deposit is held. This includes details like the conditions for refunding the deposit, potential deductions, and the timeline for returning it. Illinois law requires landlords to return the deposit within 45 days, or provide an itemized list of damages that justify deductions. Make sure your receipt reflects these timelines and conditions.

Not Providing a Copy to the Tenant

Always give a copy of the receipt to the tenant immediately after receiving the deposit. This helps both parties keep accurate records. Failure to do so can lead to disputes regarding the amount paid and the terms of the deposit.

Another common mistake is failing to sign or date the receipt. Both parties should sign it, and the date should clearly show when the deposit was received. Without this, it may be hard to prove the transaction details if a dispute arises later.

Finally, make sure your receipt is not vague. Generic statements like “security deposit received” can create confusion. Be specific about the amount, purpose, and terms to avoid misunderstandings down the line.

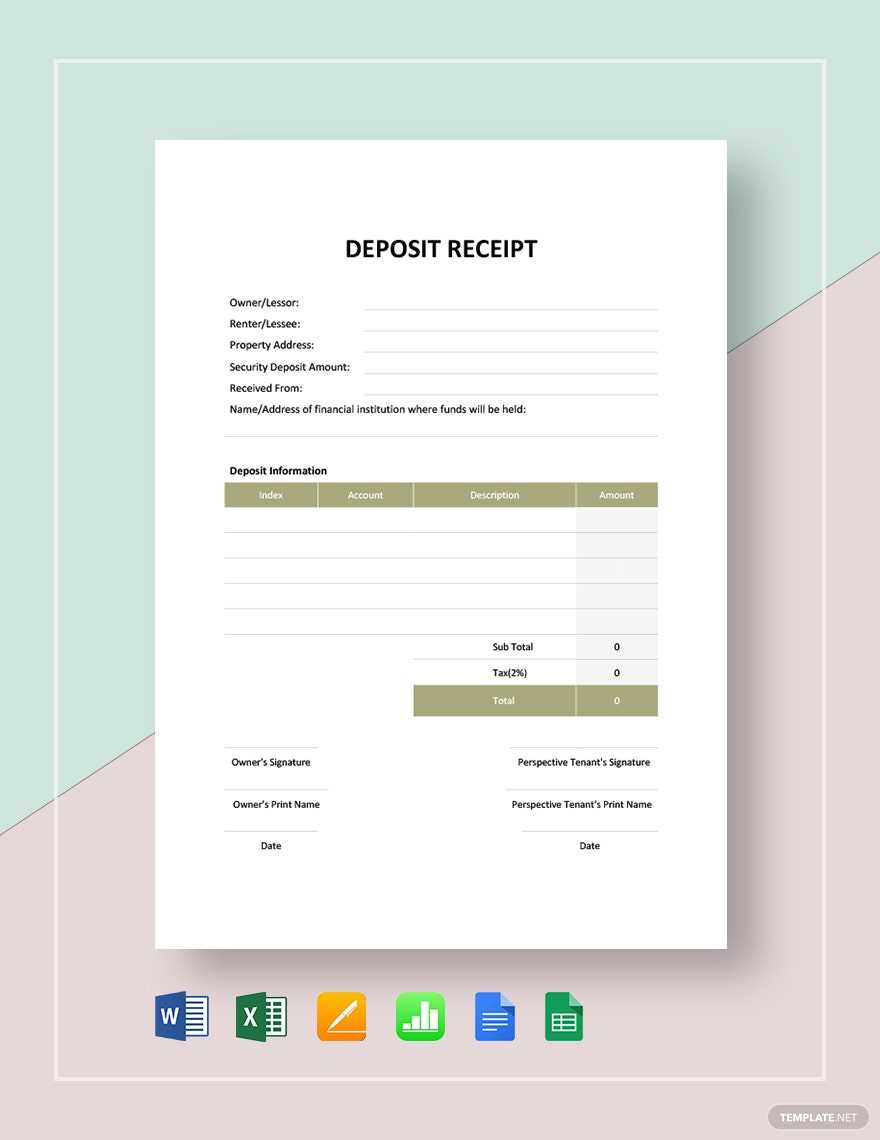

Ensure your security deposit receipt for Illinois complies with local laws by including these key details:

Key Information to Include

| Item | Details |

|---|---|

| Tenant’s Name | Full legal name of the tenant. |

| Landlord’s Name | Full legal name of the landlord or property management company. |

| Amount Paid | Exact dollar amount of the security deposit. |

| Property Address | Complete address of the rental property, including unit number if applicable. |

| Date of Payment | The exact date the security deposit was received. |

| Purpose of Deposit | State the purpose, such as “security deposit for rental agreement.” |

| Conditions for Return | Briefly outline the conditions under which the deposit will be returned. |

Tips for Clarity

Clearly state the conditions for withholding any part of the deposit, such as damages or unpaid rent. Include the timeline for returning the deposit after the lease ends–Illinois law requires the return within 30 days unless there are deductions.