Use this template to create clear and concise receipts for any monetary transactions. A well-structured receipt ensures transparency and protects both parties involved in the transaction. Whether you’re making or receiving a payment, a receipt serves as proof of the agreed amount and the service or goods exchanged.

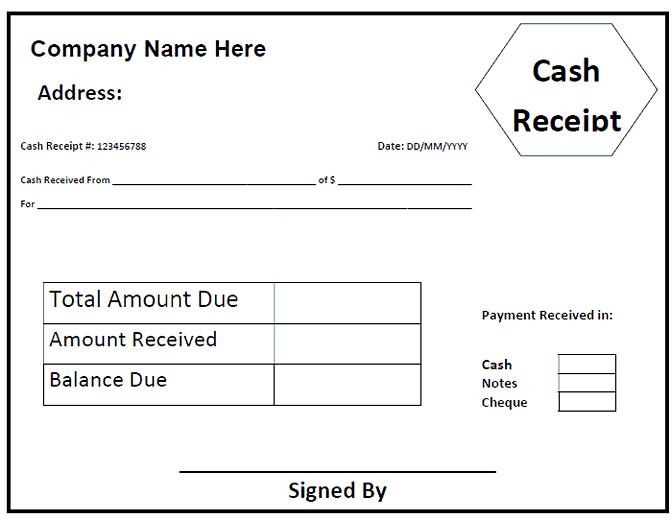

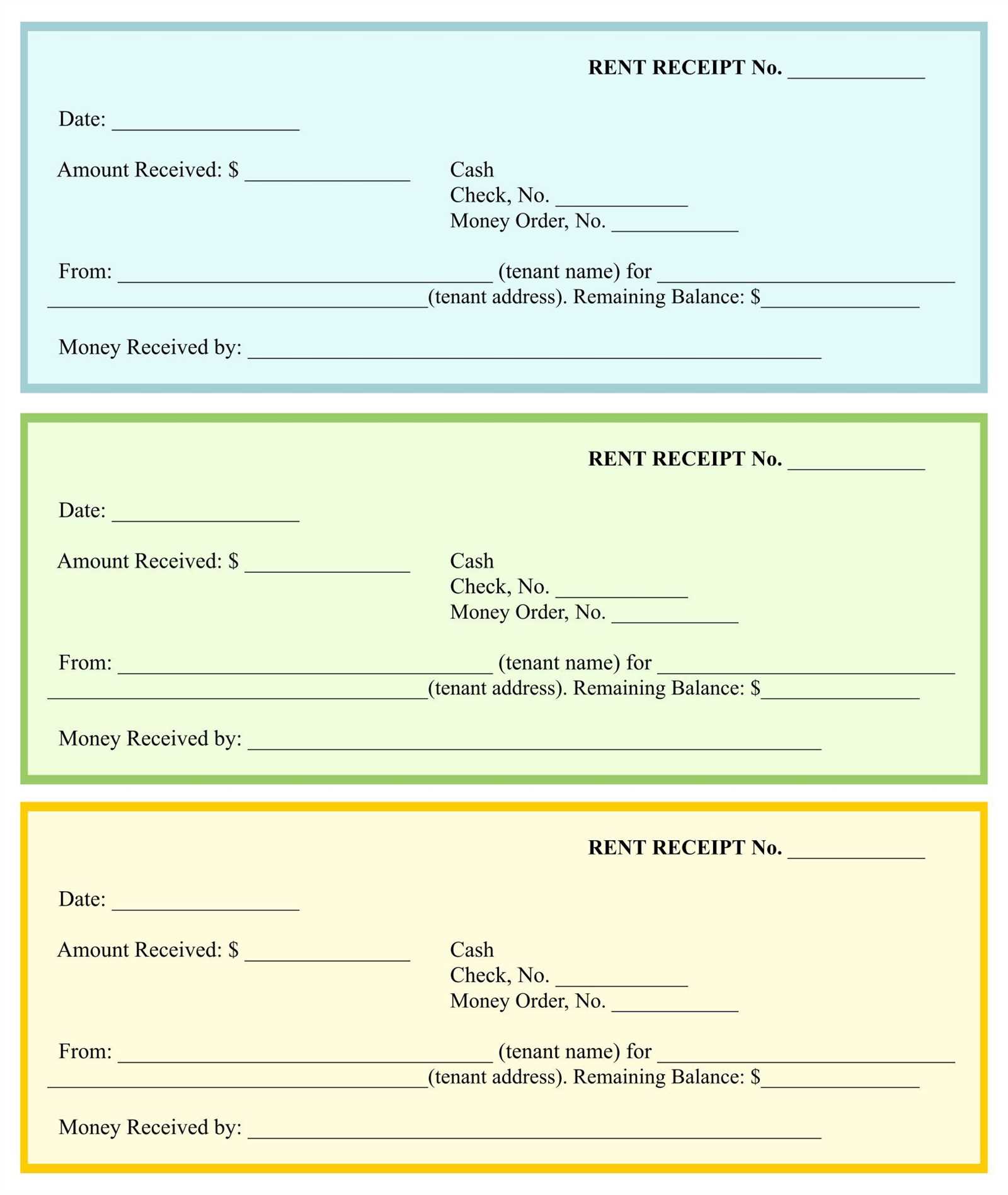

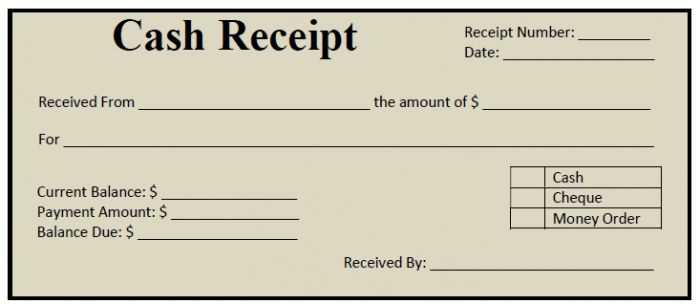

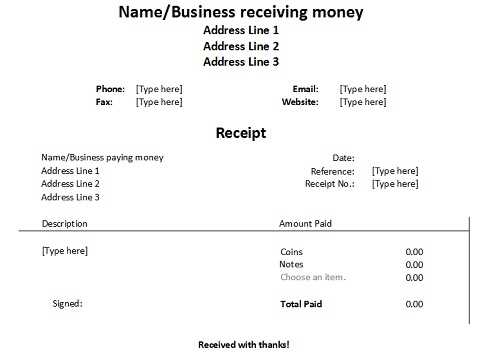

Customize the template to include details such as the payer’s and payee’s names, the amount, date, and description of the payment. Include payment methods, whether it’s cash, credit, or bank transfer, for added clarity. This makes your receipt more comprehensive and trustworthy.

It’s also a good idea to include a unique receipt number for tracking purposes. This is especially useful for businesses or individuals who deal with multiple transactions. Make sure to save copies of the receipt for future reference.

Here are the corrected lines:

Ensure all amounts are clearly stated and match the received payment. Each entry should include the amount, currency, and method of payment. Use a standardized format for the date to avoid confusion, ensuring consistency throughout the document.

Clear Identification

Always include the payer’s name, address, and contact details. This makes the receipt easily traceable and helps avoid any discrepancies in the future. It’s also advisable to provide a unique reference number for each transaction for tracking purposes.

Detailed Payment Breakdown

If the payment includes multiple items or services, break them down individually on the receipt. This not only makes it easier to verify the amount but also adds clarity in case of any disputes or inquiries later on.

Receipt for Money Paid Template

Use this template to create clear and concise receipts for payments made. The key components include the payer’s name, amount paid, date, and the reason for the transaction. Ensure the receipt is easy to read and includes necessary details for both parties.

Key Sections to Include

Start with the title, “Receipt for Money Paid,” and then add the following sections:

- Payer’s Name

- Recipient’s Name or Business

- Amount Paid (in both words and numbers)

- Payment Method (cash, credit, etc.)

- Date of Payment

- Description of Goods or Services

Additional Notes

If applicable, include transaction references or invoice numbers to link the payment to specific orders. This makes tracking easier for both the payer and the recipient. Always ensure the receipt is signed by the recipient to confirm the transaction.

Begin with the receipt header, which should clearly state “Receipt” or “Payment Receipt.” Include the date of the transaction directly below it. This establishes the context of when the payment occurred.

Next, list the name of the payer and the recipient. This identifies the parties involved. If necessary, include contact information, like an email or phone number, for both parties. It’s helpful but not always required for personal receipts.

Detail the goods or services provided. Be specific with descriptions and include quantities if applicable. Clearly state the amount paid for each item or service. Use simple numbers, and if there are multiple items, list them on separate lines for clarity.

Indicate the total amount paid at the bottom of the itemized list. Use a clear label like “Total” to highlight this number. You can also specify the currency if needed, especially for international transactions.

Finally, include a signature line at the bottom. This adds a personal touch and confirms that both parties are in agreement with the receipt. You can add a thank-you note or a statement like “Payment received in full” for added clarity.

To create a clear and professional business payment receipt, include these key components:

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference.

- Date of Payment: Indicate the exact date when the payment was made.

- Payee and Payer Information: Include the name and contact details of both the business (payee) and the customer (payer).

- Amount Paid: Clearly state the amount received, along with the currency.

- Payment Method: Specify whether the payment was made by cash, credit card, bank transfer, or another method.

- Invoice or Order Number: Reference the invoice or order that the payment is associated with, if applicable.

- Itemized Breakdown: If relevant, list the items or services purchased with their corresponding prices.

- Taxes or Fees: Include any taxes or fees applicable to the payment.

- Payment Terms: Include any specific terms related to the payment, such as due dates or late fees, if necessary.

- Signature or Approval: Provide space for signatures or a stamped approval to confirm the transaction.

Additional Considerations

If your business deals with international clients, ensure the receipt includes the exchange rate used and any applicable currency conversion details. For online businesses, consider offering digital receipts with the same level of detail and easy access for customers.

When designing a receipt template, adjust the layout based on the payment method used. For cash payments, include details like the amount tendered and any change given. This helps clarify the transaction for both parties.

For Card Payments

For card payments, include the type of card (e.g., Visa, MasterCard) and the last four digits of the card number for security. Mention any transaction fees if applicable and always indicate the payment gateway or processor used.

For Online Transactions

In online payments, it’s useful to add an order or transaction ID and the payment service provider (e.g., PayPal, Stripe). Indicate the payment status, whether the payment was successful or pending, and include the date and time of the transaction for clarity.

Tailoring the receipt format to each payment method ensures transparency and accuracy, making it easier for the recipient to understand the details of their payment.

Use a clear and concise format for your receipt to ensure all necessary information is included. A simple list of details can help prevent confusion. Start with the recipient’s name, date of payment, amount paid, and payment method.

Essential Elements

- Recipient’s Name: Ensure the name of the person receiving the money is clearly listed.

- Date of Payment: Indicate the exact date when the payment was made.

- Amount Paid: Write the exact sum, including both numeric and written formats.

- Payment Method: Specify whether it was a cash transaction, bank transfer, or another method.

- Purpose of Payment: If applicable, briefly mention the reason for the payment.

Formatting Tips

Keep the text easy to read by using clear fonts and organizing the content into bullet points or short sections. Avoid unnecessary details that don’t directly contribute to understanding the transaction. A simple, direct approach will improve clarity.