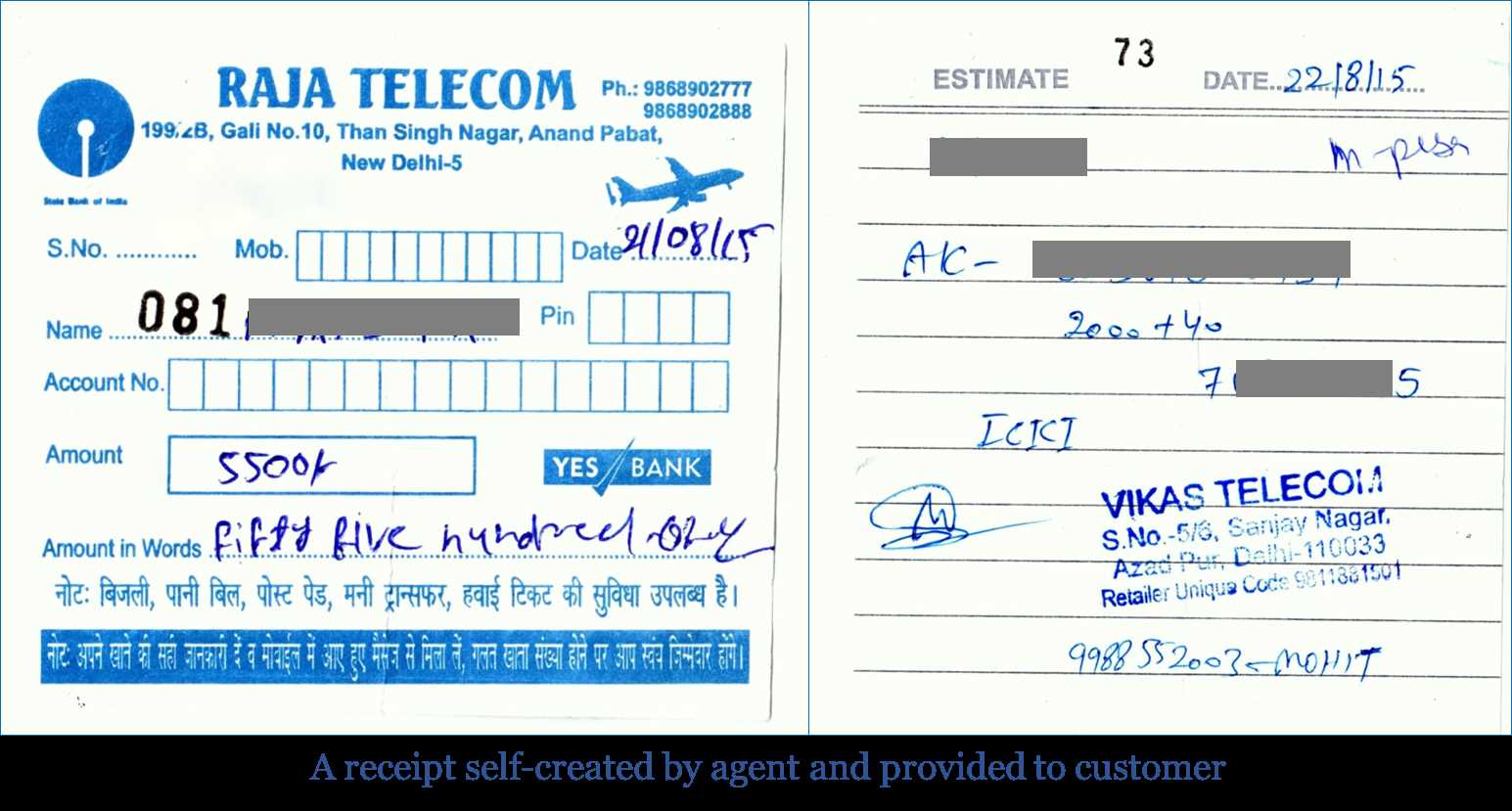

A bank transfer receipt template is a practical tool for recording payment transactions. It provides a clear record of the transfer details for both the sender and the recipient. Using a template ensures consistency, accuracy, and legal compliance in documenting financial transfers.

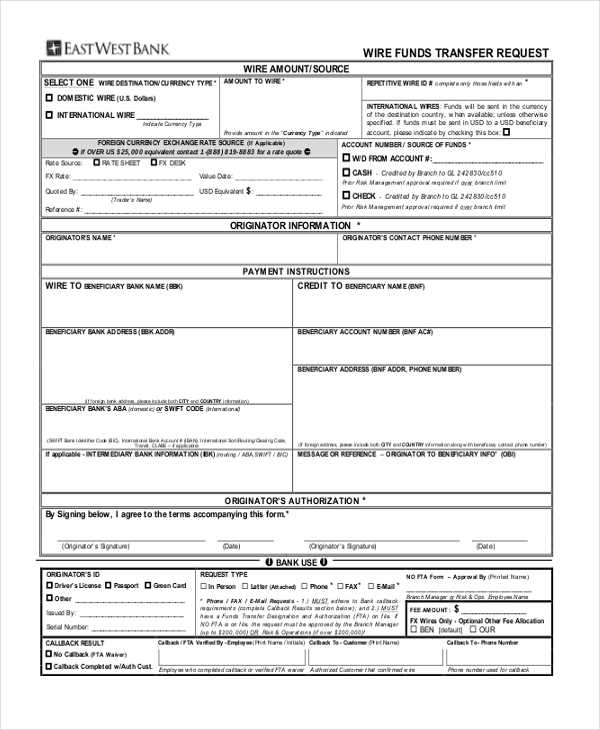

The template should include specific information like the sender’s name, recipient’s name, transaction amount, date, and unique transaction number. It’s also helpful to include the sender’s bank details and the recipient’s bank account for additional transparency. This information guarantees that both parties can refer to the same record in case of any issues or disputes.

Having a standardized receipt format prevents confusion and provides a reliable trail for bookkeeping. For business transactions, it also assists in maintaining tax records. Creating your own template or using a pre-designed version ensures all necessary details are captured while maintaining professionalism.

Here’s the revised version of the text with minimal repetition and preserved meaning:

To create a concise bank transfer receipt template, focus on key details: the sender’s and recipient’s names, the transaction date, amount, currency, and payment reference. Include clear sections for each item to avoid confusion. Label the sender’s and recipient’s information separately, ensuring both parties’ details are easy to find. Display the payment method and any associated fees directly below the transaction amount for transparency.

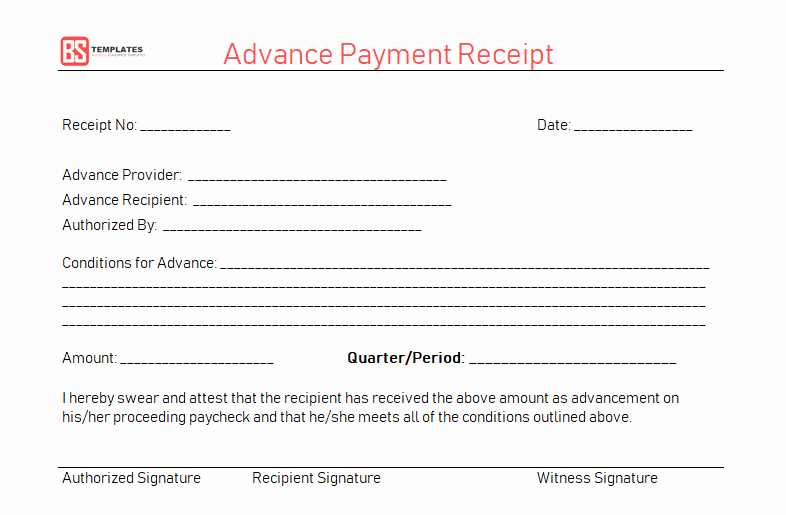

Recipient Information

Start by listing the recipient’s full name, address, and account number. If the transaction is international, include the recipient’s bank code or SWIFT/BIC. This allows the recipient to easily verify the transfer details.

Transaction Summary

Include a brief overview with the transfer amount, transaction date, and reference number. Make sure to separate the total amount sent from any transaction fees, so the net amount sent is clear.

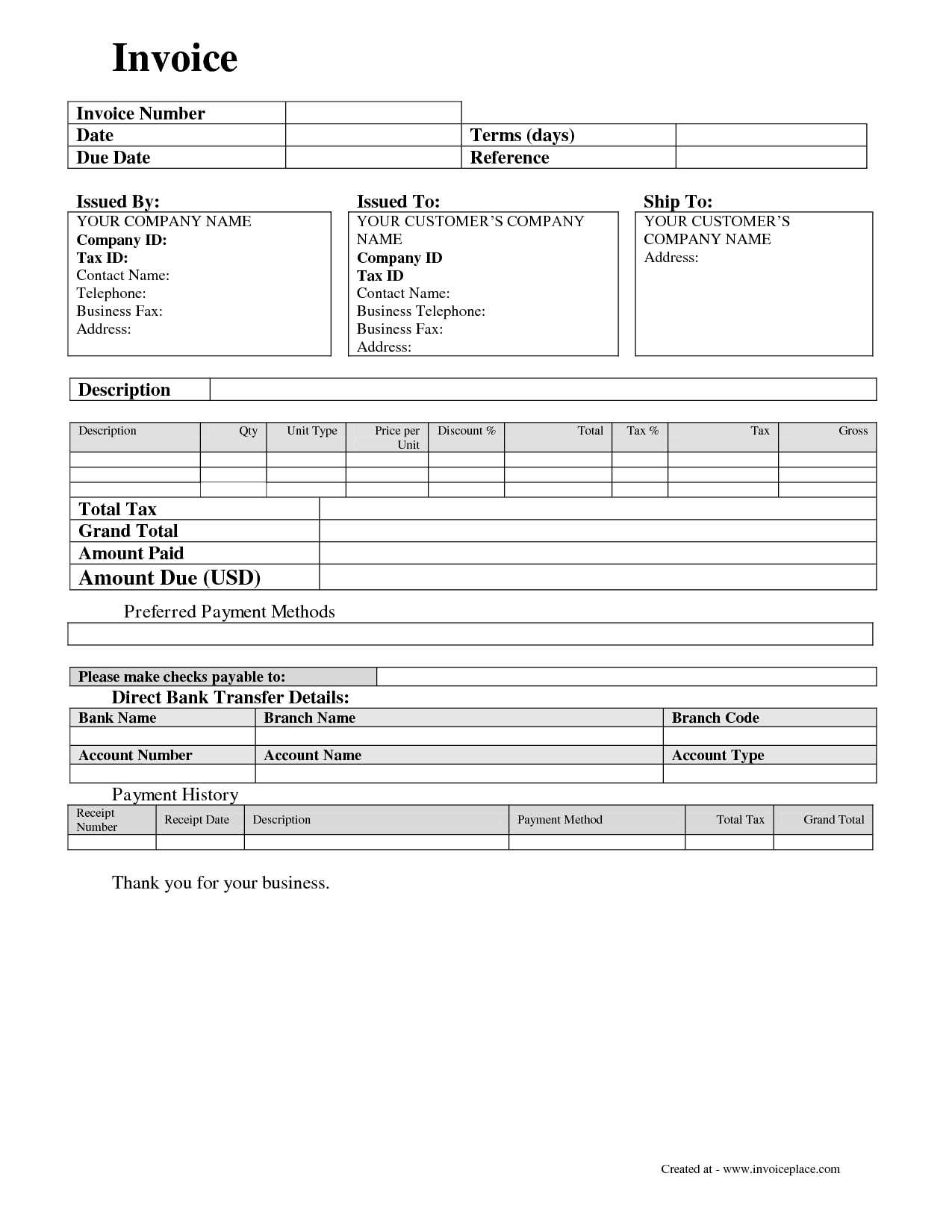

- Bank Transfer Receipt Template

A bank transfer receipt template should include key transaction details to serve as a proof of payment. This ensures transparency and provides both parties with a reliable record. Start by clearly stating the names of the sender and recipient, along with their respective bank details, including account numbers and bank names. The date of transfer is crucial for future reference.

Template Structure

Ensure the template is organized to display the following information:

- Transfer Reference Number – unique identifier for the transaction.

- Sender’s Name and Account Information – name, account number, and bank details.

- Recipient’s Name and Account Information – name, account number, and bank details.

- Transaction Amount – the exact amount transferred, including the currency.

- Date and Time of Transfer – when the transaction was processed.

- Transfer Fees – if applicable, clearly state any fees deducted during the transfer.

- Method of Transfer – bank transfer, wire transfer, or other payment methods used.

Formatting Tips

Keep the design simple and legible. Use clear headings, section breaks, and bold for important details to make it easy for the recipient to find specific information. Make sure the font is readable, and avoid unnecessary graphics that might distract from the content.

Consider providing space for additional notes or terms that might be relevant to the transaction. This can help clarify any additional instructions or agreements associated with the transfer.

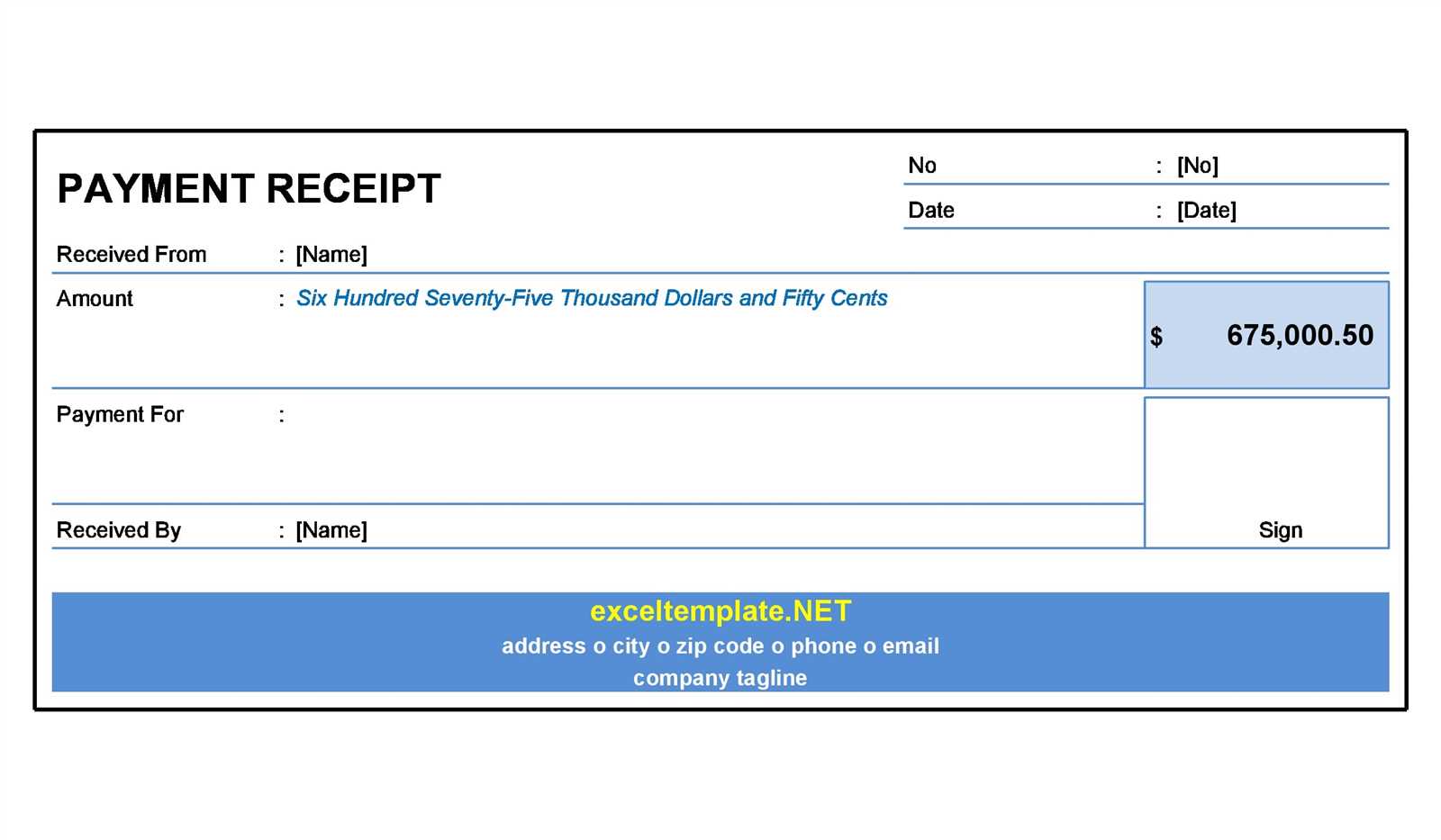

Begin by including key transaction details. These should cover the date, the sender’s and recipient’s information, the transaction amount, and the unique reference number. This data ensures clarity and traceability.

Use a clean and organized layout. Structure the template with clear headings and sections, such as “Sender Details,” “Recipient Details,” “Transaction Summary,” and “Bank Information.” This format helps to quickly locate any necessary information.

Incorporate your business logo and contact details. This establishes your brand and provides the recipient with easy access to your support services. Keep the design simple and professional, avoiding clutter.

For security purposes, include a statement confirming that the transaction was completed successfully. This can be a brief note like “Transaction completed successfully on [date].” It adds legitimacy to the receipt.

If applicable, include payment method details (such as bank name or account type). This may be particularly helpful for record-keeping or auditing purposes.

Finally, ensure the template is easily adaptable. As transactions can vary, creating a flexible design will allow you to update the template for different transaction types or regulatory requirements. Keep the file format compatible with various platforms, such as PDF or HTML, to ensure easy sharing and printing.

Include the following details in a bank transfer receipt to ensure complete transparency and clarity:

- Transaction Date: Record the exact date the transfer was made.

- Transfer Amount: Clearly state the amount sent, with the correct currency.

- Sender Information: List the sender’s name and account number for identification.

- Recipient Information: Include the recipient’s name and account details.

- Transaction Reference Number: Use a unique identifier for the transaction for easy tracking.

- Bank Details: Include both the sender’s and recipient’s bank names and addresses.

- Fees: Specify any fees charged for the transaction, if applicable.

- Authorization Code: Add the transaction confirmation or authorization code if available.

- Transfer Method: Mention the method of transfer (e.g., wire transfer, ACH, etc.).

These details provide a complete record and help track the transaction if needed in the future.

Use clear and consistent formatting when creating a bank transfer receipt. Include essential details like the sender’s and recipient’s names, account numbers, transfer amount, date, and reference number. Ensure that all fields are clearly labeled and easy to read.

Organize the information logically: start with transaction details (sender and recipient), followed by the transfer amount, date, and any other relevant notes. This sequence helps both parties quickly verify key information.

Incorporate a unique reference number for every transaction to simplify tracking. This also allows users to easily match receipts to specific transactions or accounts, reducing confusion in case of disputes or audits.

Choose legible fonts and an appropriate font size. Avoid overly decorative fonts that may hinder readability. A simple, professional design helps ensure that the receipt is both visually appealing and easy to understand.

Clearly indicate the currency used in the transaction. If the transfer involves foreign currencies, specify the exchange rate applied at the time of the transfer to prevent misunderstandings.

For added security, consider including a watermark or other authentication feature to make it harder to forge the receipt. This adds an extra layer of protection to the document and instills trust in the recipient.

Lastly, always offer the option for both digital and printed receipts. While digital versions are often more convenient, physical copies may still be necessary for certain contexts, such as tax filings or legal documentation. Providing both ensures flexibility and thorough record-keeping.

To create a clear and professional bank transfer receipt template, use the following elements:

Transaction Information

Include the transaction date, amount, and currency. Clearly state the sender and receiver details, such as names, account numbers, and bank names. This will ensure transparency in the transaction.

Reference Number

Generate a unique reference number for each transaction. This helps in identifying the transfer easily and ensures traceability for both parties.

Make sure to add any applicable fees and the total amount after deductions. For a polished receipt, include a space for a signature or confirmation, validating the transaction.