For accurate record-keeping, use a reliable home improvement receipt template. It helps track expenses, making it easier to manage project costs and handle any warranties or tax deductions. This template can save time by organizing key details such as service dates, contractor information, and materials used.

Choose a template that suits the project type–whether it’s a simple renovation or a large-scale remodel. Ensure it includes fields for the total cost, payment method, and a breakdown of labor and materials. This transparency will help avoid misunderstandings and simplify budgeting for future home projects.

Many online tools offer customizable templates. Select one with clear formatting and easy-to-fill-in sections. Whether you’re a DIY enthusiast or hiring professionals, maintaining an organized receipt record can help you stay on top of your home improvement efforts.

Here are the corrected lines:

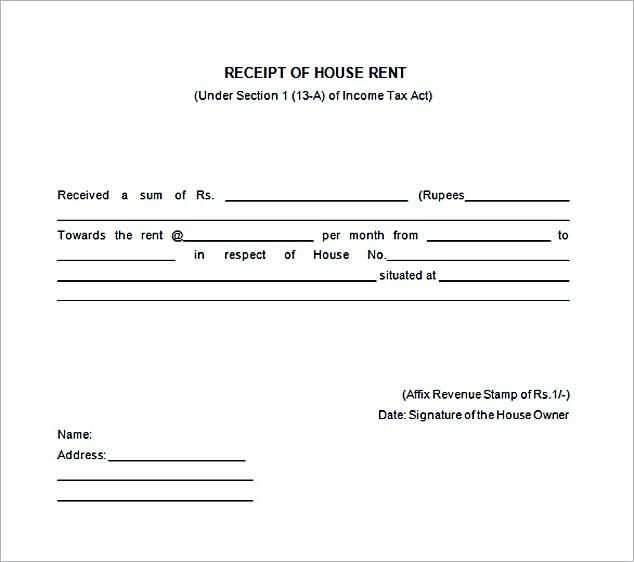

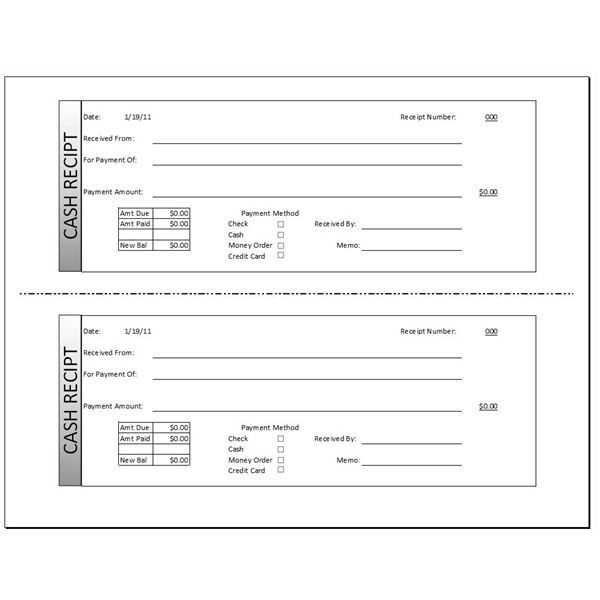

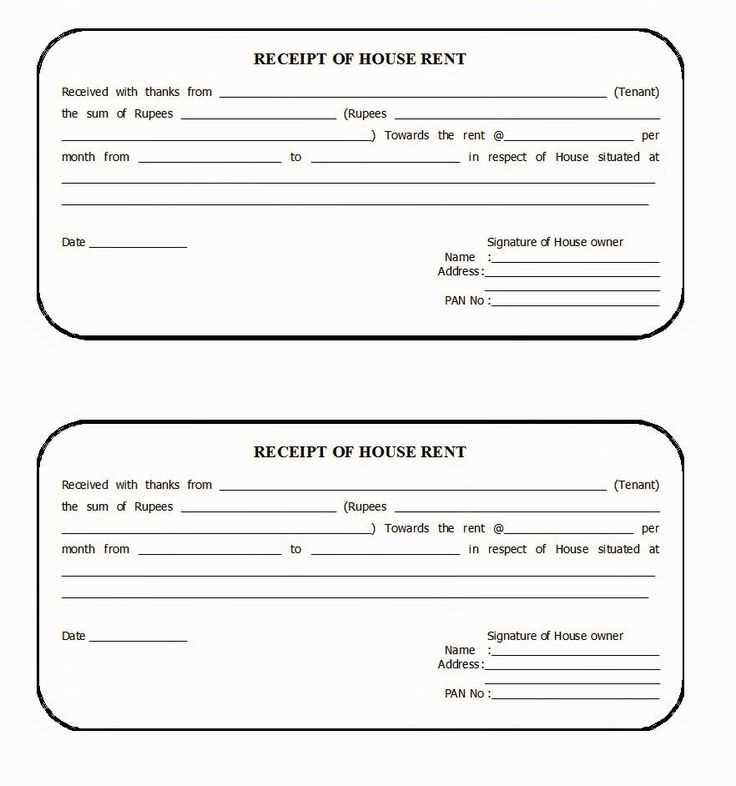

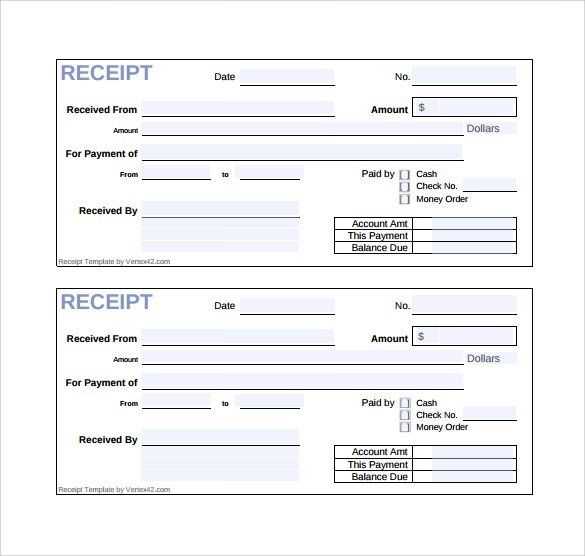

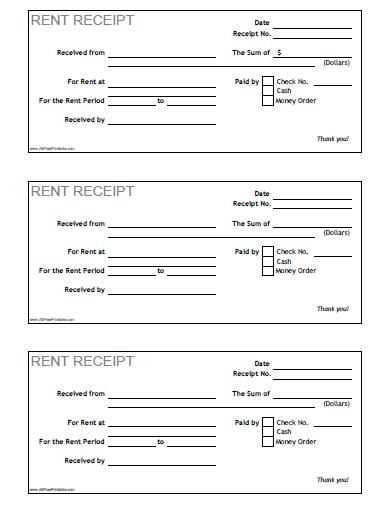

Ensure your receipt templates include clear fields for all necessary details, such as the service provided, date, and payment method. This will reduce confusion for both parties involved.

Detailed Breakdown

List each item or service separately, along with its corresponding price, taxes, and total amount. This allows for transparency in all transactions.

Customer Information

Make space for both customer and contractor details to be recorded. Include name, address, and contact details for easy follow-up if needed.

Confirm that the template design is user-friendly and clear. Using an organized layout will make it easier for clients to understand the provided services and the amount due.

- Home Improvement Receipt Templates

To simplify tracking home improvement expenses, use templates that clearly list the scope of work, materials used, and the total cost. These templates provide transparency and help avoid confusion later. You can create a receipt that includes sections for both labor and materials, ensuring that all charges are accounted for accurately.

Key Sections to Include

- Date: Always include the transaction date for reference.

- Contractor Details: List the business name, address, and contact information.

- Work Description: Specify what work was completed, including materials used, labor time, and any additional services provided.

- Breakdown of Costs: Clearly show the costs for labor, materials, and any other charges, with the subtotal and total at the end.

- Payment Method: Note whether the payment was made in cash, via credit card, or check.

- Signature: Include a space for the contractor’s signature to confirm completion and the agreed payment amount.

Where to Find Templates

Home improvement receipt templates are widely available online. Many websites offer free downloadable templates in formats such as PDF, Word, or Excel. Alternatively, you can create a custom template in any word processing program to suit your specific needs.

For greater ease, some accounting or invoicing software also provides receipt templates that can be tailored to home improvement projects. These templates often come with automated fields, reducing the chances of error.

Customize your template by first identifying the type of renovation you are working on. Each project has unique requirements, from simple repairs to full remodels. Tailor the layout of the template to capture all relevant details for the specific work you’re undertaking.

Adjust sections related to materials, labor, and timeline to match the scope of your renovation. For a kitchen remodel, for example, add space for custom cabinetry, countertop materials, and appliance specifications. A bathroom renovation template should emphasize plumbing, fixtures, and tile options.

| Renovation Type | Key Sections to Add |

|---|---|

| Kitchen Remodel | Cabinet details, countertop selection, appliance costs, layout adjustments |

| Bathroom Remodel | Plumbing specifics, tile material, fixture brands, water pressure requirements |

| Living Room Makeover | Flooring options, paint colors, furniture layout, lighting upgrades |

| Home Exterior | Siding materials, roofing, window replacement, landscaping items |

Update pricing information to reflect the specific vendors or contractors you plan to work with. If using contractors, include fields to track their contact details, hourly rates, and materials supplied.

Include a progress section to help you monitor milestones and deadlines. For instance, a renovation may require different stages like demolition, framing, and final inspection, so having a separate section for each can help keep the project on track.

Ensure your template is flexible, allowing you to add or remove items as the renovation evolves. Flexibility is key for unexpected changes or additions that may come up during the project.

Ensure your renovation receipt templates comply with local tax laws. Using an accurate and detailed template helps prevent issues when reporting expenses or claiming deductions. Here’s what to keep in mind:

- Include all necessary details: The receipt should clearly state the date of work, the contractor’s name, description of services, materials used, and the total amount paid. This ensures transparency in case of an audit.

- Verify contractor’s status: Ensure that the contractor is legally registered, and their services are taxable under local regulations. Failure to do so may lead to problems with tax authorities.

- Track labor and material costs separately: Some tax authorities distinguish between labor and material costs. This separation can help you qualify for specific deductions or credits related to materials purchased for home improvement.

- Understand tax deductions: In some regions, renovation costs may be deductible if they improve the value of your home. However, tax benefits vary based on your location and the type of work done.

- Keep all receipts for future reference: Store physical or digital copies of your renovation receipts. These documents can be necessary if you need to substantiate your claims during tax filing or in case of an audit.

By maintaining thorough and accurate records, you can avoid misunderstandings with tax authorities and make sure you’re getting the maximum tax benefits available.

Use invoice and receipt templates from tools like Microsoft Excel or Google Sheets for straightforward, customizable options. These platforms allow easy input of your branding and transaction details, ensuring a polished result without the need for additional software.

For more advanced features, consider QuickBooks or FreshBooks. These tools automate much of the receipt creation process, from calculating totals to generating itemized lists. They also support tax rate adjustments, making them ideal for businesses of various sizes.

If you’re looking for a more graphic-driven design, Adobe Spark or Canva offers receipt templates with visually appealing layouts. These tools also provide the flexibility to adjust fonts, colors, and logos, creating a unique brand presentation.

For businesses that need to integrate receipts with payment processing systems, Square or PayPal provide seamless receipt creation that links directly to transactions. These platforms save time by automatically filling out most fields, leaving only the final touches to be added manually.

For those who need a more DIY approach, software like LibreOffice or OpenOffice can be used to create receipt templates from scratch, offering complete control over the layout and design. These options work well for businesses with specific branding needs or those that handle a variety of transaction types.

How to Create an Organized Home Improvement Receipt Template

Design a home improvement receipt template that clearly outlines key transaction details. Focus on including the following sections:

- Header with Company Information: Include your business name, address, and contact details at the top of the receipt.

- Client Information: Clearly list the customer’s name, address, and contact number to ensure the receipt can be traced back to the client.

- Detailed Description of Services: Break down the work completed or materials provided, itemized with individual prices. Be as specific as possible to avoid confusion.

- Dates and Payment Terms: Note the start and completion dates of the project. Specify payment terms and include the due date for the final payment.

- Total Cost and Tax Information: Provide the total cost and itemize taxes separately to maintain transparency.

- Payment Method: Indicate how the client paid, whether by cash, credit card, check, or another method.

- Signature Line: Add a space for both parties to sign, confirming that both the work and payment have been completed.

This format not only keeps transactions clear but also helps to prevent disputes and ensures both parties are on the same page regarding the scope of work and costs.