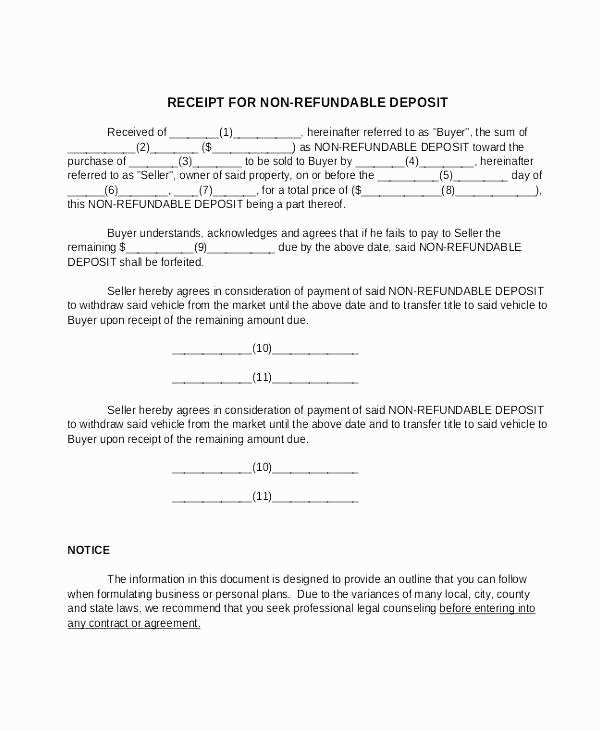

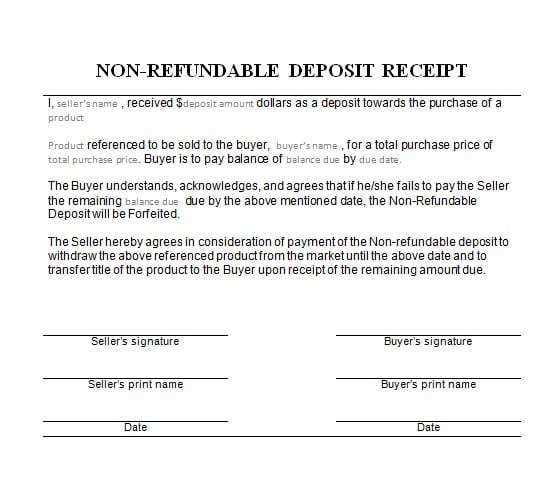

Creating a receipt for a non-refundable deposit requires a clear and structured format. Make sure to include key details, such as the amount received, the date of the transaction, and the terms of the deposit. Ensure the receipt is legally sound by including a statement that the deposit is non-refundable, protecting both the payer and the recipient.

Start with the recipient’s and payer’s names, followed by the specific amount deposited. Clearly state the reason for the deposit and any services or goods associated with it. Be specific about the non-refundable nature of the deposit, avoiding any ambiguity. This ensures that both parties are on the same page regarding the terms.

Next, include the payment method used, such as credit card or bank transfer, along with the transaction reference if applicable. You may also want to mention any additional conditions that might affect the deposit, like cancellation policies or delivery timelines. Make it easy for both parties to review the details by formatting the receipt neatly.

Sure! Here’s a revised version with minimized repetition:

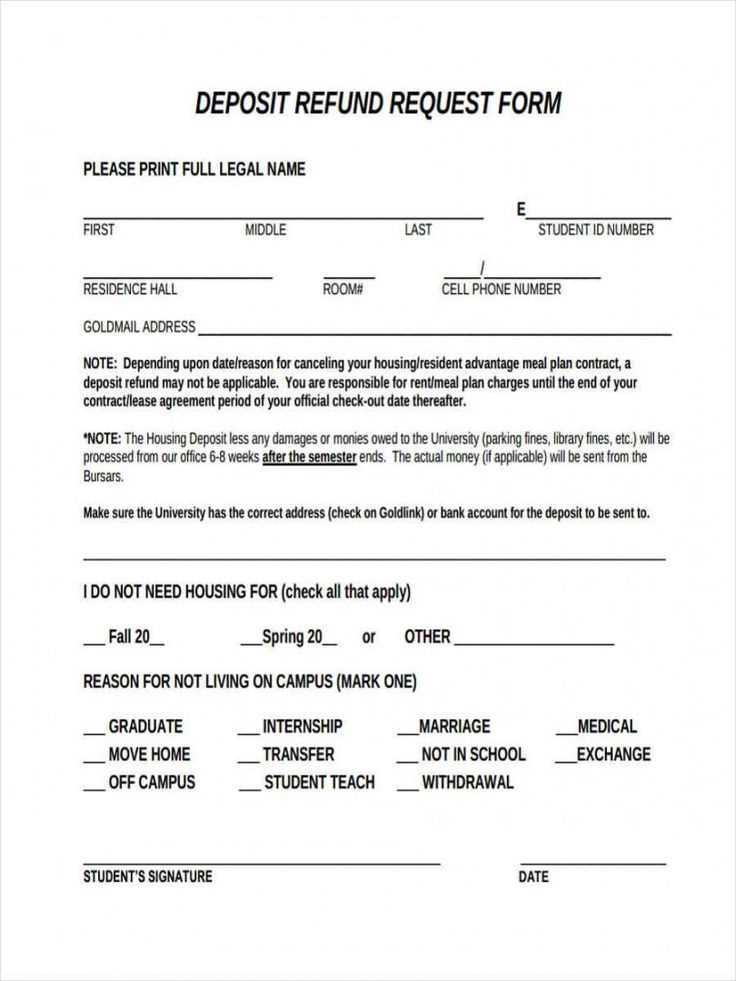

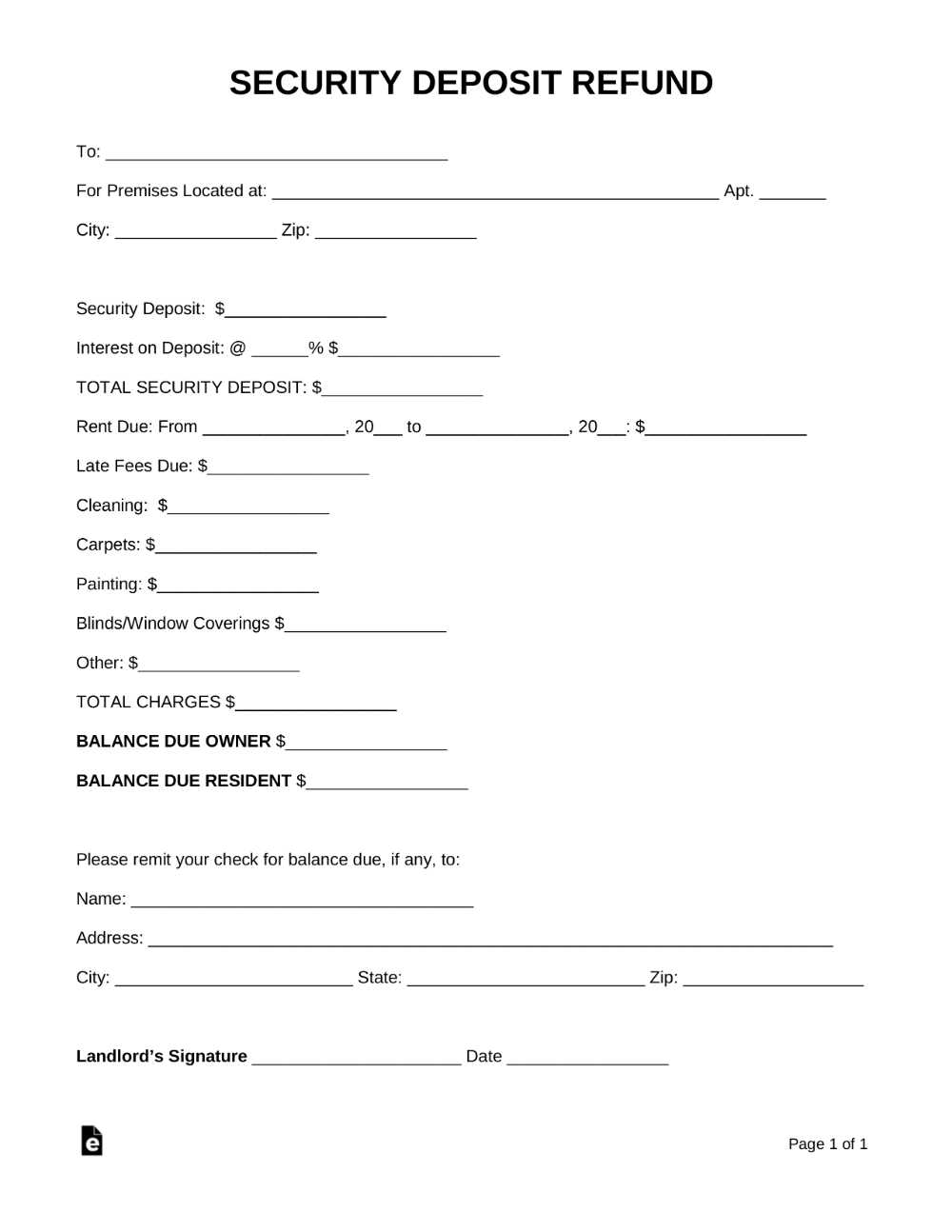

To draft a receipt for a non-refundable deposit, include the following key elements:

Client Name and Contact: Clearly state the client’s full name and contact details to avoid any confusion.

Deposit Amount: Specify the exact deposit paid, and note that it is non-refundable. This sets clear expectations for both parties.

Payment Date: Include the date the payment was received, as this is important for both record-keeping and any future disputes.

Description of Service or Product: Provide a clear description of the service or product the deposit secures, ensuring there is no ambiguity.

Remaining Balance and Payment Terms: If there is an outstanding balance, note the amount remaining and the due date for final payment.

Non-Refundable Clause: Reiterate that the deposit is non-refundable to prevent any misunderstandings.

Terms and Conditions: Outline any additional terms, such as cancellation policies, deadlines, and other important details regarding the agreement.

This approach ensures that both parties are fully informed about the payment terms, minimizing the potential for future conflicts.

Receipt Template for Non-Refundable Deposit

For creating a receipt for a non-refundable deposit, clearly state that the deposit is non-refundable and specify the amount. Include the name of the individual or business receiving the deposit, the date it was made, and the purpose of the deposit. Clearly outline any terms that apply to the deposit, such as cancellation policies, to avoid misunderstandings. Ensure that both parties sign or acknowledge the receipt to confirm agreement.

Include the following details in the receipt: the total deposit amount, the transaction date, the payer’s name, the payee’s name, and the reason for the deposit. Mention the non-refundable nature of the deposit, with a clear statement that it will not be returned under any circumstances. Adding contact information for both parties provides extra clarity. If applicable, include the payment method used for the deposit.

Watch out for common mistakes such as failing to specify the non-refundable nature of the deposit or omitting the terms associated with the deposit. Ensure that all relevant details are included, as incomplete information can lead to confusion or disputes. Also, avoid vague language, which may weaken the enforceability of the receipt. Double-check spelling and ensure both parties agree to all terms outlined in the receipt before finalizing it.