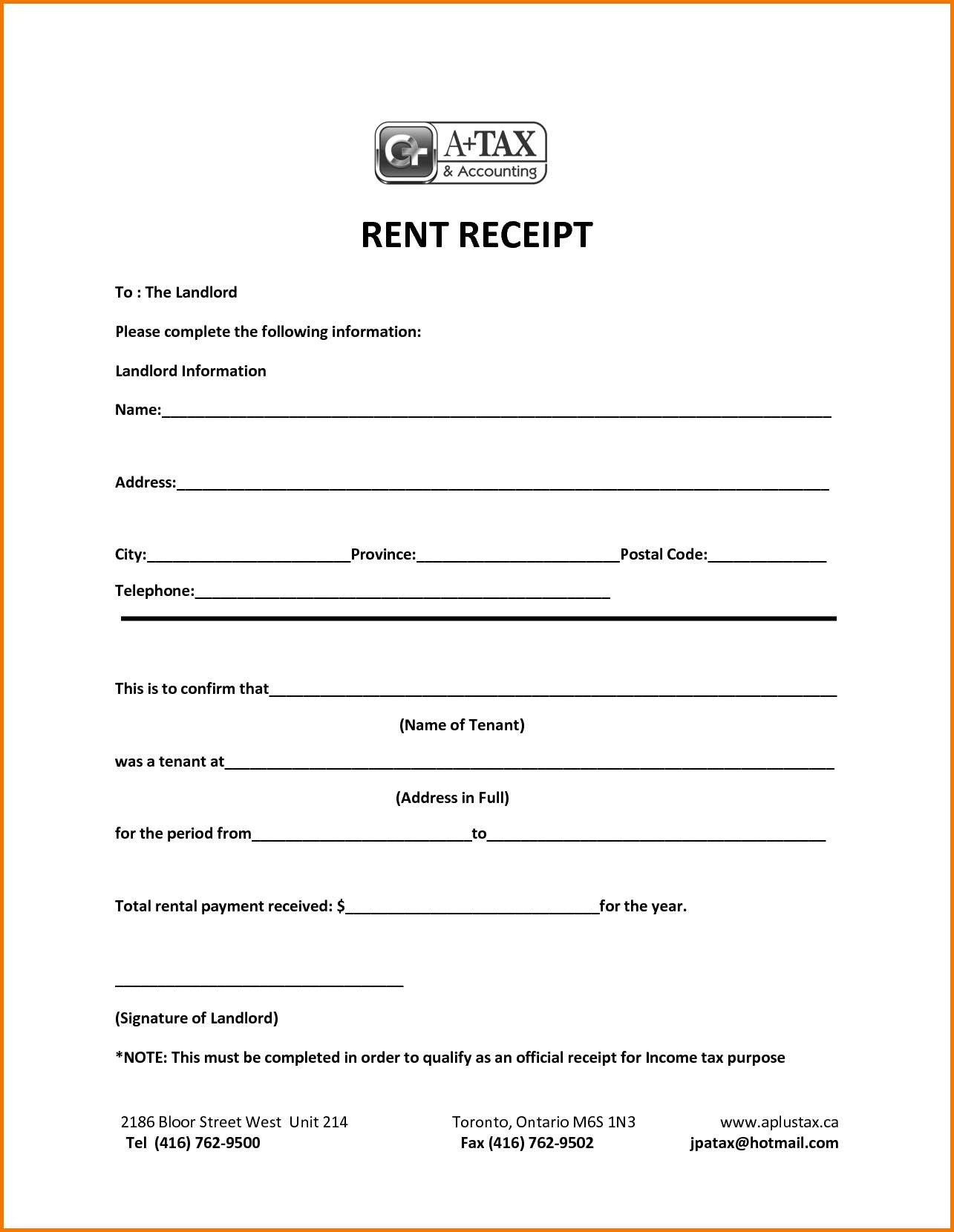

To simplify your income tax filings, it’s necessary to provide a clear rent receipt template. This document acts as proof of rental payments, making it easier for you to claim deductions or validate expenses. Use the following template to create a professional and concise rent receipt. Ensure all details are accurately filled in to avoid delays or complications during tax season.

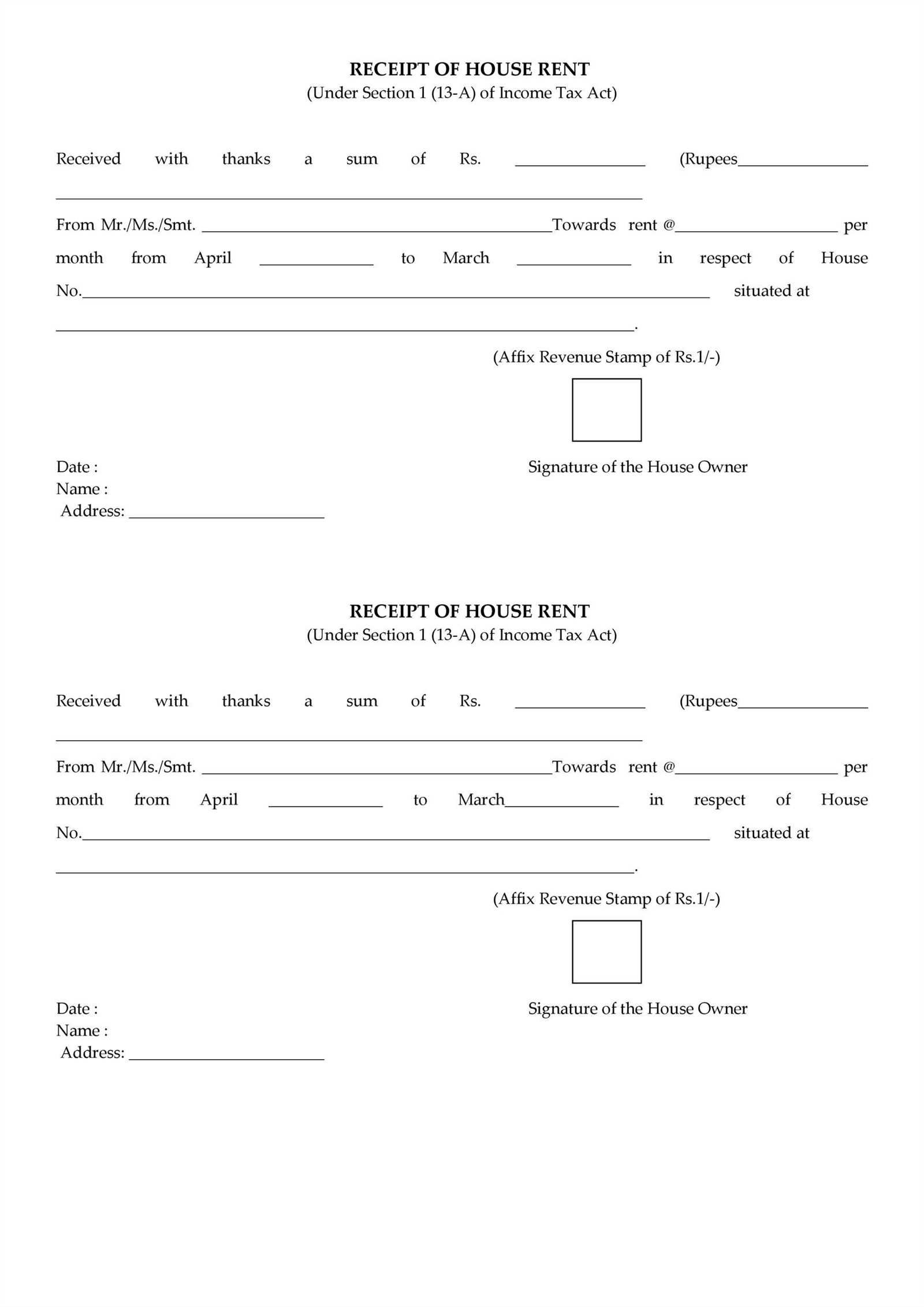

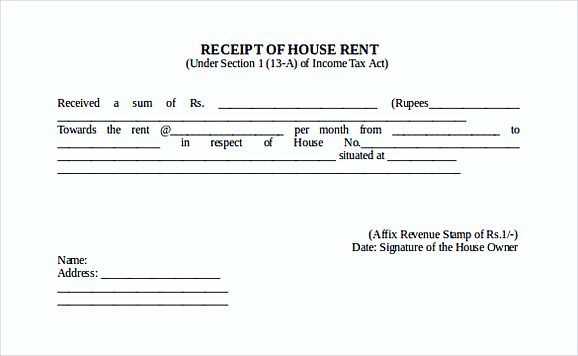

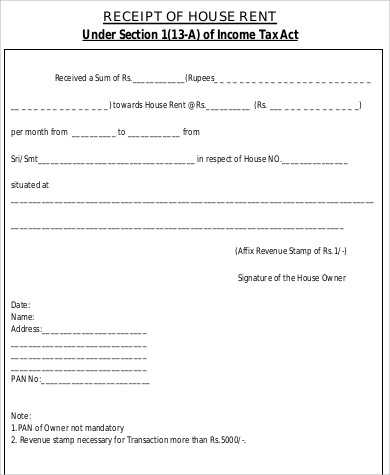

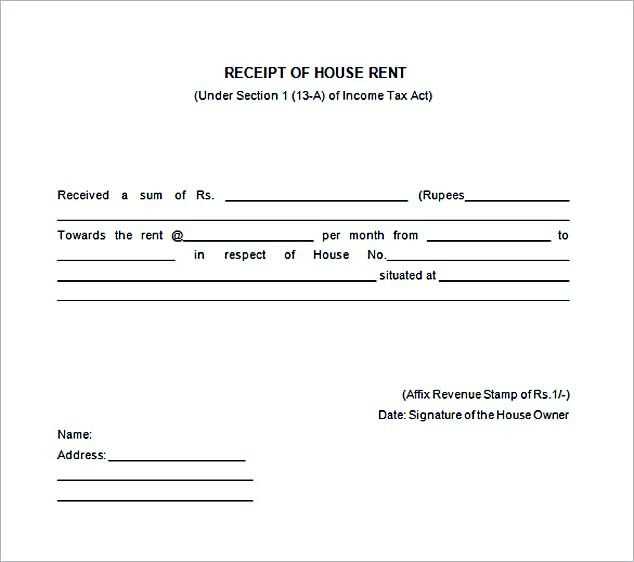

Template Structure: Include the tenant’s name, rental property address, monthly rent amount, and payment period. Specify the date of payment and the method used (e.g., cash, check, or online transfer). Don’t forget to include the landlord’s name, signature, and contact information to validate the receipt.

Why the Template Matters: A properly structured rent receipt helps maintain transparency in your rental transactions. It provides a reliable reference should the tax authorities require documentation for deductions or audits. By sticking to this template, you ensure consistency in your filings and avoid unnecessary complications.

Here are the corrected lines, reflecting your preferences:

Ensure that the date of payment is clearly mentioned in the receipt. It should correspond to the exact day the rent was paid. Additionally, include the full address of the rental property for clarity.

Use precise amounts for rent paid, specifying the currency used. For instance, if rent was paid in USD, write “USD” after the amount.

Always mention the full name of the landlord or property manager and their contact information. This helps in verifying the validity of the receipt.

Provide a unique receipt number for tracking purposes, especially if multiple receipts are issued during the year.

Lastly, ensure that the purpose of the payment (rent) is clearly stated on the receipt. This is necessary for tax purposes and helps avoid confusion.

- Rent Receipt for Tax Purposes Template

When creating a rent receipt for tax purposes, include the following key elements: the date the payment was made, the full name of the landlord and tenant, the rental property address, the amount paid, and the payment period. Clearly specify the rent amount paid, indicating whether it includes utilities or other fees. For record-keeping, mention whether the payment was by check, cash, or another method.

Ensure that the document is signed by the landlord and includes their contact information. This will serve as proof for the tenant during tax filing. Providing this detailed template helps both parties maintain accurate records and comply with tax regulations without complications.

To create a rent receipt for income tax purposes, include the following key details: the landlord’s and tenant’s names, the rental property address, the amount of rent paid, the payment period, and the date of payment. It’s important to clearly state whether the payment is for a specific month or multiple months.

Key Information to Include

Ensure that you list the payment method (e.g., cash, check, or bank transfer) and any additional charges, like late fees, if applicable. Mention the rental period (start and end dates) and provide a unique receipt number to track payments. If the tenant has paid in advance, note this in the receipt.

Providing a Signature and Acknowledgement

Both the landlord and tenant should sign the receipt to confirm the transaction. Landlords should keep a copy for their records, while tenants should file the receipt with their tax documents to substantiate the rental payments during tax filing.

Ensure you provide clear and accurate information when issuing a rent receipt. Below are the key details that must be included:

Tenant and Landlord Information

Include the names and addresses of both the tenant and the landlord. This identifies who the payment is from and who it’s for.

Payment Details

Clearly state the date of the payment and the amount paid. Specify whether the payment is for one month or a different time period. If there are any late fees or discounts applied, they should be detailed as well.

Rental Property Information

Include the address of the rental property to avoid confusion about which property the receipt pertains to, especially if the landlord has multiple properties.

Payment Method

Specify the payment method used (e.g., cash, cheque, bank transfer). This helps to maintain a clear financial record for both parties.

Signature or Acknowledgment

The receipt should be signed by the landlord or authorized representative, confirming that the payment has been received. This adds a layer of verification and formality to the transaction.

| Detail | Description |

|---|---|

| Tenant’s Name | The full name of the tenant making the payment. |

| Landlord’s Name | The full name of the landlord receiving the payment. |

| Payment Amount | The total amount paid for the rental period. |

| Payment Date | The specific date on which the payment was made. |

| Payment Method | How the payment was made (e.g., cheque, cash, bank transfer). |

| Property Address | The address of the rental property associated with the payment. |

| Signature | The signature of the landlord or their representative confirming receipt. |

Ensure all details are accurate before issuing a receipt. Incorrect information can lead to tax issues or disputes with tenants. Check the following common errors:

- Missing or incorrect date: Always include the exact date of the transaction. A missing or incorrect date may invalidate the receipt for tax purposes.

- Incorrect recipient information: Ensure the tenant’s name and address are correctly stated. This is crucial for recordkeeping and tax reporting.

- Omitting payment details: Specify the exact amount paid and the method of payment. Lack of this information can raise questions from tax authorities.

- Failure to include rental period: Include the start and end dates of the rental period. This helps confirm the payment’s relation to a specific period.

- Not keeping copies: Retain copies of all issued receipts. Failure to do so can cause issues when proving income or expenses during tax filings.

- Not numbering receipts: Always assign a unique number to each receipt. This helps maintain a clear, organized record of transactions.

- Wrong tax rate: Double-check the applicable tax rate before finalizing the receipt. An incorrect rate can cause discrepancies during tax reporting.

Double-check before issuing

Before issuing a receipt, review all details to avoid common mistakes. Ensure accuracy in every field, as even small errors can lead to significant complications later.

Keep organized records

Maintain an organized system for storing receipts. This will make it easier to access information when preparing tax returns or addressing any potential disputes.

Include the landlord’s full name and address in the top section. Ensure the rental property’s address is listed clearly.

State the date for which the rent payment was made. Specify the rental period, such as monthly, quarterly, or annually.

Detail the rent amount paid, including any adjustments like late fees or discounts, if applicable.

List the payment method (e.g., cash, bank transfer, check) along with any transaction reference number, especially if paying electronically.

For clarity, include a statement confirming the payment was for rent and not for any other purpose, such as utilities or services.

Always sign and date the receipt at the bottom. It provides confirmation that the landlord acknowledges receipt of payment.