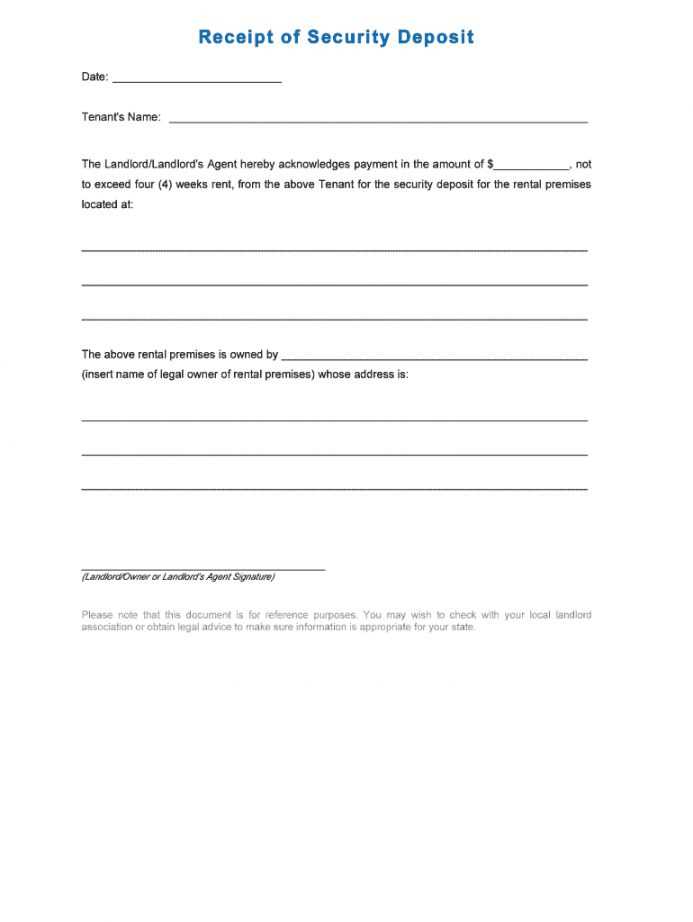

A holding deposit receipt is a crucial document for both landlords and tenants when securing a rental property. This receipt acts as proof that the tenant has paid a holding deposit to secure the property, preventing other potential tenants from applying. It should clearly state the amount paid, the terms surrounding the deposit, and what happens if the tenant either proceeds with the lease or withdraws.

Clear terms are necessary to ensure both parties understand the conditions surrounding the deposit. The receipt should outline whether the deposit is refundable and under what circumstances. For example, it may be refunded if the tenant decides not to move forward due to issues beyond their control, or it may be non-refundable if the tenant changes their mind after a certain point.

Ensure the receipt includes all relevant details like the tenant’s and landlord’s contact information, the property address, and the date the deposit was paid. Accuracy in this document helps prevent any disputes or confusion about the transaction, making it a helpful tool for a smooth rental process.

Here are the revised lines based on your requirements:

When creating a holding deposit receipt, include the following sections to ensure clarity and compliance:

Key Information to Include

- Tenant’s Name: Clearly state the name of the individual or party paying the deposit.

- Landlord or Agent’s Details: Include the full name and contact information of the landlord or agent collecting the deposit.

- Deposit Amount: Specify the exact amount being held as a deposit.

- Property Address: Provide the full address of the rental property for which the deposit is being held.

- Date of Payment: Include the exact date the deposit was received.

Additional Information to Include

- Conditions of Return: Detail any conditions under which the deposit will be returned, such as damage to property or unpaid rent.

- Signature: Ensure both the tenant and landlord or agent sign the receipt to acknowledge its accuracy and agreement.

- Deposit Type: Specify if the deposit is refundable, non-refundable, or if it covers any particular fees.

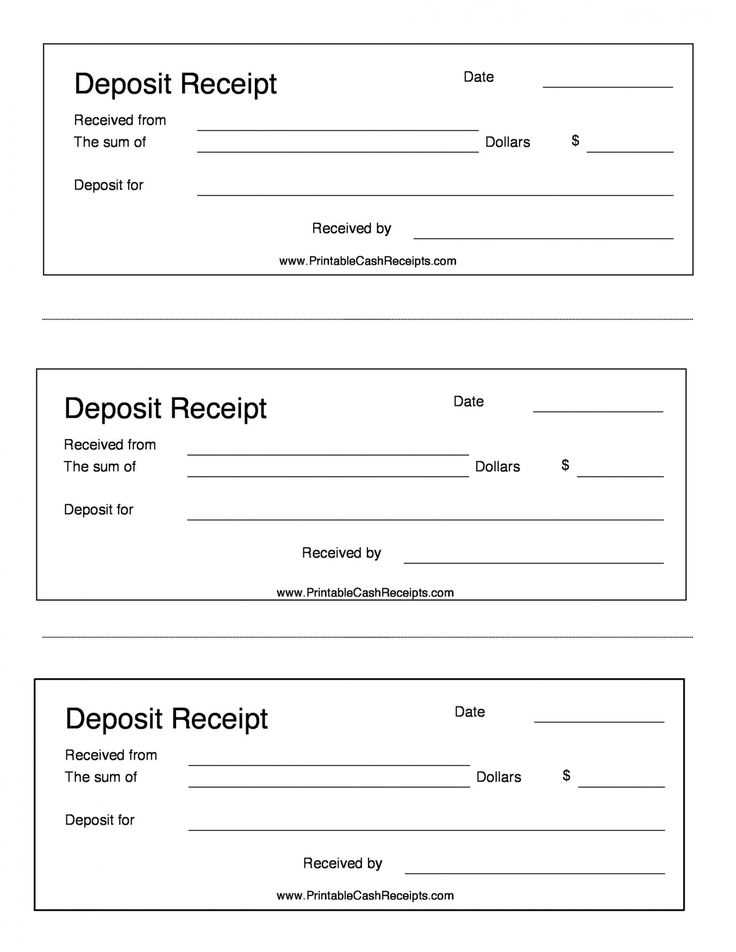

- Holding Deposit Receipt Template

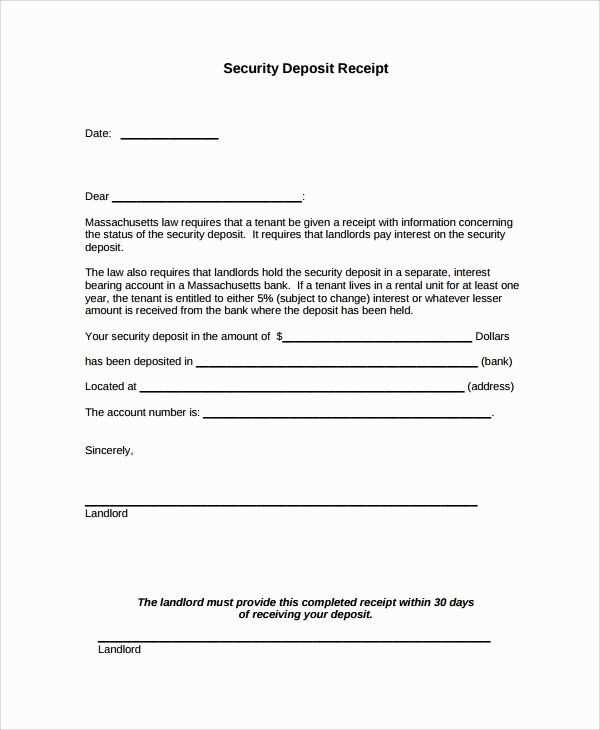

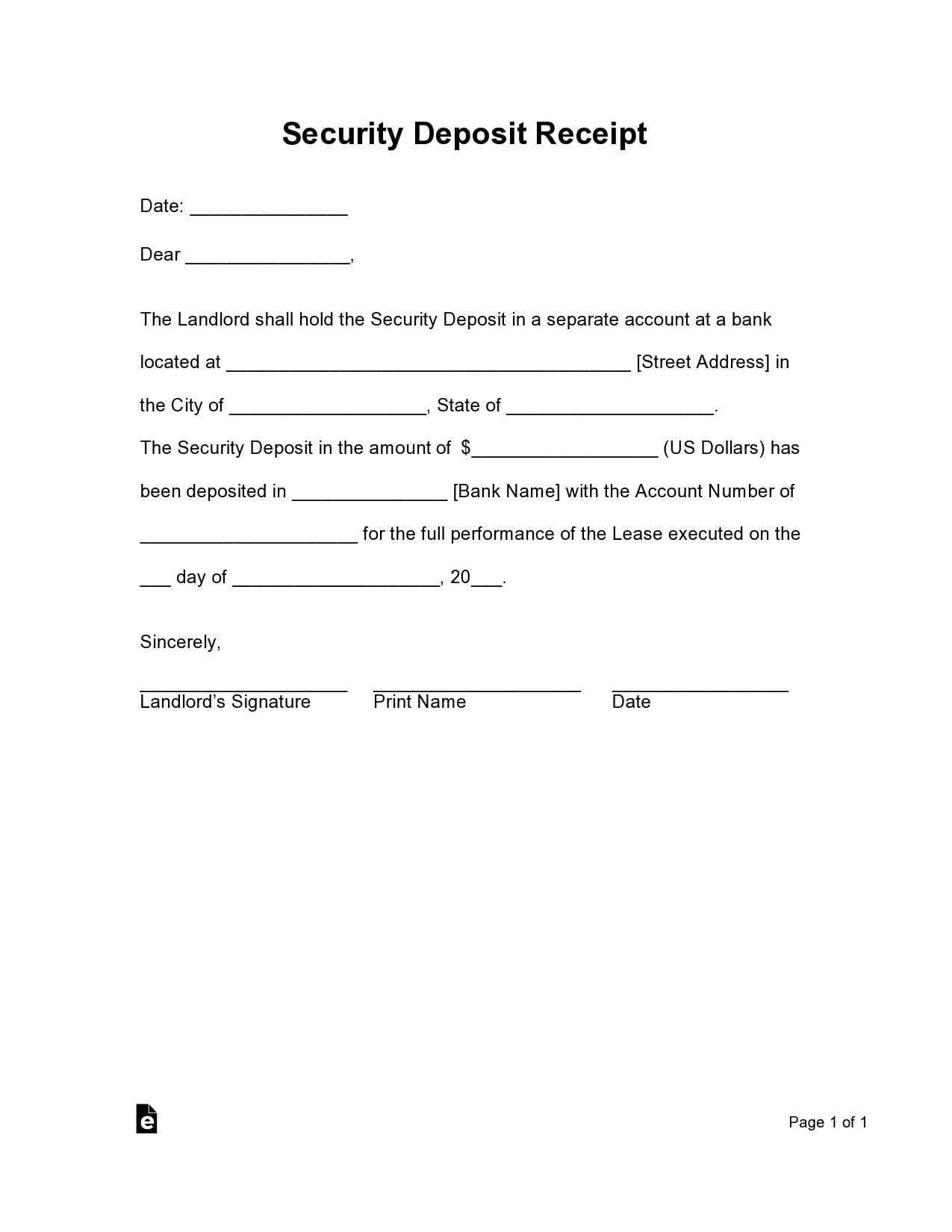

Use a holding deposit receipt template to document the payment of a deposit made to secure a rental or purchase agreement. This receipt clearly outlines the deposit amount, the purpose of the payment, and any terms or conditions related to its return. Include essential details such as the payer’s name, the property or item involved, and the date of the transaction. Ensure the template is straightforward and includes a section that confirms whether the deposit is refundable or non-refundable, and any circumstances under which it could be forfeited.

The receipt should also contain a unique reference number for record-keeping purposes. This helps in tracking the deposit in future correspondence and avoids confusion. When drafting the template, keep the language clear and concise, using simple terms that the payer can easily understand. Providing the terms and conditions of the holding deposit upfront ensures both parties are aligned on expectations.

First, gather all necessary information. This includes the tenant’s name, the date the deposit was received, and the amount. Make sure the amount matches the agreed-upon deposit sum.

Step 1: Add Basic Details

Start by including the tenant’s name and contact information. Then, specify the date the deposit was paid. Clearly state the deposit amount, and if applicable, mention the payment method (e.g., cash, check, bank transfer).

Step 2: Define the Purpose of the Deposit

Clarify that the deposit is intended to secure a rental property. Include any terms related to the deposit’s use, such as whether it covers damage or is refundable at the end of the lease.

Step 3: Include Legal Language (if necessary)

If relevant, include terms regarding the deposit’s return. For example, you may add a section explaining conditions under which the deposit is forfeited or refunded. Make sure this section aligns with local regulations.

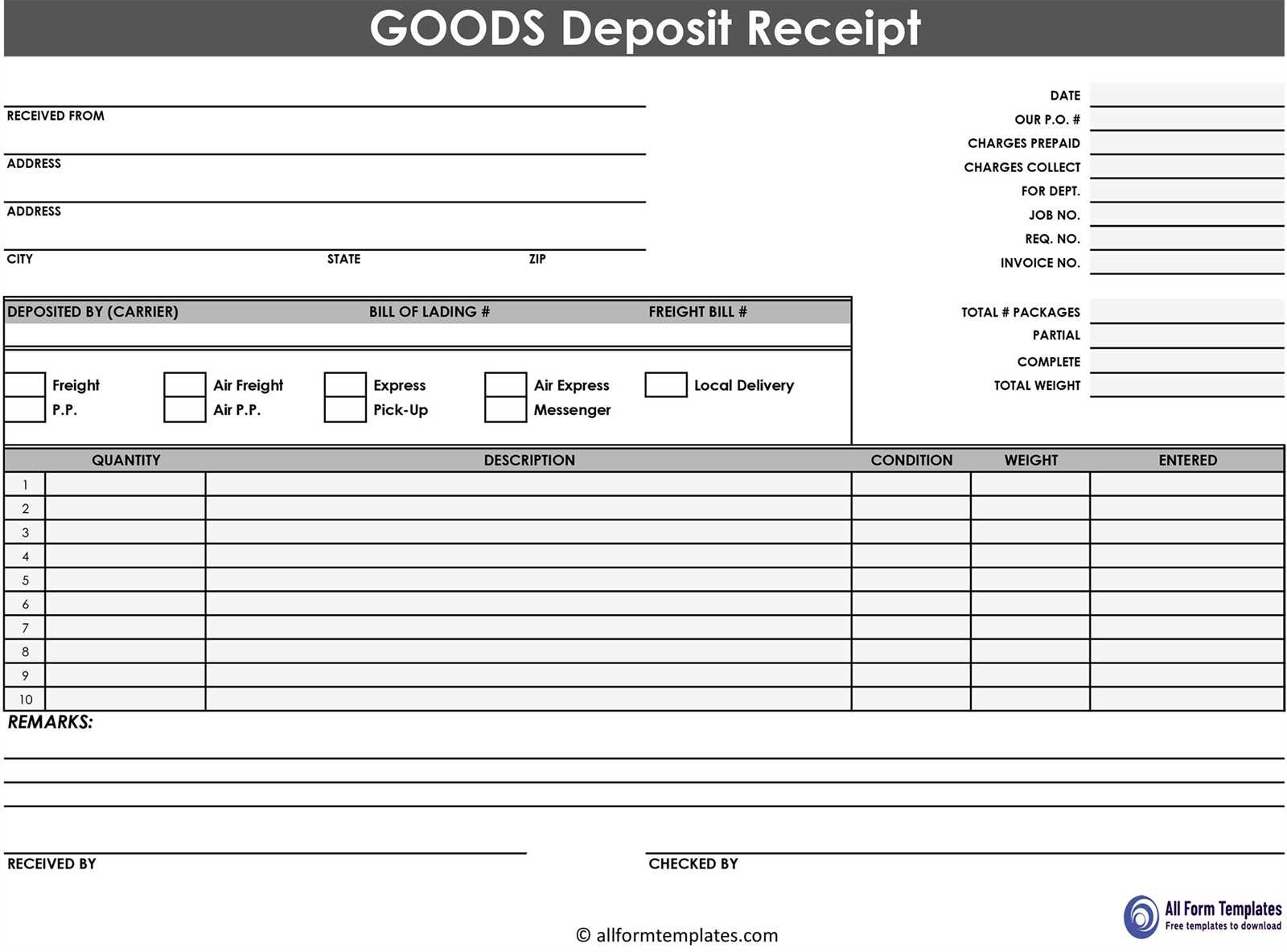

Step 4: Create a Table of Payment Details

| Description | Amount |

|---|---|

| Deposit Paid | $500 |

| Payment Method | Bank Transfer |

| Receipt Number | 123456 |

Conclude by confirming that both parties acknowledge the receipt and agree to the terms outlined. Include space for signatures, along with dates for both parties to sign the receipt. This ensures clear mutual understanding of the deposit terms.

Specify the full names of both parties involved in the transaction: the landlord or property manager and the tenant. This ensures clarity about who is receiving the holding deposit and who is paying it.

Deposit Amount: Clearly state the exact amount being held. Include both the currency and any relevant payment references to avoid confusion.

Date Received: Indicate the date when the deposit is paid. This helps establish a clear timeline for both parties.

Purpose of Deposit: State the reason for the deposit. Mention whether it’s held for a rental agreement, property reservation, or other specific reasons.

Property Details: Provide the address or description of the property being reserved, ensuring there is no ambiguity regarding the location.

Refund Policy: Clearly outline the terms under which the deposit will be refunded. Include conditions like cancellation terms, non-payment, or other situations where the deposit may not be returned.

Signatures: Both parties should sign the receipt. This confirms mutual agreement on the terms outlined and reduces the risk of disputes later.

Contact Information: Include contact details for both parties, so they can reach out if any issues arise regarding the holding deposit.

In legal agreements, a holding deposit receipt confirms the transfer of a deposit and sets the foundation for any further steps in the transaction. It’s crucial to clearly state the purpose of the deposit, its amount, and any conditions tied to it. This receipt serves as proof of payment and may help resolve disputes regarding the deposit’s return or forfeiture.

Ensure the agreement specifies the refund terms. If the deal falls through, the document should outline under which circumstances the deposit is refundable and what conditions could lead to forfeiture. Also, include the date the deposit was made and the method of payment to avoid confusion in future discussions.

Use the receipt to establish a timeline for any actions to take place, such as the final payment or transfer of goods. This timeline should be mutually agreed upon to prevent any potential delays or misunderstandings.

Key Points to Include in a Holding Deposit Receipt

Ensure the receipt clearly states the amount of the deposit, the date it was paid, and the purpose of the deposit. Include the name of the tenant and the landlord or agent, as well as the address of the property involved. Specify the terms under which the deposit will be returned or retained, particularly in the case of a breach of agreement. Clearly outline any conditions for using the deposit, such as damage to the property or unpaid rent. Provide space for both parties to sign and date the receipt for legal clarity.

Keep a copy of the signed receipt for future reference. It’s essential for both parties to understand their obligations regarding the deposit to avoid disputes. Make sure the receipt is simple, clear, and free of unnecessary jargon, ensuring both parties are informed.