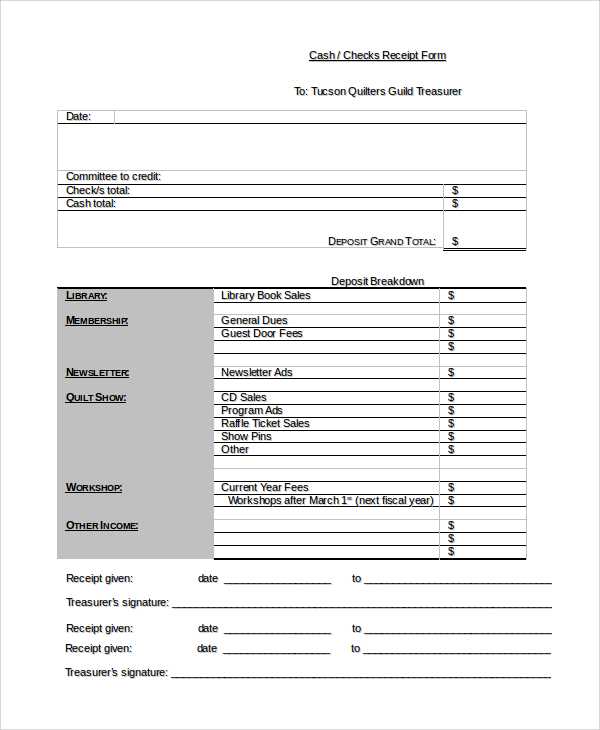

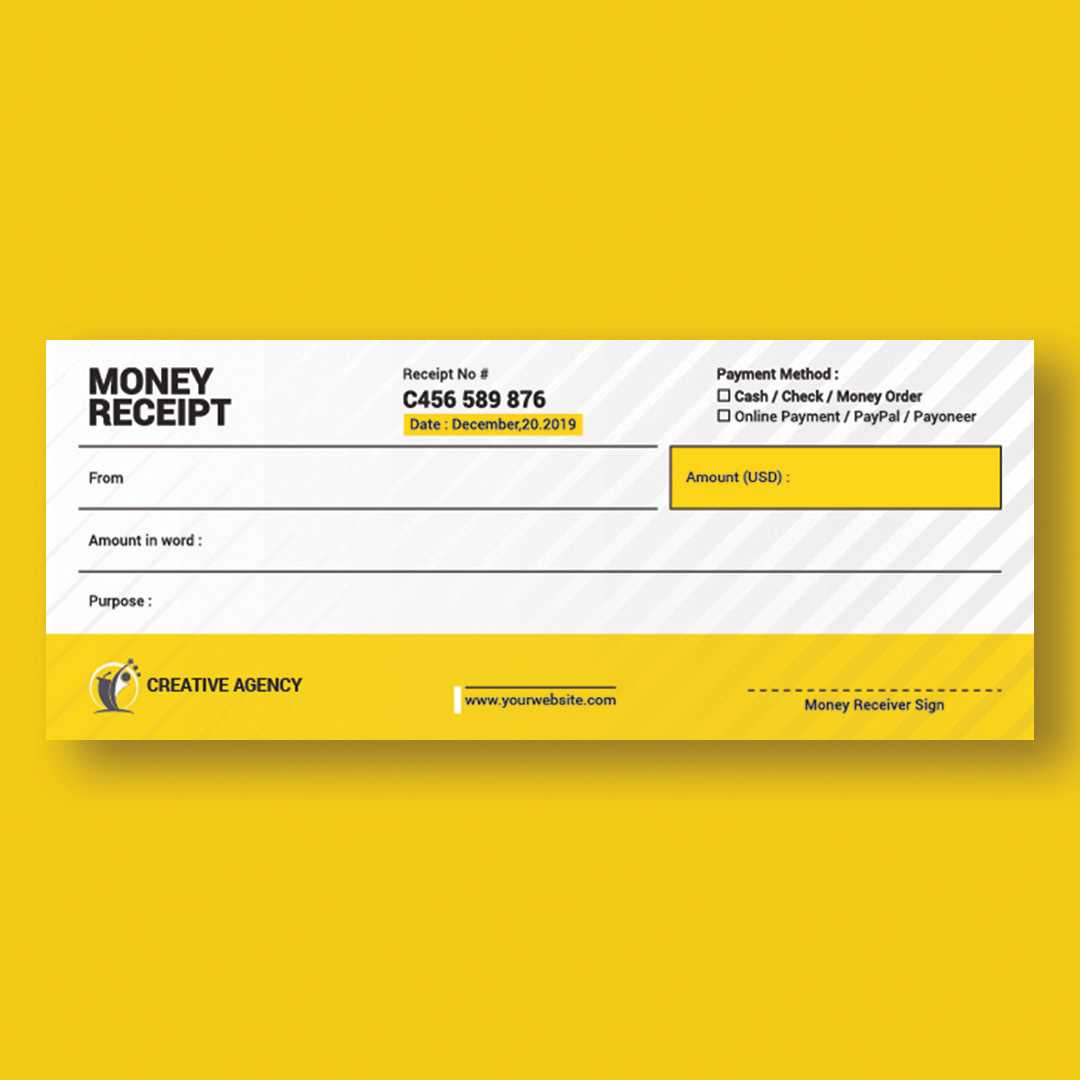

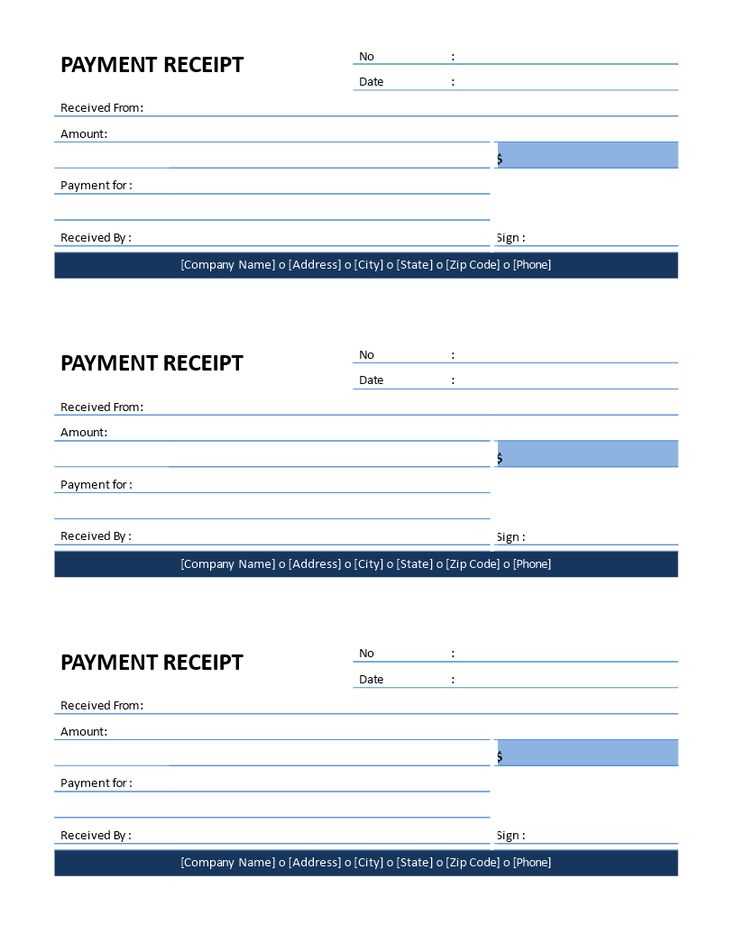

For anyone managing cheque payments, a receipt template is a practical tool to maintain clear and accurate records. It simplifies the process by detailing the transaction’s key elements, ensuring both parties have confirmation of the payment. Use the template to quickly fill in essential details, including the cheque number, payment amount, payer’s information, and the recipient’s signature.

Start with a straightforward layout. Include date of payment, the cheque number, and the exact payment amount in words and figures. This ensures the cheque is easily traceable. Add fields for the payer’s name, contact details, and the purpose of the payment. A clear breakdown of this information keeps everything transparent and organized.

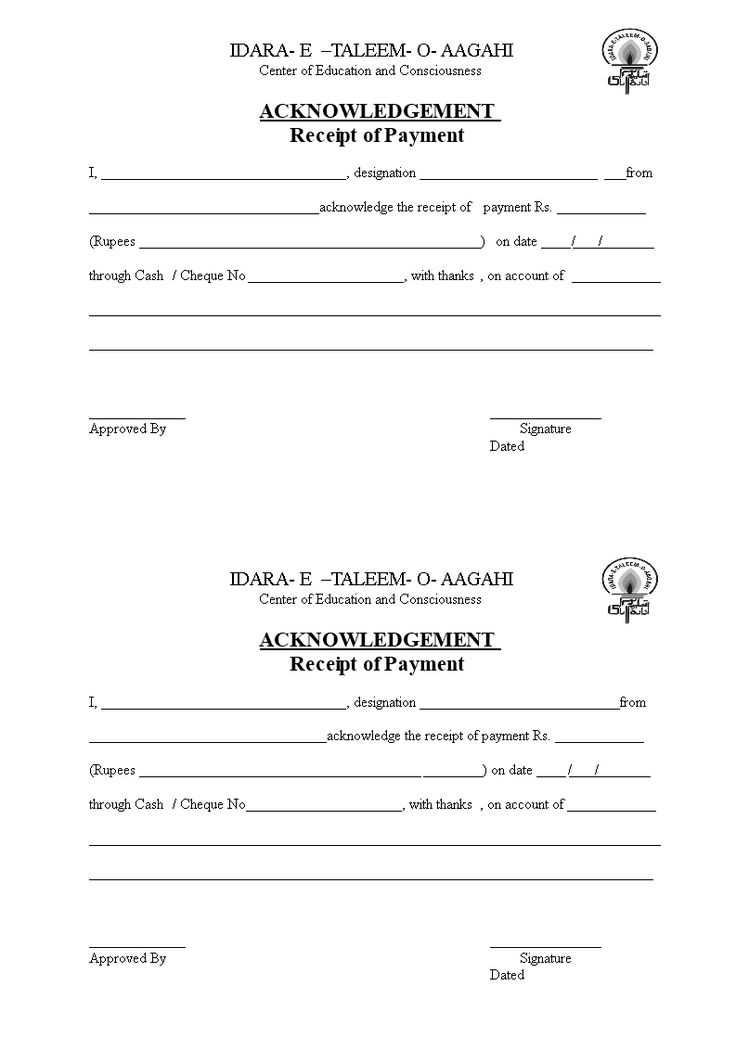

For security and clarity, always provide a space for the recipient’s signature upon receiving the payment. This serves as an acknowledgment that the transaction was completed successfully. Make sure to include a unique reference or serial number on the receipt to track payments without confusion.

With this template, you’ll find it easier to maintain a reliable record of cheque transactions, which is valuable for both business and personal financial management.

Sure, here’s the revised version with reduced repetition:

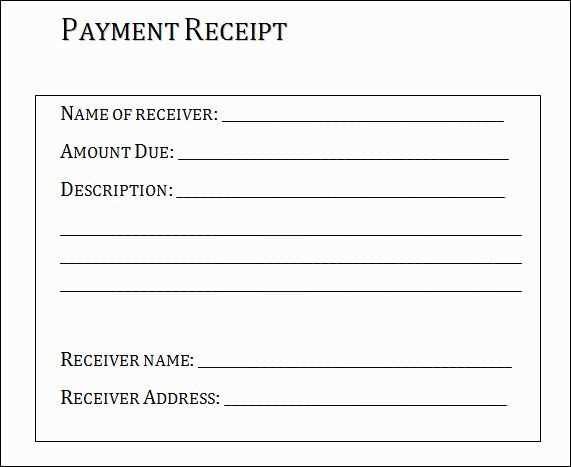

When drafting a cheque payment receipt template, ensure that it contains the necessary details for both parties involved. A clear and concise format reduces confusion and ensures accuracy in record-keeping.

- Payee Information: Include the full name and address of the recipient.

- Cheque Details: Record the cheque number, issue date, and bank name for easy reference.

- Payment Amount: Clearly state the amount written on the cheque, both in words and figures.

- Cheque Type: Specify whether it is a personal, certified, or bank cheque.

- Payment Purpose: Mention the reason for the payment to ensure both parties understand the transaction.

- Signature: Provide space for the payee’s signature to validate the receipt.

By organizing these components in a logical order, you ensure a professional, straightforward receipt that can easily be referenced later.

- Cheque Payment Receipt Template

To create a clear and accurate cheque payment receipt, include these key details:

Receipt Information

The receipt should have the payer’s name, cheque number, amount paid, and the payment date. Ensure to include the recipient’s name and the purpose of the payment. This helps both parties track payments efficiently.

Formatting the Template

Start with a simple structure. Use clear headings like “Cheque Number”, “Amount Paid”, and “Date of Payment”. Below each heading, provide space for the relevant information. For example, under “Amount Paid”, you can use a placeholder like “_____” for easy filling. This ensures that all necessary information is included and easy to locate.

To create a customisable receipt template for cheque payments, focus on the key elements that need to be included in every receipt. Start with a clearly defined header that shows the name of your business, contact details, and payment information. This will set the stage for the rest of the document.

In the main body, include the cheque number, payment amount, and the date of the transaction. Leave space for the payer’s name and the purpose of the payment. You can also provide an area for any reference or invoice number related to the payment. Make sure the design accommodates different fonts and sizes to easily adjust for any unique formatting requirements.

Next, add sections for additional notes or instructions, where needed. This can be particularly useful for adding payment terms, or refund policies. A section for signatures, either from the payer or a company representative, ensures proper documentation of the transaction.

Finally, ensure the template is flexible by making it possible to adjust any text field. You can use placeholders for dynamic information, such as payer name, cheque number, or payment amount, so they can be quickly filled in when generating receipts. Use simple, clear formatting and structure so that it can be adapted easily in the future.

Include the payee’s name to confirm who received the payment. The cheque number must be clearly stated for reference. List the amount in both figures and words to avoid any confusion. Ensure the payment date is visible, confirming the timing of the transaction.

Bank and Transaction Details

Provide the name of the bank and branch where the cheque was processed. This information helps verify the payment source. The payer’s and payee’s signatures must appear on the receipt, confirming the transaction’s legitimacy.

Store payment receipts in an organized manner to ensure easy retrieval and accuracy in financial reporting. Use a consistent system to categorize receipts, whether by date, vendor, or type of payment. This prevents confusion when reviewing records at a later time.

Organizing Receipts Efficiently

To maintain clarity, create separate folders or digital files for different types of payments. For example, keep cheque receipts in one folder and credit card receipts in another. Use clear labeling conventions such as “Paid on [Date]” and “Cheque # [Number]” to avoid misplacement.

Regularly Reviewing and Updating Records

Schedule periodic reviews of your receipts. This ensures no payments are overlooked or missed when updating your records. Set aside time monthly or quarterly to verify that all receipts are recorded and any discrepancies are addressed promptly.

| Receipt Type | Suggested Organization Method | Frequency of Review |

|---|---|---|

| Cheque | Label by cheque number and date | Monthly |

| Cash | Store by payment date | Monthly |

| Credit Card | Group by merchant or payment type | Quarterly |

By maintaining a methodical approach to storing and reviewing payment receipts, you enhance the accuracy of your financial records and make audits or tax filings much simpler. This practice helps prevent mistakes that could result from missing receipts or miscategorization.

To create a cheque payment receipt, you must include the key details of the transaction. Ensure the document contains the cheque number, date of payment, payee’s name, and the amount received. Also, be sure to add the payer’s information and the payment method (cheque), so the receipt is easily traceable for both parties.

Key Elements of a Cheque Payment Receipt

First, include the cheque number at the top of the receipt for reference. This is essential for tracking the payment in case of any disputes or inquiries. Next, clearly state the payment amount in both numerical and written form. Always include the date on which the cheque was issued, as this helps verify the payment timeline.

Additional Considerations

If applicable, include details of the cheque issuer’s bank, as well as the branch code. A signature from both the payer and payee can further confirm the legitimacy of the transaction. It’s a good idea to keep a copy of the receipt for your own records and provide the original to the payer as proof of payment.