Creating a blank receipt template in the UK is straightforward and offers flexibility for businesses or personal use. You can quickly generate a receipt with the right fields, ensuring all necessary details are included. These templates are useful for various transactions, from small purchases to professional services, without the need for complex software.

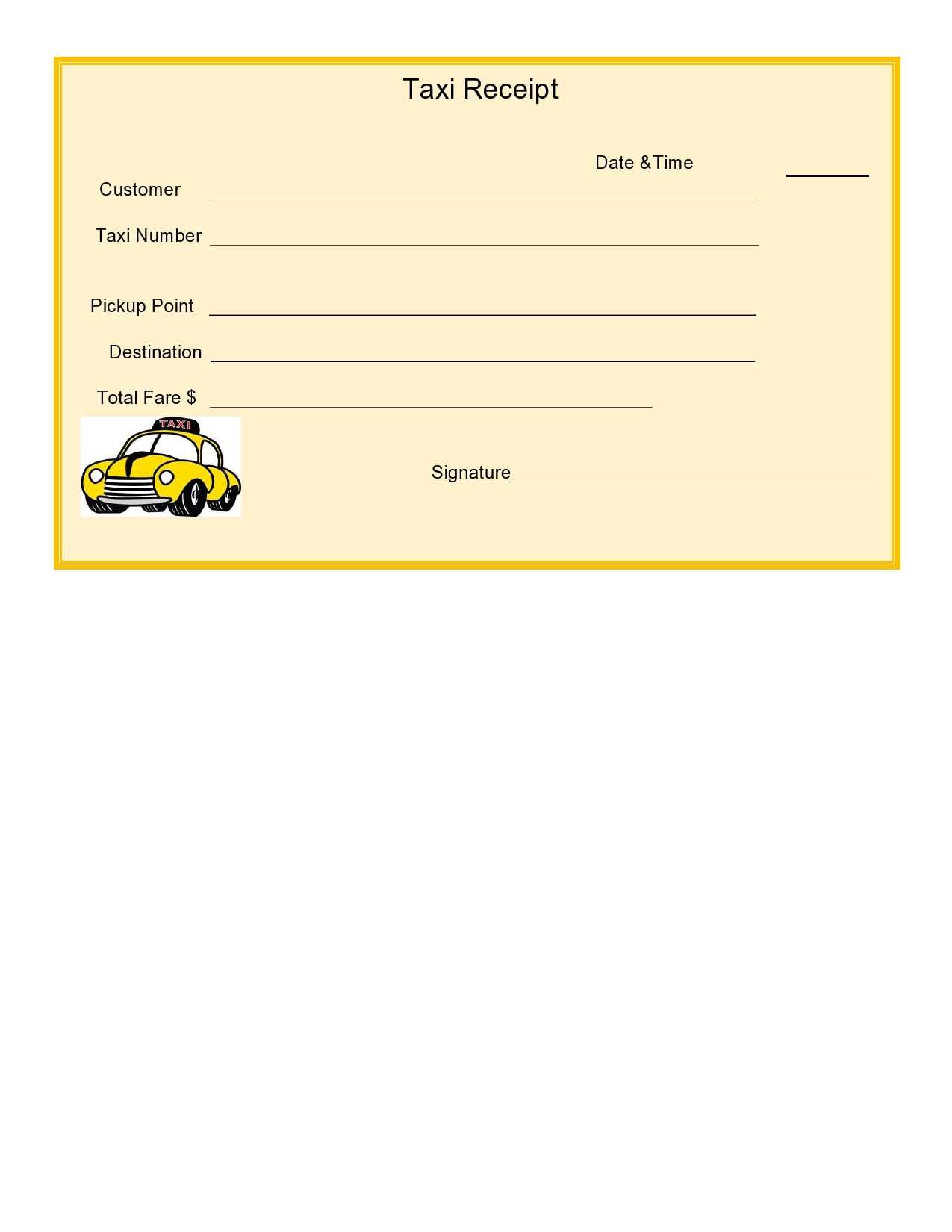

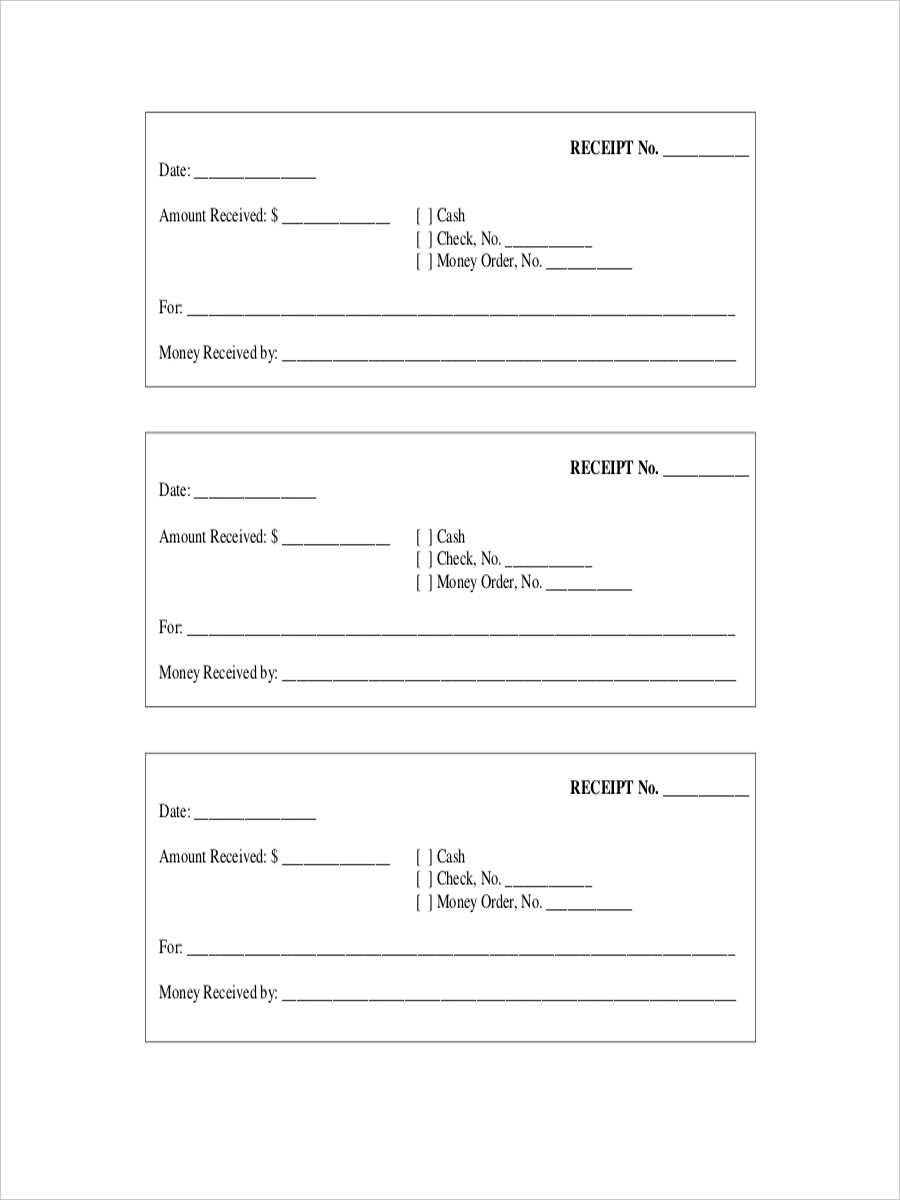

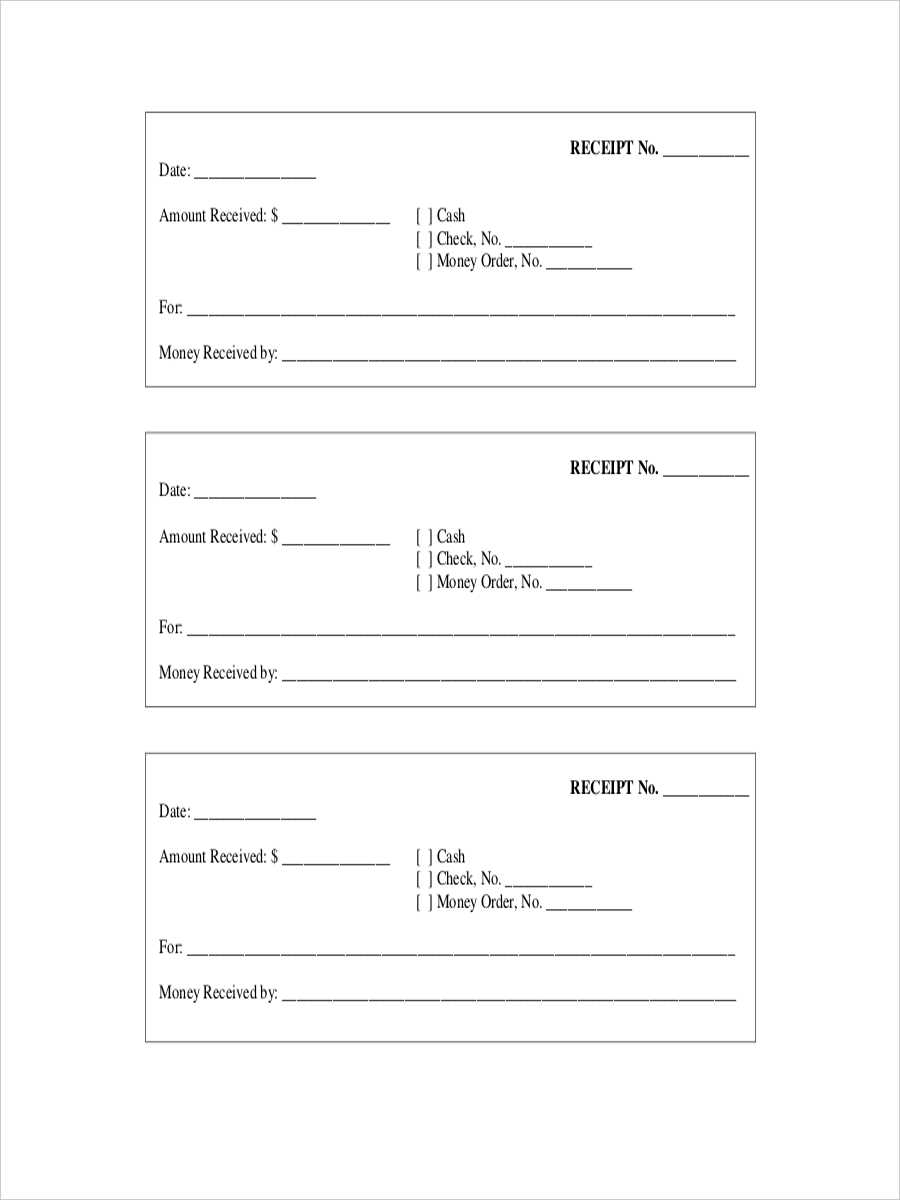

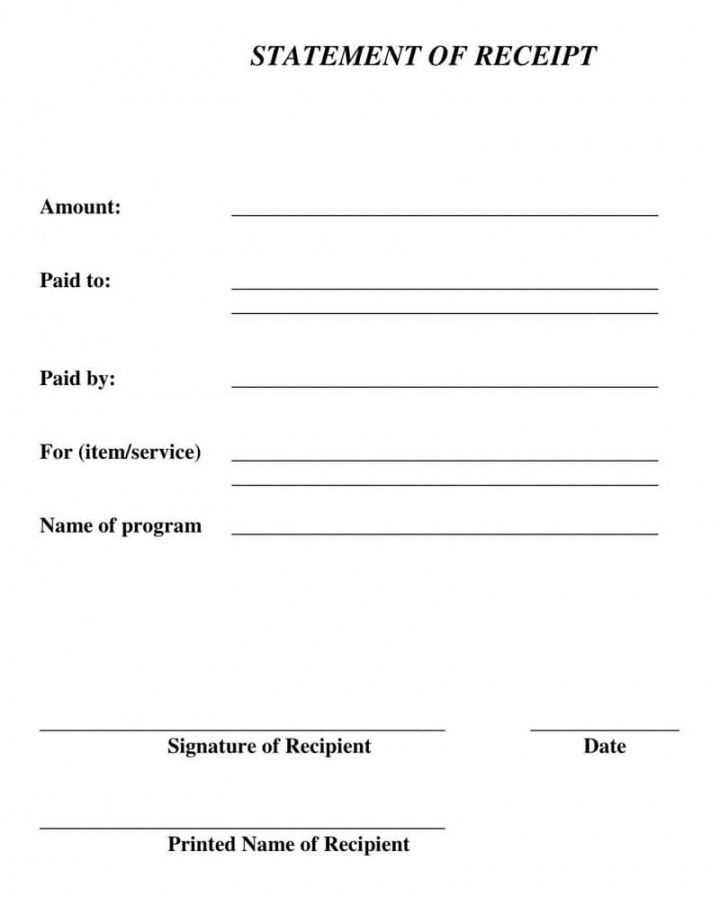

Make sure your template includes basic elements like date, itemized list of products or services, total amount, and payment method. These details are crucial for both clarity and legal purposes. By organizing the receipt in a clear and concise format, you can avoid confusion and ensure smooth transactions.

Additionally, customizing the template with your business name and contact information adds professionalism. Whether you’re handling cash payments or bank transfers, having a standard receipt format makes it easier to track and verify transactions in the future.

Blank Receipt Template UK

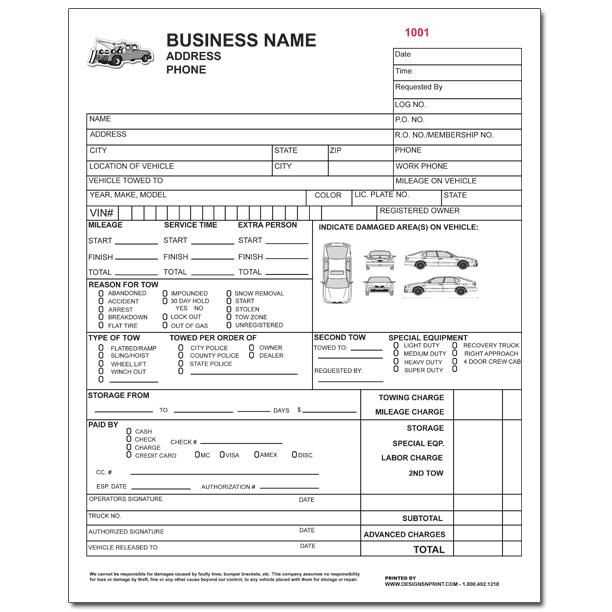

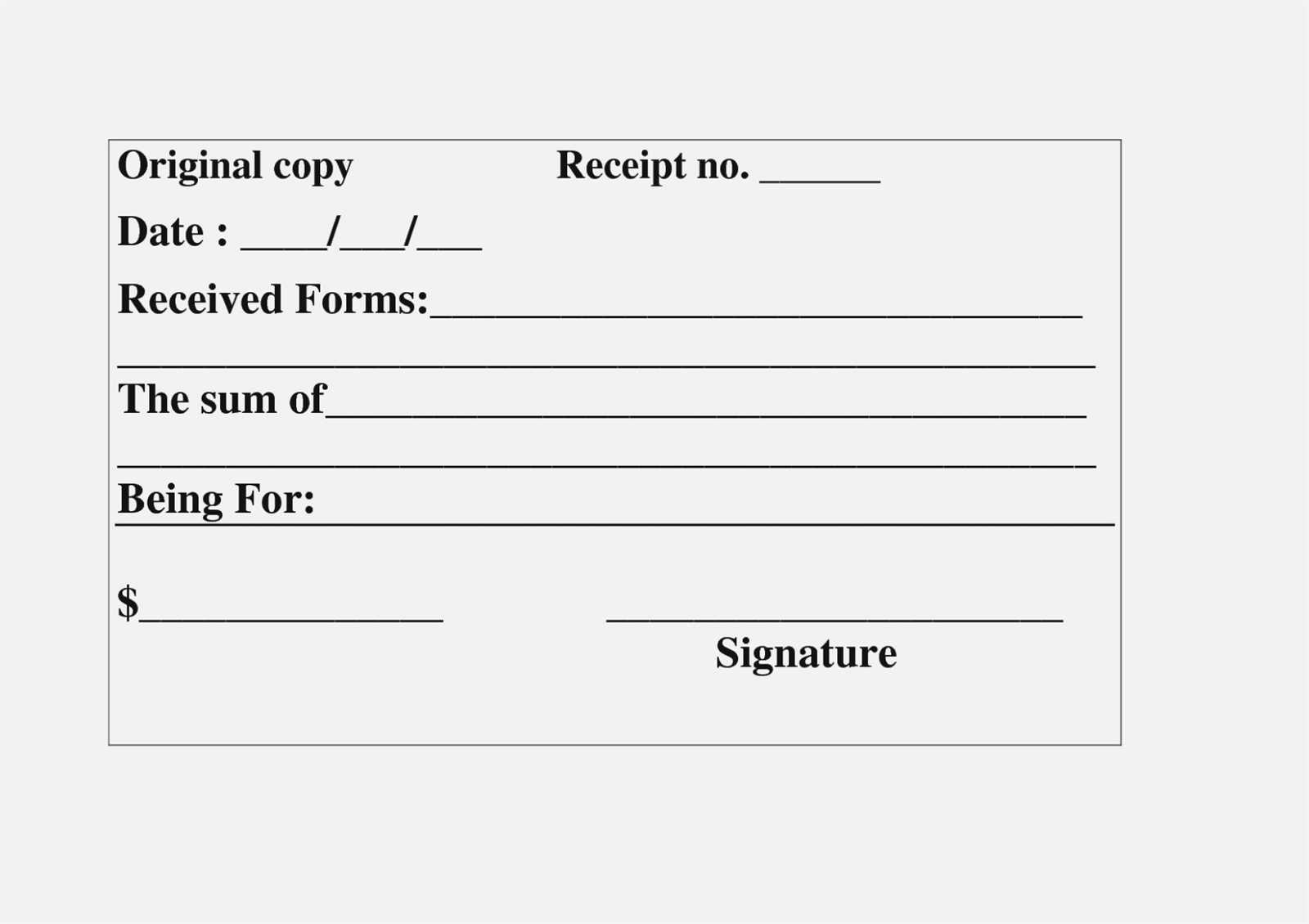

For a clear and functional receipt template, make sure it includes the following key details: the business name, address, and contact details, as well as the buyer’s name and address. Add a unique receipt number for easy tracking and reference.

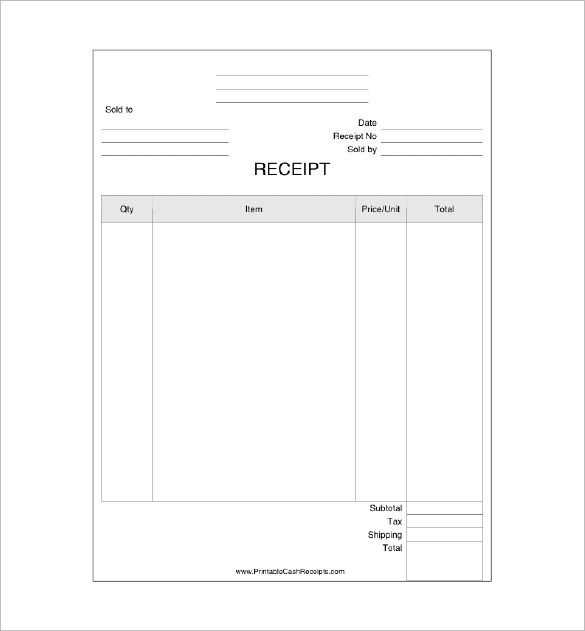

The date and time of the transaction should be clearly stated. Include a detailed breakdown of the items or services purchased, including their prices and any applicable taxes or discounts. A subtotal, tax amount, and total cost will ensure transparency for both parties.

Provide a clear payment method section (e.g., cash, card, or bank transfer), along with the payment status–whether paid or pending. Leave room for any additional notes or terms and conditions related to the sale or services rendered.

Ensure that the receipt is easy to print or save as a PDF, maintaining clarity in layout and font size. A simple, professional design without unnecessary decoration helps focus attention on the transaction details.

Lastly, it’s recommended to include a section for the business’s logo or branding for a polished look. This will also help customers identify the receipt as official and trustworthy.

How to Download and Customize a Blank Receipt Template for Personal Use

To download a blank receipt template, search for a trusted website offering free templates in formats like Word, Excel, or PDF. Websites like Template.net, Vertex42, or Microsoft Office templates are great starting points. Select the template that suits your needs and click on the download link. Most templates are free but may require you to create an account or provide an email address to access the download.

Once you’ve downloaded the template, open it in the relevant program (Word, Excel, or PDF editor). Customize the following fields to personalize the receipt:

- Business Information: Replace the placeholder with your business name, address, and contact details.

- Receipt Number: Add a unique identification number for each receipt to help track transactions.

- Date: Set the date of the transaction. Most templates have a field for the current date that you can edit manually.

- Itemized List: Enter the products or services sold, along with their prices, quantities, and any applicable tax.

- Total Amount: Adjust the total cost based on the items listed, including taxes, discounts, or additional fees.

If needed, adjust the design by changing fonts, colors, or layout to match your branding. Some templates may allow you to add logos or additional information like payment methods. Once you’ve made the necessary adjustments, save the customized receipt on your device and print it for use or send it digitally to your customers.

Key Elements to Include in a UK Receipt Template for Small Businesses

A UK receipt template for small businesses should include the following details to ensure compliance with legal requirements and provide clarity for both the business owner and the customer:

1. Business Information

Include your business name, address, and contact details at the top of the receipt. If your business is VAT-registered, add your VAT number to avoid any confusion about tax status.

2. Receipt Number and Date

Each receipt should have a unique receipt number for easy tracking and record-keeping. The date of the transaction is crucial to establish the timeline of purchases or services provided.

3. Customer Information

While not mandatory, providing customer details such as their name and address may be helpful, especially for higher-value transactions. This can also aid in future communication or returns.

4. Description of Goods or Services

Be specific about the items or services purchased. Include clear descriptions and quantities to ensure there is no ambiguity about what was sold.

5. Total Amount and Payment Method

Clearly list the total amount charged, breaking down any VAT if applicable. Specify the payment method, whether it’s cash, credit card, or another form of payment.

6. VAT Information (if applicable)

If your business is VAT-registered, include the VAT rate and the amount charged. This is necessary for tax purposes and ensures transparency in the transaction.

Legal Requirements for Blank Receipts in the UK: What You Need to Know

Blank receipts in the UK must comply with certain legal standards. Businesses issuing receipts should ensure that the template includes specific details to meet consumer protection laws. The receipt must clearly display the business name, address, and contact details. Additionally, the receipt should state the date and amount of the transaction. Though blank receipts are commonly used in industries like hospitality, they must be completed properly to reflect the actual transaction. Using generic templates is acceptable as long as the required information is added before finalizing the document.

The UK does not mandate a specific format for receipts, but it’s crucial to avoid ambiguity. A blank receipt template should allow for clear entry of information like item descriptions, prices, and any discounts or taxes applied. Failure to provide a valid, complete receipt could result in confusion or disputes with customers, especially in cases of returns or exchanges.

In some industries, such as retail, keeping records of receipts is a legal requirement for tax purposes. Businesses must maintain these records for a set period to ensure compliance with HMRC regulations. The format of the receipt may vary, but it must be legible and not misleading.