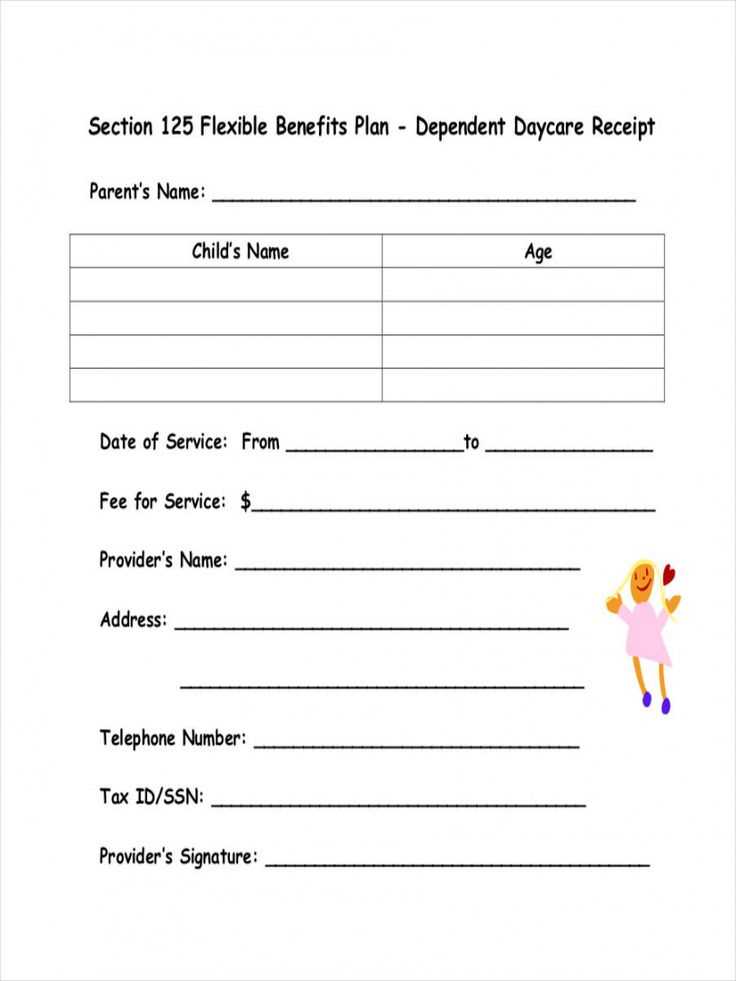

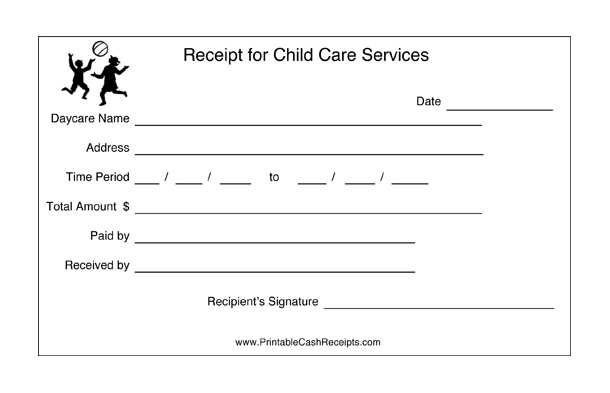

Use a well-structured FSA daycare receipt template to ensure clarity and compliance with tax requirements. The template should clearly list the daycare provider’s details, including the business name, address, and tax identification number. Include the date of service, the number of hours or days provided, and the total amount paid.

Be sure to also add specific information about the child’s name and the service period, which will help streamline the reimbursement process. Include a breakdown of any applicable fees or charges, such as after-hours or additional services, to avoid confusion later on.

If the provider offers a receipt with the required details, make sure it aligns with the template’s standards for easy record-keeping. This way, you can ensure that your FSA submission goes smoothly and meets all documentation requirements.

Here’s the corrected version:

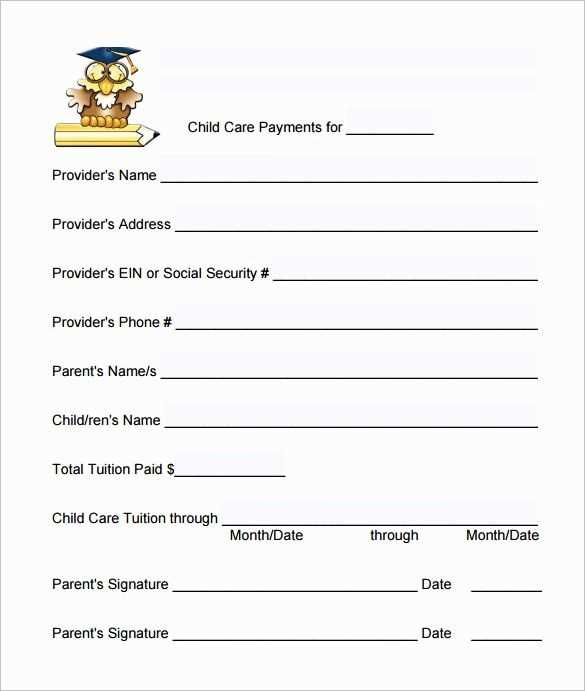

For an accurate FSA daycare receipt template, start by clearly stating the provider’s name, address, and contact information. Include the dates of service, the child’s name, and the total amount paid. Break down the charges into separate categories if necessary. Ensure the receipt specifies whether it covers full or partial daycare services for the period. Don’t forget to include any applicable tax information. At the bottom, add a statement confirming that the payment was made and that no further balance is due.

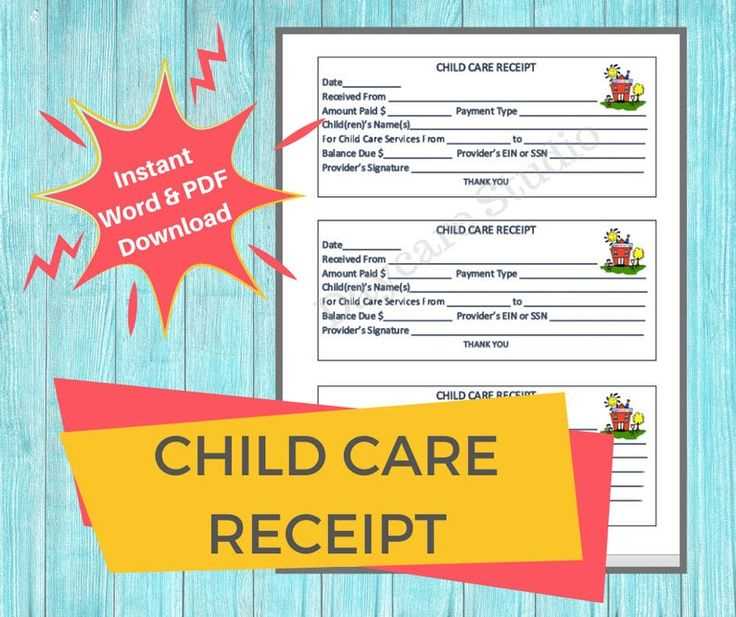

- FSA Daycare Receipt Template

When creating an FSA daycare receipt, it’s important to include key details for reimbursement. The receipt should clearly show the provider’s name, address, and phone number. Specify the dates of service and the type of care provided. Break down the charges with a detailed list, showing the total amount paid. Ensure the receipt includes the child’s name and age, if applicable, to align with FSA guidelines.

For clarity: Always double-check the accuracy of the amounts and dates to prevent any issues with your FSA claim. If the provider does not issue a receipt with these details, request a revised one to ensure smooth processing of your claim.

Remember: Some FSAs may have specific formats or additional requirements, so it’s always a good idea to review your plan’s guidelines before submitting your receipt.

Ensure your daycare receipt includes these key details for FSA reimbursement:

- Provider’s Information: List the daycare center’s name, address, and contact information.

- Parent’s Information: Include your name and any relevant identifying information, such as an account number.

- Child’s Information: Mention the child’s name and age.

- Dates of Service: Specify the exact dates when the daycare services were provided.

- Amount Paid: Clearly state the total amount you paid for services rendered.

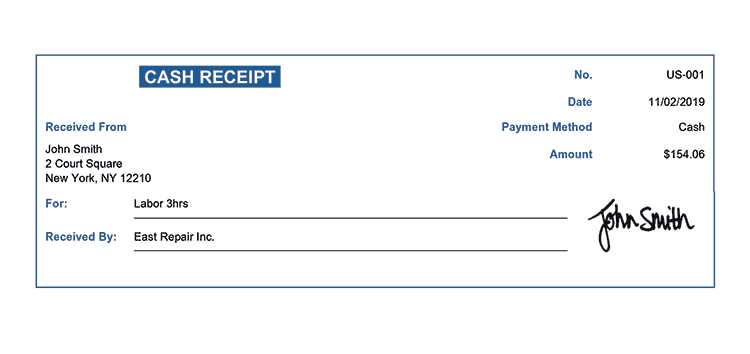

- Payment Method: Indicate how the payment was made, whether by check, credit card, or other means.

- Signature or Official Stamp: Ensure the receipt is signed or stamped by the daycare provider to validate the transaction.

By including these specifics, you will create a receipt that meets FSA requirements for reimbursement without issues.

One common mistake is submitting receipts that lack clear identification of the service provider. Make sure the daycare provider’s name, address, and phone number are included. Without these, your receipt may not be accepted by FSA administrators.

Another issue arises when dates or times are unclear. Receipts must specify the exact date(s) when services were rendered. Avoid vague descriptions like “January daycare” or “care for the month.” Instead, list each date individually if multiple days are involved.

Ensure that the receipt clearly states the amount paid and matches the service description. It is not uncommon to receive receipts that don’t detail the specific charges for daycare services, which can lead to delays or denials.

| Common Mistakes | How to Avoid Them |

|---|---|

| Lack of provider information | Ensure daycare provider’s name, address, and contact details are listed. |

| Unclear dates or times | Include the specific dates services were provided, not just a general timeframe. |

| Missing service details | Clearly list the specific services rendered along with the corresponding amounts. |

| Failure to itemize charges | Break down each charge separately to prevent confusion. |

Avoid submitting receipts that mix personal and daycare-related expenses. FSA administrators will require clear separation to process your claims accurately. Keep daycare-related charges distinct from any other services or products purchased during the same transaction.

Lastly, make sure to submit the correct format of the receipt. Handwritten receipts, while valid in some cases, can be rejected if they don’t follow the proper guidelines. Always check that the receipt format aligns with FSA requirements before submitting.

To submit your daycare receipt for FSA reimbursement, gather the required documentation from your provider. This should include the provider’s name, address, tax ID number, and a detailed breakdown of services rendered, including dates and amounts paid. Make sure the receipt reflects the total cost of care, not just the portion eligible for reimbursement.

Next, log into your FSA account and select the option to submit a claim. Upload a clear, legible copy of the daycare receipt. Double-check that all necessary information is included. Some FSA plans may also require a claim form, which can be filled out directly on the website or downloaded and submitted with the receipt.

If your provider is not listed in the FSA system, you may need to provide additional documentation, such as a signed statement from the provider confirming their qualifications and the services provided. After submission, review the details to ensure accuracy before finalizing the claim.

Once your claim is processed, monitor your FSA account for updates. If any issues arise, contact customer support for clarification or to resolve discrepancies. Reimbursements are typically issued within a few weeks, depending on your plan’s processing times.

Ensure your daycare receipt template includes accurate, up-to-date information. Begin by listing the provider’s name, address, and contact details. Include the child’s name, dates of service, and the amount paid. Make sure the receipt is clear, legible, and easy to interpret. A line item for each service provided, including any extra charges or discounts, helps maintain transparency.

Use a standard format: Make it simple by creating a template that can be reused, saving time. Include a unique receipt number for tracking and reference purposes. Make sure to specify the payment method and note if any portion was paid by a third party, like an FSA or HSA account.

Double-check dates: Ensure the dates of service match the time period that was actually paid for. Be precise with the breakdown of any fees, including tuition, registration, or activity costs. This can help avoid any confusion or misunderstandings later.

Finally, always confirm that the daycare provider’s information is up-to-date on the template and easily accessible for tax purposes or FSA reimbursement claims.