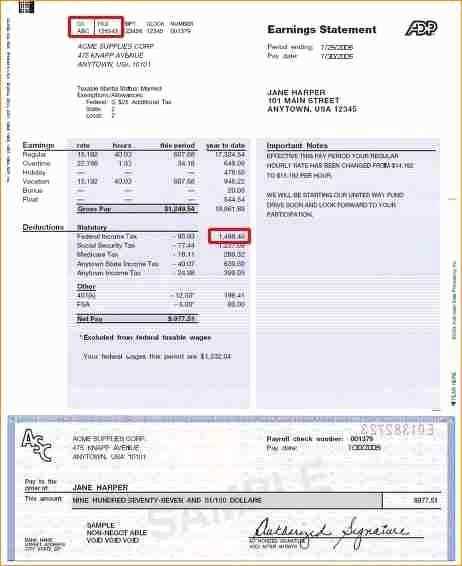

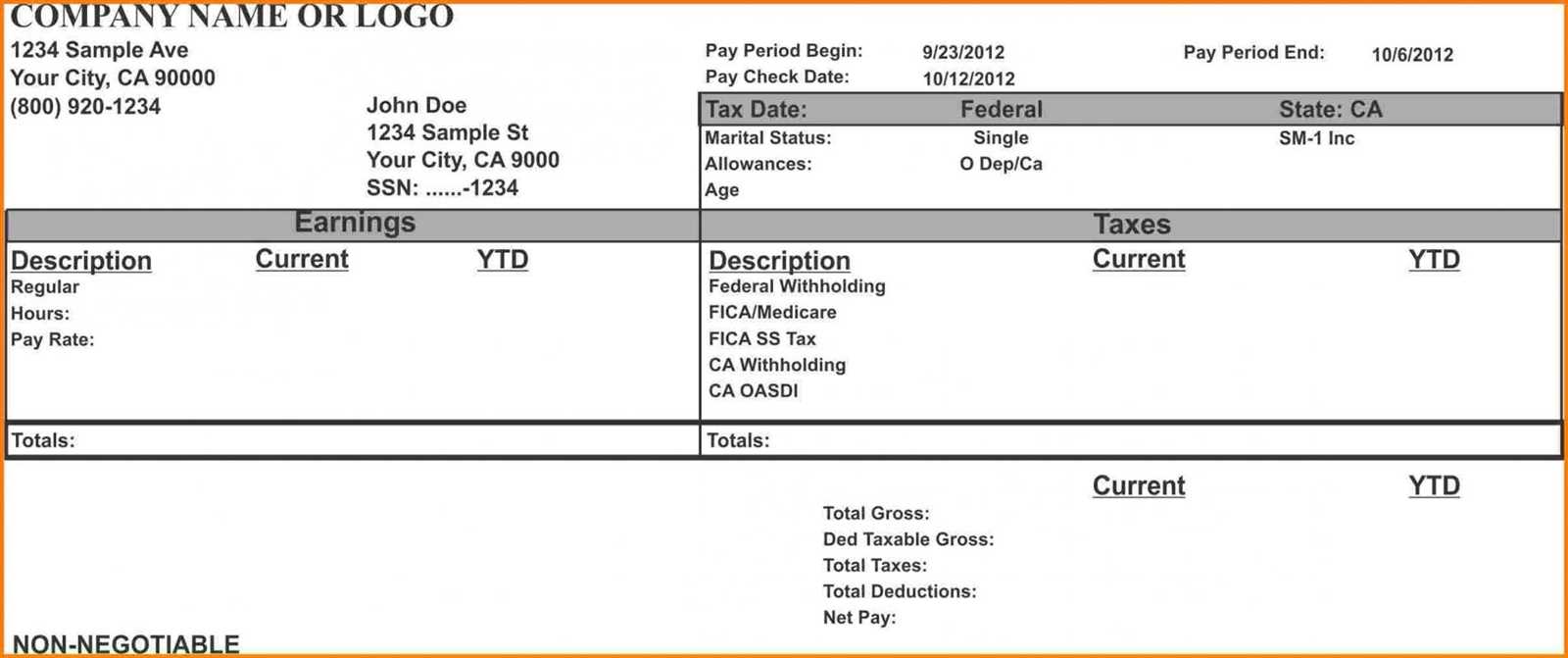

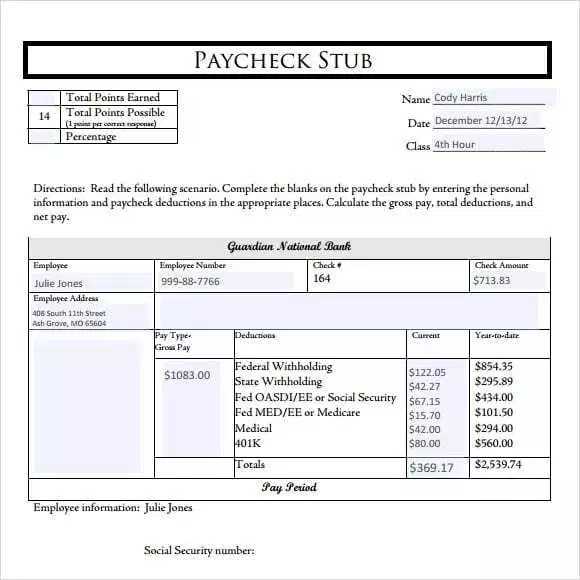

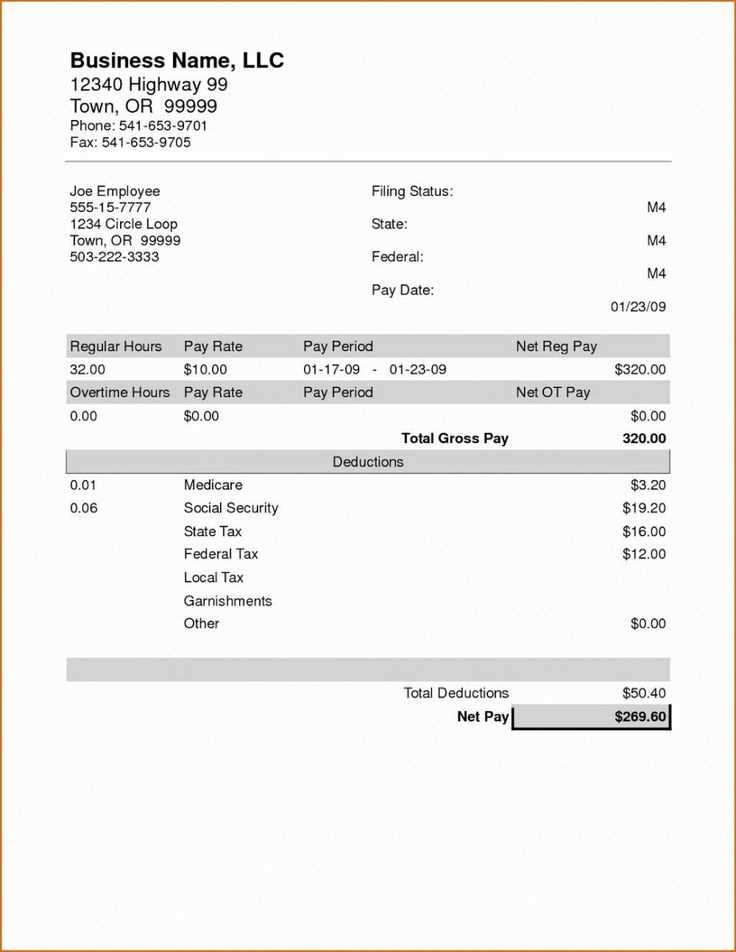

To create a clear and organized pay stub receipt, use a template that includes all the necessary details. Start by including the employee’s name, the pay period, and the total earnings. Make sure to break down the earnings into categories like regular hours, overtime, bonuses, and deductions. This transparency helps both employees and employers track income accurately.

Include a section for taxes, such as federal, state, and local taxes, as well as other deductions like retirement contributions or health insurance. By laying out these components clearly, employees can easily understand how their take-home pay is calculated.

Don’t forget to provide the final net pay, which is the amount after all deductions. A well-structured template can save time and reduce confusion, ensuring both employers and employees stay on the same page regarding compensation.

Here’s the corrected version:

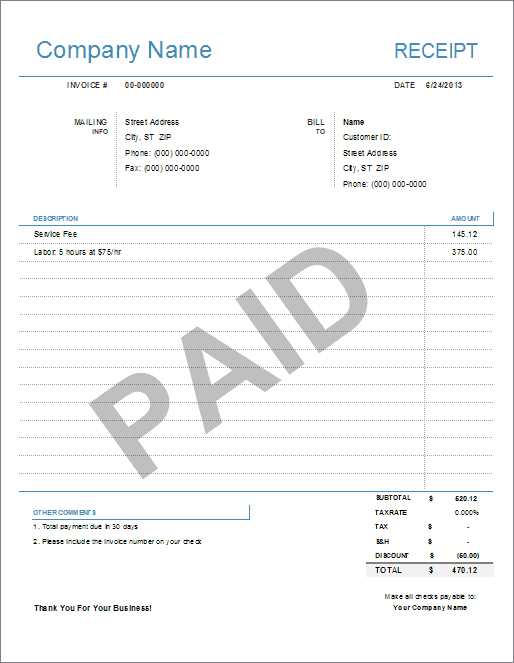

Ensure that the pay stub receipt template you use includes the employee’s full name, pay period, gross earnings, deductions, and net pay. This information should be clearly separated and easy to read. The company’s details, such as name, address, and tax identification number, should also be included to make the receipt valid and compliant with legal requirements.

Key Elements to Include

List all relevant earnings, such as regular pay, overtime, bonuses, and commissions. Deduction details, such as taxes, insurance, and retirement contributions, should follow a clear breakdown. The net pay should be easily distinguishable, and any adjustments (e.g., corrections or special payments) should be noted separately.

Tips for Clarity

Use a simple layout with separate sections for earnings, deductions, and adjustments. Keep fonts readable and ensure all figures are accurate. Double-check calculations to avoid discrepancies and make the pay stub easy to understand for employees.

Pay Stub Receipt Template: A Practical Guide

Customizing a pay stub receipt template for your business is a straightforward task that ensures both clarity and accuracy in payroll processing. Focus on including all necessary details to meet legal requirements and offer transparency to employees. A well-structured template helps prevent errors and streamlines payroll management.

How to Customize Your Pay Stub Template for Your Business

First, choose a format that aligns with your company’s needs. You can opt for a digital or paper template. For customization, ensure that the template includes fields for employee details (name, address, job title), the pay period, total earnings, and deductions. Keep the design simple but organized, with clear sections for each type of compensation (regular, overtime, bonuses) and any applicable deductions (taxes, insurance). A clean layout with intuitive sections helps both employers and employees understand the breakdown easily.

Key Components to Include in a Pay Stub Receipt

Make sure the following elements are included:

- Employee Information: Name, address, and employee ID.

- Pay Period Dates: Start and end dates for the current pay cycle.

- Earnings Breakdown: Separate sections for regular wages, overtime, bonuses, and commissions.

- Deductions: Detailed listing of all deductions such as taxes, retirement contributions, and insurance premiums.

- Net Pay: The total amount paid after all deductions are applied.

- Employer Information: Company name, address, and contact information.

How to Ensure Legal Compliance with Pay Stub Receipts

To stay compliant with labor laws, review your local and national regulations regarding pay stub requirements. Most jurisdictions require that the pay stub clearly outline deductions and provide employees with a detailed account of their earnings. Double-check that your template complies with minimum wage, tax reporting, and other regional labor laws. Always update the template if there are changes in tax rates or benefits that impact employee pay.