For landlords and tenants in Ontario, providing a clear rental receipt is a must. A rental receipt serves as proof of payment and outlines the details of each transaction. It’s crucial to have a template that includes all necessary information to avoid any confusion or disputes later on.

A basic Ontario rental receipt should include the tenant’s name, rental property address, the amount paid, the payment method, and the payment date. This simple format ensures that all the essential details are covered and can be easily referenced in case of any disagreements. Adding a description of the rental period or the rent due for that specific month also helps clarify the transaction.

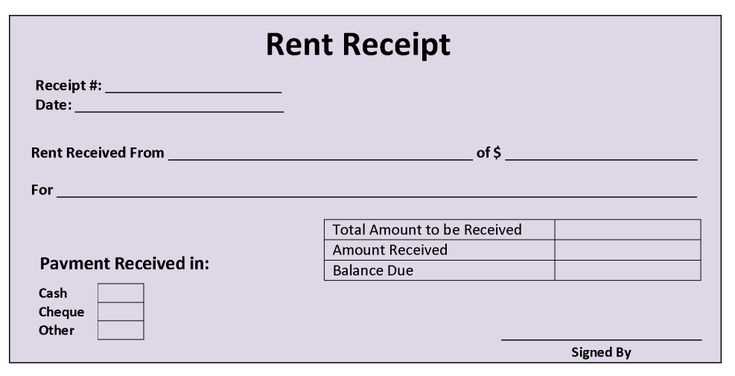

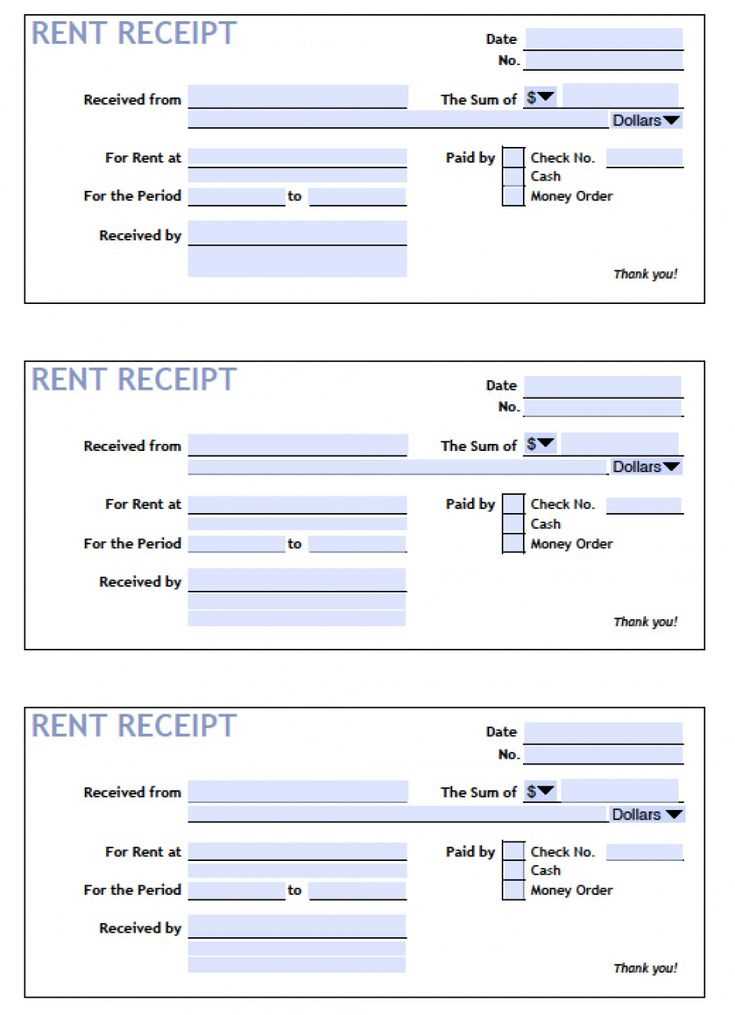

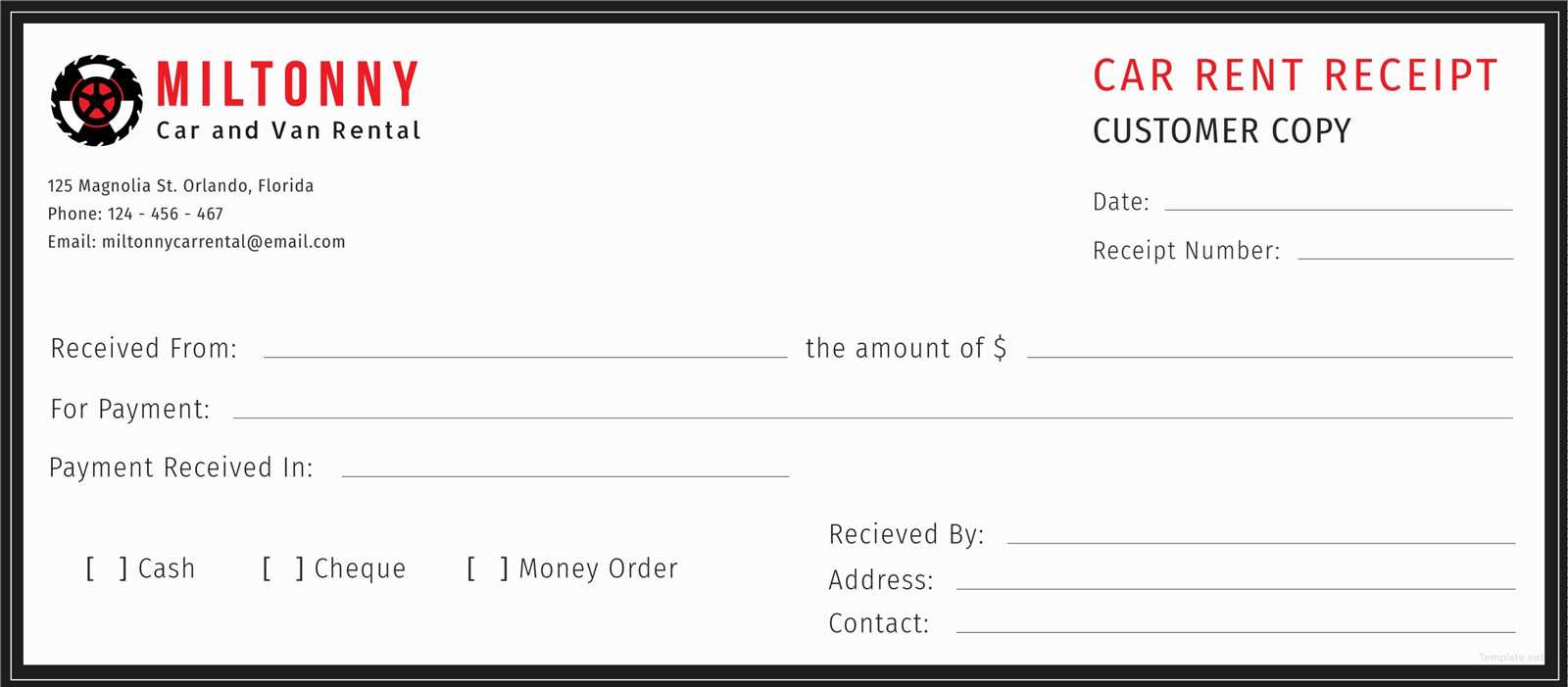

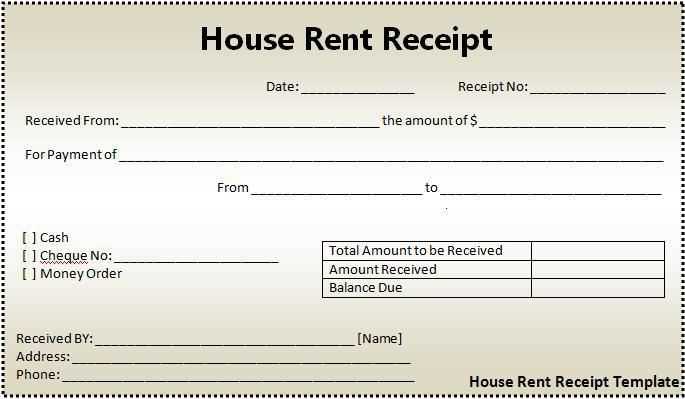

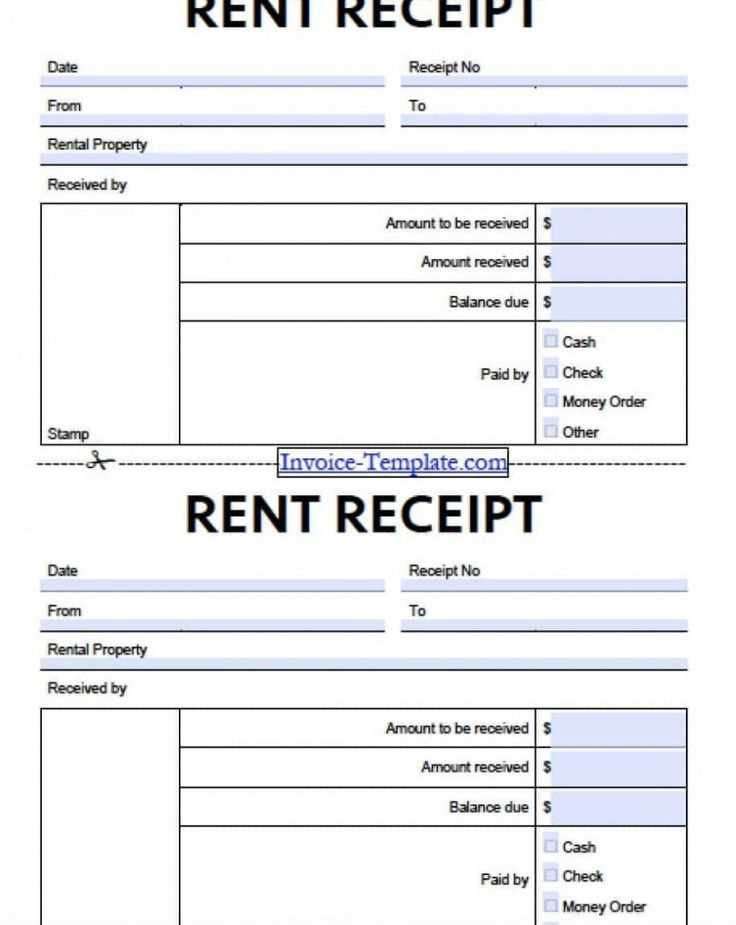

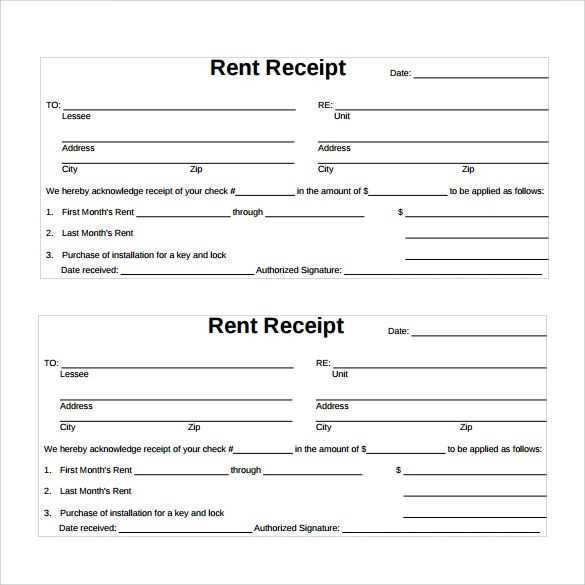

Consider using a template to ensure consistency and professionalism in your records. Many templates are available online and are designed to comply with Ontario’s rental laws. Some even include space for additional notes or a signature, which can further authenticate the payment.

Here is the corrected version:

For landlords in Ontario, creating a rental receipt is a straightforward but important task. A rental receipt should include the tenant’s name, address of the rental property, the payment amount, the payment date, and the period the payment covers. Make sure to mention the method of payment, whether cash, cheque, or electronic transfer. Additionally, include your name or your business name, along with a contact number or email address in case the tenant needs clarification.

Key Information to Include

Below is a list of essential details for a valid rental receipt:

- Tenant’s Full Name: Always include the full name of the tenant who made the payment.

- Rental Property Address: Specify the exact address of the rental unit, ensuring it’s clear which property the payment refers to.

- Payment Amount: Clearly state the amount paid by the tenant.

- Payment Date: Include the date on which the payment was made.

- Payment Method: Indicate whether the payment was made by cash, cheque, or electronic transfer.

- Payment Period: Mention the period covered by the payment (e.g., from January 1 to January 31).

- Landlord’s Contact Information: Provide a contact number or email address for any inquiries.

Tips for Clarity

To avoid confusion, ensure the receipt is clear and readable. Avoid using abbreviations that might not be understood, and double-check that all figures are accurate. A rental receipt serves as proof of payment, which can be useful in disputes or for tax purposes.

Rental Receipt Ontario Template Guide

In Ontario, a rental receipt serves as proof of payment for rent. Ensure that your template includes the following critical elements for clarity and legal purposes:

- Landlord’s Information: Full name, address, and contact details.

- Tenant’s Information: Name and address of the tenant paying the rent.

- Rental Period: Specify the month or weeks for which rent is being paid.

- Amount Paid: Clearly state the amount of rent paid, including currency. If partial payments were made, list each payment separately.

- Payment Method: Note whether the payment was made via cheque, cash, bank transfer, etc.

- Date of Payment: Include the exact date the payment was received.

- Receipt Number: Include a unique receipt number for tracking purposes.

- Signature: The landlord should sign the receipt to authenticate the document.

Creating a simple, easy-to-read rental receipt template ensures both parties are on the same page, protecting tenant and landlord rights alike. Using a template that includes these items will make record-keeping and dispute resolution much easier.

To create a legal rental receipt in Ontario, include the following key elements:

- Landlord’s name and contact details: Clearly list the full name and address of the landlord or property management company.

- Tenant’s name: Include the full name of the tenant or tenants renting the property.

- Property address: Specify the full address of the rental property where payment is being made.

- Date of payment: Record the exact date when the rent was paid.

- Amount received: Specify the amount paid by the tenant. If a partial payment is made, indicate that as well.

- Payment method: Indicate how the payment was made (e.g., cheque, cash, electronic transfer).

- Rental period: Mention the specific rental period that the payment applies to, such as the month or week.

- Receipt number: Include a unique receipt number for reference, especially in case of any future disputes.

The receipt should be signed by the landlord or authorized representative. A copy should be provided to the tenant immediately after payment is received.

Staying consistent with these details ensures the receipt meets the legal standards in Ontario. This documentation can serve as proof in case of any disputes over rent payment or rental agreements.

Clearly list the rental property address. This includes the street name, unit number (if applicable), city, and postal code. This ensures there’s no confusion about the location of the rental.

Include the tenant’s name. Identify who is renting the property, whether it’s an individual or multiple tenants.

Record the payment amount received. Specify the rental payment amount, including any additional charges such as utilities, parking, or late fees. It should be clear whether the amount is a partial or full payment.

Clearly state the date of payment. This confirms when the payment was made and helps avoid any future disputes over payment timing.

Indicate the payment method. Whether the payment was made by cash, cheque, bank transfer, or another method, noting this creates transparency and documentation of the transaction.

Don’t forget the lease term dates. Mention the start and end date of the rental period for which the payment applies. This helps clarify the scope of the payment.

Include any outstanding balances, if applicable. If there’s any balance carried forward or remaining unpaid, list it to ensure all parties are aware of what is owed.

Lastly, provide a receipt number or other unique identifier. This reference number makes it easier to track and retrieve the receipt for future reference.

One common mistake is not including the rental period. Always specify the start and end dates of the rental to avoid confusion later. Omitting this information can lead to disputes over the rental duration.

Another frequent error is failing to itemize the payment details. Make sure to list the rent amount, any applicable taxes, and other charges separately. This ensures transparency and helps avoid any misunderstandings regarding the total payment.

Double-check the tenant’s name and contact information. Incorrect details can complicate future communication and create problems with record-keeping. Always verify the tenant’s name before issuing the receipt.

Don’t forget to include your contact information as the landlord. This makes it easier for tenants to reach out if they need clarification or face any issues with the rental agreement.

Another mistake is neglecting to number the receipts. Sequential receipt numbers help track payments efficiently and prevent confusion if multiple receipts are issued over time.

Make sure the payment method is clearly stated. Whether the payment was made via cash, cheque, or bank transfer, the receipt should reflect the payment method to provide accurate documentation of the transaction.

Lastly, avoid issuing a receipt without a clear statement indicating that the payment is for rent. The purpose of the payment should be unambiguous to prevent any misinterpretation of the transaction.

Ensure your rental receipt template in Ontario includes all required details. At a minimum, it should display the names of the landlord and tenant, rental property address, and a clear breakdown of payment amounts. Specify the rental period and payment due date, along with the amount paid and the date payment was received.

Always include a receipt number for reference and a note that confirms the payment method, whether by cash, cheque, or electronic transfer. This helps maintain clear records for both parties. It’s also recommended to provide space for both the landlord and tenant’s signatures, reinforcing the transaction’s validity.

Check that the template complies with Ontario’s laws by including any applicable taxes, late fees, or special payment arrangements. This ensures transparency and minimizes any future disputes.