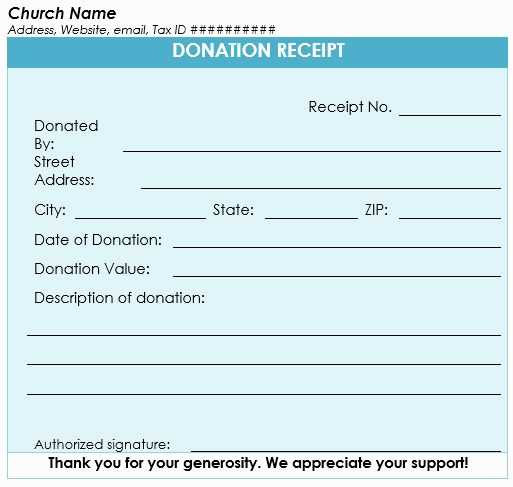

Using a free donation receipt form template helps streamline the process of acknowledging charitable contributions. It simplifies the task of providing donors with the necessary information for tax deductions while ensuring compliance with relevant regulations.

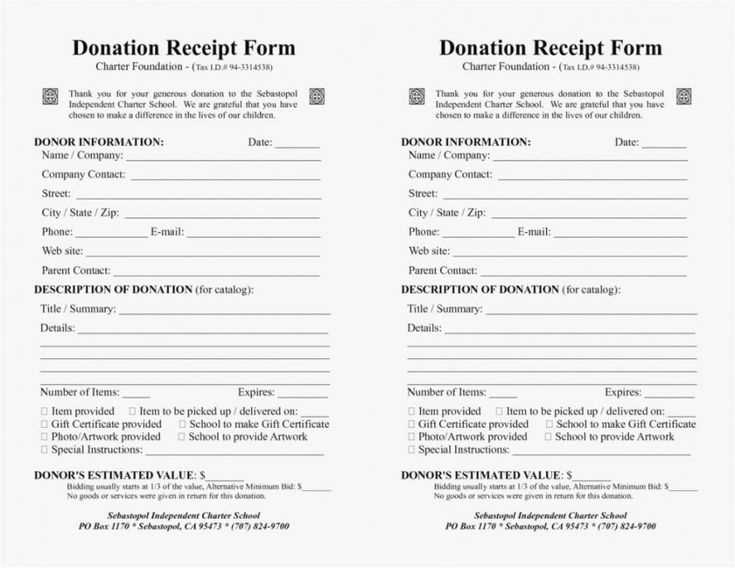

The key details in such a receipt include the donor’s name, donation amount, the date of the donation, and the nonprofit organization’s information. Providing an itemized list of donations is also common for those who contribute goods or services. Using a template ensures all essential fields are covered, preventing any missing information that could complicate tax filings.

Make sure to customize the template to suit your organization’s specific needs. Add your organization’s logo, adjust the wording to match your style, and make sure that it adheres to legal requirements. This simple tool will save time and reduce errors, especially during busy fundraising periods.

Here’s the revised version:

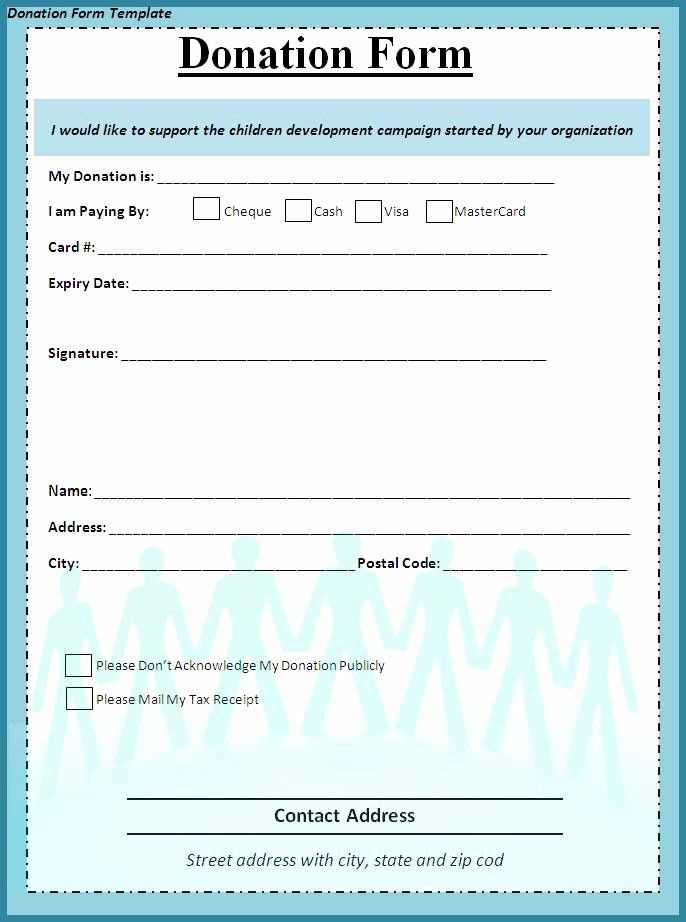

For creating a free donation receipt form, focus on simplicity and clarity. Ensure you include key details like donor information, donation amount, and the date of donation. You can easily set this up in any word processor or use free online templates.

The receipt should contain the following details:

| Information | Description |

|---|---|

| Donor’s Name | Include the full name of the donor. |

| Donation Amount | State the exact amount donated, either as a total or individual items if applicable. |

| Date of Donation | Clearly mention the date when the donation was made. |

| Organization Name | The name of the charity or nonprofit receiving the donation. |

| Tax ID (if applicable) | Include the nonprofit’s tax identification number for tax purposes, if required. |

Ensure the receipt is easy to read. You can add a brief thank-you note at the bottom, but avoid adding any unnecessary details. A clean, straightforward format will help recipients use it for tax purposes or other needs without confusion.

- Free Donation Receipt Template

Use a simple donation receipt template to ensure accurate tracking of donations. Include key details such as the donor’s name, donation date, amount, and any goods or services exchanged. Customize the template to fit your organization’s needs and add your logo or relevant tax-exempt information.

Ensure the receipt is clear and concise. Donors should easily understand the value of their contribution and the tax benefits they may receive. A well-organized format not only streamlines the donation process but also strengthens trust and transparency with your supporters.

If applicable, include a section specifying whether the donation was in cash, check, or another form. Be sure to acknowledge non-monetary donations with a brief description of the donated items. This ensures the donor receives all necessary details for tax reporting.

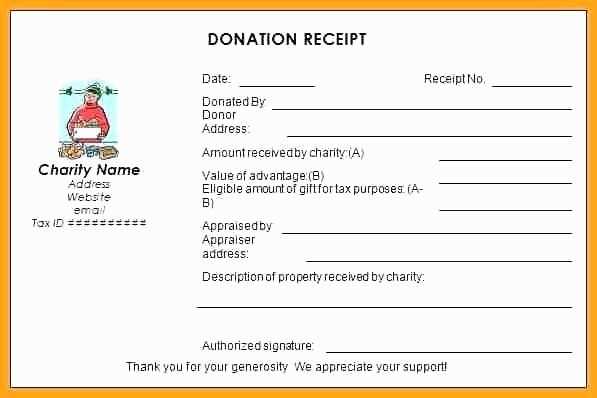

Begin by including the donor’s name and address at the top of the receipt. This provides clear identification for both the donor and the recipient organization.

Detail the Donation Amount

Next, list the exact amount donated. Be sure to note whether it was a monetary donation or an item. Include a description if it’s a non-cash donation, such as goods or services, for transparency.

Include Date and Acknowledgement Statement

Record the date of the donation and add a short statement acknowledging the gift, such as “Thank you for your generous donation.” This helps confirm the transaction and shows appreciation to the donor.

Finally, include your organization’s contact details and tax-exempt status (if applicable) to ensure the donor can use the receipt for tax purposes if needed.

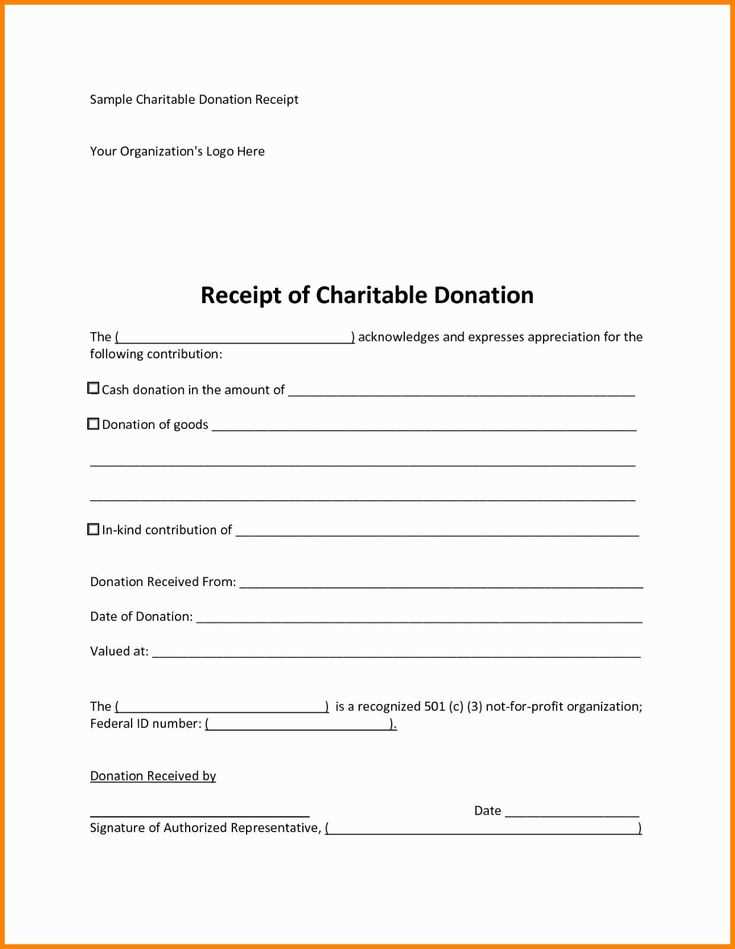

A donation receipt should contain specific details to ensure clarity and accuracy for both the donor and the recipient organization. Here’s what to include:

Donor Information

Include the name and contact details of the donor. This ensures the receipt is properly attributed and can be referenced later. If applicable, include a mailing address for follow-up correspondence.

Donation Details

Clearly state the amount donated, along with the date of the donation. If the donation was made in kind, describe the item(s) and provide an estimated value. This helps both parties keep accurate records for tax purposes.

Organization Information

Include the name, address, and tax-exempt status of the organization receiving the donation. This confirms that the donation was made to a qualified entity and is eligible for tax deductions.

Statement of No Goods or Services Provided

If no goods or services were exchanged for the donation, include a statement to that effect. This is important for tax documentation, as it validates the contribution as a charitable gift.

To customize your donation receipt template, focus on the key details your organization needs to include. Begin with your organization’s name, logo, and contact information at the top of the form. This ensures the recipient can easily identify the source of the donation.

Adding Donation Information

Include the donor’s name, donation amount, and the date of the donation. For organizations, ensure these are clearly marked so donors can easily track their contributions for tax purposes. If applicable, mention the donation method (e.g., cash, check, credit card) and include a brief note on whether any goods or services were exchanged for the donation.

Legal and Tax Details

Ensure that the receipt includes a statement about the non-profit status of your organization. Mention the tax-exempt status and any specific language required by local or federal tax laws. This will help donors during their tax filing process.

Tailor the design to reflect your organization’s branding while maintaining clarity and professionalism. A simple layout with readable fonts and sufficient white space makes it easier for donors to access and understand their donation details.

Steps to Customize a Donation Receipt Form

Start by including key details that identify the donor and the donation. These elements should be easy to locate and understand:

- Donor Information: Full name, address, and contact details.

- Donation Details: Date of donation, amount donated, and donation type (cash, check, in-kind).

- Nonprofit Information: Legal name, tax ID, and contact details of the organization receiving the donation.

Required Elements

Ensure the form includes these necessary elements:

- Clear statement of no goods or services provided in exchange for the donation (if applicable).

- Signature field, if needed, for legal validity.

Formatting Tips

Make the receipt easy to read by following these formatting guidelines:

- Use simple fonts and large text for essential information like donation amount and donor details.

- Organize sections with bold headings to separate donor info, donation details, and nonprofit details.

- Ensure the form is printable and can be emailed directly to the donor.