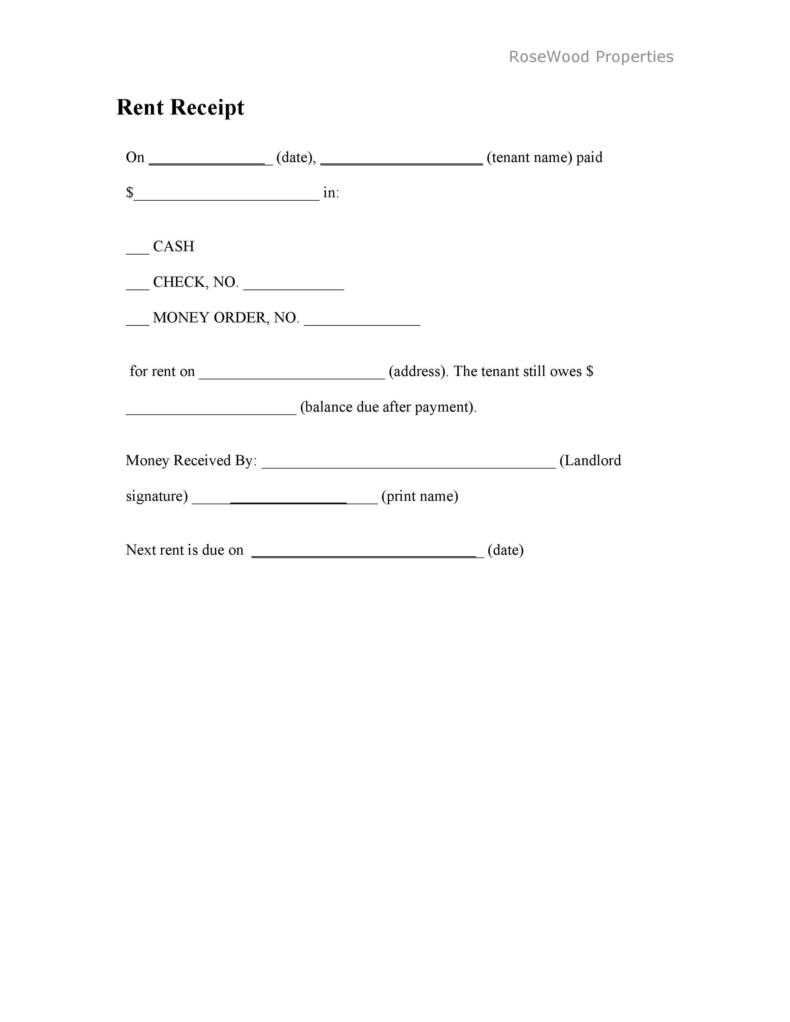

Ensure smooth transactions with a deposit receipt template that you can easily print and use for your financial records. This template helps track payments, providing a clear and professional way to acknowledge any deposits made. Whether you’re a small business owner or need it for personal use, a printable template streamlines the process and ensures no detail is overlooked.

Customize the template to include all necessary information, such as the amount deposited, date, and recipient. It’s a quick way to maintain organized documentation without the hassle of creating receipts from scratch each time. Make sure to store copies for both your records and the payee’s reference.

Take advantage of a free printable template, designed to fit various needs and simplify your financial paperwork. With just a few clicks, you can have a professional receipt ready to go. Adjust the layout as needed, making it suitable for different types of deposits, whether for services or goods.

Here’s the revised version with no repetition of words:

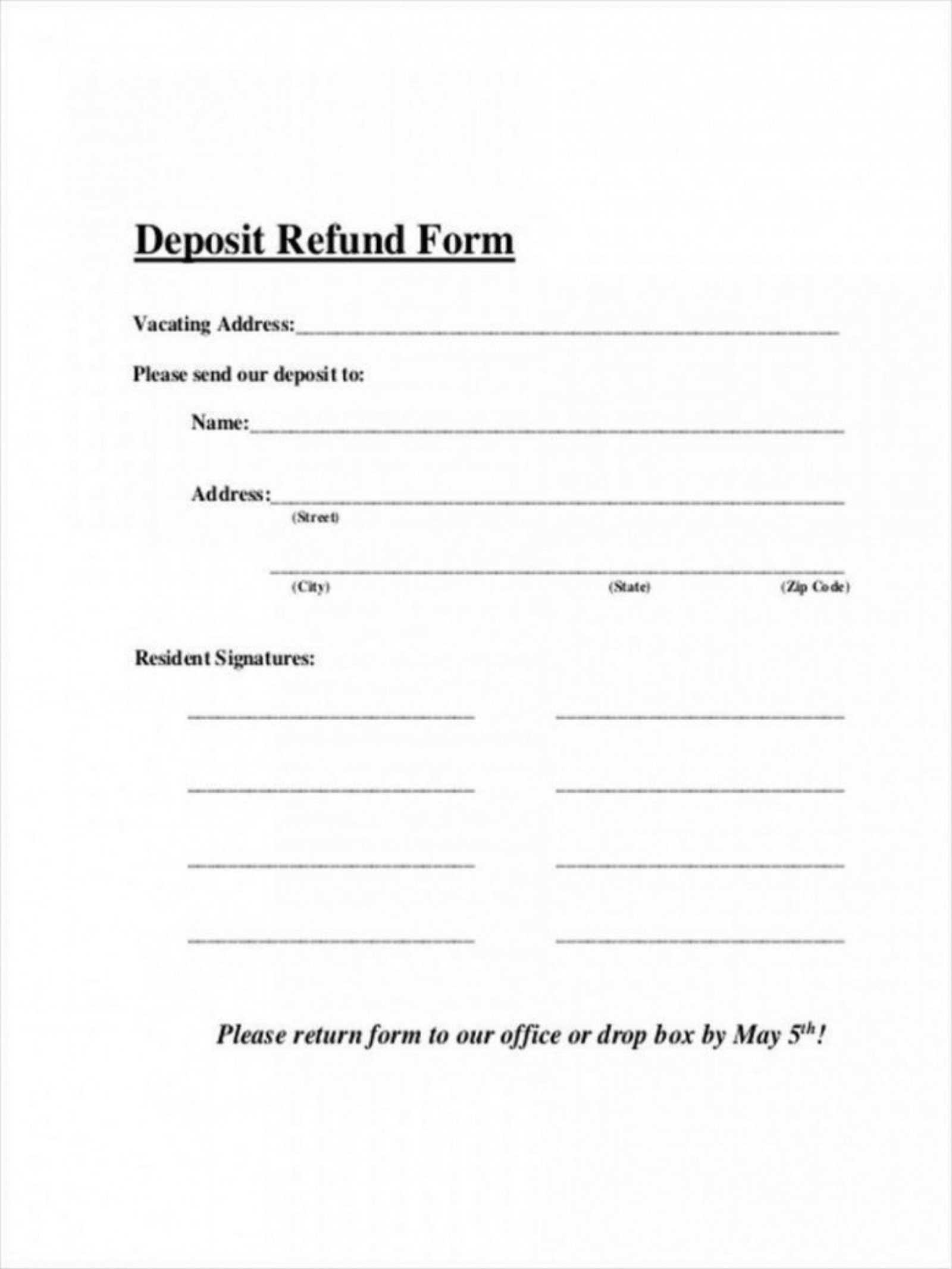

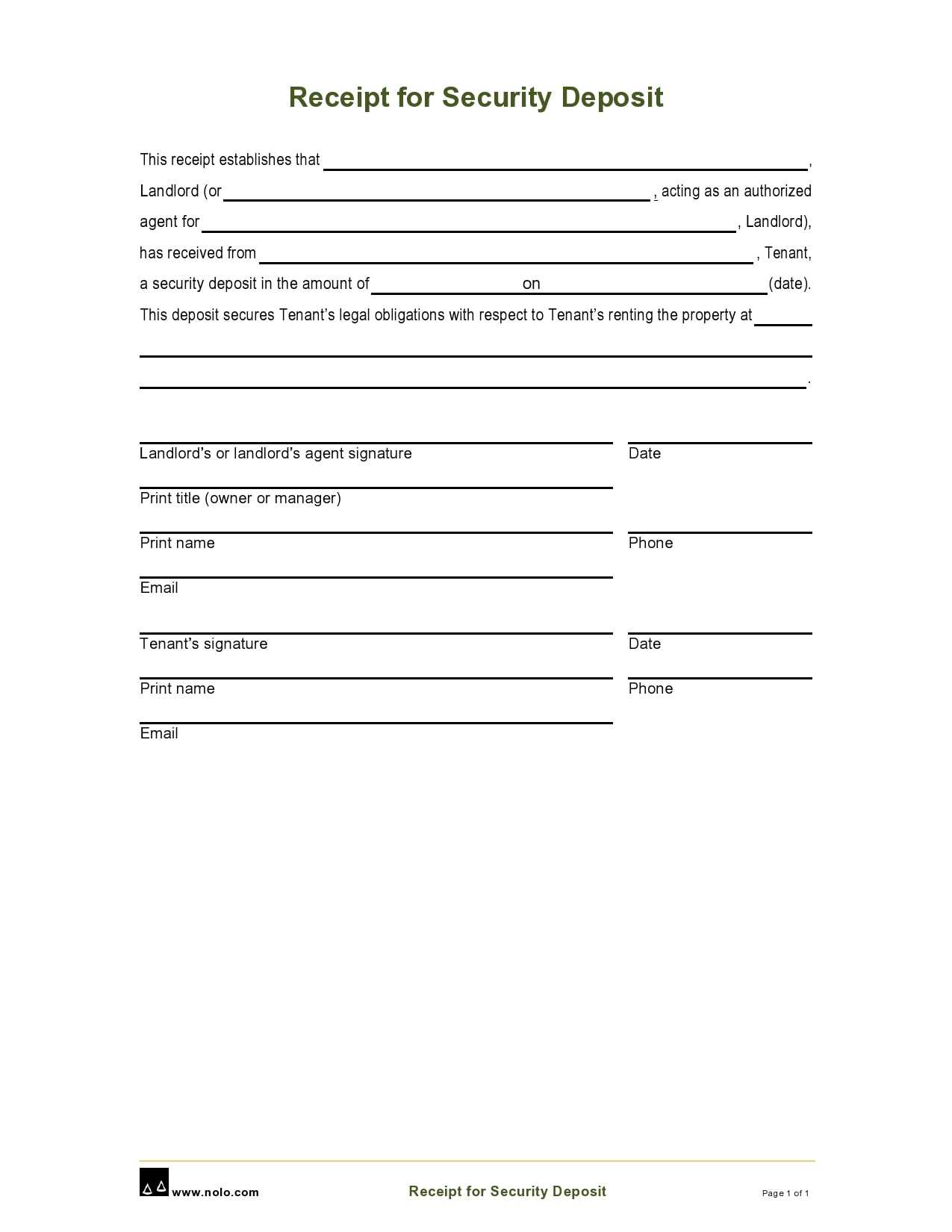

Start by ensuring the deposit receipt clearly indicates the deposit amount, the date, and the involved parties. Use a clean layout, so the information is easy to understand at a glance. Make sure the document includes all necessary details without overcrowding it with irrelevant data.

Key Information to Include

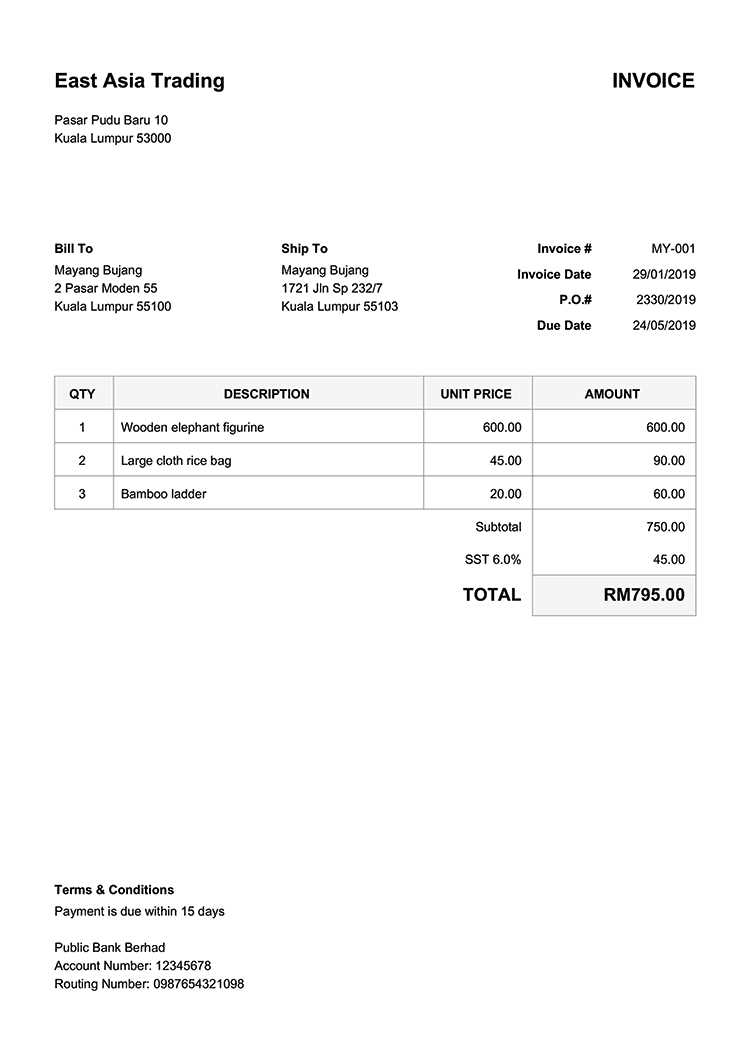

| Field | Details |

|---|---|

| Deposit Amount | State the exact sum deposited, in words and figures. |

| Date | Include the exact date the deposit was made. |

| Depositor’s Name | Clearly mention the name of the person or entity making the deposit. |

| Recipient’s Name | Include the name of the recipient receiving the deposit. |

| Transaction Reference | If applicable, provide a reference number for tracking purposes. |

Formatting Tips

Use bold text for headings, ensuring they stand out. Leave enough space between sections to avoid visual clutter. Ensure the font is easy to read and the size is appropriate for quick reading. Avoid using overly complex language or legal jargon, unless necessary.

- How to Design a Deposit Receipt Template

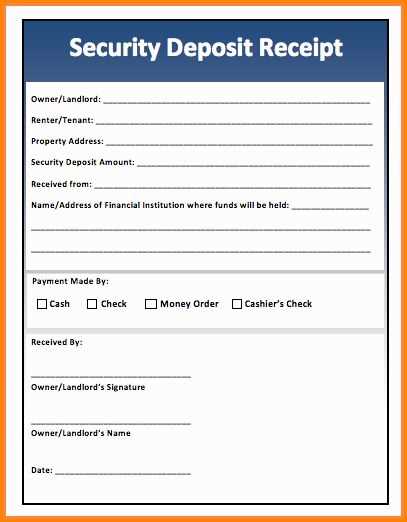

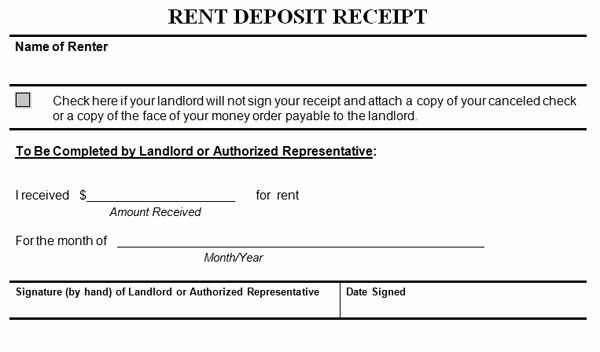

Focus on the basics: the template should clearly display the deposit amount, date, and depositor’s details. Start with a section for the depositor’s name and contact information, followed by the amount deposited and the deposit method (cash, check, bank transfer, etc.). Add a unique transaction number for tracking and reference.

Include space for the receiving party’s details, such as business name and contact information. A signature line or digital confirmation area ensures authenticity. Make sure to leave space for any additional notes or conditions related to the deposit, like fees or special terms.

Choose a simple layout, using clear fonts and ample spacing to avoid clutter. Ensure the document is easy to understand at a glance. You may want to incorporate your logo or branding for consistency, but keep the design clean and professional.

Lastly, offer flexibility in format. Make the template available in different file types (PDF, DOCX, or as a fillable form) to accommodate various needs. This helps ensure that users can easily fill out and print or save the receipt as necessary.

Using printable deposit receipt templates streamlines the process of documenting financial transactions. These templates ensure accurate and consistent records, reducing the risk of errors when recording deposit information.

Time-Saving

Printable templates save valuable time by providing a pre-designed structure. Rather than creating receipts from scratch, you can focus on filling in the necessary details, speeding up the entire process.

Customization

Templates offer flexibility, allowing customization with your business logo, contact details, and specific deposit terms. This enhances the professional appearance of your receipts and ensures they align with your brand identity.

- Easy to edit and personalize.

- Adaptable to different financial needs.

- Helps maintain a uniform appearance for all receipts.

Accuracy and Clarity

With pre-set fields for crucial information like deposit amount, date, and recipient details, templates ensure nothing important is missed. This clarity reduces disputes and provides clear documentation for both parties involved.

Cost-Effective

Using free printable templates eliminates the need for expensive software or professional receipt creation services, making it an affordable option for individuals and businesses alike.

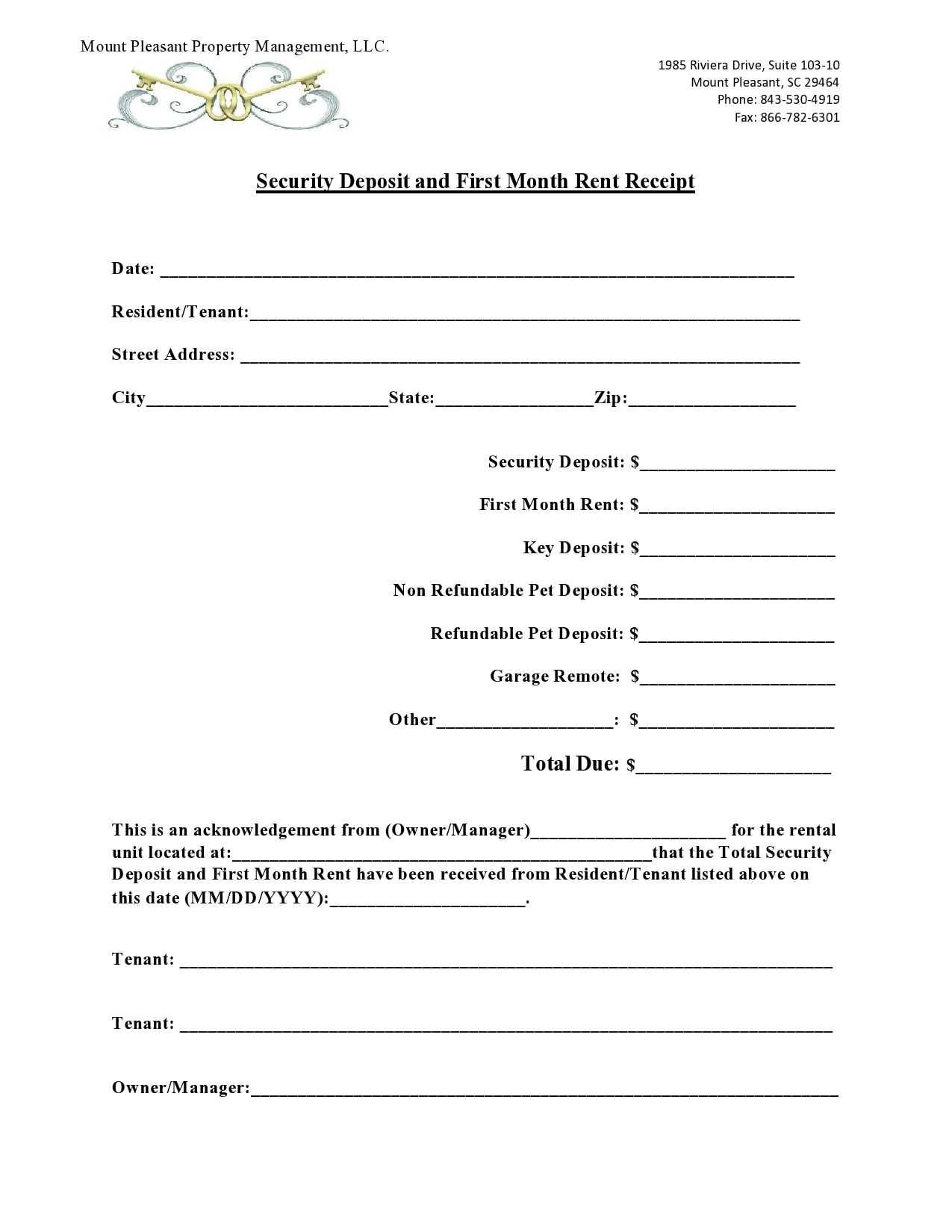

To effectively tailor your deposit receipt templates, consider the specifics of each deposit type. Different deposit scenarios, such as cash, check, or online payments, require certain details to be highlighted on the receipt. For cash deposits, include fields for the total amount, the denomination breakdown, and the person handling the transaction. For checks, ensure there’s space to record the check number, the bank name, and the deposit amount. For online payments, provide a transaction reference number and payment method for clarity.

Designing Templates for Different Deposits

When customizing your receipt template, focus on the transaction’s nature. For cash deposits, include a detailed breakdown for transparency. For checks, the bank information and check number are vital. Online payments should capture the payment method and reference numbers to keep a record of the electronic transaction. Adjust your template layout for easy tracking of deposit types by ensuring there’s enough space for all necessary details without making it cluttered.

Incorporating Flexibility for Future Deposits

Flexibility is key in accommodating varying deposit types. Create adjustable fields for easy additions or modifications in the future. For instance, leave space for additional transaction details that might arise, such as adjustments for specific accounts or temporary hold times. This adaptability ensures the template remains functional across different deposit scenarios without needing to be redesigned each time a new deposit type is introduced.

Choose a straightforward design for your printable deposit receipt. Focus on clarity and simplicity, ensuring that each section is easy to fill out. Include spaces for the depositor’s name, deposit amount, date, and any reference number for tracking purposes.

Key Fields to Include

- Depositor Name: Clearly label the space for the person or business making the deposit.

- Deposit Amount: Specify a field for both the total deposit amount and the breakdown if necessary.

- Date: Include a date field to record the exact day of the transaction.

- Reference Number: Add an optional field for a reference or transaction number to ensure traceability.

Tips for Use

- Ensure each field is large enough to accommodate legible writing, especially if the document is printed by hand.

- Consider adding a space for both the deposit receiver’s name and a signature for verification.