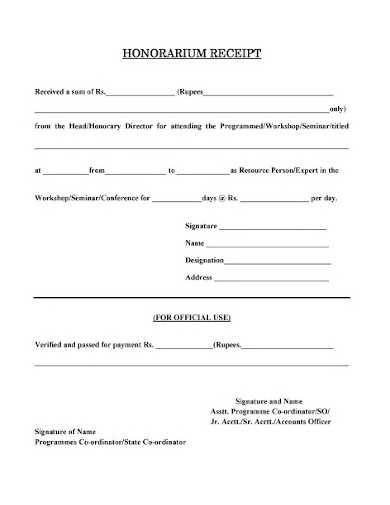

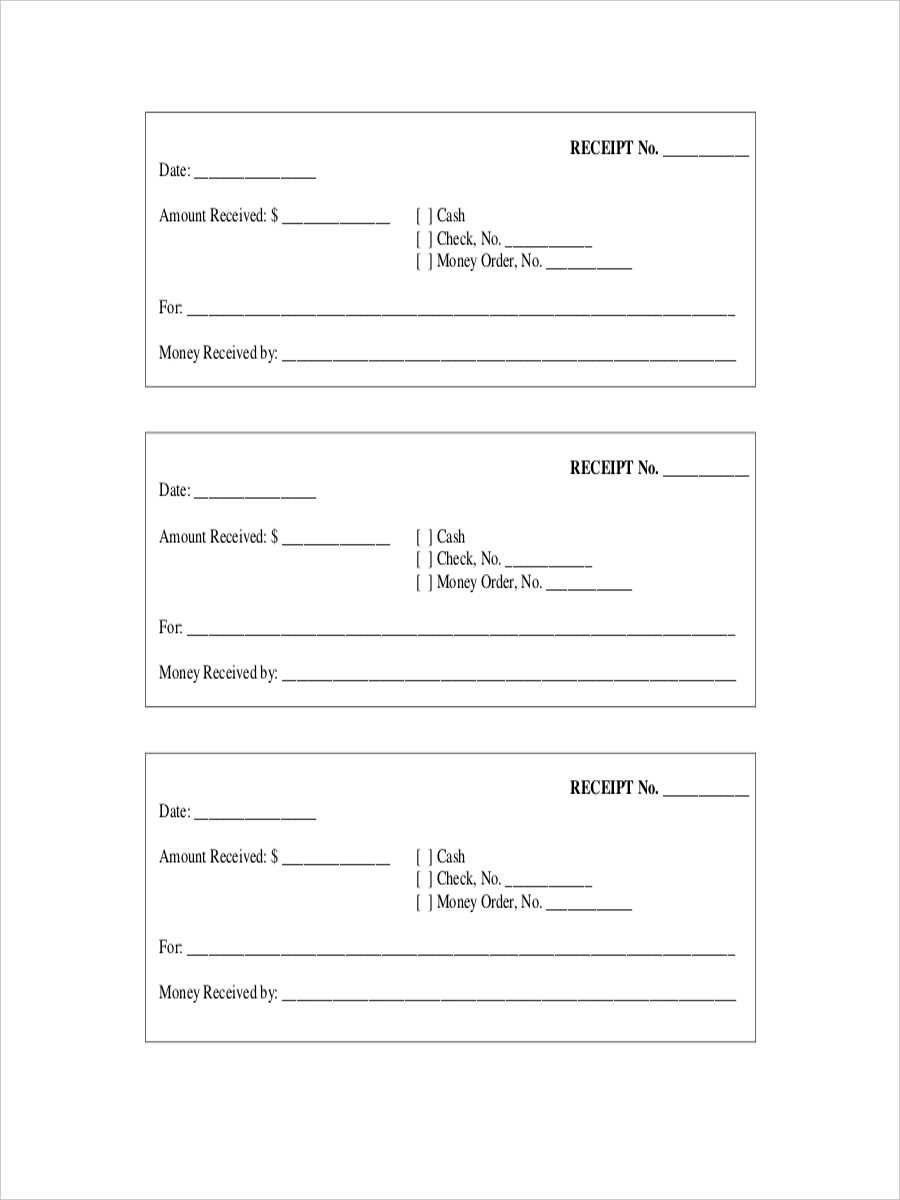

If you need a clear and concise honorarium receipt, use a simple template that includes all necessary details. This document should capture the amount paid, the purpose of the payment, and the recipient’s information. It acts as proof of payment for both the payer and the recipient, ensuring transparency in financial transactions.

Include the name of the payer and recipient, the payment amount, and the date of payment. If applicable, list any services provided or conditions tied to the honorarium. A well-organized format makes it easy for both parties to reference important details when needed.

Don’t forget to add a signature line at the bottom of the receipt. This adds credibility to the document and helps ensure both parties acknowledge the transaction. Including a unique reference number can also make tracking easier for future reference.

Key components to include:

- Name and address of payer and recipient

- Payment date and amount

- Description of services or reason for honorarium

- Signature lines for both parties

- Receipt or reference number (if applicable)

By sticking to this structure, you’ll create a straightforward, professional honorarium receipt that serves its purpose without any unnecessary details.

Here are the revised lines with minimized repetition:

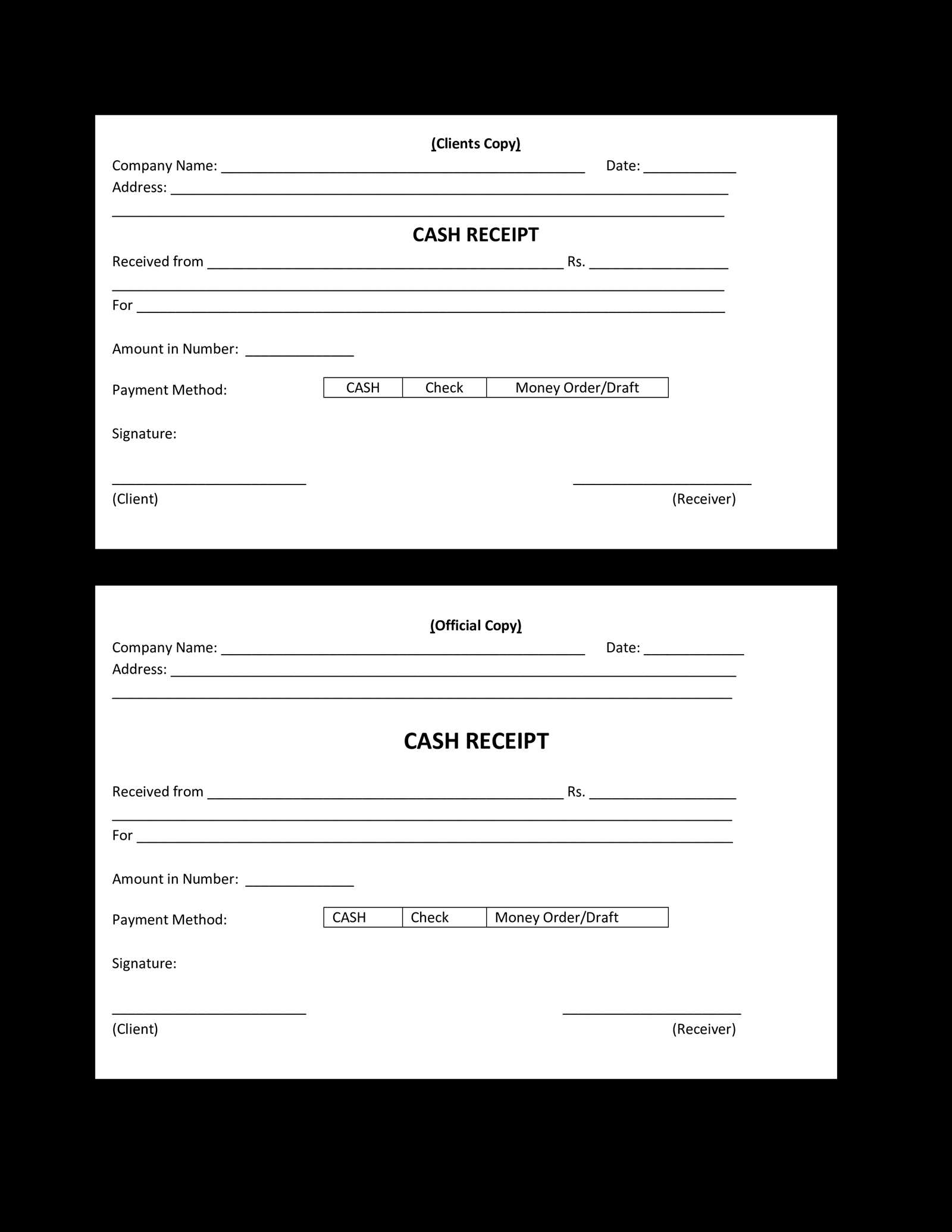

Ensure that each section of the receipt is clear and concise, minimizing redundant wording. For example, instead of repeating phrases such as “received the amount,” state it once clearly. Always confirm that the date and payment method are explicitly mentioned to avoid ambiguity.

- Recipient’s Information: Include full name, address, and contact details. Avoid unnecessary repetition of contact information.

- Amount: Specify the payment amount only once. Avoid restating it in different parts of the receipt.

- Payment Method: If the payment method is “bank transfer,” mention it only once with all relevant details.

- Date: Ensure the date is listed clearly at the top, and don’t repeat it in the body of the receipt.

By following these recommendations, the honorarium receipt will be precise and free from unnecessary repetition.

- Honorarium Receipt Template

To create a professional honorarium receipt, follow these steps:

Start by including the date of the transaction at the top. This helps clarify the timeline of the payment.

Next, add the name of the recipient, including their address if necessary. It is important to clearly identify the person receiving the honorarium.

Specify the amount paid in both words and figures to avoid confusion. Make sure the amount matches the agreed-upon sum.

Indicate the payment method, whether it’s by check, cash, or bank transfer. This adds transparency to the transaction.

Include a description of the services provided or the reason for the payment. This clarifies the purpose of the honorarium.

Ensure the signature of the recipient is included. This serves as acknowledgment that the payment has been received.

Finally, leave space for the signature of the payer, if required, to confirm the transaction is completed from both sides.

Once you have these key details, you will have a clear and professional honorarium receipt template to use in future transactions. Make sure to double-check for accuracy before issuing the receipt.

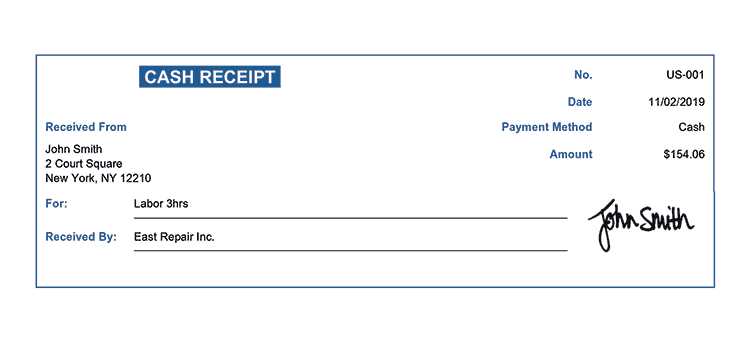

Begin by listing the full name of the payer and payee. Include their contact information and any relevant identification numbers, such as a business ID or VAT number. This ensures both parties are clearly identified in the transaction.

Specify the date the payment was made. This detail is crucial for accurate record-keeping and financial transparency.

Clearly outline the payment amount. Break it down if necessary, showing any deductions or additional charges, such as taxes or fees. Use clear figures to avoid confusion and errors.

Describe the reason for the payment. Whether it’s for services rendered, goods sold, or another purpose, include specific details to ensure the transaction is easily understood.

Include the payment method. Whether it was made via bank transfer, check, or cash, record the exact method used. This adds clarity to the transaction and helps reconcile accounts.

If applicable, include a payment reference number or invoice number. This will make it easier to track the payment in the future.

Finally, add a statement confirming that the payment has been received in full. This provides a sense of closure and assures the payer that no further amounts are outstanding.

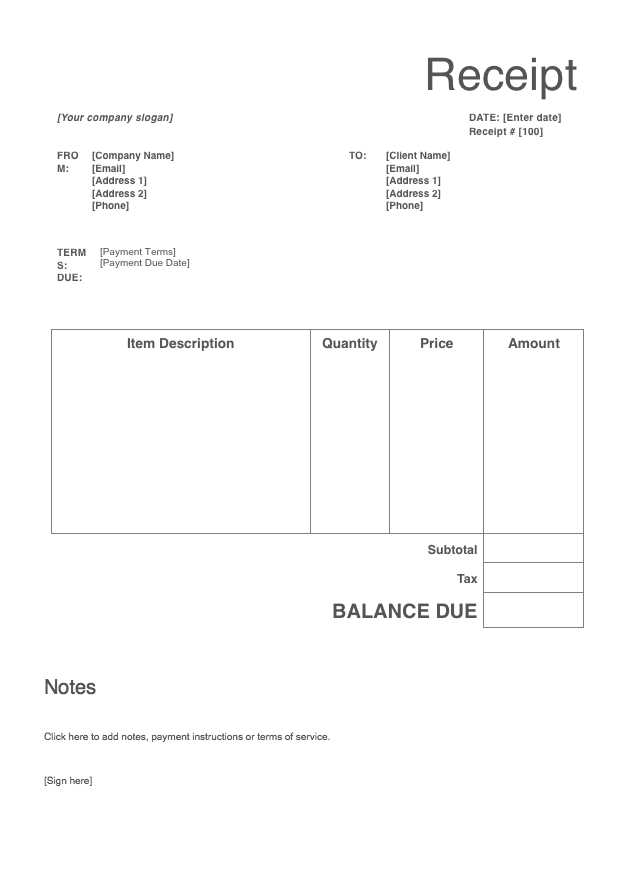

One of the most frequent mistakes is failing to clearly define the amount. Always ensure the agreed honorarium is stated explicitly to avoid misunderstandings. Vague terms can lead to confusion about the compensation amount, creating issues down the line.

Another common error is neglecting to specify the payment terms. Outline when the honorarium will be paid and whether it will be in a lump sum or installments. Being unclear about payment dates can cause unnecessary delays or dissatisfaction.

Incorrect tax handling is another issue to address. Ensure that tax deductions, if any, are accounted for according to local regulations. Mistakes in tax reporting can lead to fines or complications with tax authorities.

Not keeping proper records of the transaction is another risk. A receipt should always be issued and filed for future reference. This helps protect both the issuer and the recipient from potential disputes.

Make sure the description of the work or service for which the honorarium is given is precise. Avoid overly general terms like “services rendered” without clarifying the specific tasks performed. A detailed breakdown helps to support the payment’s legitimacy.

| Error | Recommendation |

|---|---|

| Unclear Honorarium Amount | State the agreed amount explicitly in writing. |

| Unspecified Payment Terms | Clarify payment schedule, terms, and method of payment. |

| Incorrect Tax Handling | Follow local tax regulations and deduct appropriately. |

| Lack of Record-Keeping | Provide a receipt and keep records of the transaction. |

| Vague Work Description | Detail the services or work done to justify the payment. |

Finally, avoid overlooking any legal requirements. Each jurisdiction may have its own rules for issuing honorariums, especially in relation to employment laws or specific industry standards. Checking these details beforehand ensures smooth transactions and compliance.

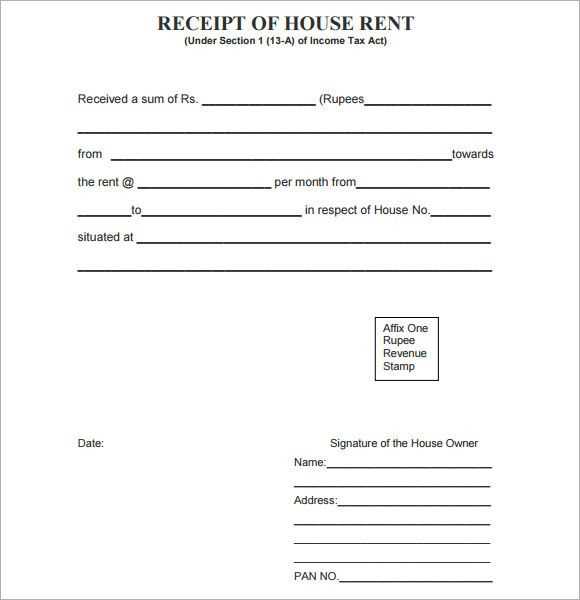

Honorarium receipts serve as proof of income for individuals who receive payment for services such as speaking engagements, performances, or freelance work. For tax reporting, include these receipts as part of your total income when filing your tax return.

Record All Payments

Always keep track of the amount, date, and source of the honorarium payment. This helps ensure your tax filings are accurate. The receipt should clearly indicate the payment amount and the nature of the service provided. In some cases, honorarium payments may need to be reported under self-employment income, so it’s important to accurately categorize them when filing taxes.

Report as Miscellaneous Income

Honorarium payments are typically reported as miscellaneous income. You should include them in the “Other Income” section on your tax return. If you’re self-employed, report these earnings on Schedule C (Form 1040) to account for the income properly. Remember, failing to report these payments could lead to penalties or fines from the IRS.

When drafting a receipt for an honorarium, be clear and concise in the details you provide. Ensure that the document includes the full name of the recipient, the amount received, and the date of payment. It’s important to specify the service or task for which the honorarium was given.

Include the recipient’s contact details, such as their address or email, to establish a formal record. The receipt should also outline the method of payment–whether cash, check, or electronic transfer–along with any relevant transaction IDs if applicable.

Double-check for accuracy in all details, especially the amount paid and the payment date. In case of discrepancies, a clear paper trail can prevent misunderstandings. Additionally, ensure that both parties sign the document to authenticate the transaction.