To simplify your FSA dependent care reimbursement process, ensure all receipts are clear and accurate. Use the receipt template below to capture necessary details like the provider’s name, services rendered, and dates. Always keep your receipts organized for easy reference during the reimbursement submission.

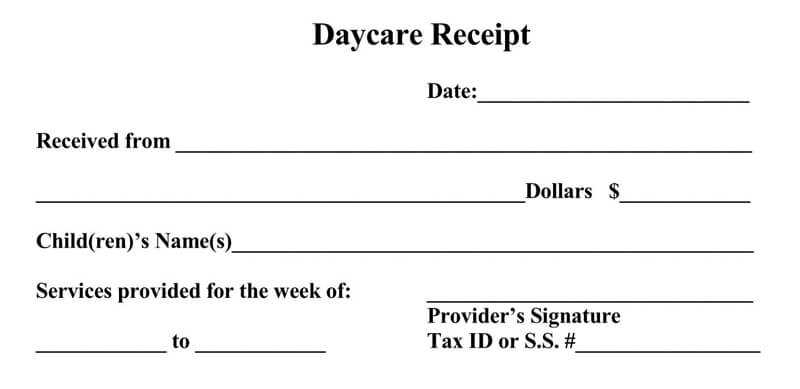

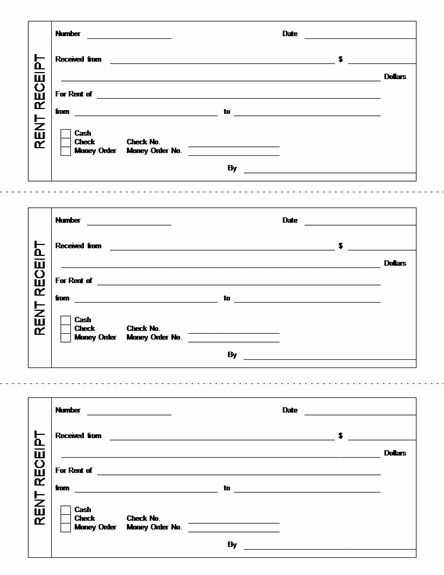

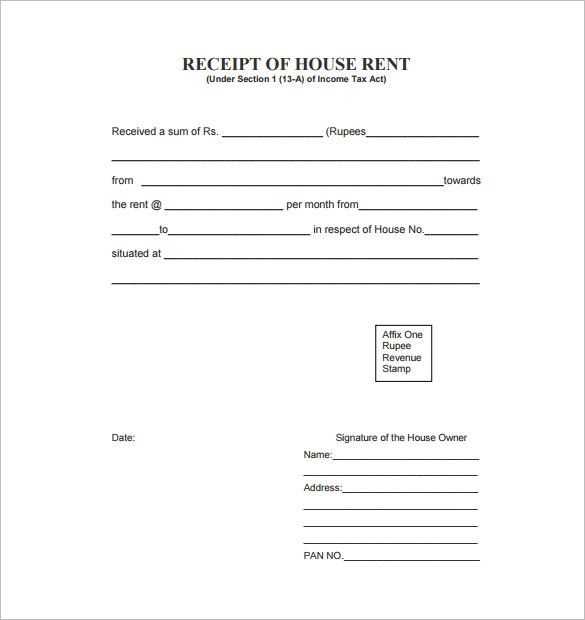

Template Information: The receipt should include the caregiver’s name, their contact details, the service dates, and the amount paid. Verify that the services provided are specifically for child or dependent care and that the payment amount corresponds to the actual expense incurred.

Common Fields to Include:

- Caregiver’s name and address

- Date(s) of service

- Amount paid

- Nature of service (e.g., daycare, after-school care)

Once completed, attach the receipts to your FSA claim for swift processing. Ensure the template is filled out legibly and completely to avoid delays or issues with your claim.

Here is the corrected version:

To create an accurate FSA dependent care receipt, ensure it includes all relevant details. Start by listing the name and contact information of the provider. Include the dates of service, along with a clear description of the care provided. The total amount paid should be stated clearly, specifying any additional charges or discounts. Make sure the provider signs or stamps the receipt to confirm the services. Double-check that the receipt meets the specific requirements for reimbursement through your FSA plan.

Additional Tips

When gathering receipts for FSA claims, it’s important to keep all supporting documents organized. A detailed breakdown of the care received can streamline the reimbursement process. If you are unsure whether a receipt meets the necessary criteria, reach out to your FSA administrator for clarification.

- FSA Dependent Care Receipt Template

To submit claims for dependent care expenses, ensure the receipt template contains all the necessary details. Begin by including the provider’s full name, address, and phone number. This verifies the authenticity of the care services provided.

Key Elements of the Receipt

- The date(s) of service: Include the exact dates when care was provided.

- Service details: Clearly describe the care services rendered (e.g., daycare, after-school care, etc.).

- Amount charged: Specify the total amount for each service rendered.

- Provider’s signature or confirmation: This validates the receipt as an official document.

Submission Tips

Attach a copy of the receipt template to your FSA claim form. Make sure all information is legible and accurate to avoid delays. If you submit electronically, check the resolution of your scanned document to ensure clarity.

To create a valid receipt for reimbursement, ensure that it includes specific details required by your FSA plan. First, clearly state the name of the service provider or facility where the care was provided. Include the date of service, the amount paid, and a breakdown of the costs, if applicable. This will help ensure that each expense can be matched to your plan’s requirements.

Key Elements to Include

- Provider Name: This should be the full name of the person or company that provided the service.

- Date of Service: Clearly list the date when the care was provided. Avoid general statements like “January 2025” – specify the exact date.

- Detailed Breakdown: If the receipt involves multiple services, break down each charge. For instance, separate charges for different types of care or service hours.

- Amount Paid: Show the total amount you paid, including any taxes or additional fees. Make sure it matches your payment method or statement.

Important Notes

Check if the receipt includes any missing information, such as the payer’s name or a payment method, as these may be required for reimbursement processing. If you paid by check or credit card, ensure that this is mentioned along with a transaction number or reference.

Lastly, ensure that the receipt is signed and dated by the provider, confirming the legitimacy of the transaction. Double-check all entries to avoid delays or issues with reimbursement.

Double-checking the details on your care receipts can save time and avoid delays. Here are some mistakes you should avoid:

- Incorrect Dates: Always ensure the dates on the receipts match the period for which you are claiming. Even small discrepancies can lead to rejection.

- Missing Provider Information: Verify that the care provider’s name, address, and contact details are clearly visible and accurate.

- Unclear Service Description: Ensure that the receipt clearly describes the care services provided. Vague descriptions like “childcare” without specifics may be flagged for review.

- Incomplete Payment Details: Always include the full amount paid. Incomplete or incorrect amounts can cause confusion and delays.

- Overlooking Required Signatures: Some receipts may require a signature from the care provider. Ensure that all necessary signatures are included before submission.

- Submitting Invalid Receipts: Avoid submitting receipts that don’t meet the requirements. Check that the document is an official receipt and not just a payment confirmation.

- Ignoring FSA Deadlines: Be aware of submission deadlines. Late receipts may be rejected, even if they’re otherwise valid.

By avoiding these common mistakes, you can streamline the process and ensure that your care receipt submissions go through smoothly.

If your care receipt is rejected, check the reason given in the rejection notice. Often, it may be due to missing information or formatting errors. Correct the issue and resubmit the receipt to the appropriate authority. If the rejection was unclear, contact your provider for clarification.

1. Review the Rejection Reason

- Incorrect or missing receipts.

- Details that do not match the original submission (e.g., wrong dates, amounts).

- Expired or invalid documentation.

2. Address the Issue

Once you identify the issue, make necessary adjustments. Double-check receipt dates, ensure all required information is present, and ensure it follows submission guidelines. If you missed an important step, follow the guidelines closely to prevent further errors.

3. Contact Support If Needed

If you’re unable to resolve the issue on your own, reach out to the relevant customer support team. They can guide you on how to fix the problem or clarify any confusion regarding the rejection.

| Issue | Action |

|---|---|

| Incorrect Date | Correct the receipt date to match the service period. |

| Missing Information | Ensure all required details (like service provider name, contact info, etc.) are included. |

| Invalid Documentation | Submit updated or valid documents. |

After making corrections, submit your receipt again. If problems persist, follow up with the relevant department to ensure a timely resolution.

To create a valid receipt for FSA dependent care, follow these simple steps:

- Provide Your Details: Include your full name, address, and FSA account number at the top of the receipt.

- List the Caregiver’s Information: Include the caregiver’s name, address, and Tax Identification Number (TIN) or Social Security Number (SSN) if applicable.

- Specify Care Dates: Clearly state the start and end dates of the dependent care provided.

- Breakdown of Services: Itemize the care provided, listing each service and the corresponding charges.

- Total Amount: Include the total amount paid for services during the covered period.

- Signature and Date: Have the caregiver sign and date the receipt to verify the provided services.

Ensure that your receipt is accurate and contains all required information to avoid delays in processing claims.