Use a credit card receipt template to streamline your payment tracking. These templates allow you to quickly generate receipts with all necessary details for your transactions. Whether you’re managing personal expenses or handling business transactions, a clean and organized receipt will save time and avoid confusion.

Customize the template to suit your needs by adding or removing fields like transaction date, merchant name, amount paid, and payment method. This will help you create a tailored document that fits your specific requirements. A simple, easy-to-fill template ensures accuracy and prevents mistakes during receipt creation.

When selecting a template, look for one that offers clear layout options and supports both printed and digital formats. You can even integrate the template into your accounting software for seamless record-keeping. Consistency in format will make it easier to track payments, ensuring you have an organized system for future reference.

By using these templates, you’ll be able to improve your financial documentation and maintain organized transaction records. This small step can significantly reduce errors and save you from unnecessary hassle when reviewing past payments.

Here’s a detailed plan for an informational article on “Credit Card Receipt Templates” with 6 headings. Each heading covers a distinct and practical aspect of the topic, formatted in HTML:

1. Understanding Credit Card Receipt Templates

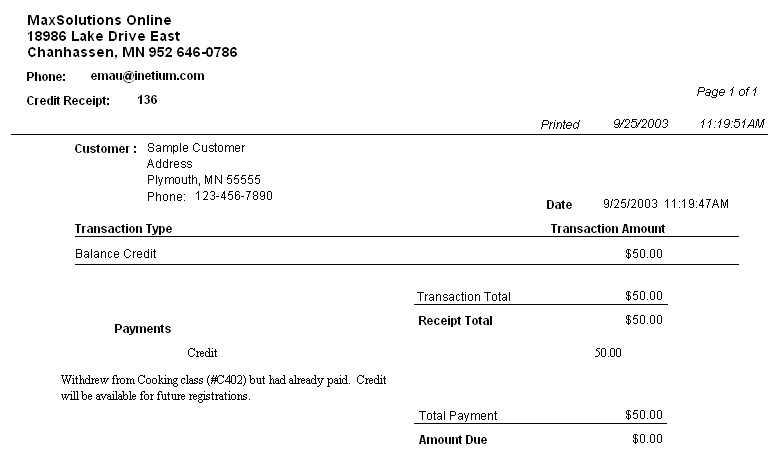

Credit card receipt templates are standardized documents used by businesses to confirm payments made via credit cards. They typically include transaction details such as the merchant’s name, date, payment amount, and authorization code. Choose a simple, clean layout to make these elements easy to read and understand.

2. Key Elements to Include in a Credit Card Receipt

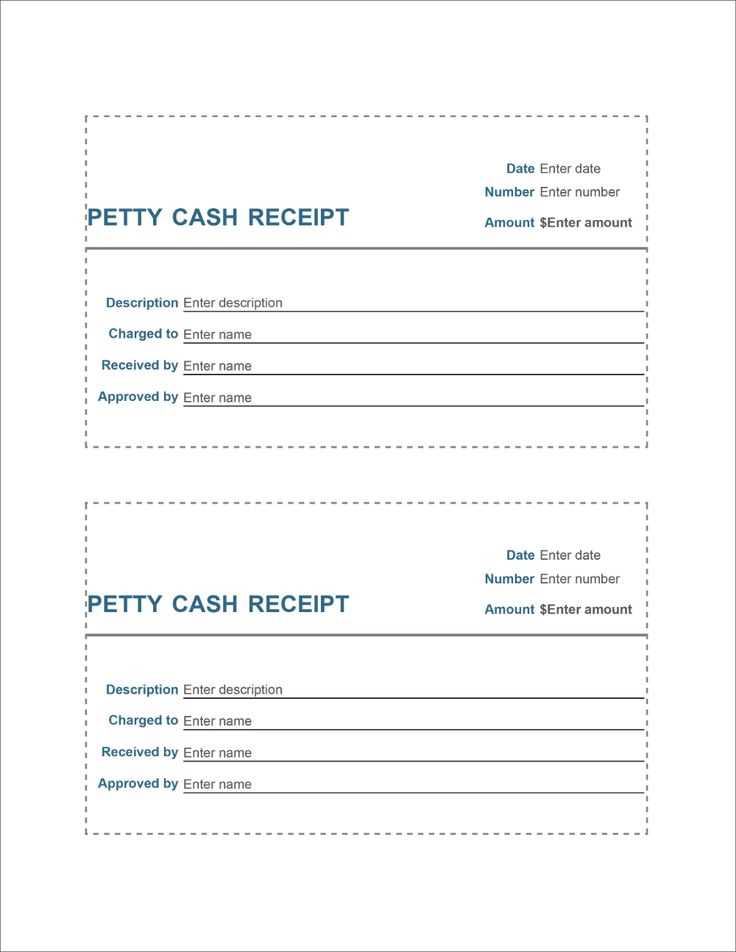

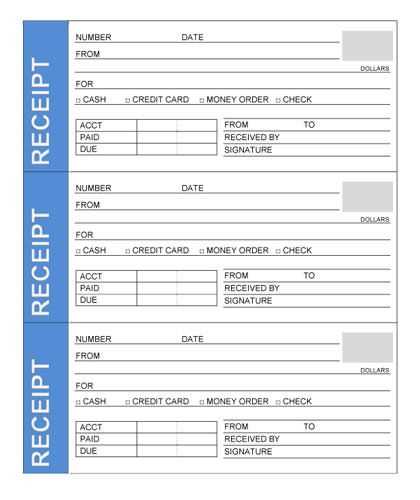

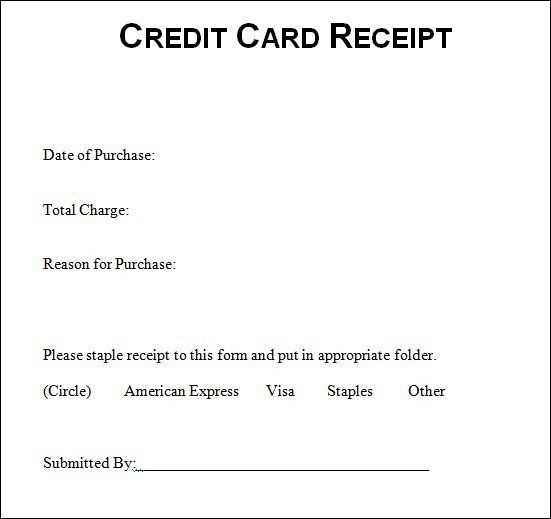

Include basic transaction details: merchant information, transaction amount, cardholder’s name (if required), and authorization number. Additionally, add payment method, date, time, and a unique receipt number for tracking purposes. These are the must-have elements to ensure clarity and compliance.

3. Customizing Templates for Your Business Needs

Customize your receipt templates to fit your brand’s identity. Add your logo, contact details, and payment terms. Adjust the layout for clarity, and ensure all relevant information is visible at a glance. Simple customizations can enhance the customer experience and reinforce your brand’s professionalism.

4. Legal Requirements for Credit Card Receipts

Ensure your receipts comply with local regulations. Many countries require merchants to include specific information such as tax rates or specific wording for refunds. Check your region’s laws to avoid legal issues related to payment processing and consumer rights.

5. Benefits of Using a Credit Card Receipt Template

Using a standardized template saves time, reduces errors, and ensures that all necessary information is included. Templates also make it easier to maintain records and provide clear documentation for both customers and businesses, which simplifies returns or disputes.

6. Best Practices for Storing and Managing Receipts

Digital storage of receipts offers convenience and reduces the need for paper filing. Implement a secure system to organize receipts by date, transaction type, or customer. Cloud-based storage options provide easy access and backup protection. Always ensure compliance with privacy laws when storing sensitive customer data.

Credit Card Receipt Templates

Choose a receipt template that includes the cardholder’s name, transaction date, merchant information, and total amount paid. Ensure the template has space for transaction details such as the last four digits of the card number and any applicable fees. Opt for a clean design that highlights the most important information while keeping everything clear and legible.

For businesses, using an electronic receipt template is a great option to automate the process. Look for templates that integrate with payment systems or allow you to easily input transaction data. Include a space for payment confirmation and a unique receipt number for reference.

Ensure compliance with regulations by adding necessary disclaimers or security notices. A footer can include a link to your business’s privacy policy or contact details in case of any discrepancies.

- How to Create a Custom Credit Card Receipt Design

To create a custom credit card receipt design, focus on clarity and functionality. Begin by determining the necessary information to include. At a minimum, your receipt should display the merchant’s name, transaction date, card type, transaction amount, and authorization code.

Step 1: Choose a clean layout. Use clear sections to separate each piece of information, making it easy for the customer to read. A simple two-column structure works well: one for labels (e.g., “Amount”, “Date”) and the other for the corresponding details.

Step 2: Incorporate the brand’s logo and colors. This ensures your receipt aligns with your business’s identity. Keep the design minimal to avoid clutter. Too many visual elements can distract from the essential transaction details.

Step 3: Add transaction details in a readable font size. Avoid small fonts that could make important information hard to read. Ensure the text is legible under different lighting conditions, especially for printed receipts.

Step 4: Include a footer with contact information and return policy. This can be helpful if the customer needs to follow up about the transaction.

Step 5: Test your design. Print a few samples to check how it looks physically and on different devices. Make adjustments to ensure everything aligns properly and is easy to understand.

By following these steps, you’ll create a functional and professional custom credit card receipt design that enhances the customer experience while maintaining your brand’s identity.

Begin with the store name and contact details. This should include the business name, address, phone number, and email, ensuring the customer knows where the transaction occurred.

Include a unique receipt number for tracking purposes. This helps in identifying and referencing the transaction, especially for returns or customer inquiries.

Provide the transaction date and time. This helps both the customer and business maintain accurate records for warranty claims, accounting, or returns.

List the purchased items or services. Include a brief description along with the price, quantity, and any applicable taxes. Break down discounts if applicable, showing a clear total cost for transparency.

Clearly show the payment method used. Whether it’s a credit card, debit card, cash, or other, this lets the customer confirm their method of payment.

Lastly, display the total amount paid, including any taxes, discounts, or extra charges. Ensure that this is prominently placed at the bottom of the receipt for clarity.

Choose a format that suits your business needs while remaining clear and straightforward for your customers. A clean, minimal design helps to focus attention on key details, such as transaction amount, date, and payment method. Keep the template structure simple to avoid unnecessary confusion. Choose between traditional paper formats or digital templates depending on your target audience’s preferences.

Consider Size and Layout

The layout should be easy to read and not overcrowded. Use a clear hierarchy, with the most important information, like the amount and recipient, placed prominently. You can experiment with a horizontal or vertical layout, but ensure consistency with your brand’s style. Horizontal layouts are often better for digital formats, while vertical ones work well in printed receipts.

Customizable Elements

Make sure your template allows for customization to reflect your brand’s identity. Include options for adding a logo, business name, and contact details. Consider offering space for specific transaction notes or customer information, which can be tailored to different types of purchases.

Implementing automation for credit card receipt generation improves accuracy and reduces manual workload. Utilize software tools that integrate seamlessly with your payment processing system to generate receipts instantly upon transaction completion.

- Set up automatic receipt generation through payment gateway APIs or POS systems to trigger when a payment is processed.

- Customize receipt templates to include necessary details, such as transaction date, amount, merchant name, and payment method.

- Ensure compliance with local regulations, including data protection and transaction reporting requirements.

- Integrate automated email services to send receipts directly to customers, reducing paper usage and ensuring quick delivery.

- Use cloud storage for easy retrieval and archiving of receipts, providing secure access and backup options.

By automating receipt generation, businesses save time, enhance customer experience, and streamline accounting processes. This ensures receipts are consistently accurate and sent without delay.

Credit card receipts should follow specific regulations to ensure compliance and protect both businesses and consumers. Each receipt must clearly state the essential transaction details, including the merchant’s name, transaction date, total amount, and authorization code. This is particularly important for disputes, refunds, and tax purposes.

Data Protection and Privacy Laws

Credit card receipts contain sensitive personal information. Businesses must comply with privacy regulations like the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). Storing or sharing customer data without explicit consent can result in severe penalties.

Card Network Regulations

Visa, MasterCard, and other card networks require that receipts display only the last four digits of the card number. Full card details should never be shown to avoid identity theft and fraud risks. Additionally, receipts must not include the CVV code, which is intended for authorization purposes only.

| Regulation | Requirement |

|---|---|

| GDPR | Protect customer data and gain consent for storage. |

| Card Network Rules | Display only the last 4 digits of the card number; exclude the CVV. |

| Consumer Protection Laws | Ensure transparency on pricing and transaction details. |

Failing to adhere to these requirements could lead to financial penalties or legal actions. Businesses should regularly review these rules to ensure compliance and maintain customer trust.

Receipt templates may appear straightforward, but issues can arise. Here are some common problems and how to resolve them:

Formatting Issues

- Problem: Misaligned text or incorrect font size may distort the look of a receipt.

- Solution: Ensure proper margin settings and use standard fonts like Arial or Times New Roman. Check template previews before finalizing the layout.

Missing Information

- Problem: Customers often report missing fields like item descriptions or payment methods.

- Solution: Double-check template fields. Customize templates to include necessary details such as transaction date, tax, and method of payment.

Inconsistent Branding

- Problem: Templates lack a uniform brand style or logo.

- Solution: Customize receipts with your logo, consistent color scheme, and business name to maintain brand identity.

Legal Compliance Issues

- Problem: Some templates may not comply with local or industry-specific regulations regarding required information on receipts.

- Solution: Stay updated on regional regulations. Adjust templates to meet legal requirements, such as including tax identification numbers or refund policies.

Technical Glitches

- Problem: Sometimes templates don’t print correctly, or the software crashes.

- Solution: Test templates across different devices and ensure compatibility with your point-of-sale system. Update your software regularly to avoid bugs.

Always ensure that the receipt template includes clear and accurate details about the transaction. Include the transaction date, merchant name, cardholder’s name, and the total amount. It is important to display the payment method used, along with the last four digits of the credit card for identification.

Consider adding a space for any additional notes or a reference number to help both parties track the transaction. This ensures transparency and reduces the chance of confusion later on.

Make the layout clean and easy to follow. A well-organized structure helps users quickly understand the details of the transaction without unnecessary clutter.

Lastly, ensure that the receipt is formatted in a way that it can be easily printed or saved as a digital file. This allows for quick access and archiving when needed.