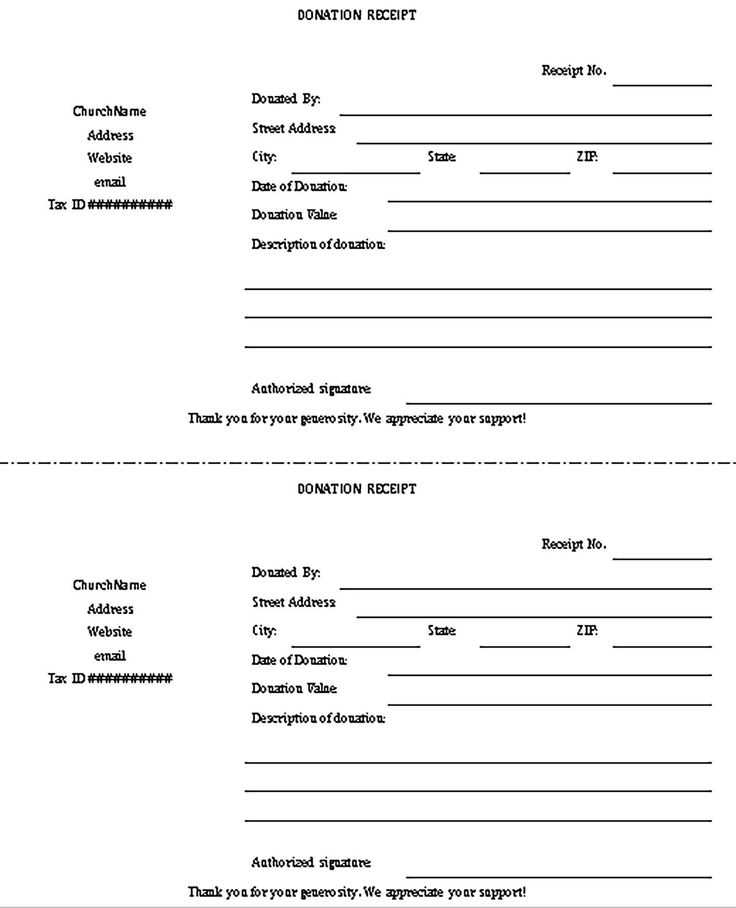

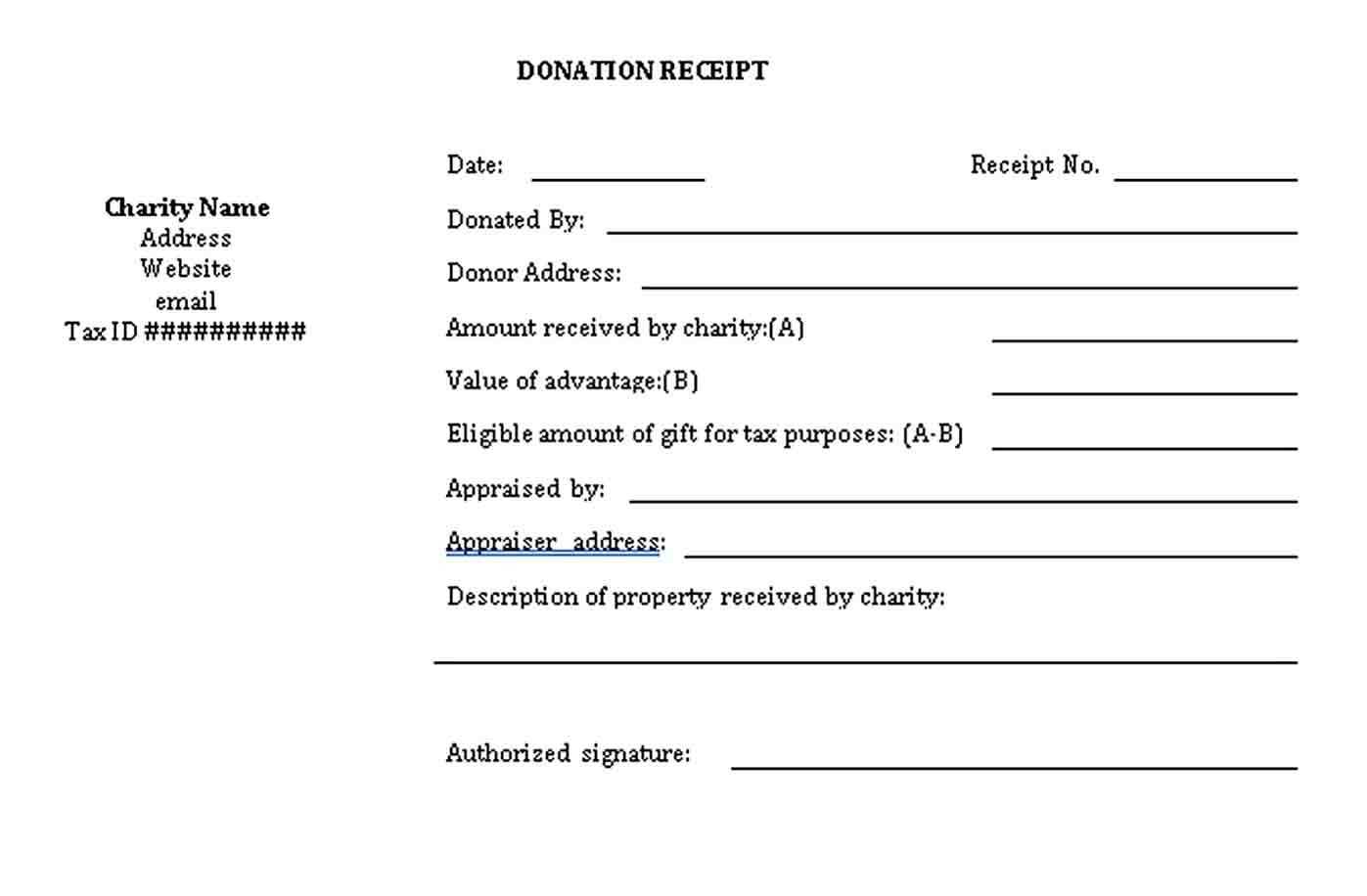

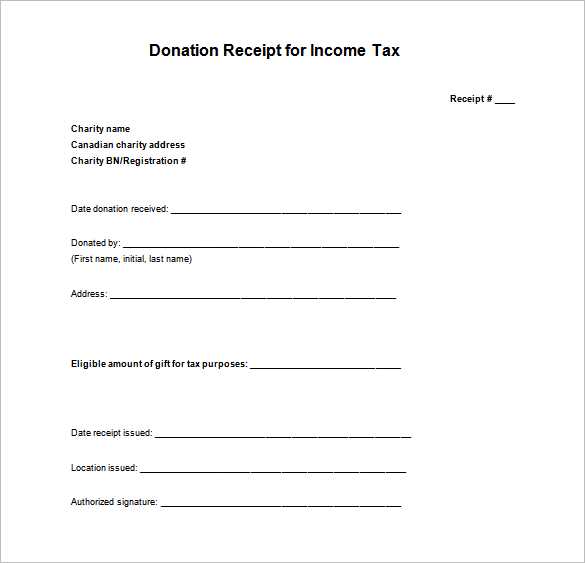

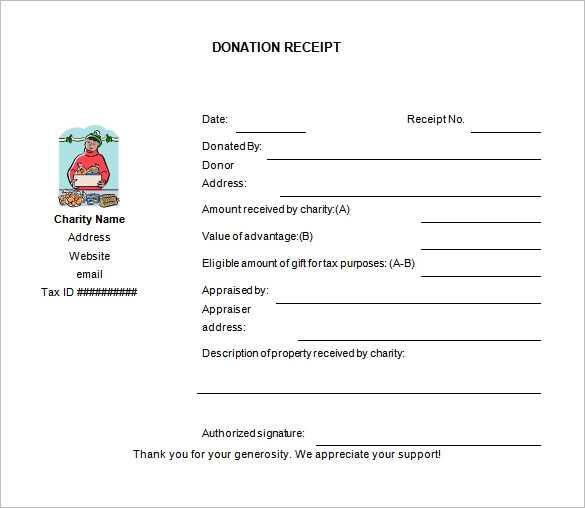

Creating a donation receipt template in PDF format allows organizations to easily acknowledge contributions while ensuring compliance with tax regulations. This template should include specific details like the donor’s name, donation amount, date, and any goods or services provided in exchange. Keep the design clean and easy to fill out, ensuring all necessary fields are clear and accessible.

Ensure the template also includes a section for the organization’s contact information and a brief statement confirming the tax-exempt status if applicable. Adding a unique receipt number can help keep track of donations for both the donor and the organization. These details will make the receipt more professional and organized, enhancing both usability and accountability.

The use of a PDF format provides consistency and easy sharing. Once designed, the template can be used repeatedly, saving time and reducing errors. Most importantly, make sure the PDF is fillable, so it can be easily completed electronically before being sent out to the donor.

Here’s the revised version:

Use a simple and clear layout for your donation receipt template. Start with the donor’s information, such as name and address, at the top. Follow with the donation amount and the date received. Include a brief description of the purpose of the donation. This helps ensure clarity for both the donor and your organization.

Important Details to Include

Ensure that the receipt includes the organization’s name and tax identification number, along with a statement acknowledging that no goods or services were provided in exchange for the donation, if applicable. This is key for tax purposes.

Formatting Tips

Make sure the template is easy to fill out. Use a consistent font style and size throughout the document. Organize the sections clearly so that the most relevant information stands out for the donor. Keep the layout professional but straightforward.

Donation Receipt Template PDF

Creating a receipt template in PDF format is a straightforward process. First, select a PDF tool that allows for text and form field integration. Use fields for the donor’s name, donation amount, date, and a description of the donation type. Make sure to include your nonprofit’s name, tax-exempt status, and contact details. This information helps ensure the document is both professional and legally compliant.

Customizing receipts for different donation types involves adjusting the content based on what the donor has contributed. For monetary donations, include the total donation amount and specify whether it was a one-time or recurring gift. For in-kind donations, list the item(s) donated and provide an estimated value. Additionally, add a clear statement indicating that the receipt does not reflect any goods or services provided in exchange for the donation.

Automating receipt generation can save time for nonprofit organizations. Implementing a system that integrates donation records with receipt creation can eliminate manual data entry. Many online donation platforms offer built-in features for automatically generating and sending PDF receipts. This not only simplifies the process but also ensures accuracy and timeliness, helping your nonprofit stay organized and efficient in acknowledging contributions.