To ensure your donors receive the proper documentation for their tax deductions, it’s important to create a donation receipt that follows IRS guidelines. A clear and accurate receipt helps donors claim their deductions while also protecting your organization’s status. Start by including key information such as the donor’s name, the donation date, and the total value of the contribution.

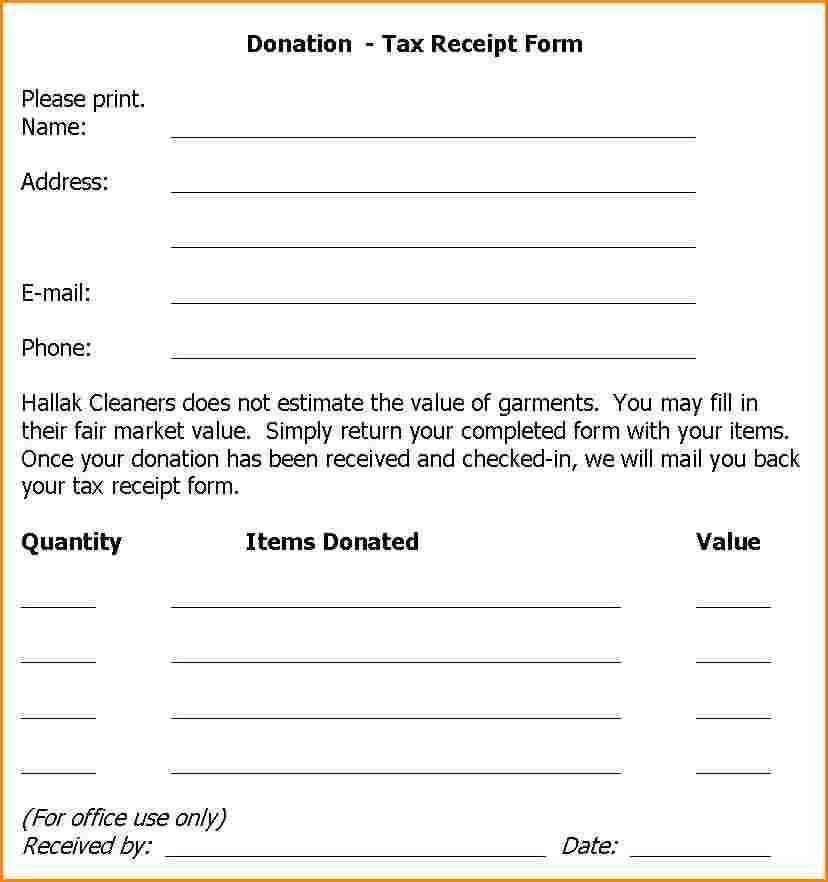

The receipt should also feature your organization’s name, address, and tax-exempt status, which is essential for verification. For non-cash donations, include a description of the donated items and a fair market value estimate. This transparency will help avoid any confusion during tax filing.

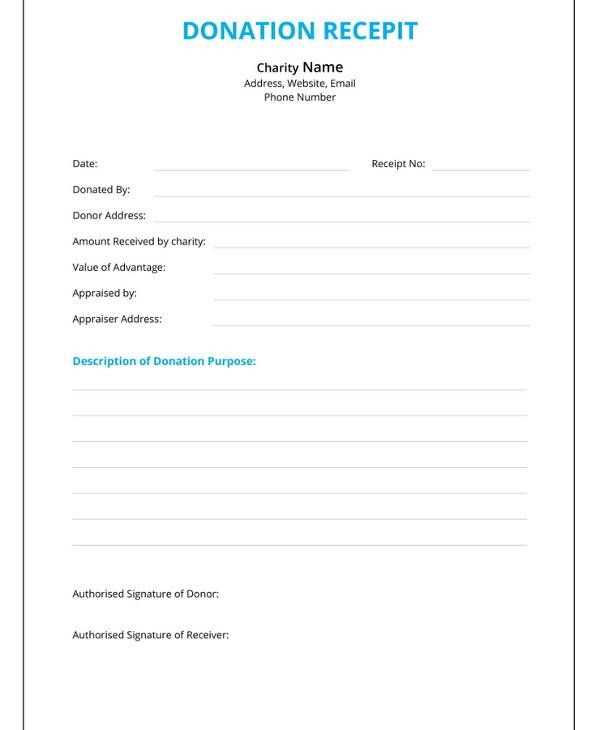

If the donor received any goods or services in exchange for their donation, note the value of those items and provide a statement clarifying the amount that is tax-deductible. Clear language on this point ensures compliance and prevents misunderstandings.

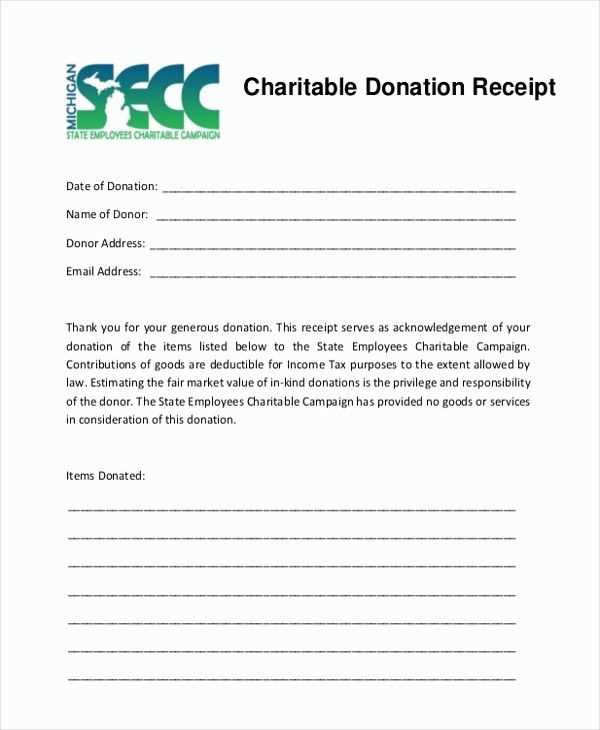

A simple receipt template might look like this:

Organization Name Organization Address Tax-Exempt EIN: [Insert EIN]Donation Date: [Insert Date]Donor Name: [Insert Donor Name]Donation Amount/Description: [Insert Amount or Description]Statement: "No goods or services were provided in exchange for this donation."

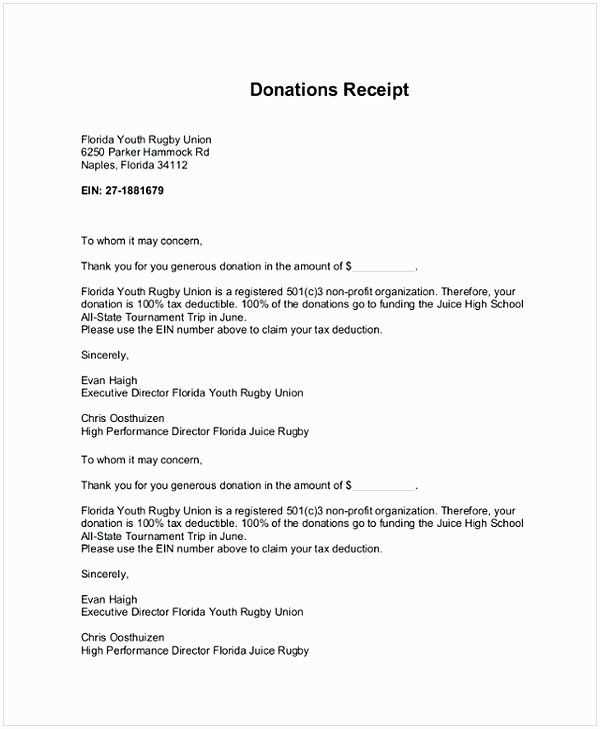

This template will help your donors maintain accurate records for tax purposes while ensuring your organization remains compliant with IRS regulations. With just a few key details, you can streamline the process and support your donors’ needs.

Here’s the revised version:

Ensure the donor’s name, the donation amount, and the date of the contribution are clearly listed. If applicable, include the type of donation, whether it’s cash or in-kind. Always specify that no goods or services were provided in exchange for the donation, as this is a requirement for tax-deductible receipts. Make it easy for the donor to track the donation details by providing a unique receipt number.

For organizations in the United States, include your tax-exempt status and EIN (Employer Identification Number) at the bottom. This reinforces the legitimacy of the donation and simplifies the process for donors during tax filing. Remember to thank the donor in a concise and appreciative manner.

Keep the format clean and easy to read, allowing the donor to access all the necessary details at a glance. Consistent, accurate records will make future interactions smoother and encourage more donations.

Template for Tax Deductible Donation Receipt

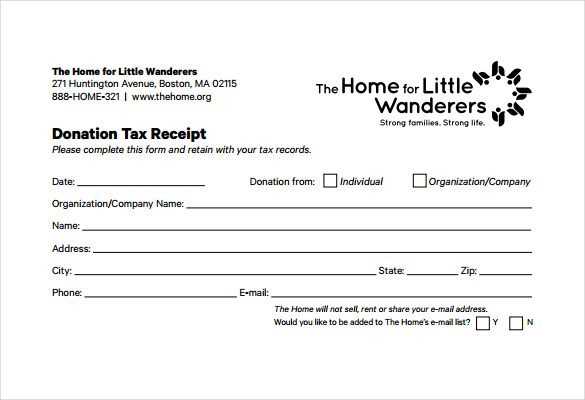

Designing a tax-deductible donation receipt requires attention to key details that ensure compliance with tax laws and provide a clear acknowledgment for your donors. The header should contain the organization’s name, address, and logo for brand identity, as well as a statement confirming the organization’s tax-exempt status. Use a bold, easily readable font for the organization’s name and contact information. Include the IRS tax identification number to reinforce credibility.

The body of the receipt should contain the donor’s name, the donation amount or description of the donated property, and the date of the donation. Specify whether the donation was monetary or non-monetary, and if the latter, include an estimated value of the donation if applicable. If any goods or services were provided in exchange for the donation, include a clear statement of their value so the donor can determine the deductible portion. A common phrase to use is: “No goods or services were provided in exchange for this donation” if that’s the case.

When formatting the receipt, ensure that the layout is clean and straightforward. Use clear sections and bullet points where necessary to make it easy to find important information. Issue receipts promptly after receiving donations to ensure timely tax filing by donors. If the donation exceeds a certain amount, consider providing a formal acknowledgment with additional details, but always keep the receipts easy to reference for the donor’s tax records.