A rental bond receipt is a crucial document for both landlords and tenants in Australia. It confirms the payment of the bond and serves as a record of the transaction, protecting both parties in case of disputes. This receipt should clearly outline key details such as the bond amount, payment method, tenant’s name, property address, and the date the bond was paid. Having a well-organized and clear rental bond receipt helps avoid misunderstandings about the bond at the end of the lease agreement.

Make sure the rental bond receipt includes a statement confirming the bond has been lodged with the relevant state or territory authority. Each state in Australia requires landlords to submit the bond to a government body for safekeeping, such as the Rental Bond Board in New South Wales or the Residential Tenancies Bond Authority in Victoria. This ensures that the tenant’s funds are protected during the lease term.

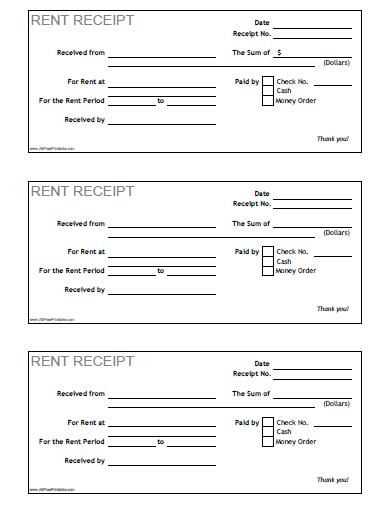

Use a simple template to document the bond payment. Include the tenant’s full name, rental property details, bond amount, and any relevant payment instructions. This template will not only serve as proof of payment but also as a reference should any issues arise when the bond is refunded at the conclusion of the tenancy.

Here’s the corrected version:

Ensure the rental bond receipt includes all the necessary details to avoid any confusion later on. This document serves as proof of payment and protects both the landlord and tenant. Below is the correct structure for the receipt:

- Tenant’s full name – Clearly list the tenant’s legal name.

- Landlord’s full name or agency name – Include the property manager or landlord’s official name.

- Property address – The address of the rented property.

- Amount paid – Clearly state the amount of the bond payment.

- Date of payment – The exact date the payment was made.

- Payment method – Indicate whether the bond was paid via bank transfer, cheque, cash, etc.

- Receipt number – Assign a unique reference number for future tracking.

- Landlord or agent’s signature – Ensure the document is signed by the appropriate person.

It’s also a good idea to include any special terms or conditions if applicable, such as deductions from the bond or the timeline for its return after the lease ends.

Keep a copy of the receipt and provide one to the tenant. Both parties should retain this document for their records. For extra security, ensure the receipt is issued as soon as the bond is paid.

- Rental Bond Receipt Template Australia

A rental bond receipt serves as an important legal document confirming the receipt of the bond payment from a tenant. In Australia, the template for this receipt should clearly outline the details of the bond transaction to ensure transparency and avoid any potential disputes between landlords and tenants.

Key Information to Include

For the rental bond receipt to be valid, the following details must be included:

- Tenant’s Name: Full legal name of the tenant(s).

- Landlord’s Name: Full legal name of the landlord or property management company.

- Property Address: The address of the rental property where the bond applies.

- Bond Amount: The total amount paid by the tenant as a security bond.

- Date of Payment: The exact date when the bond payment was made.

- Receipt Number: A unique identifier for the transaction to ensure record keeping.

- Payment Method: Details of how the payment was made (e.g., bank transfer, cheque, cash).

- Signature: Both the landlord and tenant should sign the receipt to confirm the transaction.

Additional Tips

It’s advisable to keep a copy of the rental bond receipt for your records. Tenants should also receive a copy for their personal documentation. If the bond is lodged with a government authority (such as the Residential Tenancies Bond Authority in Victoria), make sure to include the relevant lodging reference number.

Providing a well-documented rental bond receipt is a simple yet effective way to ensure clarity and avoid disputes over bond refunds at the end of the tenancy.

For a clear and professional rental bond receipt, follow these steps:

1. Include Basic Information

Write down the names of both the tenant and landlord, as well as the rental property address. This establishes the context of the transaction.

2. State the Bond Amount

Clearly specify the exact amount of bond paid by the tenant. This amount should match the agreement and be clearly visible on the receipt.

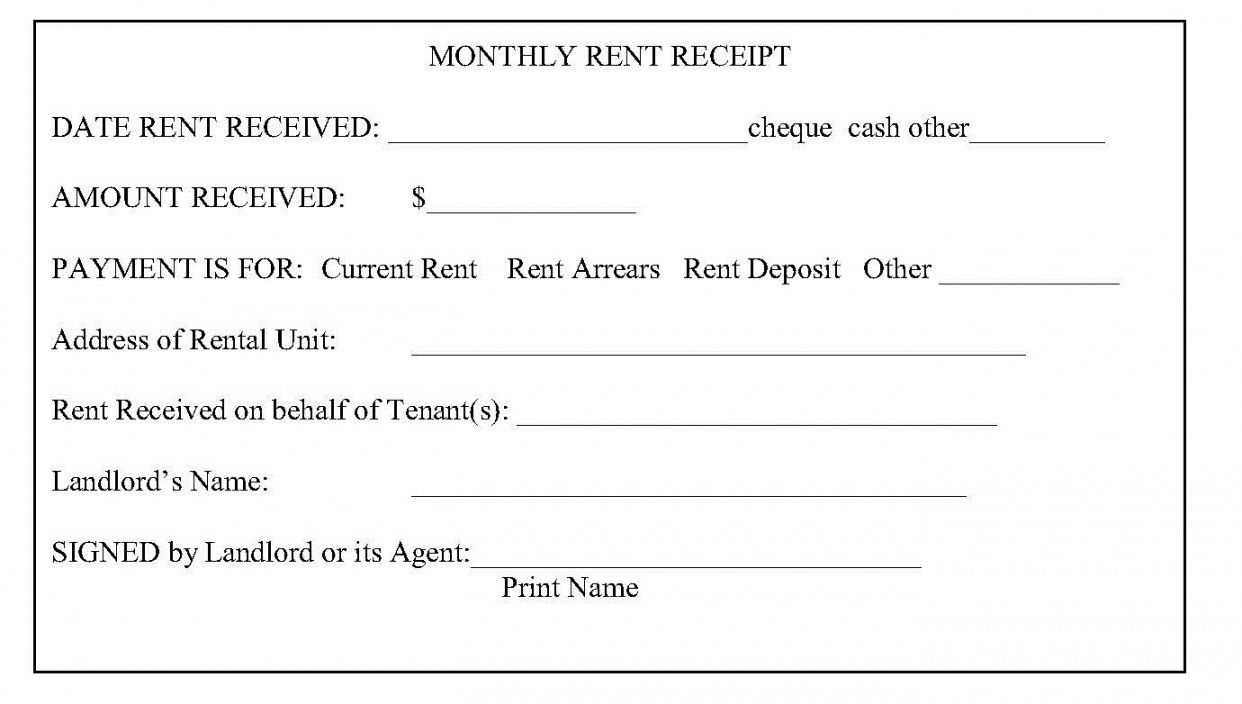

3. Document the Payment Method

Note how the bond was paid (e.g., cash, bank transfer, cheque). If the payment was made electronically, include transaction details like the reference number and date of payment.

4. Include the Payment Date

Record the date the bond payment was received. This helps track the timing of the transaction.

5. Reference the Lease Agreement

Link the bond receipt to the rental agreement by including the lease start date or any relevant reference number to ensure the bond corresponds to the correct property.

6. Signature of the Landlord

The landlord or property manager must sign the receipt. This confirms that the bond payment has been received and that the receipt is valid.

7. Tenant’s Acknowledgment

Ask the tenant to sign as well. This confirms their receipt of the bond payment and agreement to the terms outlined.

8. Retain Copies

Ensure both parties keep a copy of the signed receipt for their records. This will help resolve any future disputes regarding the bond.

Ensure your rental bond receipt includes the following details to maintain clarity and protect both parties involved.

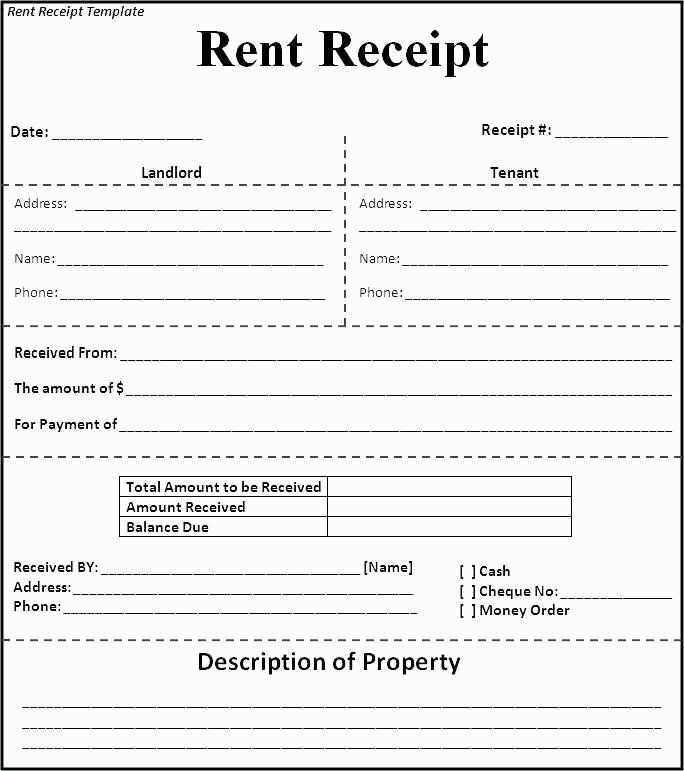

1. Tenant and Landlord Details

Clearly state the names of both the tenant and the landlord (or property manager). Include their contact details, such as email addresses and phone numbers, for easy reference in case of disputes or future communication.

2. Property Address

The address of the rental property must be listed precisely, including unit numbers, street, city, and postcode. This ensures there is no confusion regarding the location of the property covered by the bond.

3. Bond Amount

Indicate the total bond amount paid by the tenant. This amount should be clearly shown and match what was agreed upon in the lease or rental agreement.

4. Payment Details

Include the method of payment (e.g., bank transfer, cheque, or cash) and the date the bond payment was made. If possible, attach a transaction number or receipt to support the payment verification.

5. Receipt Number

Assign a unique receipt number to the bond payment. This helps to track and reference the bond payment if required for future claims or disputes.

6. Bond Holding Information

Clarify who is holding the bond (e.g., the landlord or an approved bond authority). If a government body is holding the bond, include their contact details and the relevant reference number or registration details.

7. Date of Receipt

Include the exact date when the bond was paid and received. This is important for both record-keeping and ensuring timelines are met for bond return after tenancy ends.

8. Signature of the Landlord or Property Manager

The receipt should include the signature of the landlord or property manager, confirming the acceptance of the bond payment. This helps to validate the receipt and avoid confusion later on.

9. Conditions of Bond Refund

List any conditions under which the bond may be partially or fully withheld, such as damage to the property, unpaid rent, or unclean conditions upon move-out. This provides transparency and avoids potential disputes at the end of the tenancy.

10. Tenant’s Acknowledgment

Include a space for the tenant’s signature, acknowledging they have received the receipt and are aware of the bond terms and conditions.

Sample Table of Rental Bond Receipt Details

| Details | Information |

|---|---|

| Tenant Name | John Doe |

| Landlord Name | Jane Smith |

| Property Address | 123 Main St, Melbourne, VIC 3000 |

| Bond Amount | $1,200 |

| Payment Method | Bank Transfer |

| Payment Date | February 12, 2025 |

| Receipt Number | RBR123456 |

| Bond Holding Authority | Residential Tenancies Bond Authority (RTBA) |

| Signature of Landlord | ____________________ |

| Signature of Tenant | ____________________ |

A rental bond receipt must clearly outline the terms agreed upon by both the tenant and landlord. To avoid future disputes, ensure the receipt specifies the amount paid, the property address, and the date of payment. A well-drafted receipt provides clarity and serves as a legal document in case of any conflicts regarding the bond.

Under Australian law, landlords are required to lodge the rental bond with the relevant state or territory bond authority. Failing to do so could result in fines or legal action. Tenants should request a copy of the receipt immediately after payment to ensure the bond is properly lodged.

Tenants have the right to dispute any unfair deductions from the bond. If the landlord does not return the bond in full, a formal claim can be filed with the bond authority. It’s essential to keep the receipt as proof of payment and for reference when filing a claim.

The receipt also serves as a safeguard against misunderstandings about bond deductions at the end of the tenancy. It is recommended that both parties inspect the property together at the end of the lease, documenting its condition in writing. This can help prevent disagreements about the bond’s return.

Rental Bond Receipt Template Australia

The rental bond receipt should clearly state the amount paid, the date of payment, and the landlord’s or agent’s details. It serves as proof that the tenant has paid the bond and is often required for disputes or refund claims at the end of the lease.

Key Components of a Rental Bond Receipt

A complete rental bond receipt includes the tenant’s name, address of the rental property, payment method, bond amount, and the name of the landlord or property manager. Make sure the receipt also has the date the payment was made. This ensures clear documentation and avoids misunderstandings.

Why It’s Important

Holding onto a rental bond receipt is crucial. Without it, it may be difficult to claim the bond at the end of the tenancy. Having the receipt allows tenants to verify the bond amount and confirms that the payment was made according to the lease agreement.

Always request a receipt if one isn’t automatically provided to avoid potential disputes. The document must reflect all the necessary details to be valid in any future bond-related matters.