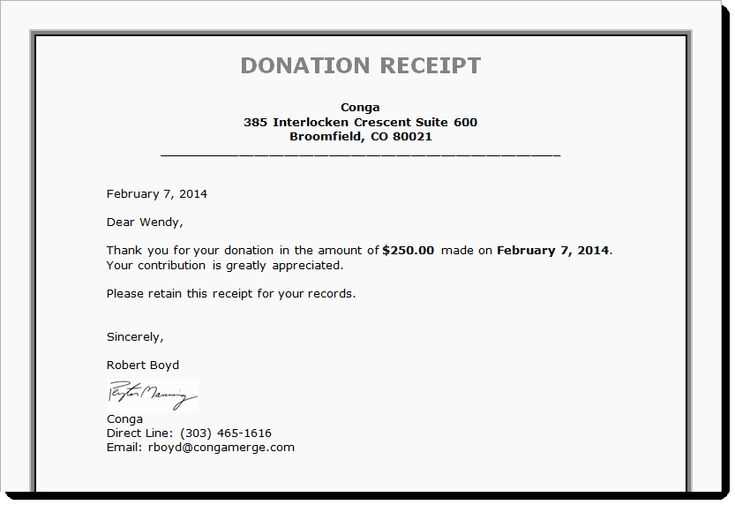

If you’re managing a 501c3 nonprofit organization, providing donors with clear and accurate donation receipts is a key part of the process. A well-designed donation receipt template simplifies this task, ensuring both you and your donors have the proper documentation for tax purposes. Start by including essential details like the donor’s name, the donation amount, and the date of the contribution.

The receipt should also include a statement that no goods or services were provided in exchange for the donation. This is important for tax-deductible contributions. To ensure transparency, you can personalize the receipt by adding your organization’s contact information and a brief thank-you message to the donor. This personal touch helps strengthen the relationship with your supporters.

Consider using a template that allows for easy customization. This way, you can quickly generate receipts for multiple donors without the need for repetitive data entry. The template should be simple to use, saving time while maintaining accuracy in every transaction. For nonprofit organizations, a donation receipt isn’t just paperwork–it’s a reflection of trust and accountability with your community.

Here are revised lines with minimized repetition, maintaining meaning:

For creating a donation receipt template, ensure the document includes key information clearly. Use simple phrases to avoid redundancy while keeping the format easy to follow. Here’s a structure that can be applied:

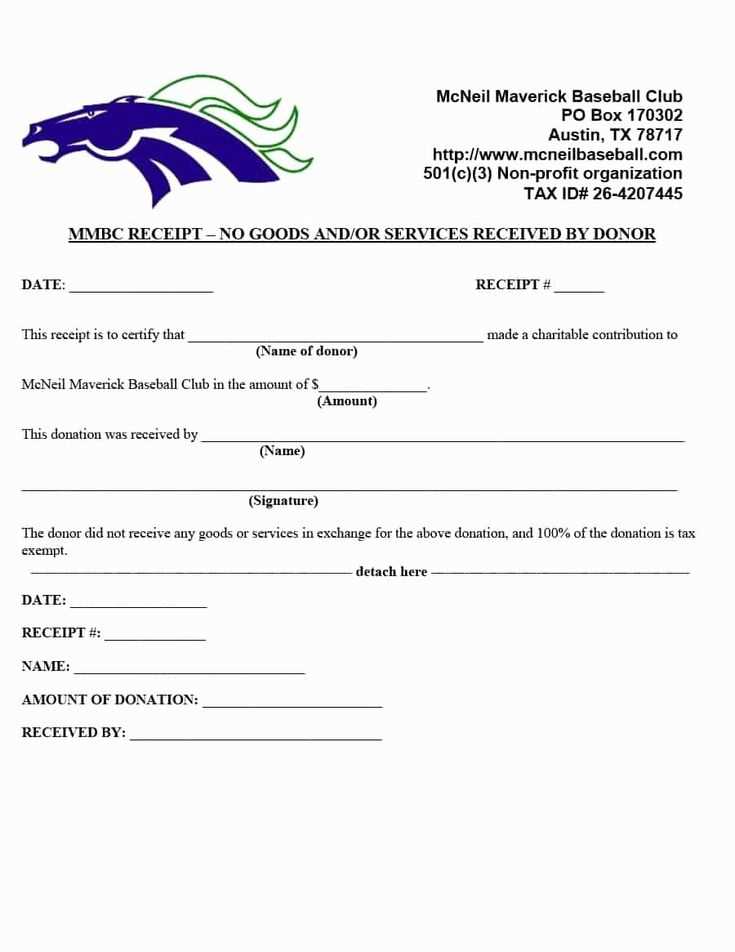

Receipt Header

- Organization name and logo

- Donation receipt title

- Date of donation

Donor Information

- Donor’s name and address

- Amount donated

- Donation type (monetary, goods, or services)

It’s essential to confirm that the document includes any tax-deduction disclaimers or instructions. Additionally, make sure to clearly state the fair market value of any non-cash donations.

Closing Details

- Authorized signature

- Contact information for questions

By structuring the receipt with this information, you can create a template that is clear, concise, and compliant with regulations.

- Free 501c3 Donation Acknowledgment Template

For non-profit organizations, providing a clear and professional donation acknowledgment is key to ensuring that donors feel appreciated. Here is a straightforward 501(c)(3) donation acknowledgment template that can be easily customized for your needs.

| Donation Acknowledgment Template |

|---|

|

Donor Information: Donor Name: [Donor’s Full Name] Address: [Donor’s Address] Email: [Donor’s Email Address] Phone: [Donor’s Phone Number] Organization Information: Organization Name: [Your Nonprofit’s Name] Organization Address: [Your Nonprofit’s Address] Tax ID Number: [Your Nonprofit’s Tax ID] Donation Details: Amount Donated: $[Amount Donated] Date of Donation: [Date of Donation] Donation Type: [Cash, Check, Goods, etc.] Donor’s Message: [Optional Donor’s Message] Statement of Acknowledgment: Dear [Donor’s Name], Thank you for your generous contribution of $[Amount Donated] made on [Date of Donation]. Your support helps us [short statement about how the donation will be used]. [Your Nonprofit’s Name] is a 501(c)(3) tax-exempt organization. No goods or services were provided in exchange for your contribution, and your donation is fully tax-deductible to the extent allowed by law. If you have any questions, please feel free to contact us at [Your Contact Information]. Sincerely, [Your Name] [Your Title] [Your Nonprofit’s Name] |

Using this template ensures clarity for both the donor and your organization, while meeting IRS requirements for donation acknowledgment. Customizing this format with specific donation details will make it personal and professional for each supporter.

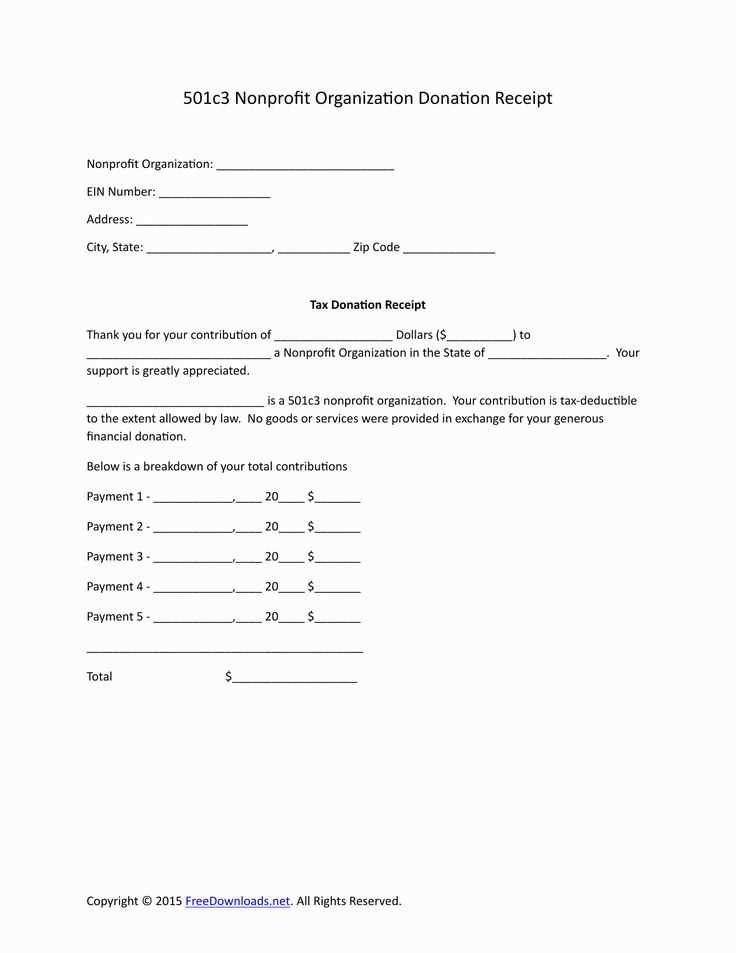

To create a straightforward 501c3 donation receipt, focus on including the key elements required for tax purposes. A receipt should clearly state the donor’s name, donation date, amount, and the nonprofit’s details. Make sure the template is clear and easy to fill out, ensuring no important information is overlooked.

Include Key Donation Information

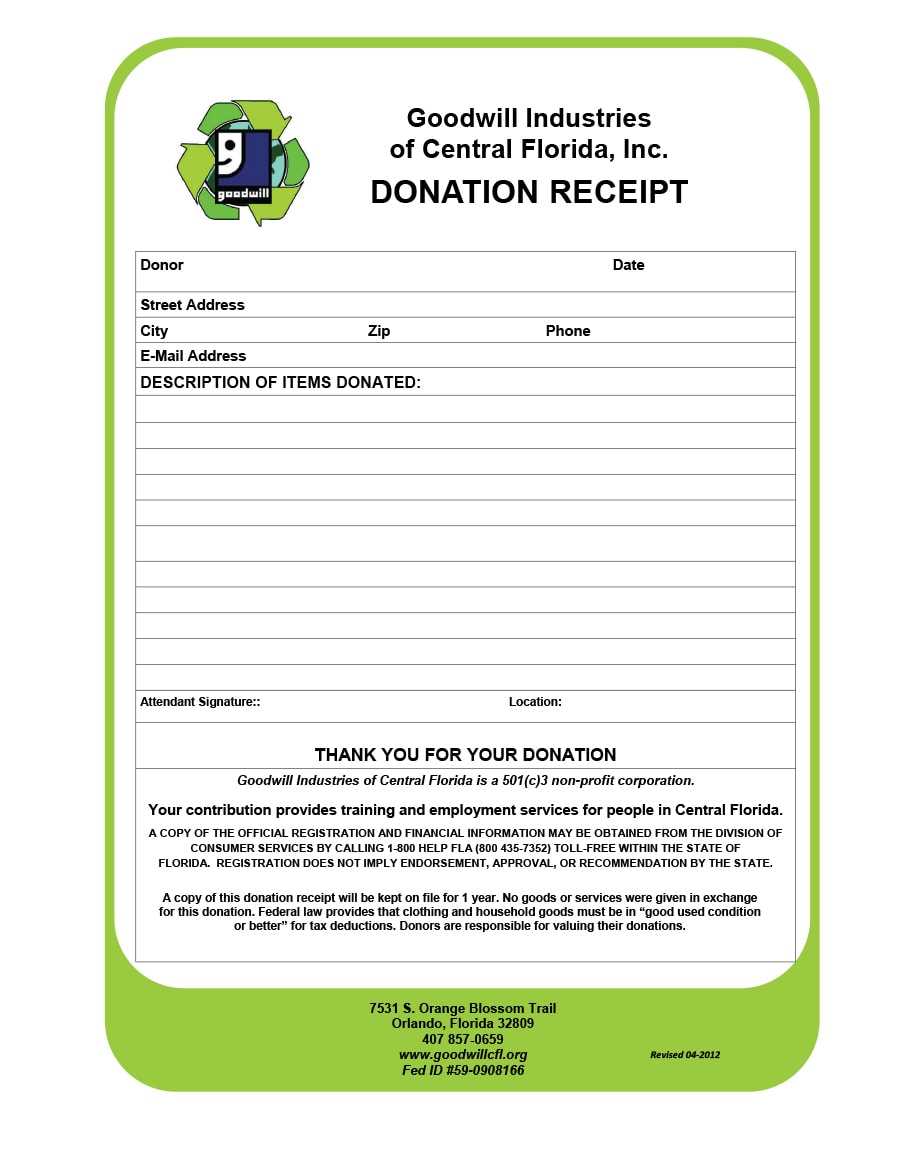

First, list the donor’s full name and address. Specify the donation date and the total monetary value of the contribution. If the gift is non-monetary, such as goods or services, describe the donated items along with their fair market value.

Include Nonprofit’s Legal Details

The nonprofit’s name, address, and 501c3 tax-exempt status should be prominently displayed. Adding the IRS Employer Identification Number (EIN) helps validate the organization’s tax-exempt status and provides the necessary reference for tax purposes.

Ensure your receipt includes a statement confirming that no goods or services were provided in exchange for the donation, or list the value of any goods or services given. This ensures the donor can claim the full tax deduction for their gift.

Adjust your receipt template to reflect the specifics of each donation type. This helps ensure accuracy and clarity for both your organization and your donors. For instance, if the donation is in-kind, include a clear description of the donated items, their estimated value, and the condition. Be specific about the non-cash nature of the contribution to comply with IRS guidelines.

Including Donation Type Details

For cash donations, list the exact amount contributed. If the donor opts to donate securities or stocks, mention the number of shares and the market value at the time of the donation. Acknowledging matching gifts from employers can also be incorporated, noting the matching amount separately from the donor’s original contribution.

Additional Notes and Custom Fields

Consider adding custom fields like special project names or fund designations. This provides clarity on how the donation is being used, especially for designated or restricted gifts. If applicable, include a reminder for donors to consult a tax advisor for their deductions, especially for larger donations that may require additional documentation.

Ensure each donation receipt includes the donor’s name, donation date, amount, and a clear statement confirming whether the donation was monetary or non-monetary. For non-monetary donations, include a brief description of the item(s) donated, though not the value.

Use a standardized format for your receipts. This helps maintain consistency and makes it easier for donors to understand the tax implications of their contributions. Include your 501(c)(3) organization’s name, tax ID number, and a statement that no goods or services were provided in exchange for the donation, if applicable.

Track all issued receipts in a database or donation management system. Ensure every donation has a corresponding record that includes the donor’s contact details and donation specifics. This streamlines future communication and ensures that you can efficiently manage tax reporting and acknowledgments.

Send receipts in a timely manner–ideally within a few days after the donation is made. A quick acknowledgment builds trust and shows donors that their contributions are valued.

Maintain a secure system for managing receipts. Protect both digital and physical copies to safeguard donor information. Regularly back up your database to prevent any data loss.

Lastly, periodically review your practices to ensure compliance with IRS guidelines and adjust as needed to maintain transparency and credibility with your supporters.

Donation Receipt Template: Best Practices for Clarity

To ensure a smooth experience for both donors and the organization, provide a well-structured donation receipt template. Make sure it includes all required details, such as the donor’s name, donation amount, and date of the contribution.

- Donor Information: Always include the name and contact details of the donor. This helps with tax purposes and future communication.

- Donation Details: Clearly state the donation amount, whether cash or goods, and any restrictions placed on the donation, if applicable.

- Organization Information: Include the name, address, and tax-exempt status number of your 501(c)(3) organization.

- Thank You Note: Express gratitude to the donor. A short note acknowledging their generosity helps build goodwill and long-term relationships.

- Legal Disclaimer: Include a statement clarifying that no goods or services were exchanged for the donation, which is crucial for tax deduction purposes.

Use a clean and easy-to-read format to avoid confusion. Keep the language straightforward and professional. A donor should be able to understand their receipt at a glance, ensuring transparency and trust.