Creating a ground rent receipt template is straightforward and can save time when managing rental payments. A well-structured template ensures both landlord and tenant have a clear record of payments made, helping to avoid misunderstandings and legal issues down the line. By following a few simple steps, you can design a professional receipt that meets all necessary requirements.

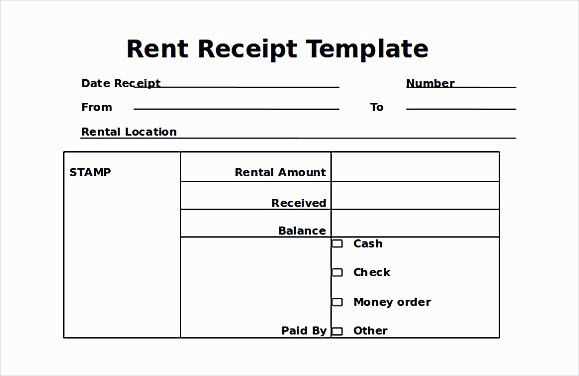

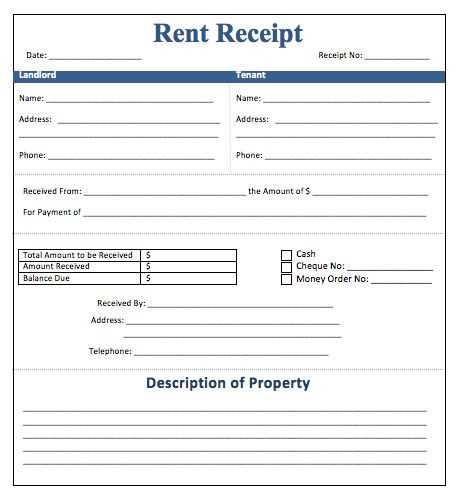

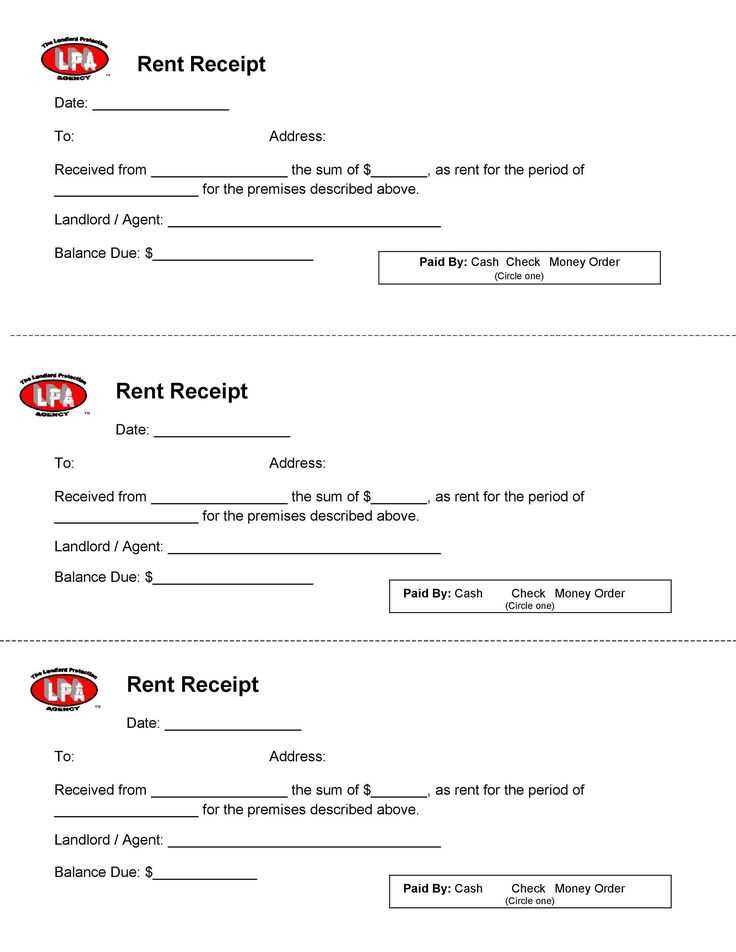

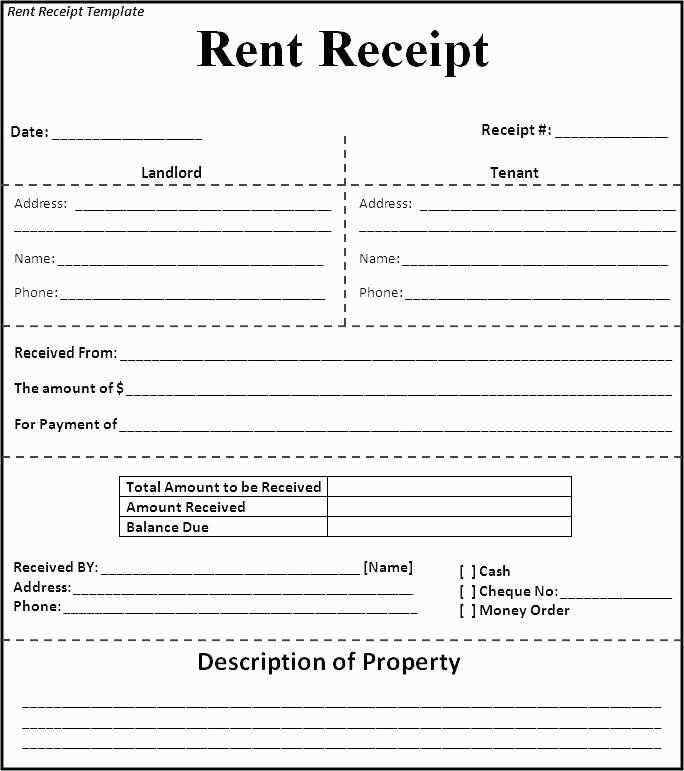

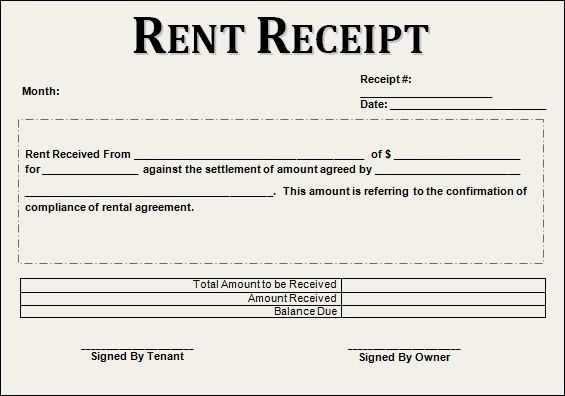

The template should include key information such as the landlord’s name and contact details, the tenant’s name, property address, payment date, amount paid, and payment method. It’s also important to note the rental period the payment covers, whether it’s monthly, quarterly, or annual. This transparency not only helps in record-keeping but also strengthens communication between parties.

To make the template more user-friendly, consider adding space for any additional notes or references to late fees or payment adjustments. Keep the layout clean and easy to read, ensuring that all important details are highlighted for quick reference. This small but significant tool can greatly streamline your property management process.

Here’s the revised text with minimized repetition:

To create a ground rent receipt template, include the following key elements for clarity and accuracy:

Basic Information

Start with the tenant’s name, the property address, and the date of the payment. This ensures that both parties can easily identify the transaction.

Details of Payment

Clearly state the amount paid, the payment period (e.g., monthly, quarterly), and any reference number if applicable. This provides transparency and helps in record-keeping.

Include a section where the payment method is specified, such as bank transfer, cheque, or online payment. This eliminates confusion over how the payment was made.

Lastly, add space for both parties’ signatures or a digital acknowledgment to validate the receipt.

This structure helps streamline the receipt process and minimizes errors or misunderstandings in the future.

Ground Rent Receipt Template: A Practical Guide

How to Format a Ground Rent Receipt for Clarity

Key Details to Include in a Ground Rent Receipt

Customizing Your Template for Various Lease Terms

Legal Aspects of Issuing Ground Rent Receipts

Managing Payments and Receipts for Multiple Ground Rent Properties

Using Digital Tools to Create and Store Receipts

Ensure your ground rent receipts are clear and professional by organizing them with specific details that leave no room for confusion. Include the following elements:

Key Elements for a Ground Rent Receipt

Start with the tenant’s name, property address, and the date of payment. Include the amount paid, the payment method (e.g., check, bank transfer), and the period covered by the rent. Additionally, a receipt number can help with tracking for both the landlord and the tenant. If applicable, mention any outstanding balance or late fees. Be sure to clearly state that the payment is for ground rent to avoid any misinterpretation.

Adapting for Various Lease Terms

Customize your template based on lease specifics. For leases with adjustable ground rent rates, include the current rate, the next scheduled adjustment (if any), and the terms of those adjustments. This transparency helps tenants understand what changes to expect in future payments. For long-term leases, also note the lease start and end dates so that both parties have a clear reference point for future receipts.

When handling multiple properties, consider a spreadsheet to manage payments and receipts. With this system, each property can be tracked independently, making it easy to generate receipts and organize records. Using software tools can streamline the process of generating, storing, and retrieving receipts quickly.

Legal considerations require that receipts be accurate and issued promptly. Failure to provide receipts may lead to disputes. Always ensure that the language used in the receipt is clear, leaving no ambiguity about the transaction, especially when dealing with complex lease terms.

Utilizing digital tools can simplify the creation and storage of receipts. Many accounting software options allow for easy customization, and receipts can be stored securely in digital formats for easy access. This method reduces paperwork and ensures that records are always up-to-date and readily available for both tenants and landlords.