Creating a professional and transparent receipt is a must for any nonprofit organization. A well-structured template ensures both the organization and the donor have clear documentation for their records. By providing receipts, nonprofits not only comply with legal requirements but also build trust with donors.

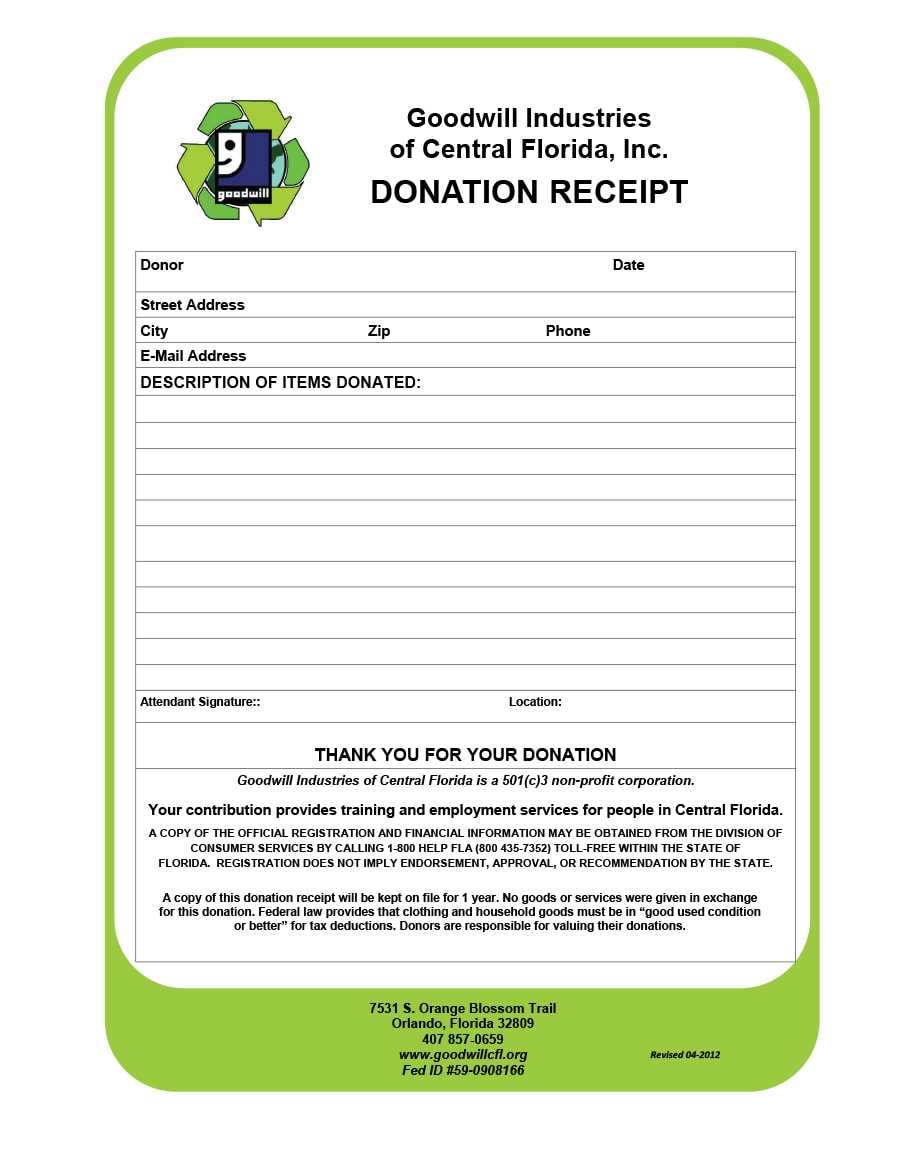

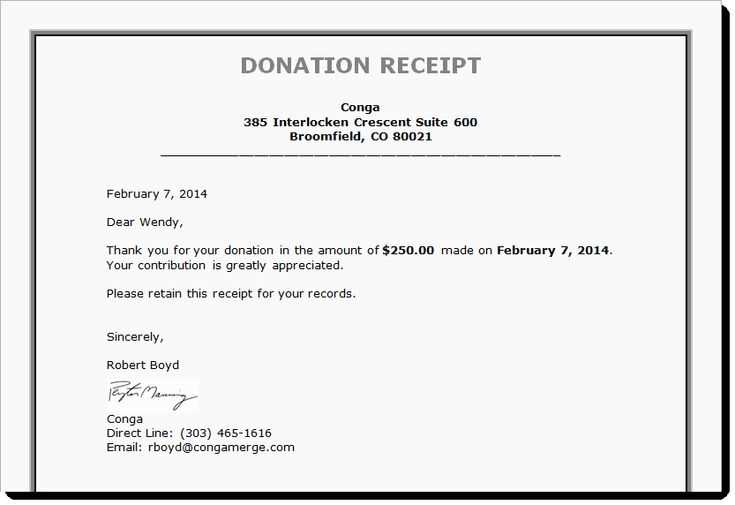

Use a simple layout that includes the name of the nonprofit, the donor’s information, the donation amount, and the date of the donation. Ensure that your template is customizable so you can add any other necessary details like a description of the purpose of the donation. This keeps everything aligned with your organization’s mission and policies.

Incorporating clear language in your receipts helps donors understand their contributions and the tax benefits they can claim. Include a statement confirming that no goods or services were exchanged in return for the donation, which is vital for tax purposes.

Consider creating a digital version of the receipt for easy distribution via email or your organization’s website. This makes the process faster, reduces paper usage, and can be a more environmentally friendly option for handling donations.

Detailed Guide to Nonprofit Receipt Templates

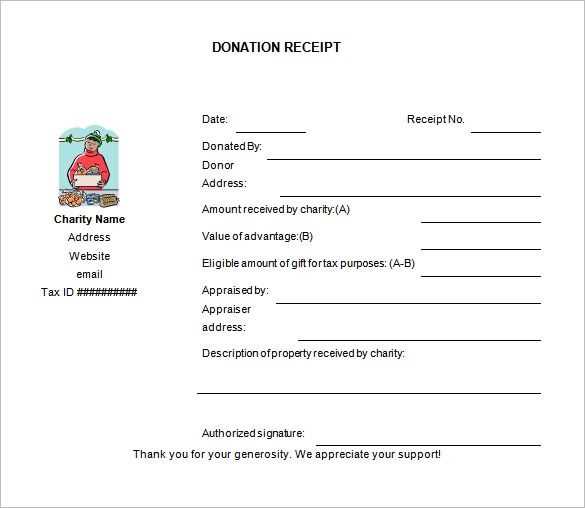

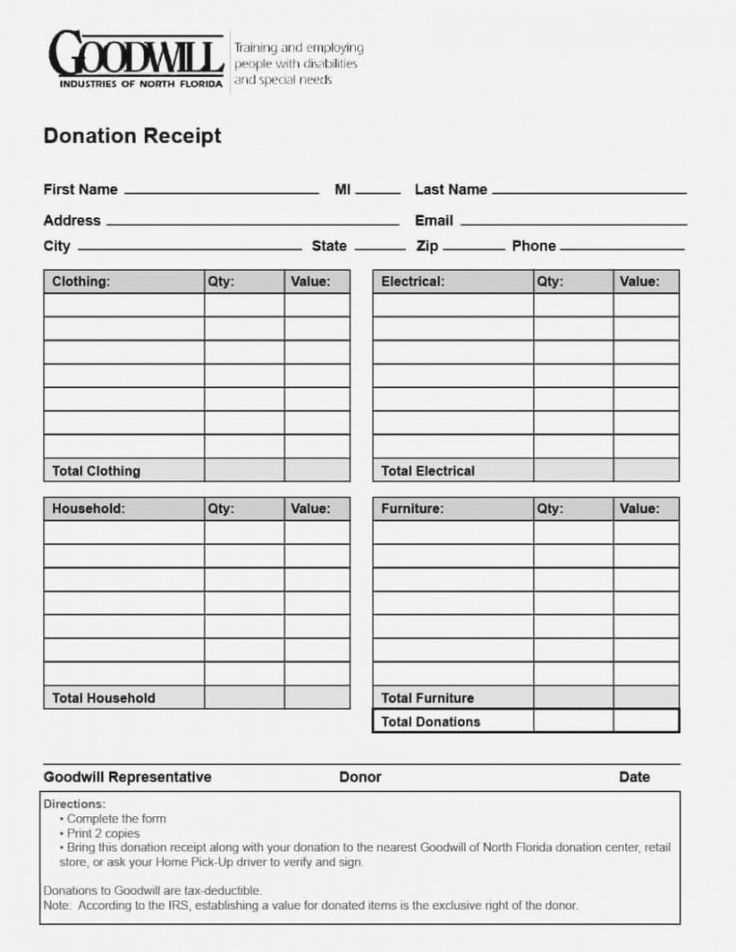

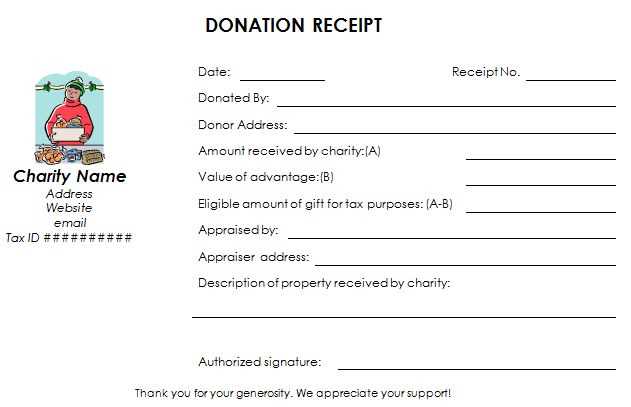

Ensure your nonprofit receipt templates include the donor’s full name, donation date, and the exact amount given. This basic information establishes transparency and trust. Include a statement indicating whether the donation was cash, goods, or services. For in-kind donations, describe the items with specific details to avoid any ambiguity.

Don’t forget to list your nonprofit’s name, address, and EIN (Employer Identification Number). These details are necessary for the donor to claim their tax deduction. Be clear on your tax-exempt status by adding a disclaimer about the tax deductibility of the donation, as required by IRS guidelines.

Make sure the receipt is signed by an authorized individual, such as a treasurer or director. This signature confirms the authenticity of the donation. Keep the format clean and easy to read. Whether digital or printed, clarity is key to ensuring the document serves its purpose both for your nonprofit and the donor.

For organizations offering donations of different types (monetary or in-kind), customize templates accordingly. Use separate sections for each type, and provide additional space for itemized lists when necessary. This approach avoids confusion and allows for quick reference when needed during tax season or other reporting periods.

Lastly, consider providing donors with a thank-you message within the receipt itself. Acknowledging their generosity can help build stronger relationships and encourage future donations. Keep this message brief but genuine, reinforcing your mission and the impact of their support.

Customizing Receipt Templates for Donations

Make your donation receipts personal and relevant by adding clear details such as the donor’s name, donation amount, and the date of contribution. Adjust the template to reflect your nonprofit’s branding–include your logo and a consistent color scheme to build trust and recognition. Also, include a short message of gratitude to make the donor feel appreciated.

Ensure the receipt meets tax regulations by including necessary information like your nonprofit’s tax ID number and a statement confirming that the donation is tax-deductible. If there are any restrictions on the donation (e.g., designated for a specific program), clearly specify that in the receipt.

Consider adding a section with payment details such as the method of donation (credit card, check, or online). If the donation was processed through an online platform, include a transaction ID for easy reference. You can also integrate your contact information in case the donor has any questions.

For recurring donations, include the frequency of the payments and specify whether the amount is monthly, quarterly, or annually. Make sure to highlight the next payment date to keep donors informed.

Lastly, simplify the layout for easy reading. Avoid overcrowding the template with unnecessary details and focus on the most important information that donors need for their records. A well-organized receipt leaves a positive impression and enhances the donor’s experience with your nonprofit.

Legal Requirements for Nonprofit Donation Receipts

Nonprofit organizations must meet specific legal standards when issuing donation receipts. These requirements vary depending on the size of the donation and the country or region where the nonprofit operates. In the U.S., the IRS mandates particular information for donations of $250 or more.

- Receipt for Donations of $250 or More: For donations exceeding $250, a written acknowledgment is necessary. This receipt must include the donor’s name, the donation amount, and a statement regarding whether any goods or services were provided in exchange for the donation.

- Value of Goods or Services: If goods or services were provided, the receipt must state their value. Donors can only deduct the amount of the donation that exceeds the value of any received benefits.

- No Goods or Services Provided: If the donation is entirely tax-deductible, the receipt must clearly state that no goods or services were exchanged for the contribution.

- Donation Date: The date the donation was made is required on the receipt. For cash donations, a specific date is vital for tax filing purposes.

- Non-Cash Donations: If the donation involves property (such as goods or real estate), the nonprofit must provide a description of the items donated. For donations worth over $500, the donor may need to file additional forms with the IRS.

- Nonprofit Status: The receipt must clearly identify the organization’s nonprofit status and include the official tax-exempt number (EIN). This confirms the donor’s eligibility for tax deductions.

Ensure the receipt contains the necessary details to help both the donor and the organization comply with legal requirements. Keep records of all donations for at least three years in case of audit or further verification. If unsure, always consult legal advisors or tax experts to avoid issues with the IRS or relevant tax authorities.

Best Practices for Distributing Donation Receipts

Send receipts as soon as possible after a donation is made. This ensures donors have the necessary paperwork for tax deductions without delay.

Use clear, concise language in the receipt. Include the donor’s name, donation amount, and the date it was received. Specify if the donation was in cash, check, or another form, and note any goods or services exchanged. This transparency helps maintain trust.

Keep Records Organized

Ensure that all receipts are accurately logged in a database for easy retrieval. This not only helps with tax filing but also improves communication with donors in the future. When receipts are sent, include a reference number for both your team and the donor’s record-keeping.

Offer Digital Receipts

Provide electronic receipts for quicker access. Donors appreciate the convenience of receiving receipts via email or downloadable PDFs. These formats are eco-friendly and simplify tracking for both parties.