To properly track your daycare expenses for tax purposes, create a clear and accurate receipt for dependent care services. A well-organized template ensures you can easily submit claims or deductions without hassle. The receipt should include the caregiver’s name, address, and tax identification number, as well as the dates and amounts paid for services rendered.

Make sure to detail the total payments made during a specific period, such as weekly or monthly. This allows for straightforward record-keeping and minimizes any confusion when referencing past payments. Including a brief description of the services, such as hours of care or age range of the dependent, further clarifies the purpose of the payment.

Keep receipts in a safe place, as they will be needed if you are audited or required to verify expenses for child or dependent care tax credits. Using a template ensures consistency in your documentation and simplifies the process of filling out tax forms or claiming deductions related to dependent care costs.

Here’s the revised version:

Ensure the daycare receipt includes the provider’s name, address, and contact information. Add the name of the child and the dates of service to clarify the time frame of the care. Clearly state the amount paid and specify whether the payment was for a specific period, such as weekly or monthly. Include the signature of the daycare provider to authenticate the document. If applicable, provide a breakdown of services to reflect additional charges for special activities or extended hours.

Be consistent with formatting for easy readability. Avoid using unclear abbreviations or jargon. Make sure all amounts are listed in the correct format and match the payment made. This will help ensure the receipt is accurate and reliable for tax purposes or reimbursement requests.

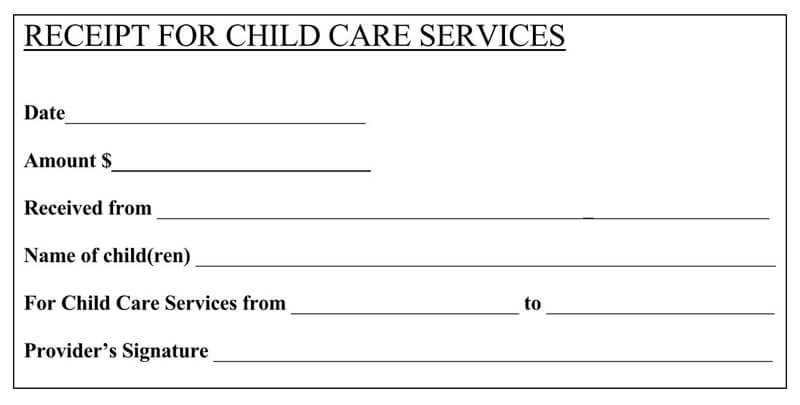

- Template for Daycare Receipt for Dependent Care

To create a daycare receipt for dependent care, include the following details to ensure it meets all necessary requirements:

- Provider’s Name and Contact Information: The daycare center or caregiver’s name, address, phone number, and email.

- Dependent’s Name: Full name of the child or dependent receiving care.

- Care Period: Clearly state the dates for which care was provided, e.g., “From January 1, 2025, to January 31, 2025.”

- Description of Services: Include a brief list of services provided, such as full-day care, after-school care, or any specific programs offered.

- Amount Paid: Specify the total payment made during the period, including any discounts or subsidies applied, if applicable.

- Payment Method: Indicate how the payment was made (e.g., cash, check, or credit card).

- Signature: The signature of the provider or authorized representative to verify the receipt.

Ensure that each receipt is clear and accurate, especially when it’s used for tax purposes or reimbursement. Double-check the dates, amounts, and services provided to avoid any confusion.

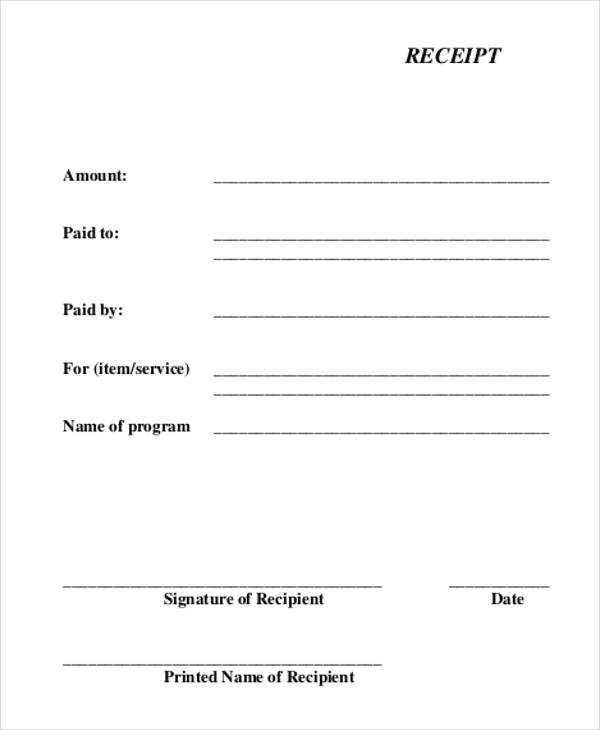

To create a receipt for dependent care tax purposes, include specific details that validate the expenses incurred. Ensure the receipt includes the following key information:

- Provider’s name, address, and phone number

- Taxpayer’s name and the name of the dependent(s) receiving care

- Dates of care provided

- Total amount paid for the care

- Signature or official statement from the care provider confirming the services rendered

Information to Include on the Receipt

The receipt should clearly indicate the services offered, whether it’s childcare, elder care, or similar dependent care. If possible, separate charges for care and any other services, such as meals or materials, to make it easier for the tax authorities to verify. Below is an example of a structured format:

| Item | Description |

|---|---|

| Provider’s Name | John Doe |

| Provider’s Address | 1234 Care Lane, City, State |

| Taxpayer’s Name | Jane Smith |

| Dependent’s Name | Tom Smith |

| Dates of Service | January 1, 2025 – January 31, 2025 |

| Total Amount Paid | $500.00 |

| Provider’s Signature | Signed by John Doe |

Key Considerations for Accuracy

When writing the receipt, be specific about the care period, services, and amounts. Ensure that it reflects the true nature of the care provided. Any discrepancy or vague descriptions may lead to complications during tax filing. Double-check that the receipt includes the name of the provider and taxpayer for easy identification, as well as a detailed description of services and costs to avoid future issues with deductions.

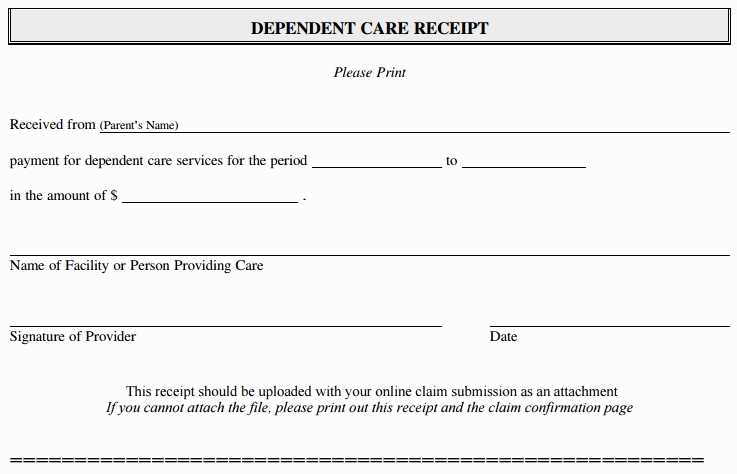

Ensure your dependent care receipt includes the name of the care provider, their address, and contact information. This will help verify the legitimacy of the service and provide a point of contact if needed.

Next, the receipt should clearly show the dates of service and the total amount paid. This is crucial for accurate reporting of expenses when claiming tax deductions or reimbursements.

Include a detailed description of the services provided. Whether it’s full-time daycare or after-school care, being specific about the type of care will ensure clarity for tax purposes.

If applicable, the provider’s taxpayer identification number (TIN) or employer identification number (EIN) should be listed. This is necessary for reporting and claiming dependent care expenses on tax forms.

Lastly, make sure the receipt is signed or stamped by the provider. A signature or official stamp adds authenticity to the receipt and helps avoid any confusion during tax filing or reimbursement requests.

Ensure the receipt includes the correct name and address of the care provider. Missing or incorrect details can lead to issues during tax filing or reimbursement requests. Double-check the provider’s information before issuing the receipt.

Clearly specify the dates and times of care provided. Vague or incomplete entries could cause confusion or delays in processing claims. Avoid general terms like “all month” or “varied hours,” and list the actual care periods instead.

State the exact amount paid for care. Some receipts may fail to break down costs by hours or services, which can create uncertainty for both the taxpayer and the care provider. Include a clear total along with itemized charges if applicable.

Don’t forget to include the taxpayer’s dependent’s name. If the dependent’s name is left off, it may be difficult to link the care services to the correct person, especially when filing for tax credits or other benefits.

Avoid omitting the care provider’s tax identification number (TIN) or Social Security Number (SSN). Without this information, the receipt may not meet the legal requirements for tax deductions or credits.

Check for accuracy in the care provider’s status. Make sure the provider is licensed and authorized to offer dependent care. Providing receipts for non-licensed providers can lead to complications and possible disqualification for dependent care benefits.

Use a folder system to keep your receipts categorized by type, such as daycare, medical, or travel expenses. This will make it easier to locate the necessary receipts when you need them for tax filing. Consider using digital tools like scanning apps to capture images of physical receipts, ensuring that no documentation is lost over time.

Set Clear Labels and Dates

Label each receipt clearly with the date of the expense and a brief description. This prevents confusion when sorting through them later. Group receipts by year and tax category for added clarity and easy access during filing. This practice will save time and effort, especially when organizing a large number of receipts.

Track Recurring Payments

If you have ongoing childcare expenses, set up a system to track monthly or weekly payments. This will ensure that you have a record for each payment, which is vital for tax deductions related to dependent care. Keeping this information updated in a spreadsheet can also help you calculate totals at tax time.

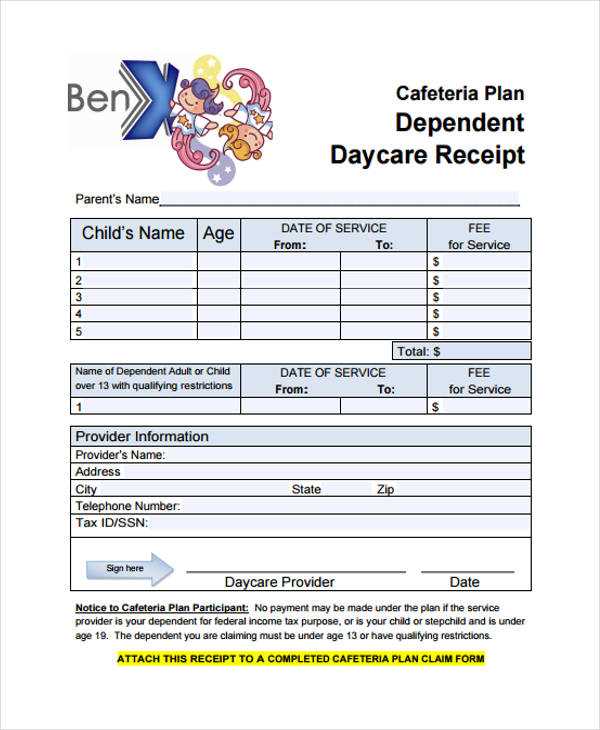

To make your daycare receipt template fit your requirements, focus on adding the necessary fields for clarity and accuracy. Begin by including the provider’s full name, address, and contact details. This ensures that the receipt is easily traceable to the daycare facility.

Next, customize the layout to clearly indicate the specific dates of service and corresponding fees. Include a section for the child’s name and age, along with the exact hours or days attended. This information is crucial for accurate record-keeping.

If your daycare charges for additional services, such as meals or special activities, ensure these are broken down separately on the receipt. This transparency helps you track all charges and may assist with reimbursement or tax deductions.

Include a field for payment method, whether it’s credit card, check, or cash. This offers a clear record of transactions. If necessary, add a line for any outstanding balances or credits, so both parties are aware of any remaining charges or adjustments.

Finally, tailor the receipt with a personalized thank you note or a reminder for upcoming payments or services. This small addition can enhance your experience and reinforce the professional relationship with your daycare provider.

Several reliable sources offer daycare receipt templates that are both easy to use and customizable. Websites like Template.net provide free and paid options, offering detailed formats for dependent care receipts. These templates are designed to meet legal requirements for tax purposes and are regularly updated to reflect any changes in regulations.

Popular Platforms for Templates

Another solid choice is Microsoft Office Templates, where users can download editable receipt formats directly into Word or Excel. These templates allow for fast customization and can be saved for future use. A simple search for “Daycare receipt” on these platforms will yield various options suitable for different needs.

Third-Party Websites

Third-party platforms such as Canva offer easy-to-design templates for those who need more visually appealing receipts. You can customize the design, adjust fields, and print them immediately. Other sites like Jotform let you create digital receipts that can be directly emailed to clients, which is perfect for paperless transactions.

When selecting a template, verify that it includes all required information like the daycare provider’s name, address, date, services provided, and the total amount paid, ensuring it meets tax reporting standards.

Daycare Receipt Template for Dependant Care

To create a daycare receipt for dependant care, it’s important to follow a clear and professional format that provides all necessary details for tax or reimbursement purposes. Here’s a simple guide to ensure all key elements are included in the document.

Key Elements to Include

- Date of Service: Specify the exact date or range of dates the care was provided.

- Caregiver’s Information: Include the name, address, and contact details of the daycare provider.

- Dependent’s Information: Provide the name of the child or dependent receiving care.

- Amount Paid: Clearly list the total amount paid for services, including any taxes if applicable.

- Payment Method: Note whether the payment was made by cash, check, or another method.

- Provider’s Signature: Ensure the daycare provider signs the receipt to confirm authenticity.

Best Practices for Clarity

Make sure the template is easy to read and free from unnecessary information. Organize the details logically and leave space for additional notes if needed. If you’re designing your own receipt, use clear fonts and a simple layout to keep the document professional.