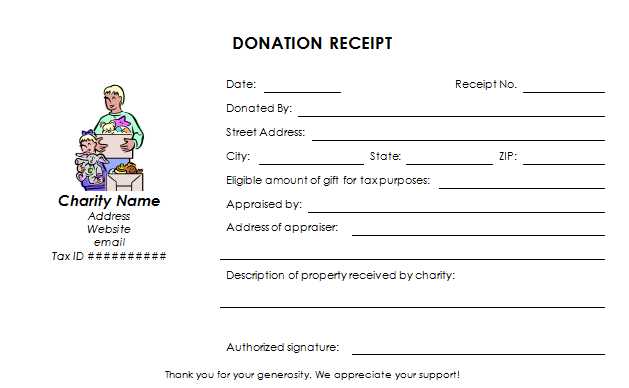

If you’re managing donations, providing donors with a clear, accurate tax receipt is a must. A well-crafted tax receipt not only helps donors claim tax deductions but also ensures your organization stays compliant with tax regulations. Below is a template that covers all necessary information and can be customized based on your specific needs.

Include the Date of the Donation – Make sure to list the exact date the donation was received. This is crucial for both your records and the donor’s tax filing.

List the Donor’s Information – Include the full name, address, and email (if available) of the donor. This ensures proper identification in case the receipt needs to be reviewed or referenced later.

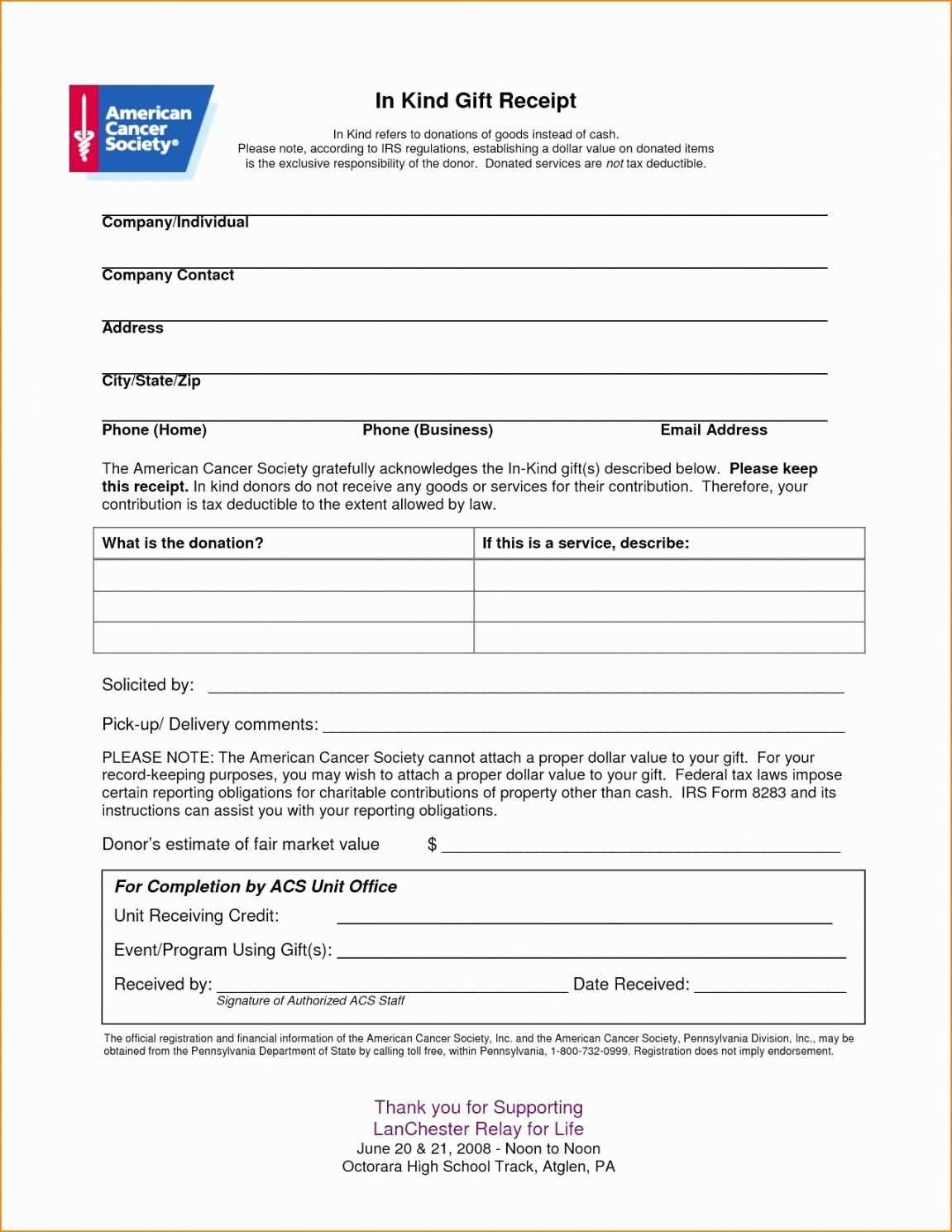

Detail the Donated Amount – Specify the value of the donation. If it’s cash, the amount should be clearly stated. If it’s in-kind (goods or services), a description and estimated value should be provided.

State the Organization’s Tax-Exempt Status – Mention your organization’s tax-exempt status and IRS identification number (if applicable). This confirms that the donation is eligible for a tax deduction.

Offer a Thank You Statement – Show appreciation for the donor’s generosity. A short thank you note adds a personal touch and strengthens your relationship with the donor.

Signature and Contact Information – Have an authorized person from your organization sign the receipt, and include contact details for any inquiries. This adds legitimacy to the document.

Here’s a version where word repetitions are reduced:

Ensure your tax receipt template is clear and concise. Limit redundant wording to avoid confusion. Use simple, direct phrases for clarity. For example, instead of repeating “donation received,” use “donation” followed by the amount and date.

Keep It Simple

Avoid repeating “thank you” or similar phrases multiple times. One clear statement of gratitude is enough. Focus on the key details: donor’s name, donation amount, and the date. This makes the receipt more professional and easier to read.

Use Consistent Terminology

Stick to standard terms like “donor” and “donation” without excessive variations. This keeps the document cohesive and minimizes unnecessary repetition. For example, instead of saying “the contribution made” and “the donation given,” choose one term and use it consistently throughout.

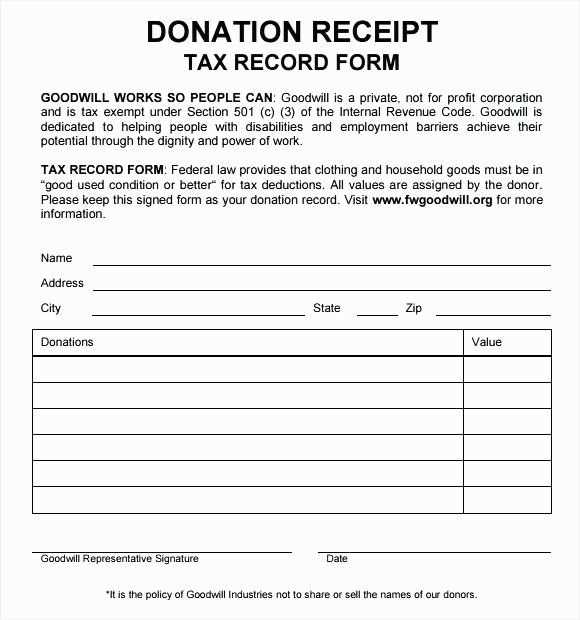

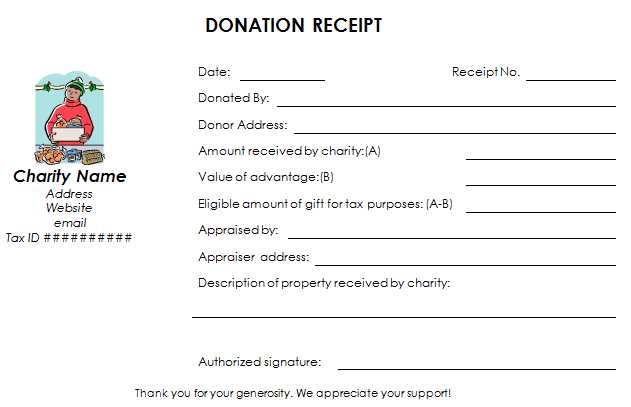

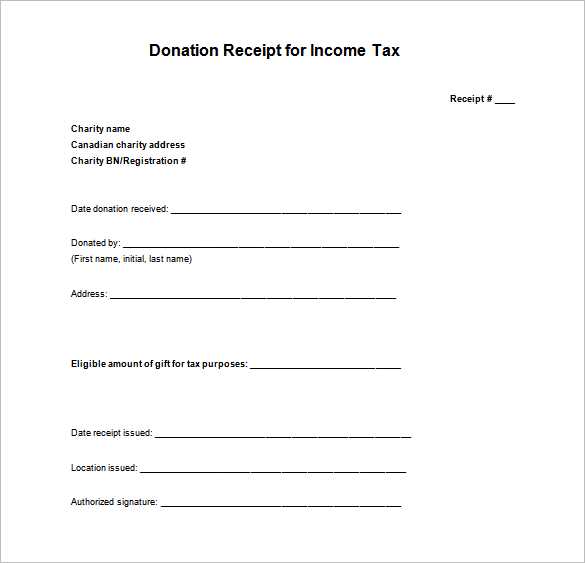

- Tax Receipt for Donation Template

Provide clear, concise, and accurate details in your tax receipt template. Include the donor’s full name, address, and the amount donated, along with the date of the donation. Specify whether the donation was cash, check, or other assets. If possible, note the fair market value for any non-cash donations, such as goods or property.

Key Information to Include:

- Donor’s name and contact information

- Organization’s name and IRS tax-exempt status (if applicable)

- Donation amount (for cash donations) or description and value (for non-cash donations)

- Date of donation

- Statement confirming no goods or services were provided in exchange (if applicable)

Ensure the language is clear, using phrases like “no goods or services were exchanged in return for this donation,” which confirms to the IRS guidelines for tax deductions. This helps avoid any ambiguity during tax filing.

Always check with a tax professional to verify you meet all legal requirements, especially if you deal with significant donations or complex items. A well-structured receipt simplifies the process for both the donor and the organization.

Include the donor’s full name, address, and contact details at the top of the receipt. This ensures accurate identification and allows for future reference if needed.

Clearly state the name and contact information of your organization, including the official tax-exempt status or registration number. This is crucial for the donor’s records and IRS submission.

Provide a brief description of the donated items or the monetary amount. For cash donations, state the exact amount given. For in-kind donations, list each item with a general description and the estimated value.

Include the date of the donation. This helps both the donor and the organization track the contribution within the correct tax year.

Include a statement confirming whether the donor received any goods or services in exchange for the donation. If so, specify the value of those goods or services. If no goods or services were received, state this clearly.

Provide a signature or authorized representative’s name and title. This adds authenticity and verifies the receipt’s legitimacy.

Ensure the receipt includes a statement that no goods or services were exchanged for donations over a certain threshold (typically $250 or more), if applicable. This aligns with IRS guidelines.

Always keep a copy of the tax receipt for your records. This will help maintain accurate records for both your organization and the donor.

A tax receipt for donations must contain certain details to ensure compliance and provide the donor with a valid record for tax deductions. Here are the key elements to include:

- Donor’s Information: The donor’s full name and address should be clearly stated. This helps ensure proper documentation for the tax authorities.

- Organization’s Information: Include the legal name of the charitable organization, its address, and tax identification number (TIN or EIN). This confirms the receipt comes from a legitimate entity.

- Date of the Donation: The exact date the donation was made must be listed. This is critical for verifying the donation year for tax filing purposes.

- Amount or Value of the Donation: Specify the monetary value of the cash donation or a description of non-cash donations (e.g., items, services). For non-cash gifts, a reasonable estimate of the fair market value is necessary.

- Statement of Non-Compensation: Include a statement that the donor received no goods or services in exchange for the donation, unless the donor received something with a value that should be deducted from the contribution.

- Signature of an Authorized Representative: An authorized individual from the organization should sign the receipt. This signature confirms the validity of the document.

- Receipt Number: A unique receipt number helps track and verify each transaction. This is especially helpful for the donor during tax filing.

By including these details, you ensure that the tax receipt is valid and serves its purpose for both the donor and the receiving organization.

Double-check donor information before issuing a receipt. A common mistake is providing inaccurate details, such as misspelling the donor’s name or listing incorrect addresses. This can lead to confusion during tax filing and create complications for the donor. Always verify that the name and contact details match your records before finalizing the receipt.

Include the proper donation description. Failing to provide clear information on what was donated can cause issues when donors try to claim tax deductions. Always specify the type of donation (e.g., cash, goods, services), the value (if applicable), and any relevant details about the contribution.

Provide the correct donation date. Issuing a receipt with an incorrect donation date can lead to misunderstandings and make it harder for the donor to claim deductions. Ensure the date reflects when the contribution was made, not when the receipt was issued or processed.

Avoid vague or ambiguous language. The receipt should clearly state that the donor did not receive any goods or services in exchange for the contribution, unless there were such exchanges. Any mention of a quid pro quo could disqualify the donor from receiving tax benefits. Stick to simple, precise wording.

Don’t forget the tax-exempt status of your organization. Including your nonprofit’s legal name and tax-exempt status is necessary. Failure to do so could result in confusion for the donor or even audit issues. Make sure you reference your 501(c)(3) status, and double-check that the number is accurate.

Double-check the donation amount. If the donor made a financial contribution, ensure that the receipt reflects the exact amount given. If the donation was non-monetary, provide a reasonable estimate of the value. Inaccurate or vague amounts could raise red flags with tax authorities.

Use this format to create a clear and simple tax receipt for donations. It’s essential that your template contains the necessary information for both the donor and the charity.

Key Information to Include

Each donation receipt should have the following details:

- Donor’s name and contact information.

- Donation amount or description of items donated.

- Date of donation.

- Charity’s name, address, and tax-exempt status number.

- Statement confirming whether the donor received any goods or services in exchange.

Donation Receipt Example

| Field | Details |

|---|---|

| Donor Name | John Doe |

| Donation Amount | $500 |

| Donation Date | February 12, 2025 |

| Charity Name | ABC Charity |

| Tax-Exempt Number | 123-456789 |

| Goods/Services Received | No goods or services received |