If you’re handling cash transactions, a cash receipt template can make the process smoother and more organized. A reliable template helps both the payer and receiver keep track of transactions and avoid any potential misunderstandings. With the UK tax system in mind, it’s important to include all relevant details, ensuring the receipt is clear and legally sound.

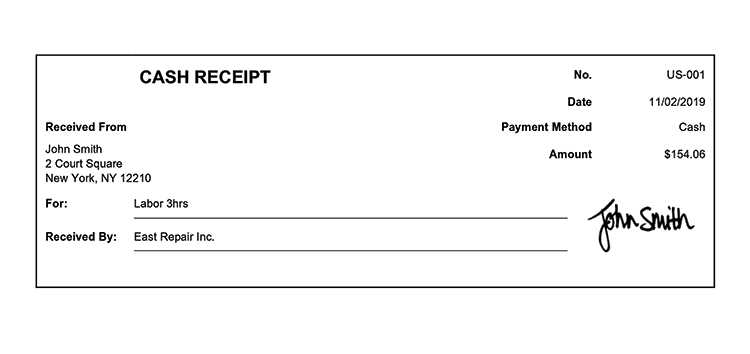

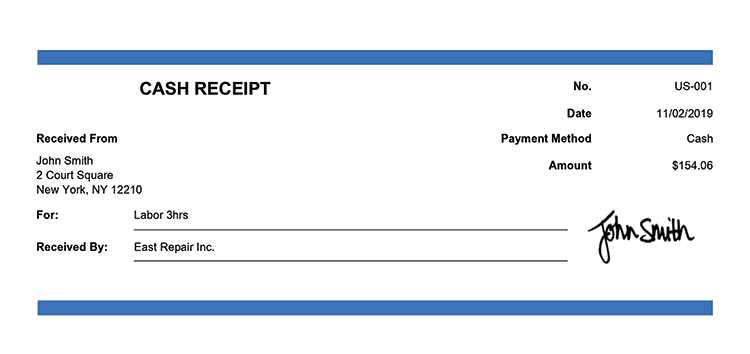

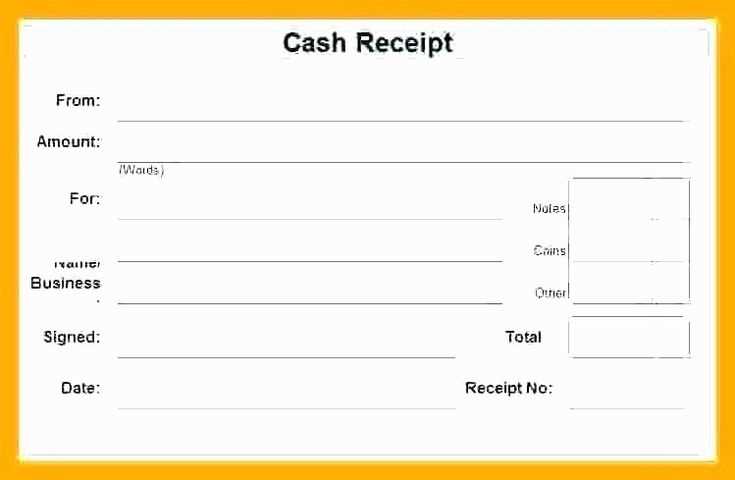

Start by including the date of the transaction. This is essential for record-keeping and aligning with accounting practices. Then, note the amount received in both numerical and written form to avoid discrepancies. Make sure the payment method is specified, whether it’s cash, cheque, or another form of payment.

Additionally, don’t forget to include a brief description of goods or services provided, along with any applicable taxes or discounts. This is particularly useful if you need to verify the transaction later or for future reference. Finally, the name and signature of the person issuing the receipt adds authenticity and accountability to the document.

Here are the corrected lines:

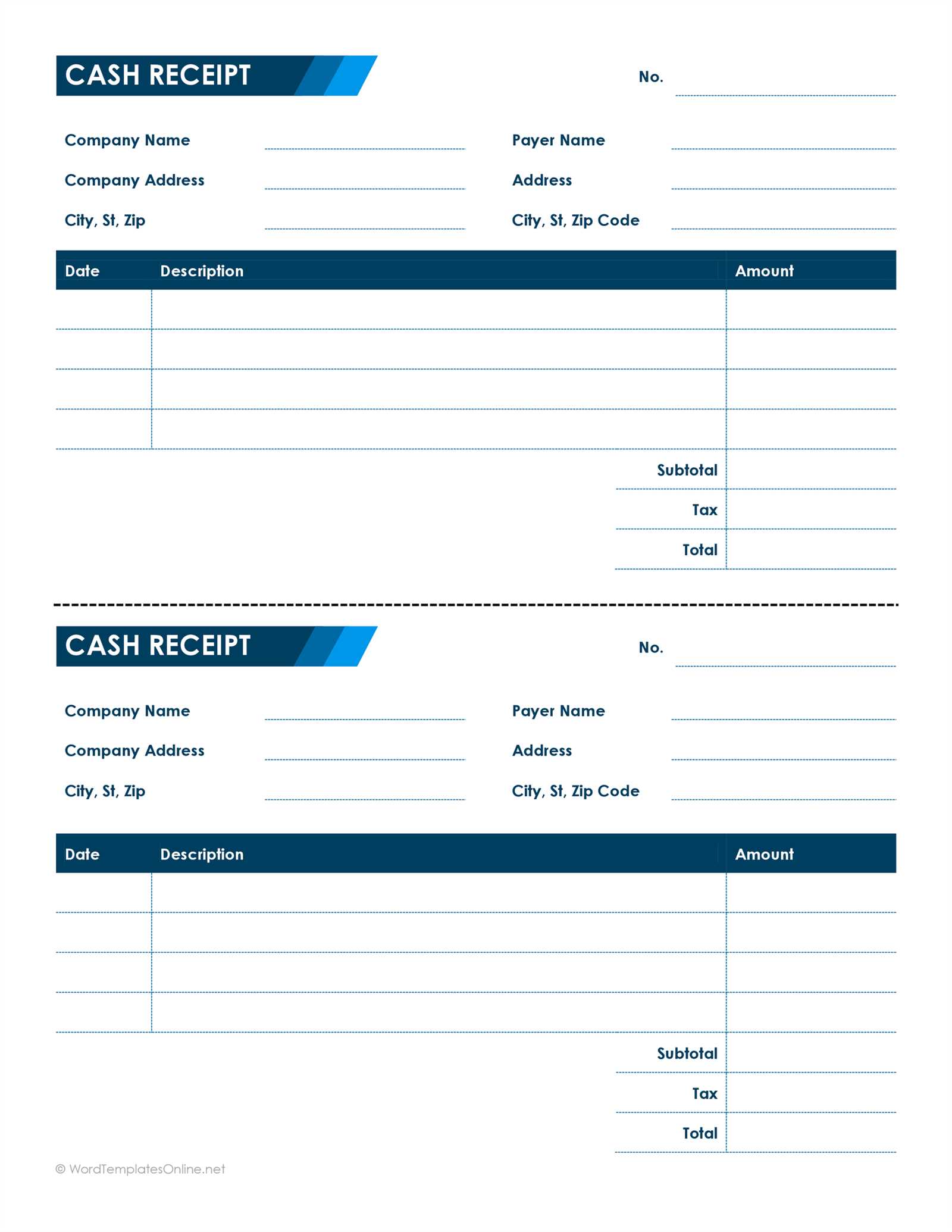

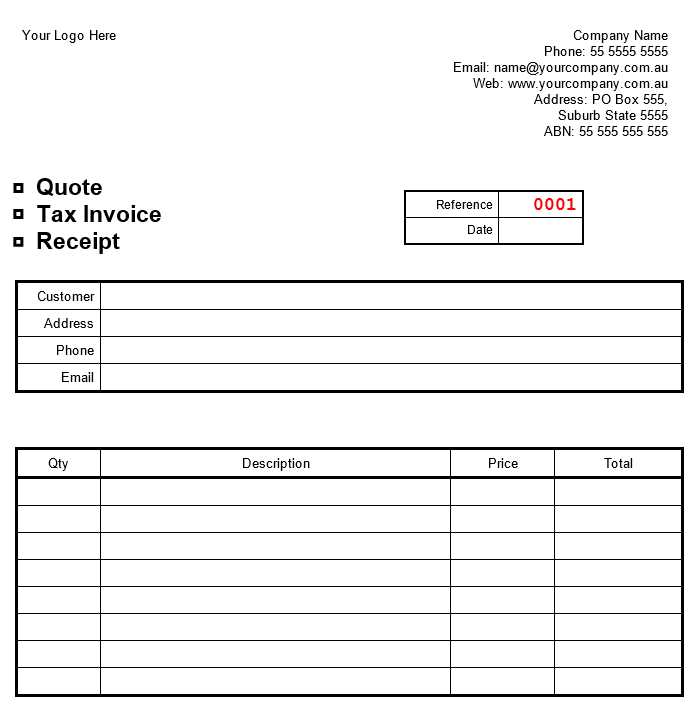

Ensure the template includes clear headings for each section, such as “Receipt Number,” “Date,” and “Amount Paid.” This helps keep all information organized and easy to locate.

Receipt Number Format

The receipt number should be unique and sequential. This can be generated automatically by your system to prevent duplication.

Amount Paid

Always indicate the exact amount paid in both numerical and written forms. This ensures clarity and reduces any chance of confusion.

- Amount in numbers: £50.00

- Amount in words: Fifty pounds only

Additional Information

Include a clear breakdown of the items or services provided, along with individual prices if necessary. This gives the recipient a full view of what they are paying for.

- Cash Receipt Template UK: A Practical Guide

When creating a cash receipt, clarity and accuracy are key. Start by including details like the date of the transaction, the name of the payer, and the purpose of the payment. These elements form the foundation of a well-structured receipt.

Key Components of a Cash Receipt

Include the following key details on your template:

- Receipt Number: Assign a unique number for easy tracking.

- Payer’s Details: Full name and contact information of the person or entity making the payment.

- Amount: Clearly state the amount paid, both in numbers and words.

- Payment Method: Specify if the payment was made in cash, cheque, or other methods.

- Transaction Purpose: Describe the reason for the payment, such as a service or product.

- Signature: Both the payer and the recipient should sign for verification.

Formatting Tips

Ensure the receipt has a clean layout. Use bold headings to highlight sections like payer’s information and payment method. The font should be legible, and there should be enough space between sections for clarity. Keep the design simple to maintain professionalism.

A cash receipt template helps ensure both parties have a record of the transaction. Customize it as needed to fit your specific business requirements.

Design your receipt template with clarity and functionality. Start with the most relevant information: the business name, address, contact details, and tax identification number. This ensures your receipt is legally compliant and provides customers with the information they may need for reference or refunds.

Include Transaction Details

List the items or services purchased, along with the price for each. Include any taxes applied and the total amount due. Ensure each line is clear and easy to read, making it simple for customers to verify what they’ve paid for.

Payment Information and Date

Indicate the payment method–whether it’s cash, credit, or debit–and include the transaction date. This helps track sales and provides an accurate record of the payment for both your business and the customer.

When issuing cash receipts in the UK, businesses must adhere to specific legal guidelines to ensure compliance with tax and accounting regulations. Receipts should clearly outline the transaction details, including the date of payment, amount received, and the names of both the payer and the recipient. This provides clarity in case of future disputes or audits.

The receipt must also include a reference to the nature of the goods or services provided, making it clear what the payment corresponds to. For VAT-registered businesses, the receipt must detail the VAT amount charged, as well as the VAT registration number. This is critical for businesses to correctly report VAT to HMRC.

Another key requirement is that receipts must be kept for a minimum period of six years, as per HMRC’s record-keeping guidelines. This helps businesses stay prepared for any tax inspection or financial review.

Employers issuing cash payments to employees should also ensure that appropriate deductions for National Insurance and income tax are reflected on the receipt, in line with PAYE (Pay As You Earn) obligations. Failure to include these details could result in fines or penalties.

Finally, digital receipts are acceptable as long as they meet the same criteria as paper receipts. Businesses using electronic systems must ensure that their digital records are secure, accurate, and readily accessible for review by relevant authorities.

Adjust the layout and fields to suit the specific nature of each transaction. For instance, when recording a sale, add a section for item details, including quantity, unit price, and total amount. For service-related transactions, include a breakdown of services rendered, hourly rates, and any applicable taxes.

If the transaction involves a deposit or payment, ensure there’s space to note the method of payment, such as cash, cheque, or bank transfer. For refunds or adjustments, a section for the original transaction reference number helps maintain clear records.

Custom fields allow you to add additional details like discounts or promotional codes. It’s useful to include an area for signatures or approval stamps, especially for transactions that require verification.

For repeat transactions, create templates that save time by pre-filling customer information or standard charges. This can reduce errors and speed up the process while keeping the documentation tailored to each scenario.

Ensure your receipt template includes a clear breakdown of each item or service, alongside its cost. List the total amount payable at the bottom, followed by any tax or discount details. Indicate the method of payment, such as cash, card, or bank transfer. Don’t forget to include the date and a unique receipt number for reference. This allows both parties to track the transaction effectively.

Always confirm that both parties sign and retain a copy of the receipt for future reference. This helps maintain transparency and can be useful in case of disputes. If needed, include a section for contact information or notes for additional clarity.

For businesses, it’s recommended to use a receipt template that complies with local tax laws and business regulations. Include your business name, address, and VAT number if applicable, ensuring you’re prepared for audits or accounting reviews.