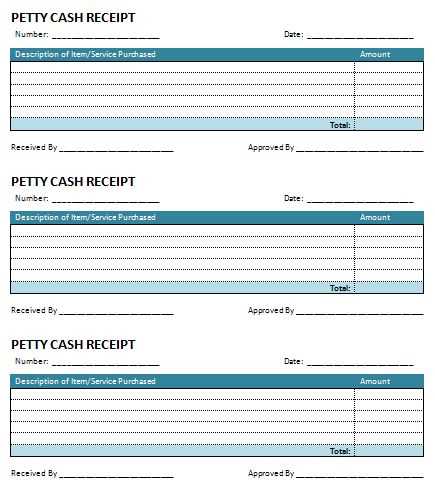

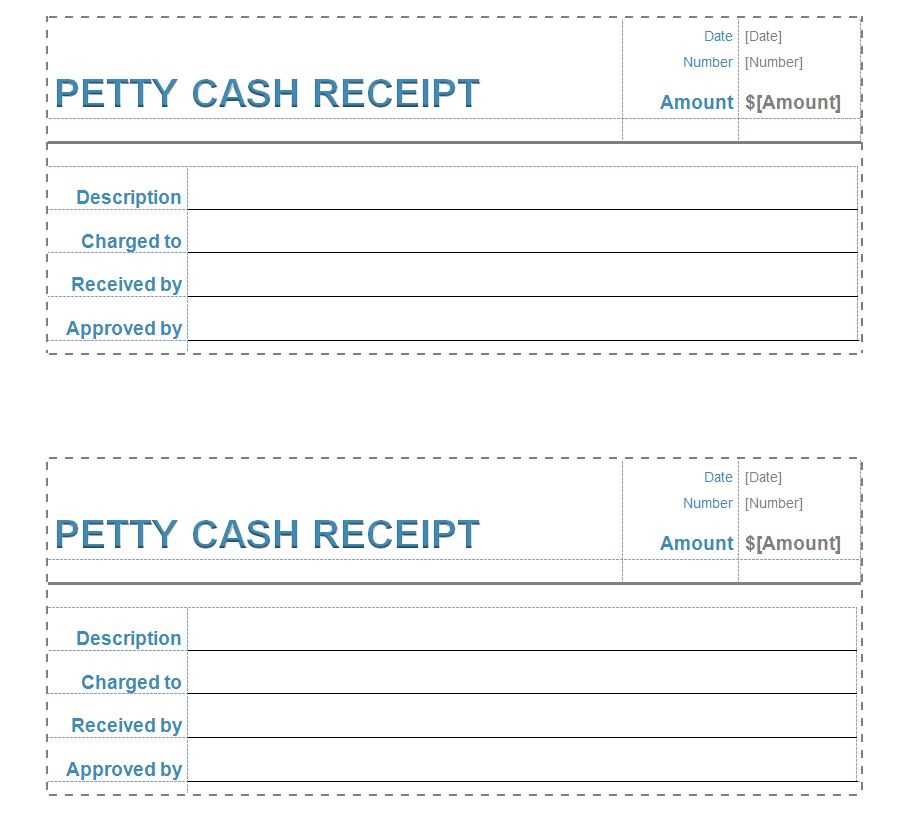

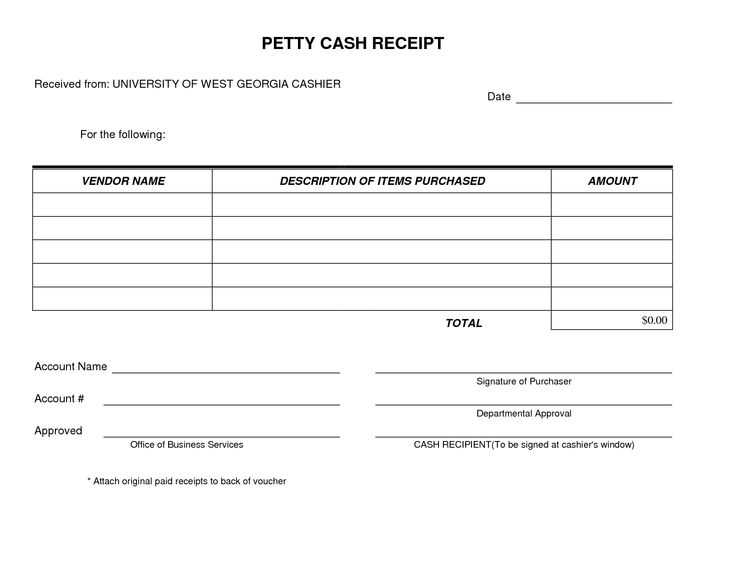

Use a petty cash receipt template to streamline your small cash transactions. It helps track each expense clearly, making record-keeping easier for your team or business.

Ensure the template includes details like the amount, date, purpose of the expense, and the individual responsible. This setup reduces confusion and enhances accountability.

Additionally, keep receipts organized and update them regularly. A well-maintained petty cash system prevents discrepancies and promotes financial transparency.

Here are the corrected lines:

Ensure that every petty cash receipt includes the date of the transaction. This provides clarity on when the funds were used.

Clearly specify the purpose of the cash expenditure. Avoid vague descriptions and make sure the reason for the transaction is understandable for future reference.

Include the amount of cash dispensed in a separate column. This will prevent confusion and maintain an accurate record of expenditures.

Use consistent formatting for entries, particularly when listing vendors or recipients of the petty cash. This helps maintain organization and avoid discrepancies.

Ensure each line has a signature or approval from an authorized individual. This serves as confirmation that the transaction has been reviewed and authorized.

| Date | Purpose | Amount | Authorized By |

|---|---|---|---|

| 2025-02-13 | Office Supplies | $45.00 | John Doe |

| 2025-02-14 | Event Catering | $120.00 | Jane Smith |

Always double-check for accuracy before finalizing the receipt. Small errors can lead to confusion during audits.

- Petty Cash Receipt Template

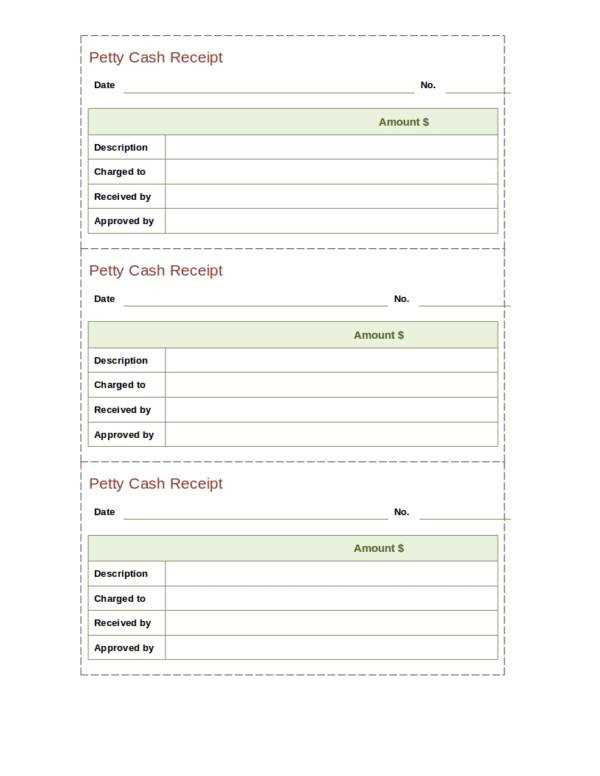

For accurate record-keeping and transparency, use a simple petty cash receipt template. The template should include the date, amount received, purpose of the transaction, and the person who received the funds. This ensures clarity and reduces confusion during audits.

Key Sections in the Template

Start by adding a section for the receipt number. This number should be unique for each transaction and will help to organize records. Next, include the name of the person receiving the funds and the department or project related to the transaction. Specify the reason for the disbursement clearly–whether it’s for office supplies, travel, or other expenses. A field for the total amount dispensed ensures you have a clear monetary record.

Additional Tips

Ensure that the template includes a signature section for both the person authorizing the payment and the person receiving the funds. This adds accountability and helps in tracking any discrepancies. Regularly update your petty cash log with these receipts to maintain an accurate overview of your petty cash balance.

Design your petty cash receipt template by focusing on clarity and simplicity. Begin with a clear title such as “Petty Cash Receipt” at the top. Ensure the template includes the following essential details:

Key Elements to Include

Receipt Number: Assign a unique identification number to each receipt for easy tracking. This will help in record-keeping and auditing.

Date: Always include the date of the transaction to document the exact day the petty cash was spent or received.

Payee Information: Record the name or designation of the person receiving the petty cash. Include a brief description of their role or reason for receiving the funds.

Amount Disbursed: Clearly state the exact amount of money disbursed. Use numeric and written formats (e.g., $50, fifty dollars) to avoid confusion.

Purpose: Specify the purpose of the petty cash transaction. Whether it’s for office supplies or travel expenses, a concise explanation helps clarify the expenditure.

Additional Details

Authorized Signatures: Include spaces for signatures from both the person authorizing the petty cash and the person receiving it. This provides accountability and approval for the transaction.

Remaining Balance: If applicable, list the remaining petty cash balance after the transaction. This allows you to track the cash flow and ensures the fund is properly managed.

After setting up these fields, format the template neatly. Ensure the text is legible, and use a simple layout. A clean design makes it easier to maintain records over time.

To create a receipt that fits different petty cash transactions, adjust the template to reflect the specifics of each case. This ensures clarity and accuracy, and makes record-keeping more straightforward.

Include Relevant Transaction Details

For each type of petty cash expense, ensure you include the following details:

- Date – Specify the exact date of the transaction.

- Amount – Clearly state the amount of money involved in the transaction.

- Description – Provide a brief description of what the money was spent on, such as office supplies or transportation.

- Recipient – Name the person or entity receiving the cash.

- Payment Method – Indicate if it was paid in cash, via cheque, or any other method.

Differentiate Between Recurrent and One-time Expenses

When dealing with recurrent petty cash transactions (like monthly supplies), clearly distinguish these from one-time purchases. You can use a specific tag or note that indicates whether the expense is part of a regular budget or a one-off expenditure. This way, it’s easier to track ongoing versus exceptional costs.

- Recurrent expenses: Label as “Recurring” or similar.

- One-time expenses: Include a note like “One-time purchase” for better differentiation.

Customizing your receipts for various transactions helps keep everything organized, allowing you to easily track expenditures, especially when they vary in frequency or purpose.

To maintain accurate cash receipts, it’s crucial to record every transaction promptly and without error. Use a standardized template that includes specific fields such as the amount received, the date, and the payer’s details. This structure ensures consistency and reduces the risk of mistakes. Keep a clear and detailed record of all payments, ensuring all receipts are signed and dated by both the payer and the receiver.

Documenting Payment Methods

Clearly distinguish between cash, checks, and digital payments on the receipt. This helps avoid confusion when reconciling the books. If the payment involves a check or digital transfer, ensure the payment reference number is included on the receipt for easy tracking.

Regular Audits

Perform regular audits to ensure all records match the actual cash flow. Discrepancies should be investigated immediately. Keeping a record of audits helps prevent fraud and ensures compliance with internal financial policies.

For tracking petty cash expenditures, ensure the receipt template includes key elements like the date, amount, and description of the expense. Keep it concise and clear for quick reference.

Receipt Format

Start with a section for the recipient’s name and the amount paid. List the payment method, whether cash or another form, and note the purpose of the transaction. Clearly separate each expense with corresponding amounts and provide space for signatures.

Additional Information

Include a section for account codes if necessary, to match the expenses to specific budgets or categories. This streamlines accounting and helps prevent errors when reconciling the cash fund.