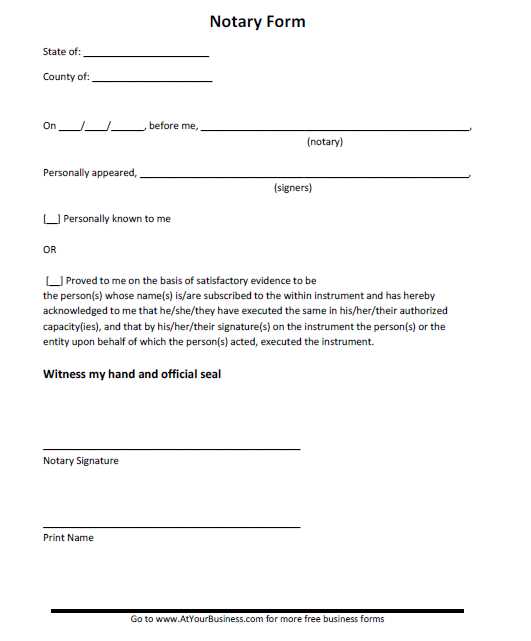

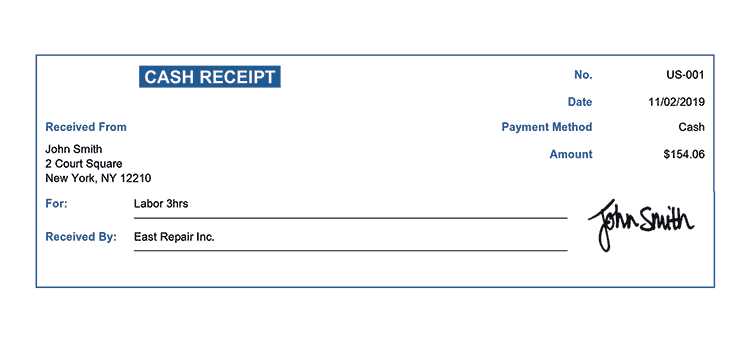

To create a notary public receipt, focus on clarity and accuracy. The template should include the notary’s full name, office address, and contact information. Specify the type of service provided, such as document notarization or oath administration, along with the date and time of the service.

List the details of the document notarized, including the title, number of pages, and the names of parties involved. Clearly state the fee charged for the service. Make sure to add a statement confirming the notary’s credentials and any applicable registration or commission details.

Finally, include a space for the notary’s signature and seal. This ensures the receipt is official and legally binding. Keep the layout straightforward, allowing the recipient to easily read and verify the information.

Here’s the adjusted version with reduced repetition of words:

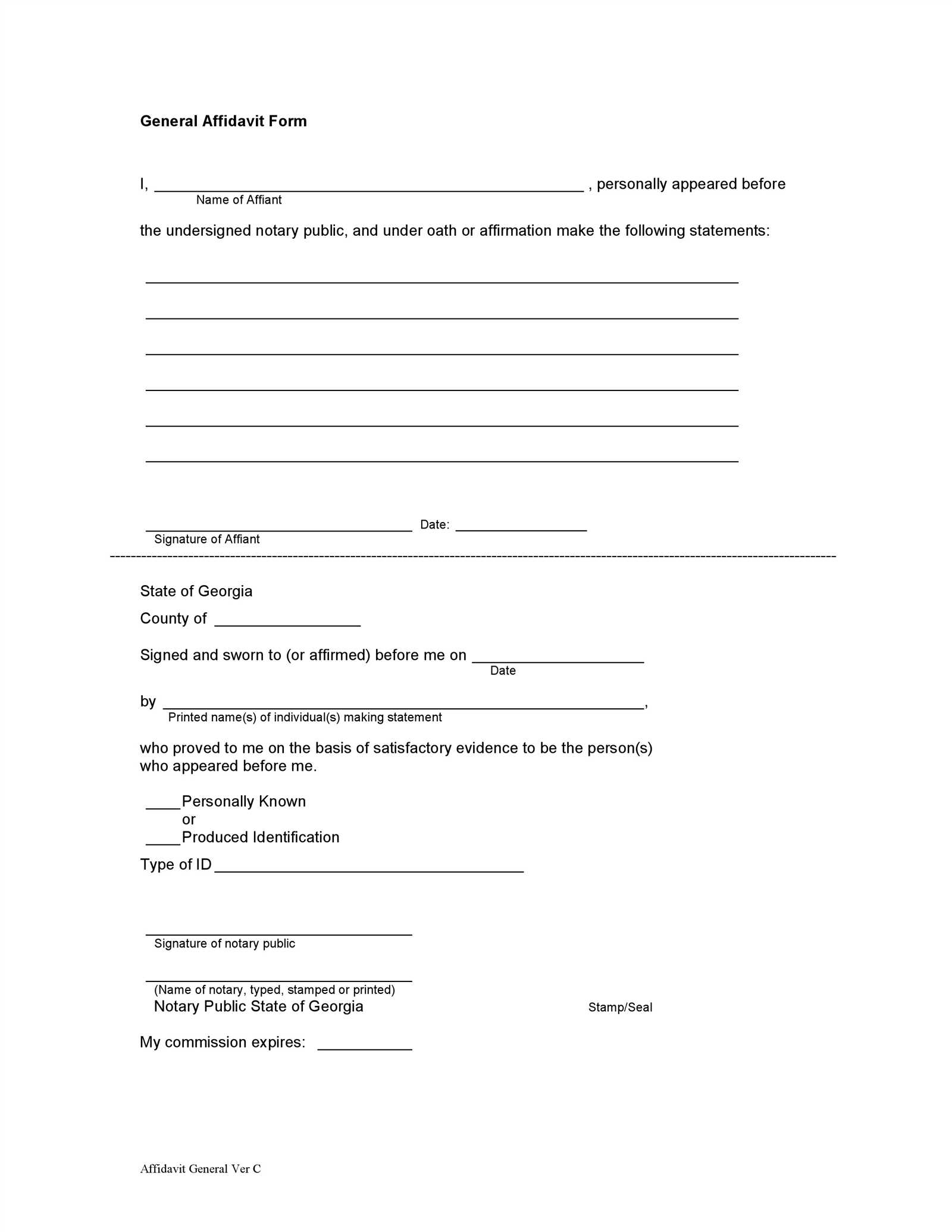

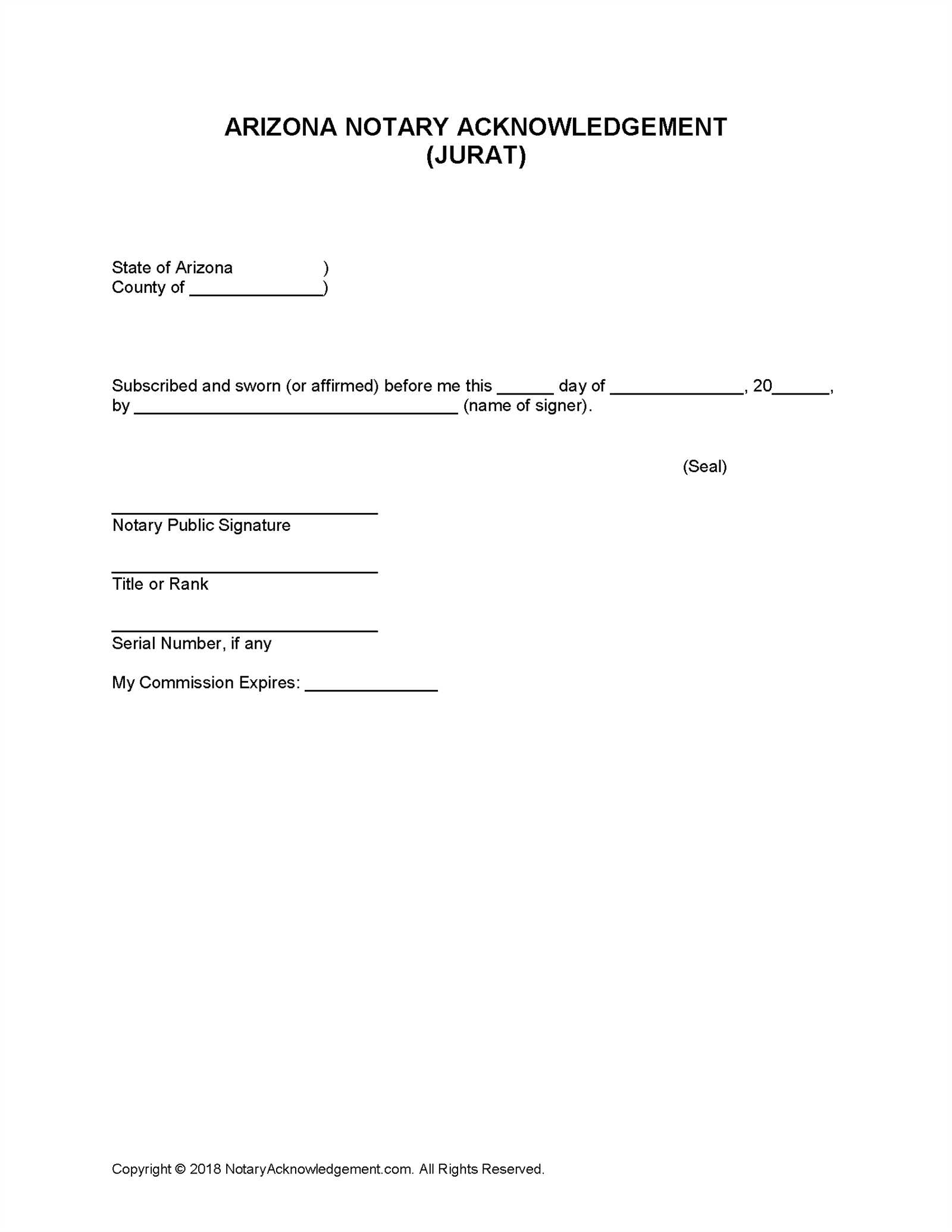

When drafting a notary public receipt, include clear, concise details such as the date, the names of the parties involved, and a description of the notarized document. Specify the notary’s credentials, location, and the notary’s signature. Ensure the receipt format adheres to your state’s regulations for notarization records. Double-check that all fields are filled in and correct to avoid legal issues.

Tip: Keep the language simple and direct. Avoid redundancy by confirming that each section of the receipt contains only necessary information. This not only makes the document easier to read but also complies with legal requirements.

Example: A properly structured receipt might include:

1. Date of notarization

2. Names of parties

3. Notary’s commission details

4. Description of the document

5. Notary’s signature and seal

By following these guidelines, you ensure that your notary receipt is both accurate and legally valid.

Notary Public Receipt Template

Key Components of a Notary Receipt

How to Customize a Notary Receipt Template

Legal Requirements for Notary Receipts

Common Mistakes in Notary Receipts and How to Avoid Them

How to Format a Notary Receipt for Different Jurisdictions

How to Store and Manage Notary Receipts

A notary receipt should clearly document the services provided and comply with local legal regulations. Ensure the template includes the notary’s name, contact information, the type of service performed, the date, the fee charged, and a unique identification number if applicable. All fields must be accurate and legible to avoid confusion or legal issues.

Key Components of a Notary Receipt

The notary receipt must include several key elements:

1. Notary’s details: Full name, contact information, and notary commission number.

2. Service provided: Specify the type of notarization, such as acknowledgment, jurat, or oath administration.

3. Date of service: Clearly state the date the notarial act was performed.

4. Fee charged: Include the exact amount charged for the service.

5. Signatures: Both the notary’s and the client’s signatures may be required depending on jurisdiction.

6. Receipt number: For tracking and organizational purposes, assign a unique identification number to each receipt.

How to Customize a Notary Receipt Template

To customize a template, replace generic placeholders with relevant details specific to your practice or jurisdiction. Adjust the format to suit your style, but ensure all required information is present. For example, include your state’s notary number and adjust the fee section to match local regulations. Customizing allows for consistency while ensuring compliance with different legal requirements.

Notary receipts should meet the legal standards of the jurisdiction where the notary practices. Review your state or country’s laws to confirm the receipt template aligns with required practices, such as notarization requirements and maximum fee limits.

Common mistakes to avoid include:

1. Omitting necessary information: Missing details like the notary commission number or incorrect dates can invalidate the receipt.

2. Inaccurate fees: Always cross-check the applicable fees before charging.

3. Unreadable handwriting: If the receipt is handwritten, ensure that the text is legible to prevent confusion.

Ensure proper formatting to suit different jurisdictions. Some states or countries may require specific wording or additional information. Always review local guidelines to avoid potential legal complications.

Finally, store notary receipts securely in either physical or digital form. A well-organized filing system will make it easier to manage receipts and retrieve them when needed for audits or legal purposes. Ensure digital records are backed up and protected with encryption.