Creating a chiropractor receipt template requires focusing on clarity and accuracy. This document needs to outline the services provided, the total cost, and any relevant insurance details. Keeping these elements organized helps both the chiropractor and the client. A well-structured receipt promotes trust and makes record-keeping easier.

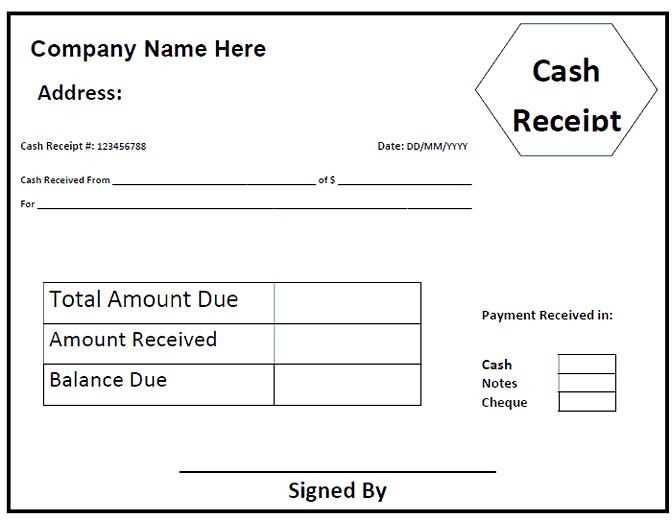

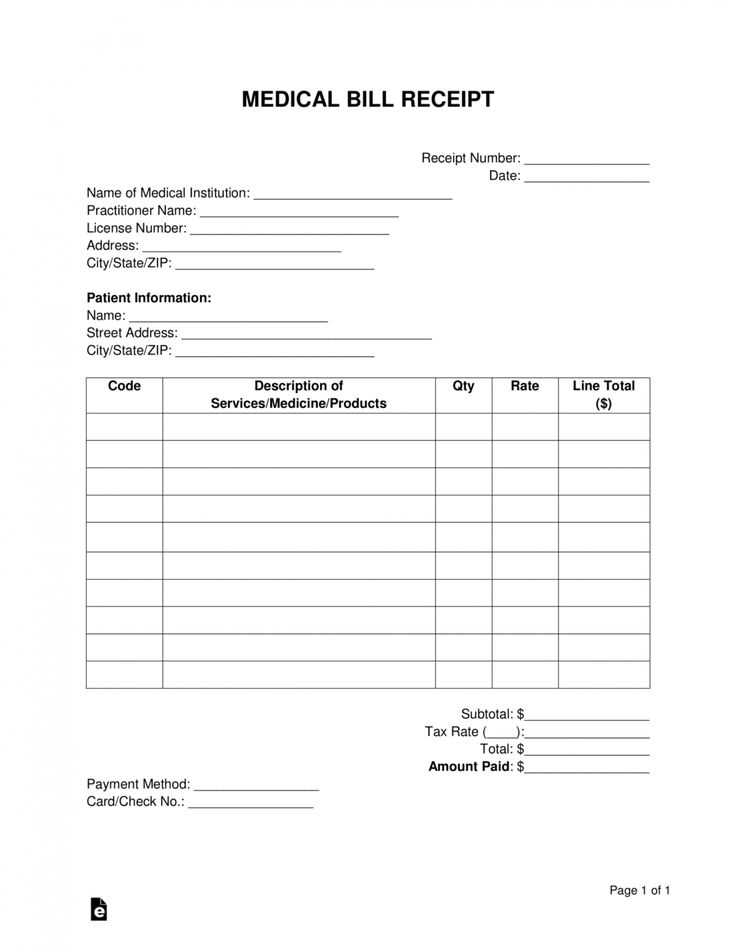

Start with including the chiropractor’s name, address, and contact information at the top of the receipt. This is crucial for identification and for any future communication. Below this, list the services provided during the visit, such as spinal adjustments, physical therapy, or consultations. Each service should be paired with the corresponding cost.

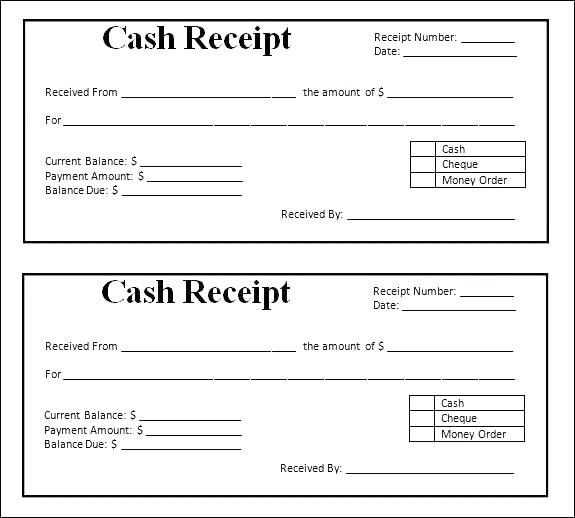

Next, include payment details, including the total amount due, any deposits paid, and the balance, if applicable. If the client is paying through insurance, include the necessary claim information and the amount covered by the insurer. Be sure to clearly distinguish between out-of-pocket expenses and insurance-covered amounts.

A final step is to add a section for the chiropractor’s signature or any necessary authorization, confirming that the services were rendered as described. This template should be versatile enough to accommodate various payment methods, including cash, card, or checks, while remaining simple to fill out and print.

Here is the corrected version:

For chiropractors, creating clear and professional receipts is a key part of maintaining organized records. A well-designed template should include specific details, such as patient information, services provided, pricing, and payment methods. Below is an example of how to structure your receipt template effectively:

Required Information for a Chiropractor Receipt

Ensure that each receipt contains the following data:

- Patient’s full name and contact details

- Detailed description of the treatment or service

- Fees for each service or treatment performed

- Total amount due and any applicable taxes

- Payment method used (cash, credit, etc.)

- Provider’s name, contact information, and licensing number

- Date of service

Sample Chiropractor Receipt Template

| Field | Details |

|---|---|

| Patient Name | John Doe |

| Service Provided | Spinal Adjustment |

| Service Fee | $75.00 |

| Tax (5%) | $3.75 |

| Total | $78.75 |

| Payment Method | Credit Card |

| Provider Name | Dr. Jane Smith |

| License Number | 1234567 |

| Date of Service | February 13, 2025 |

By using this format, you will ensure that both you and your patients have all necessary information for reference and tax purposes. Consistency in your receipt templates will also enhance professionalism and improve patient trust.

- Chiropractor Receipt Template Guide

For a clear and concise chiropractor receipt, ensure the following elements are included:

- Patient Information: Include the patient’s full name, address, and contact details for reference.

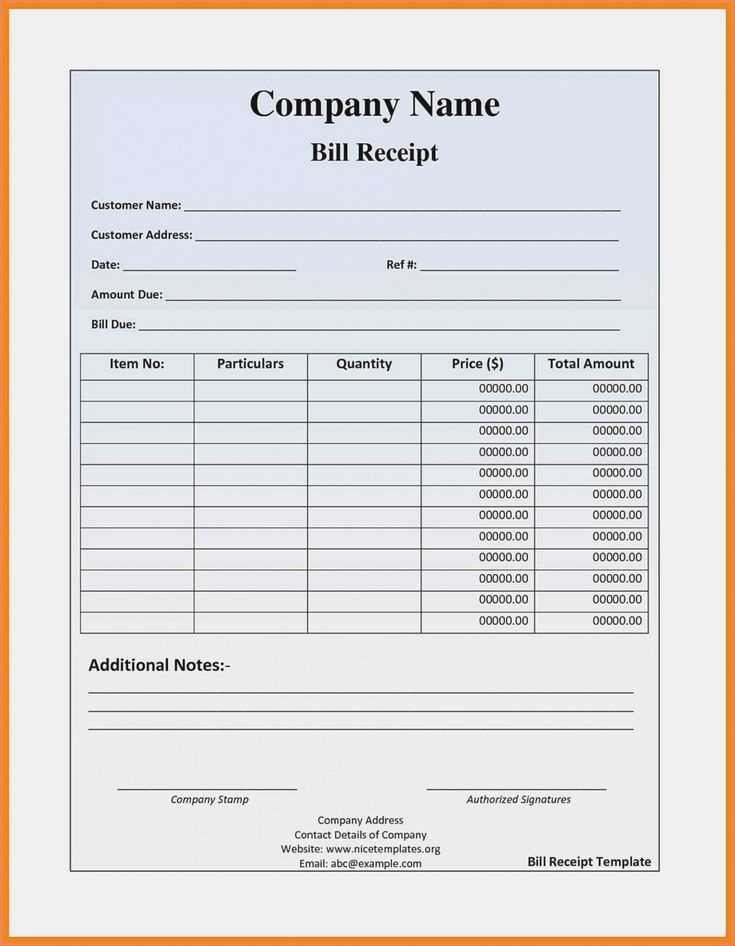

- Service Details: Clearly list the services provided, such as consultations, adjustments, or therapy sessions. Specify the duration and any relevant codes if applicable.

- Date and Time: Record the exact date and time of the service. This is crucial for insurance claims or record-keeping purposes.

- Fees: Break down the cost for each service performed. Avoid vague descriptions; be specific on pricing per service or session.

- Payment Method: Specify how the payment was made (cash, credit card, insurance, etc.), along with any transaction or invoice number for verification.

Template Example

Here is a simple structure for a chiropractor receipt template:

- Header: Include your practice name, address, and contact information at the top.

- Patient Information Section: List patient details, including their name and date of birth.

- Service Details Section: Itemize services with clear descriptions, quantity, and cost per session.

- Subtotal: Display the subtotal of all services rendered.

- Payment Section: Note payment type and any insurance adjustments.

- Signature: A space for both the practitioner and patient to sign, confirming the services and payment.

Additional Tips

- Use clear and readable fonts to ensure all details are easily legible.

- Consider including a “Thank you for your visit” message or a reminder for follow-up care.

Tailor the receipt template to fit your practice’s specific requirements. Include clear patient identification fields such as name, contact details, and insurance information. This ensures that all essential details are provided right from the start.

Adapt the service description section to reflect the type of treatments you provide. Use simple terms that patients can easily understand, specifying the techniques or therapies applied during the visit. This helps avoid confusion, especially with complex procedures.

Incorporate space for notes on the treatment plan. Patients may appreciate having reminders of the session’s focus, as it adds a personal touch and reinforces the value of the service. It’s also helpful for patients who need to submit receipts for reimbursement purposes.

Consider adding a section for payment breakdown, especially if your practice works with various payment methods or plans. Display the total amount due, any discounts applied, insurance coverage, and patient responsibilities. This transparency prevents misunderstandings.

Ensure that your receipt template includes your contact information, clinic address, and relevant licenses. This is particularly important for legal and insurance purposes, providing all necessary details in case of inquiries or audits.

Allow for easy customization in future adjustments. If you add new services or change pricing, it’s important that the template can be quickly updated without needing to redesign the whole document.

Receipts in the United States must comply with specific legal requirements to ensure they are valid for tax and business purposes. The main elements that should appear on a receipt include the date of the transaction, a description of the goods or services provided, the total amount paid, and the method of payment used. These details help both the customer and business keep accurate records for tax filings and potential disputes.

Basic Information to Include

Each receipt should clearly show the name and contact information of the business, including the address, phone number, and sometimes the tax identification number (TIN). If applicable, a state sales tax number should also be displayed. Businesses that sell taxable goods or services must itemize the sales tax separately on the receipt.

Record Keeping Requirements

Under IRS guidelines, businesses are required to maintain records of all sales transactions. This includes storing receipts for at least three years, in case of an audit. Customers should receive an itemized list showing each charge, allowing them to verify the details and ensure they have been charged correctly.

Begin with clear, detailed entries that match each service provided during the chiropractic visit. Ensure that each receipt includes the patient’s name, date of service, and specific treatment details such as adjustments or consultations. This transparency helps avoid confusion later.

Group charges logically. For instance, list each type of service separately–adjustments, therapies, or consultations–alongside the associated costs. This approach simplifies tracking for both the clinic and the patient.

Use standardized formats for listing treatment codes. Whether using ICD-10, CPT, or custom internal codes, consistency reduces errors and aids in faster processing by insurance or for tax purposes.

Include payment method details for easy reference. Whether the patient pays via card, insurance, or a third-party service, always note this clearly on the receipt. It helps clarify any discrepancies or issues with payments down the road.

Ensure all relevant legal and policy disclaimers are visible on receipts. Include information about cancellation policies, any applicable refund terms, or limits on insurance coverage. Clear communication here reduces misunderstandings.

Regularly review the format of your receipts to ensure compliance with local regulations. Make any necessary adjustments based on changes in healthcare laws or billing practices to keep your records up-to-date.

Chiropractic receipt templates should clearly display patient and provider information, including contact details, treatment dates, and the services rendered. Make sure the template has a space for both the chiropractor’s signature and the patient’s acknowledgment. It is vital to list the cost of each service and any discounts or insurance information if applicable.

Key Details to Include

For an accurate and functional chiropractic receipt, include the patient’s full name, treatment date, and a breakdown of services. Specify the amount charged for each treatment session, and if applicable, list the type of payment made (e.g., insurance, cash, credit card). Ensure the chiropractor’s business details are clear, including name, contact info, and license number if required by local regulations.

Formatting Tips

The receipt should be easy to read, with distinct sections for each type of information. Use a clean, professional layout and avoid clutter. Group similar details together, such as personal information, treatment data, and payment summary. Make sure all financial details are visible and legible to prevent confusion.