When managing real estate transactions, having a clear and professional bill receipt template is key to maintaining organized records. Whether you’re a landlord, property manager, or real estate agent, providing clients with a precise and structured receipt ensures transparency and accountability in your dealings.

Ensure that the receipt includes all critical information: the payment amount, date, property details, and services rendered. Customize the template to suit different types of real estate transactions, such as rent payments, deposits, or purchase transactions. This reduces confusion and helps both parties stay on the same page.

For greater accuracy, incorporate fields for tenant or buyer names, property address, and payment method. This also aids in future reference or dispute resolution if any issues arise. Regularly update your templates to reflect any changes in tax rates, service fees, or legal requirements to ensure full compliance with local regulations.

Here are the corrected lines with repeated words removed, maintaining word count and meaning:

When preparing a bill receipt template for real estate, make sure to remove redundant terms while keeping the core meaning intact. Review the language for clarity, ensuring each phrase serves its purpose without repetition.

Corrected Lines

| Original | Corrected |

|---|---|

| Amount to be paid for the purchase transaction is the total amount payable, including all applicable fees. | Amount to be paid for the purchase transaction, including all applicable fees. |

| The total cost of the property is calculated by adding up the total cost, taxes, and additional charges. | The total cost of the property includes taxes and additional charges. |

| The payment due on the property is due on the agreed date of payment, and is payable in full. | The payment is due on the agreed date, payable in full. |

By eliminating unnecessary repetition, you make the document more professional and easier to read. Each section should clearly reflect its purpose, ensuring the user understands the required actions without confusion.

- Bill Receipt Template for Real Estate

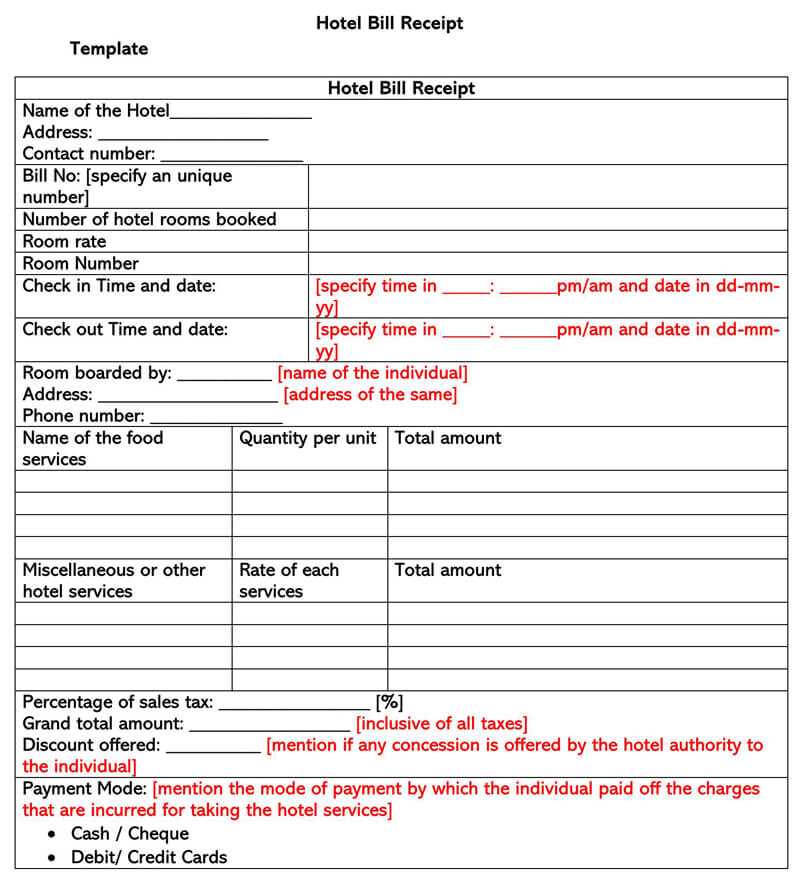

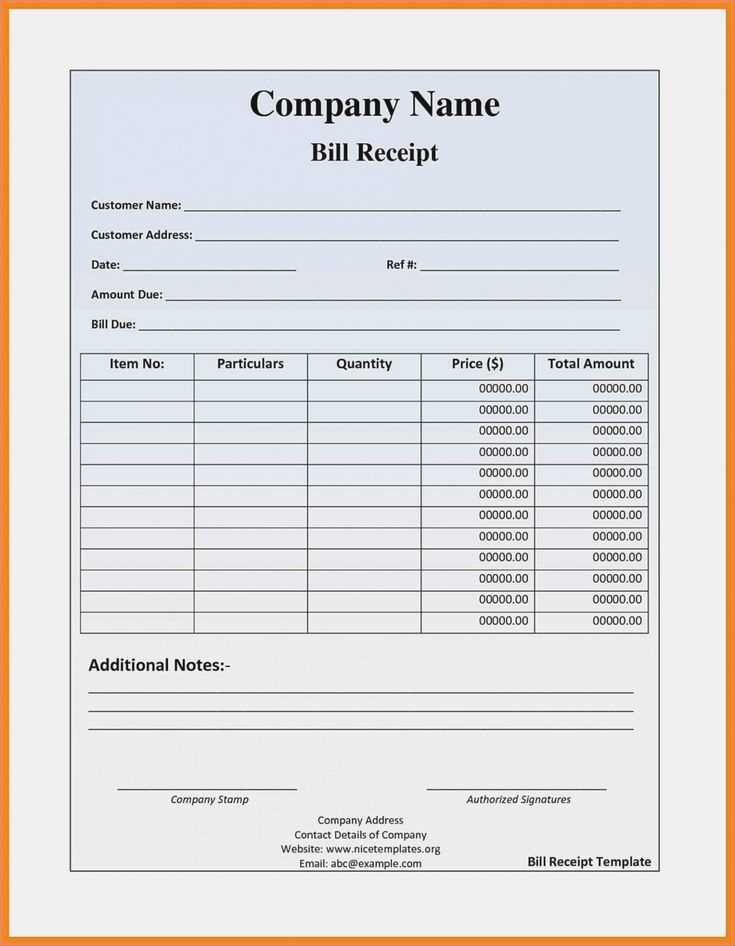

Creating a bill receipt template for real estate transactions ensures transparency and accuracy in financial documentation. Include the following key elements in your template:

1. Property Information: Specify the property address and any relevant identification numbers (e.g., unit or apartment number). This helps both parties easily reference the transaction.

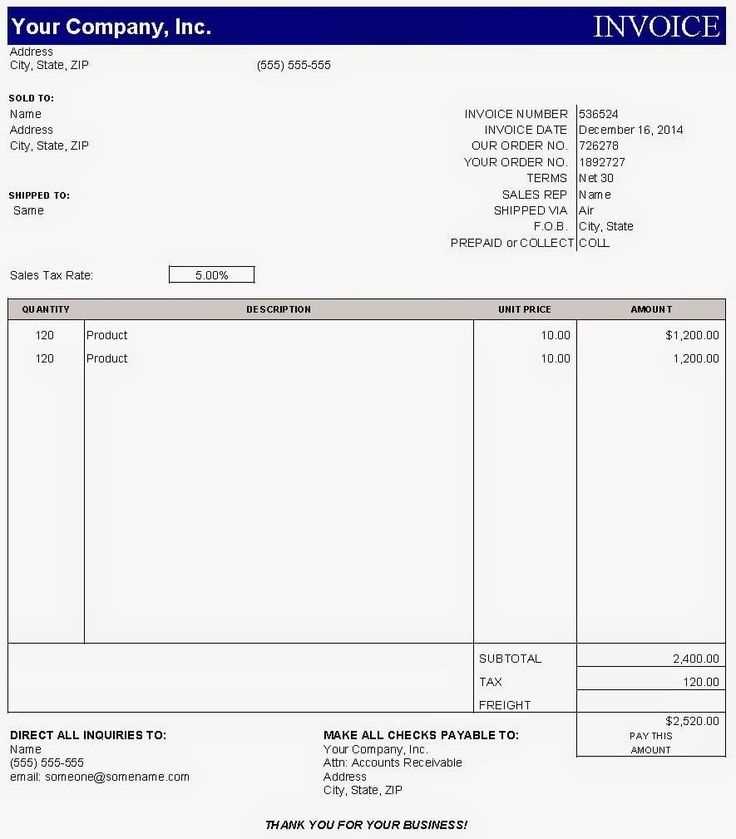

2. Payment Details: Include the total amount paid, the payment method, and the payment date. This section is crucial for keeping track of the payment history.

3. Party Details: List the names of the buyer and seller or landlord and tenant. Clearly state the roles of each party to avoid confusion later on.

4. Invoice Number: Every bill receipt should have a unique invoice number for easy identification and tracking of transactions.

5. Breakdown of Charges: If applicable, break down the payment into categories (e.g., rent, utilities, security deposit). This adds clarity and reduces disputes over payments.

6. Signatures: Provide space for both parties to sign. This confirms that the terms of the transaction have been agreed upon and completed.

7. Legal Notice: Include a brief statement regarding the terms and conditions of the transaction. This section can also mention any applicable legal requirements or obligations.

By following this template, you can create clear, organized bill receipts for any real estate transaction.

Begin by including the property address at the top of the bill. This ensures the tenant knows which rental property the payment pertains to. Customize the template with the tenant’s name, lease agreement number, and the rental period for clarity. Make sure the payment due date is prominently displayed, along with a breakdown of the charges. Include the base rent amount, any additional fees (e.g., maintenance or utilities), and any deductions or credits that apply for the month. Each section should be clearly labeled for easy understanding.

For added personalization, include your contact information (email, phone number), allowing the tenant to reach out with any questions or concerns. Customize payment instructions, specifying acceptable payment methods, such as bank transfers or online payment systems. This can help avoid confusion and ensure a smooth transaction.

Incorporate a section for late fees, outlining the terms for overdue payments. Specify the penalty amount or percentage that will be applied if the payment is not received on time. This encourages timely payments while maintaining professionalism in your communication.

If your template allows, provide a space for the tenant to indicate payment confirmation or reference numbers for transparency. Finally, consider adding a thank-you note or message at the bottom, reinforcing good tenant relations while maintaining a professional tone.

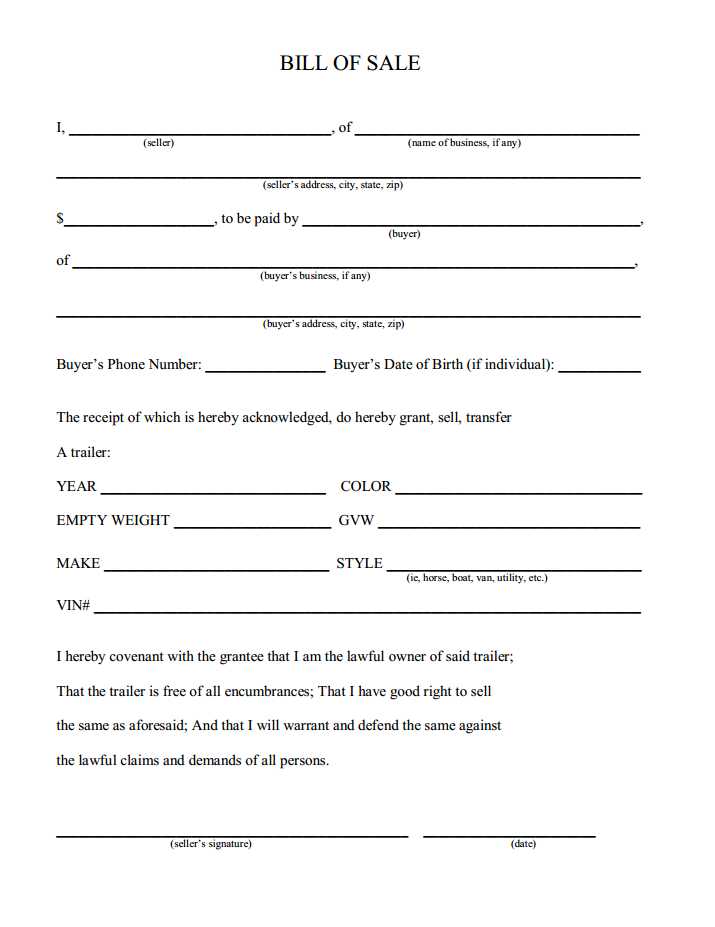

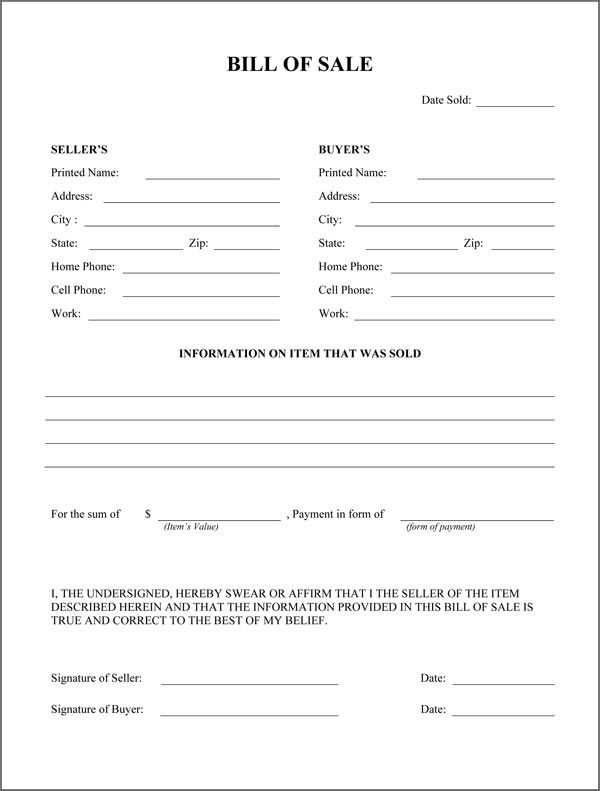

Include the following details to ensure your bill receipt for property sales is clear and legally sound:

- Seller and Buyer Information: List the full names, addresses, and contact details of both parties involved in the sale.

- Property Details: Include the property address, legal description, and any specific property identifiers like parcel numbers.

- Transaction Date: Clearly state the date when the transaction took place.

- Amount Paid: Specify the total amount paid, including any deposits and final payment amounts. Break down any additional charges or fees separately.

- Payment Method: Mention how the payment was made (e.g., bank transfer, check, cash). If applicable, include any reference numbers for traceability.

- Invoice Number: Assign a unique invoice number for easy identification and record-keeping.

- Taxes: Indicate any applicable taxes, including sales tax or property transfer tax, and the amounts involved.

- Transaction Details: Provide a clear description of the transaction, such as the nature of the sale (e.g., full payment or installment). This could also include a reference to any agreed-upon terms or conditions from the sale agreement.

- Signatures: Include spaces for both the buyer’s and seller’s signatures to validate the receipt.

- Additional Notes: If there are any specific instructions, conditions, or other relevant details, ensure they are clearly stated on the receipt.

To create digital real estate receipts, utilize a reliable receipt template or software designed specifically for property transactions. These tools allow you to input the necessary details quickly, including the property address, tenant or client name, payment amount, and payment date. Ensure the template includes clear identifiers such as a unique receipt number and your contact information for easy reference.

Steps for Generating Digital Receipts

Begin by selecting a template that fits your needs, either through online platforms or real estate management software. Many software options provide pre-built templates with customizable fields. Fill in payment details accurately, including the rent or fee paid, any discounts, taxes, and the method of payment. Double-check that all required fields are populated correctly before finalizing.

Customizing for Your Business

Customize your receipt template by adding your branding, such as logos or company colors, to create a professional look. Ensure your terms and conditions are clear, especially if you require any late fee details or early payment incentives. Once complete, convert the document to a PDF for secure sharing and archiving.

Once a receipt is generated, send it directly to the client or tenant via email. Many platforms also allow you to store receipts in a secure cloud-based system for easy future access and audits.

Design your bill receipt template to include specific fields for clarity and accuracy. Begin with a header that displays the company or landlord’s name, address, and contact information. Include a unique receipt number for easy tracking. Below the header, list the tenant’s name and property address, clearly indicating the rent or payment amount, due date, and the period it covers. Specify the payment method, whether it’s via bank transfer, check, or cash. Lastly, include a footer with any necessary legal terms or notes, ensuring the document complies with local regulations.

Make sure the template is easy to read by using a clean layout and clear labels for each section. Use bold text to highlight important details like the total amount paid and the due date. Organize the information logically and ensure there’s enough space between sections to avoid clutter. Adding a space for signatures can also validate the receipt if needed.