Basic Elements of a Mortgage Receipt

Each mortgage receipt should clearly display the following details to ensure both parties are on the same page regarding payments:

- Borrower’s Information – Full name and address.

- Lender’s Information – Name and address of the lending institution.

- Payment Date – The exact date when the payment is made.

- Amount Paid – The specific amount paid by the borrower.

- Remaining Balance – Updated outstanding balance after the payment is made.

- Loan Account Number – The unique identifier for the loan.

- Payment Method – Whether the payment was made via check, bank transfer, or other methods.

- Transaction Reference Number – A unique code for tracking the payment transaction.

How to Format the Mortgage Receipt

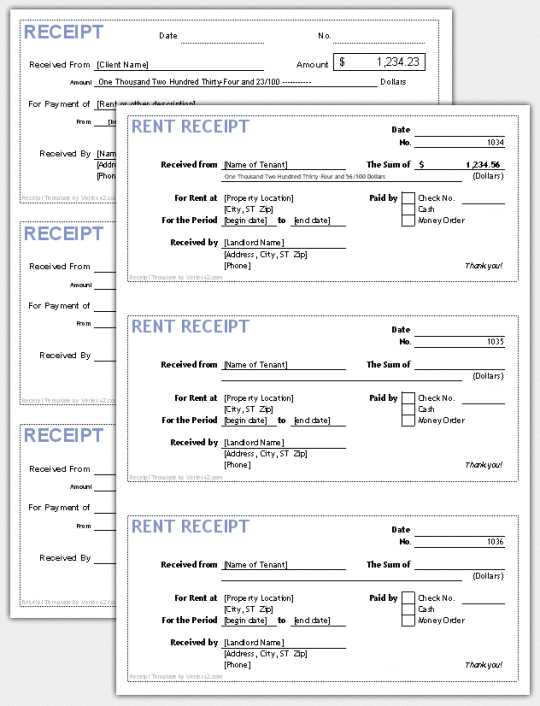

Ensure the document is structured in a clear and organized manner. Start with the lender’s details, followed by the borrower’s information. Below is an example layout:

- Lender’s Information

- Borrower’s Information

- Mortgage Loan Details – Loan number, total loan amount, interest rate, etc.

- Payment Information – Date, amount, payment method.

- Remaining Balance – Current balance after payment.

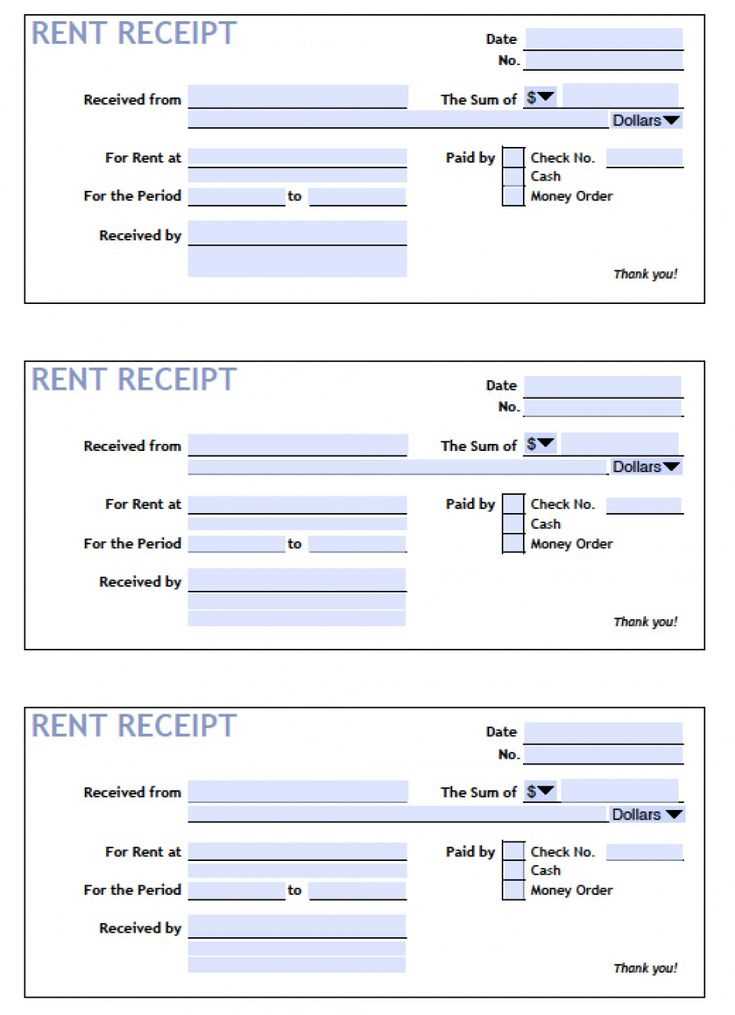

Sample Template

Lender’s Name: ABC Bank

Borrower’s Name: John Doe

Loan Number: 123456789

Payment Date: February 13, 2025

Amount Paid: $1,000.00

Remaining Balance: $150,000.00

Payment Method: Bank Transfer

Transaction Reference: ABC123XYZ

Ensure this template is customized according to the unique requirements of your mortgage agreement. Keep accurate records of each receipt for your own financial tracking and for any legal requirements in case of disputes.

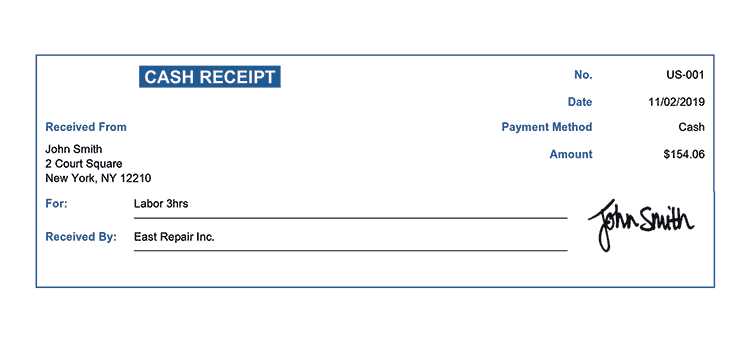

Mortgage Receipt Template

To create a clear mortgage payment receipt, begin by including the date of payment. This ensures both parties know when the transaction took place. Include the payer’s name, the recipient’s name, and the address of the property associated with the mortgage. Specify the amount paid, the method of payment, and indicate if it’s a partial or full payment. This clarity helps prevent future disputes regarding the payment status.

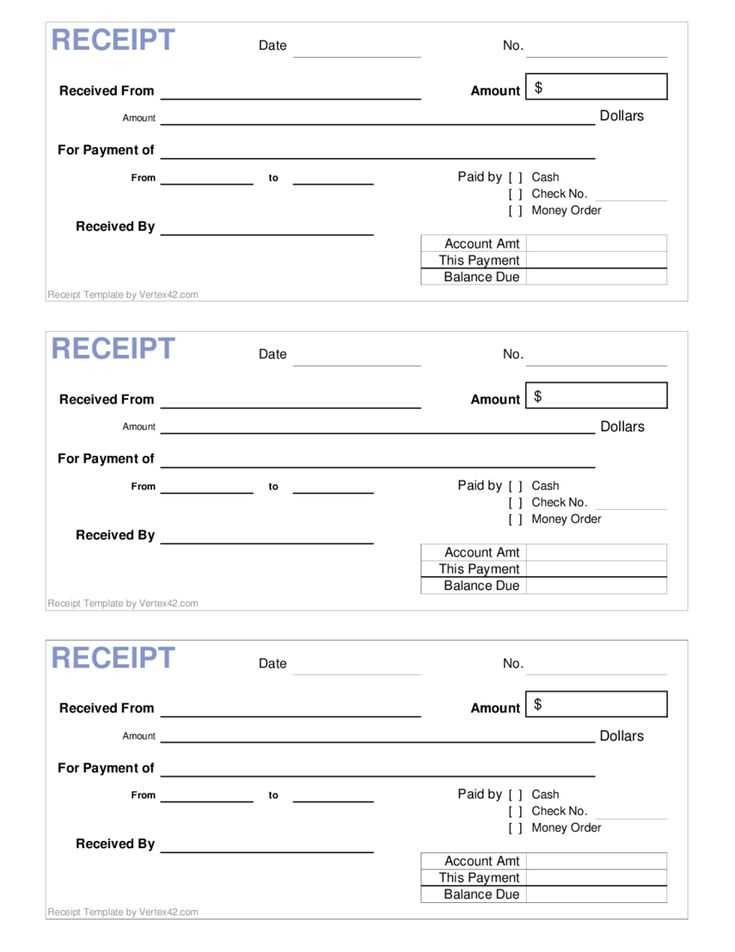

Important Details to Include in Your Receipt

Include the loan account number for easy reference. It will help to identify which mortgage the payment pertains to, especially if the recipient handles multiple loans. A detailed breakdown of the payment–such as principal, interest, taxes, and fees–adds transparency. This provides clarity on how the payment was distributed and assures the payer the amount is properly applied.

Legal Considerations for Issuing a Mortgage Payment Receipt

Ensure the receipt is signed by the recipient or their authorized representative. This acts as confirmation of payment and establishes legal accountability. Be mindful that some jurisdictions may require a specific format or additional documentation. Verify these requirements to avoid legal issues later. Always retain copies of the receipt for your records in case of any future legal or financial inquiries.