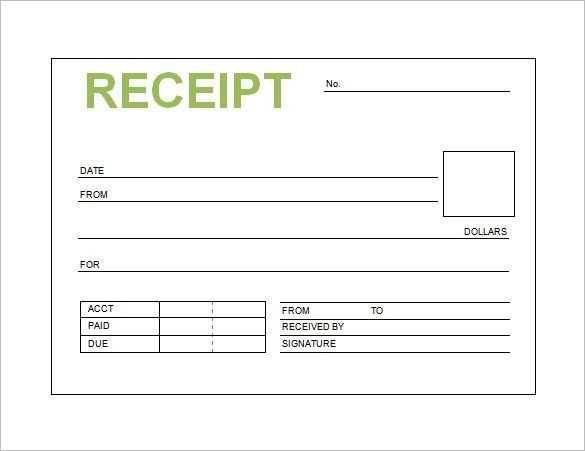

Creating a receipt database template can simplify tracking and organizing financial transactions. Begin by designing a structure that includes key fields such as date, amount, vendor, and payment method. These elements will form the core of your database, making it easy to search and filter entries based on different criteria.

Data integrity is vital when managing receipts. Include fields for transaction descriptions or categorization, so you can sort by expense type, which is helpful for budgeting or tax purposes. Ensure each entry is clear and accurate to avoid confusion later.

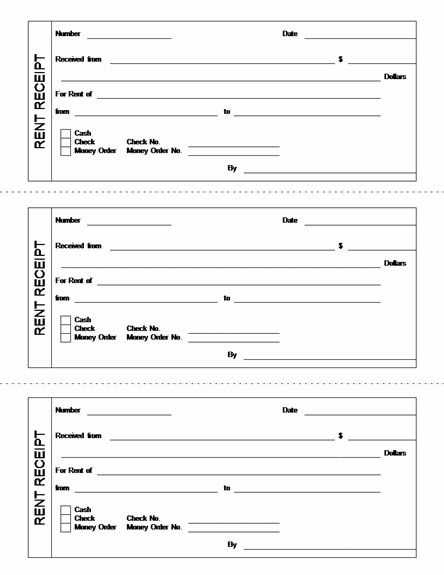

Consider incorporating a unique receipt ID for each entry. This helps avoid duplicate records and ensures easy referencing. You can also add fields for payment status, allowing you to track whether a payment was completed or pending.

Once the basic structure is in place, you can customize the template based on your needs. Whether it’s for personal finances, a small business, or an organization, tailoring the template will ensure that it works for your specific use case.

Here’s a detailed HTML outline for an informational article on the topic “Receipt Database Template,” structured with practical and specific subtopics: htmlEditReceipt Database Template: Organizing Your Financial Records

Organizing receipts is an effective way to manage your finances. A well-structured receipt database template simplifies tracking and categorizing expenses, ensuring easy access to necessary records when needed. Below is a step-by-step guide to help you create a functional template to organize your receipts.

1. Key Elements of a Receipt Database Template

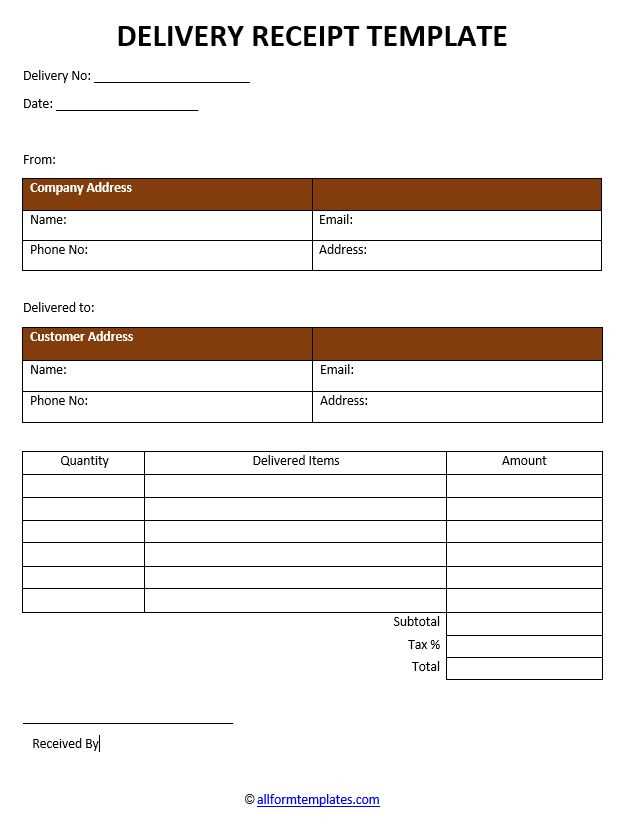

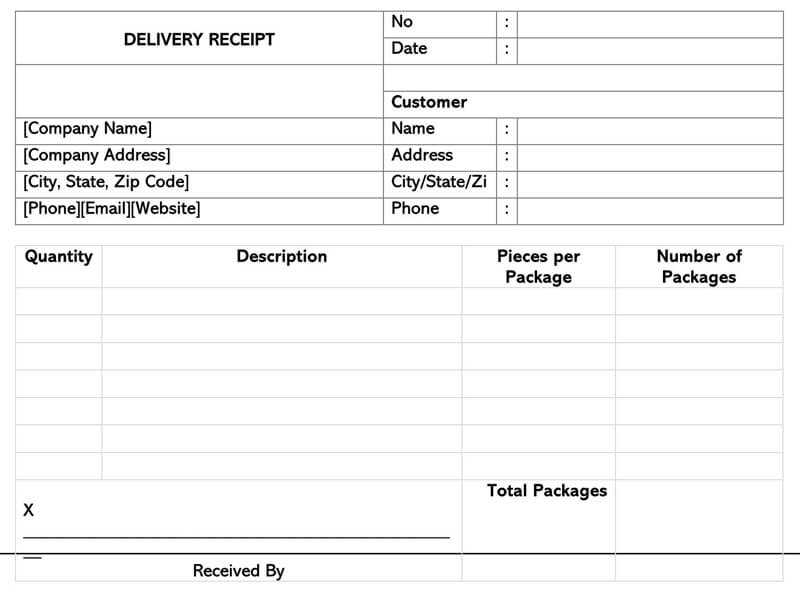

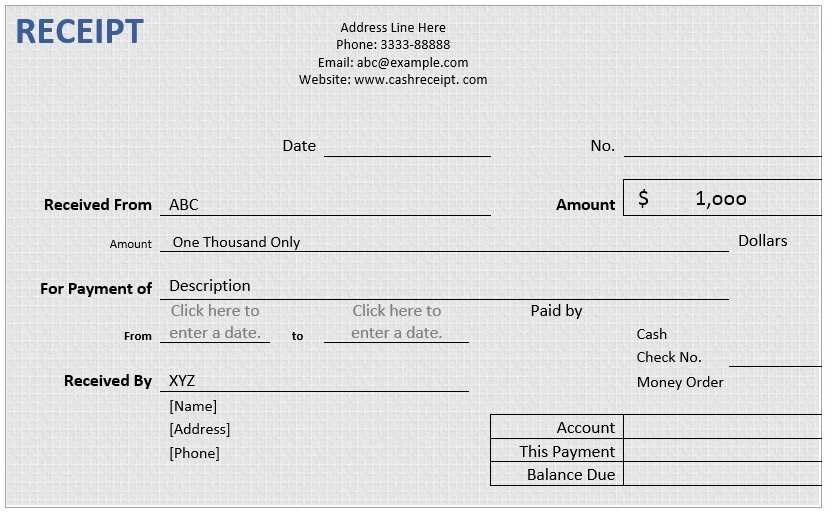

Designing an effective receipt database requires including key fields for detailed record-keeping. Each receipt entry should capture the following essential details:

| Field | Description |

|---|---|

| Receipt ID | A unique identifier for each receipt entry. |

| Date of Purchase | The date when the purchase was made. |

| Vendor Name | The business or service provider’s name. |

| Category | The expense category (e.g., office supplies, food, transportation). |

| Amount | Total purchase amount. |

| Payment Method | How the payment was made (e.g., credit card, cash, PayPal). |

| Notes | Additional details, such as the purpose of the purchase or project. |

2. Benefits of Using a Template for Receipt Organization

Using a receipt database template offers several advantages, including:

- Easy tracking of all purchases for tax filing and budget management.

- Streamlined retrieval of specific receipts for warranty claims or expense reimbursement.

- Better financial planning and reporting by categorizing expenses.

A well-organized receipt database ensures you can access transaction history at any time, aiding in budget tracking and financial transparency. When structured correctly, this template will help maintain an organized financial record with minimal effort.

Designing the Database Structure for Efficient Data Entry

Start with clearly defining your data fields. Each piece of information should have a corresponding column in the table, ensuring consistency in the data type and format across entries. Use appropriate data types for each field, like integers for amounts and text for product names, to maintain smooth data input and prevent errors. For example, setting the date field to a standard date format prevents inconsistencies in date entries.

Optimizing Data Relationships

Establish relationships between tables using foreign keys to link relevant information. This method avoids redundant data and keeps your database normalized, which simplifies data entry and reduces errors. For instance, instead of storing customer information multiple times, reference the customer ID in your receipt table, linking it to the main customer table. This minimizes duplication and ensures updates are made in a single place.

Designing for Ease of Use

Consider the user interface (UI) for entering data. A clean and intuitive design makes data entry faster and reduces human error. If possible, incorporate drop-down menus or auto-completion for fields like payment methods or product categories. This keeps the data consistent and speeds up the process. Additionally, validation rules should be set up to automatically flag missing or incorrect entries, saving time during the input process.

Customizing Templates for Different Business Needs

Adjust templates to fit the specific requirements of your business type and workflows. Focus on key details like branding, layout, and functionality to meet operational goals.

- Brand Alignment: Ensure templates reflect your brand’s identity, including logos, color schemes, and fonts. This creates consistency and strengthens your company’s image.

- Field Customization: Modify template fields to capture relevant business information. For example, retailers may need product codes, while service providers may prioritize client details.

- Automating Calculations: Set up formulas within the templates to handle common financial tasks such as tax calculations, total amounts, or discounts, saving time and reducing errors.

- Adjusting Layouts: Alter the layout to prioritize the most important sections for your business, whether it’s the payment section, itemized list, or client contact details.

Regularly review and tweak the template as your business grows. What works today may need adjustments tomorrow, so stay flexible and ready to optimize. Integrating feedback from your team helps keep the template aligned with practical needs.

Implementing Advanced Features: Automating Data Import and Reports

To streamline the process of managing receipts, automate the data import by integrating API connections or CSV file uploads directly into your database. This allows seamless data transfer without manual input, saving time and reducing human error.

Data Import Automation

Automating the import process can be done by setting up scheduled imports or triggers. For instance, configure your system to fetch CSV files from a designated cloud storage location on a daily basis. The files should be parsed, mapped to the database schema, and checked for errors before insertion. Implement validation steps, such as checking for duplicates or incorrect formats, to ensure the quality of imported data.

Automating Reports Generation

To generate reports automatically, schedule report generation based on predefined conditions, such as monthly or quarterly summaries. Use SQL queries or database functions to gather the relevant data and export it into formats like PDF, Excel, or CSV. Incorporate filtering and aggregation features, allowing users to customize the data displayed in their reports, such as grouping receipts by categories or dates.

By automating both data import and report generation, you save valuable time and ensure that your data is up-to-date and readily available for analysis at any time.