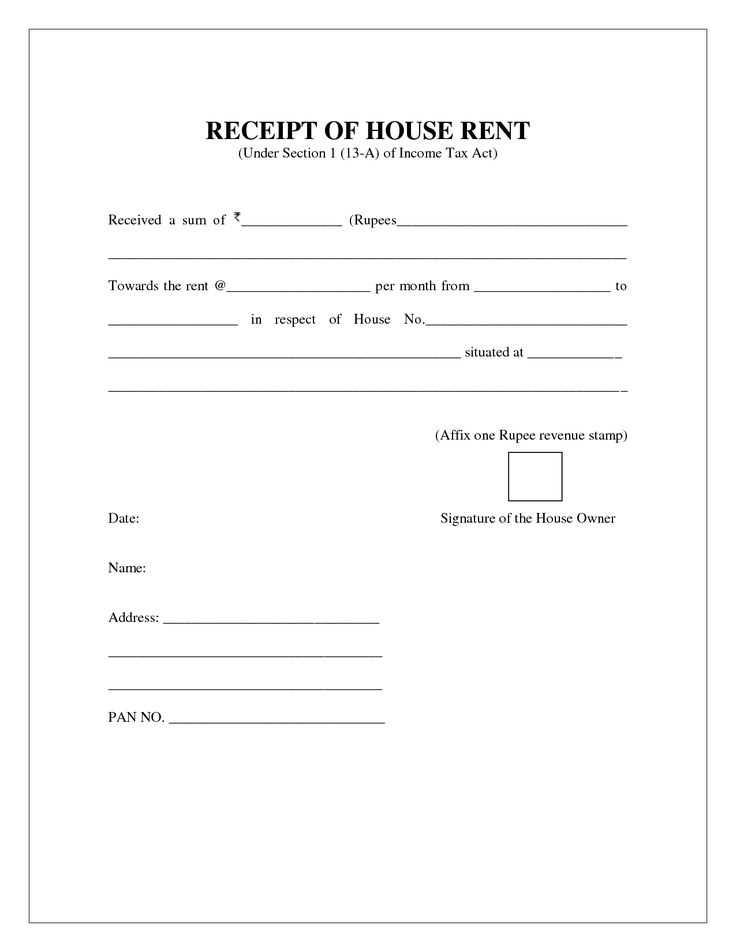

If you’re a landlord or a tenant in India, using a rent receipt template simplifies record-keeping and ensures legal clarity. Rent receipts serve as proof of payment for the rental amount and are vital for tax purposes. By providing a clear, structured format, these templates help avoid misunderstandings between landlords and tenants, promoting transparency in financial transactions.

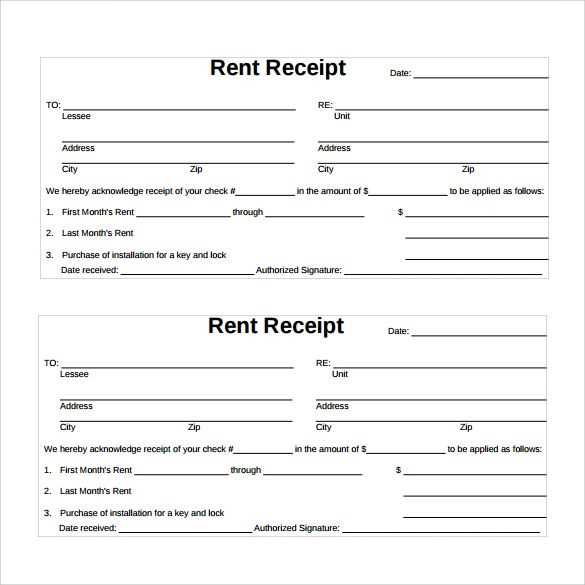

A standard rent receipt template in India includes fields like the tenant’s name, property address, rental amount, payment date, and the period the payment covers. Most templates also feature a space for the landlord’s signature and the date the receipt was issued. Utilizing a pre-designed template not only saves time but also prevents errors in recording crucial information.

Landlords can easily create rent receipts using editable templates available online. These templates can be customized to fit specific needs, such as adding the tenant’s contact information or including a rent increase clause. Be sure to choose a template that complies with Indian tax laws, as rent receipts are often required during audits or for the tenant’s income tax filings.

For tenants, keeping rent receipts organized is just as important. These receipts may be required to claim deductions under section 80GG of the Income Tax Act, which allows individuals who live in rented accommodation to receive tax benefits. Having a well-maintained record of payments can ensure smooth processing of such claims.

Here’s a revised version with the word repetition minimized:

To create a rental receipt in India, ensure your template includes the following key details:

- Landlord’s Name and Address: Clearly mention the full name and contact address.

- Tenant’s Name: Include the tenant’s full name for identification.

- Rent Amount: Specify the amount paid, in both numbers and words, for clarity.

- Rental Period: Mention the period for which the rent is applicable, such as monthly or yearly.

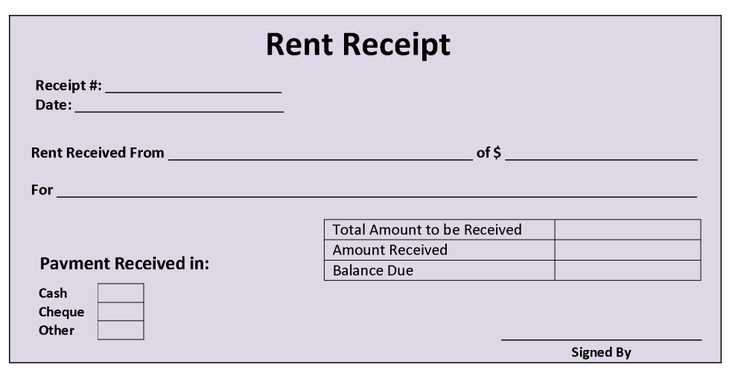

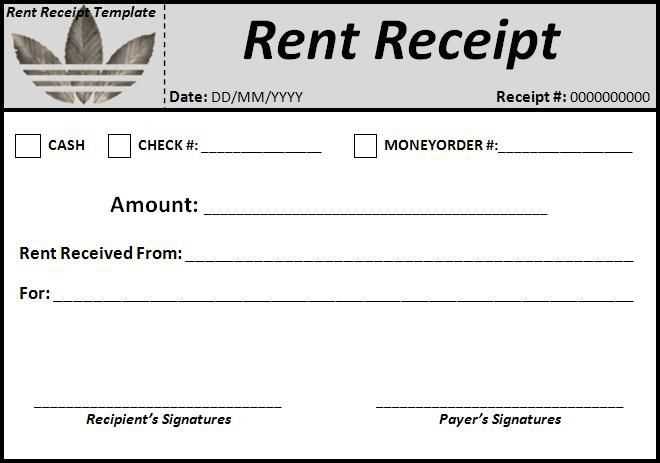

- Payment Method: Indicate how the payment was made, whether by cash, cheque, or bank transfer.

- Receipt Number: Assign a unique receipt number for record-keeping.

- Signatures: Both parties should sign the receipt, confirming the transaction.

Using these elements, you can create a clear and legally binding rental receipt for both tenants and landlords. Templates are available online for quick customization, but ensure they adhere to local regulations and include all required details for validity.

- Rent Receipt Templates in India

When creating a rent receipt in India, ensure it includes key details like the landlord’s and tenant’s names, property address, rent amount, date of payment, and payment mode. A template should be clear and professional, reflecting all relevant data accurately.

For landlords, using a rent receipt template simplifies tracking payments and maintains transparency. A good template typically features the following sections:

- Landlord Details: Full name, contact information, and address.

- Tenant Details: Tenant’s name, contact information, and address of the rented property.

- Rental Payment Information: Amount paid, rent period (from and to dates), and the payment date.

- Payment Method: Specify if the payment was made in cash, cheque, bank transfer, or any other method.

- Signatures: Signatures of both landlord and tenant to authenticate the receipt.

Templates are available in both digital and printable formats. When choosing one, select a template that suits your needs–whether you need a simple receipt for occasional rentals or a more detailed template for formal agreements. Some online tools offer customizable templates, allowing you to modify fields as per your requirements.

Using these templates also helps in complying with legal requirements, especially in formal rental agreements where receipts are mandatory for maintaining proper documentation. It is advised to keep a copy of every receipt for future reference, especially during tax filing.

Several websites provide free and downloadable rent receipt templates tailored for Indian laws and practices. Ensure the template you choose aligns with regional rental laws to avoid discrepancies.

To create a rent receipt template in India, ensure it includes all the necessary legal information to make it valid. A rent receipt should clearly identify the transaction and provide both parties with proof of payment. Follow these steps to create a legally compliant template:

| Details to Include | Description |

|---|---|

| Receipt Number | A unique number for each receipt. This helps in keeping a clear record for both parties. |

| Landlord and Tenant Names | Full names of both the landlord and the tenant should be included. |

| Property Address | The complete address of the rented property, including street and city, should be mentioned. |

| Rent Amount | The exact amount of rent paid, including the currency and words for clarification. |

| Payment Date | The date on which the rent payment was made. |

| Mode of Payment | Indicate whether the payment was made in cash, by cheque, or through a bank transfer. |

| Period Covered | The month or months for which the rent payment is being made. |

| Signature | Both the landlord and tenant should sign the receipt to confirm the payment. |

Additionally, it is important to mention if there is any GST applicable, especially in cases of commercial leases. If the rent is above Rs. 20,000 per month, the landlord should also include their PAN number for tax purposes. Keep a copy of the receipt for record-keeping purposes and always issue it promptly to avoid disputes.

Incorporating these details ensures the rent receipt is legally valid and serves as reliable evidence for both parties in case of any future disputes. By including the necessary information and following these guidelines, you’ll be able to create a rent receipt template that meets all legal requirements in India.

For a seamless rent receipt process, tailor templates to match the specific rent amounts and payment schedules of tenants. This customization ensures clarity and reduces any chances of disputes over payments. Here’s how to adjust templates for different rent amounts and payment intervals:

Adjusting for Rent Amounts

Customize the rent receipt by including accurate figures for both the monthly rent and any additional charges (like maintenance or utilities). For example, if the rent varies based on the size of the property or location, clearly specify these amounts in separate fields to avoid confusion. Use a line-item breakdown that clearly distinguishes between base rent and any other charges.

Customizing for Payment Frequencies

Rent payment frequencies can differ–whether monthly, quarterly, or annually. Customize the template by specifying the payment frequency and due dates accordingly. For tenants who pay quarterly or annually, it’s helpful to include the total amount for the period alongside the specific date range covered. This avoids any misunderstandings regarding partial payments or missed due dates.

Lastly, make sure your template accounts for any advance payments or deposits, and specify their application in the receipt. Whether it’s a one-time upfront cost or a refundable deposit, clearly state its amount and terms for better tracking.

To issue rent receipts digitally, use online tools like ClearTax, RentReceipt, or other similar platforms that offer customizable templates. After signing up, fill in tenant details such as the tenant’s name, property address, amount paid, and payment date. Some platforms also generate automatic receipt numbers for easy tracking. After entering the details, the platform will allow you to save the receipt in PDF format or send it directly to your tenant via email.

If you prefer creating receipts manually, you can design a template using tools like Microsoft Word or Google Docs. Create a format with fields for all necessary information: tenant name, amount paid, rent period, property address, and payment method. Afterward, save the document as a PDF and send it to your tenant’s email address. This method ensures clear documentation while maintaining flexibility in format.

To keep your records organized, store all issued receipts in cloud storage or on your computer. This way, you can quickly access past receipts whenever required. Using digital receipts reduces paper waste and provides easy access for both landlords and tenants in case of future disputes or verification needs.

Rent Receipts Templates in India

Ensure your rent receipt template in India covers all the necessary details. This not only helps maintain transparency but also complies with local tax regulations.

Required Information for a Valid Rent Receipt

Include the following details on the rent receipt:

- Landlord and Tenant Information: List the full names and addresses of both parties.

- Rent Payment Details: Specify the rent amount, payment method (cash, cheque, bank transfer), and the period it covers (monthly, quarterly, etc.).

- Property Information: Provide the full address of the rented property.

- Date of Payment: Mention the exact date when the rent was paid.

- GST Details: If applicable, include the GST number of the landlord and the GST amount charged.

- Signatures: Ensure both the landlord and tenant sign the receipt for verification.

Template Recommendations

A clean, simple template works best. You can use an editable Word or PDF template for consistency. Always store copies for record-keeping, especially for tax purposes.