Make your church donation receipts quick and easy to generate with a ready-made printable template. This simple yet effective tool saves time for both donors and church staff. By using a template, you ensure consistency and accuracy in the details provided to each donor.

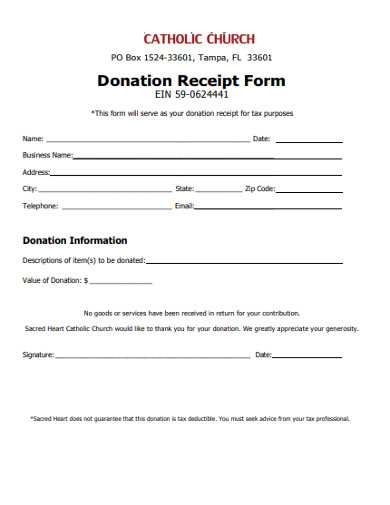

Each receipt should include key information such as the donor’s name, donation amount, date, and the church’s tax identification number. Customizable fields allow you to tailor the template to match your church’s branding and specific needs.

Having a clear, professional receipt not only keeps records organized but also helps donors with tax deductions. A printable template can be filled out and handed over immediately after a donation is made, providing the donor with a quick record of their contribution.

Choose a template that is easy to print and can be quickly edited. This ensures that all required information is included without hassle, leaving more time for your church to focus on its mission.

Here’s the corrected version:

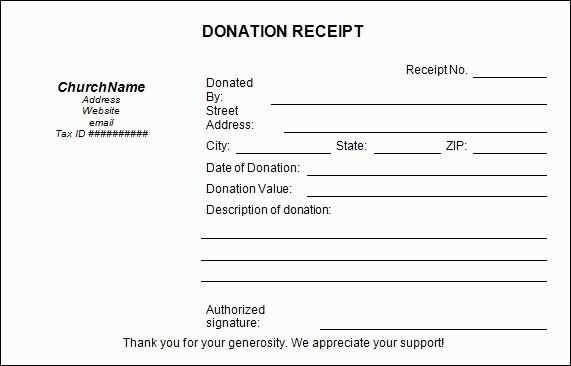

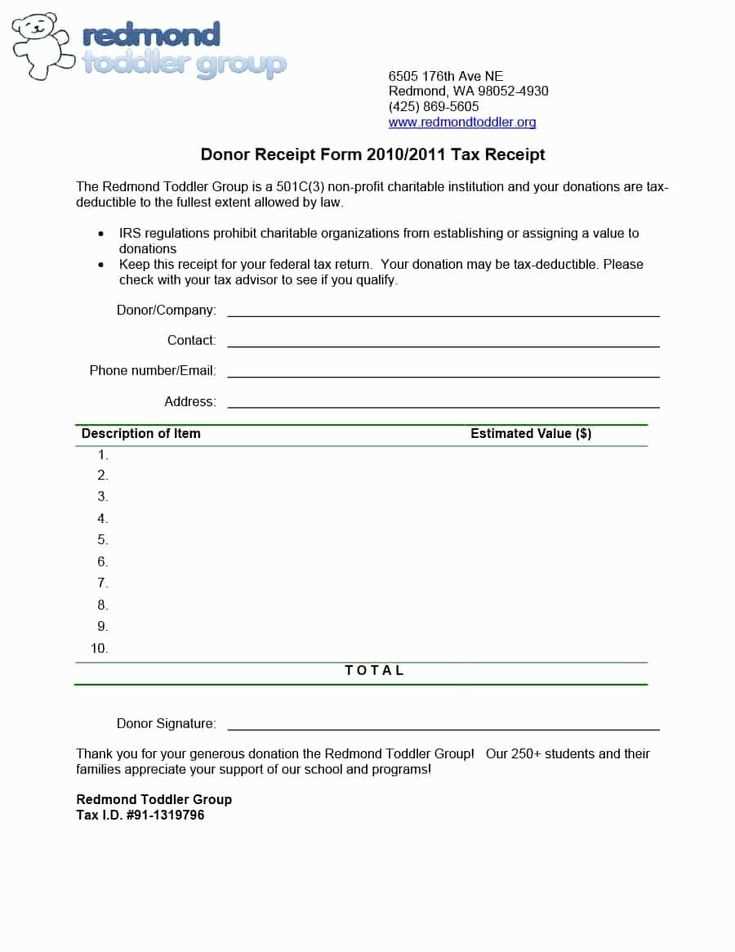

To create a professional and accurate church donation receipt template, start by clearly labeling the document as a “Donation Receipt” at the top. Make sure to include the church’s name, address, and contact details prominently at the top for easy identification.

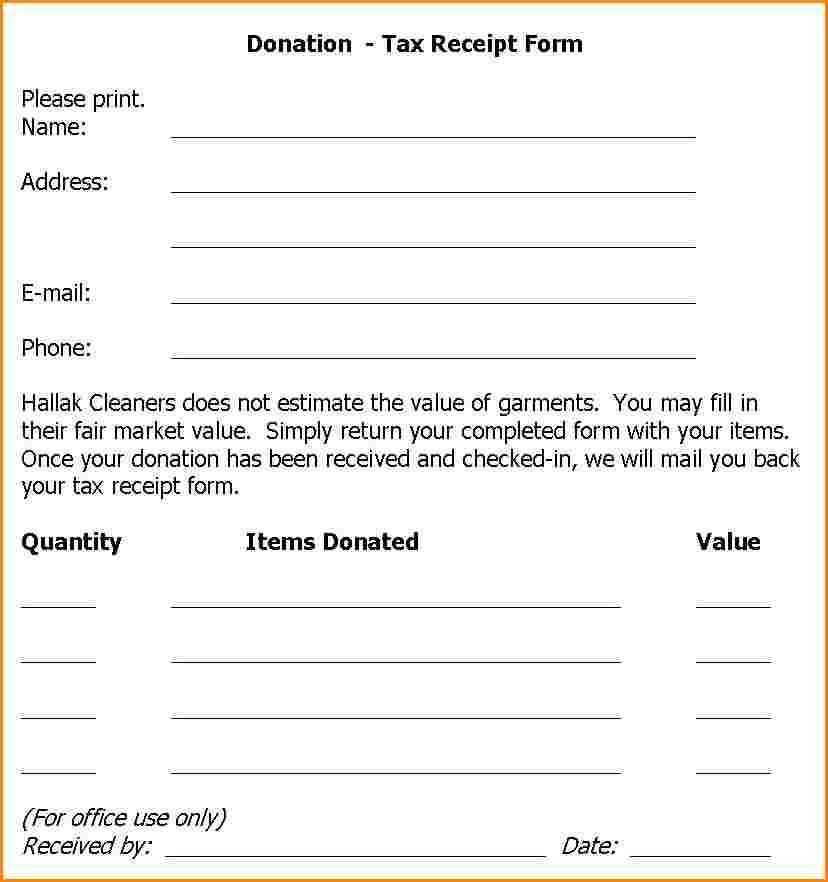

Include a section for donor information. This should cover the donor’s full name, address, and contact information. The template should also allow space to specify the donation date, amount, and method of contribution, whether it’s by cash, check, or online payment.

For transparency, a line item should detail the purpose of the donation, if applicable. This helps both the donor and the church keep accurate records. Additionally, you may want to include a brief statement verifying that no goods or services were exchanged for the contribution, as this can affect tax-deductibility.

Ensure the template allows for a place to include the name and signature of the authorized person issuing the receipt. This adds authenticity and can prevent disputes in the future.

Finally, consider including a thank-you note at the bottom of the receipt. A simple acknowledgment of the donor’s generosity builds trust and encourages future donations.

- Printable Church Donation Receipt Template

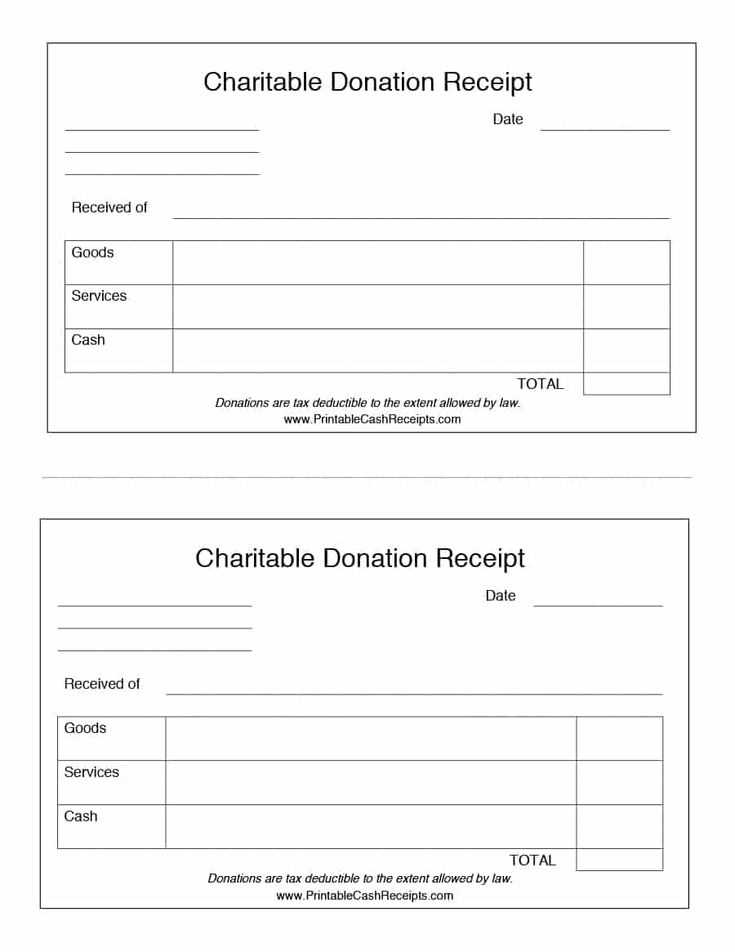

A printable church donation receipt template is a straightforward tool for acknowledging donations and ensuring accurate records. The receipt should include key information such as the donor’s name, donation amount, and the date of the contribution. It’s important to note whether the donation was in cash, check, or goods, as this can impact tax deduction eligibility.

Include the church’s name, address, and tax-exempt status to validate the receipt. For donations of goods, provide a brief description of the items donated. For cash or check donations, specify the exact amount. If applicable, provide a statement indicating that no goods or services were received in exchange for the donation, as required by tax regulations.

Ensure that each receipt is numbered sequentially for easy reference and to maintain proper records. This helps both the donor and the church stay organized. If the donation is part of a fundraising event, include the event’s name and the corresponding date to link the donation to a specific initiative.

Lastly, create space for the signature of the authorized church representative to add authenticity to the receipt. A printable template that covers these details allows for quick, accurate, and professional documentation of donations, supporting both the donor’s tax filing and the church’s financial transparency.

Design a simple template with clear sections for donor details, donation amounts, and church information. Begin by including the church’s name, address, and contact details at the top. This helps donors easily identify the organization they contributed to. Below that, add a space for the donor’s name and address to personalize the receipt.

Next, specify the donation amount in both numerical and written formats. Include the donation date and the method used, such as cash, check, or online payment. If applicable, add a section for recurring donations to make tracking easier for both the donor and the church.

Clearly state the tax-exempt status of the church and provide a disclaimer that no goods or services were exchanged for the donation. This ensures the donor can claim their donation on taxes. Finish the template with a thank you note and a signature line for the church representative.

Use a simple and legible font to make the receipt easy to read. Avoid excessive decoration that could distract from the main information. Consider offering both printable and digital versions to accommodate different preferences.

Start by including the donor’s full name. This should be accurate and reflect how the donor prefers to be addressed, which shows respect and acknowledgment. Then, clearly state the amount donated, including the currency, and the date the donation was made. Providing this detail ensures transparency and helps with record-keeping for tax purposes.

Donation Details

It’s important to specify whether the donation was for a general fund or a designated purpose. For example, if the donor contributed to a special cause like a building project or mission trip, include this information. This helps the donor see the direct impact of their generosity.

Tax Information

Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This is necessary for tax deductions. If any goods or services were provided, specify their fair market value. This detail ensures the receipt is valid for tax purposes and shows transparency in your practices.

| Element | Description |

|---|---|

| Donor’s Full Name | Accurate and respectful recognition of the donor. |

| Donation Amount | Clear statement of how much was donated and the currency. |

| Donation Date | Exact date of donation to maintain accurate records. |

| Purpose of Donation | Indicate whether the donation is for a general fund or a specific project. |

| Tax Information | Clarify whether any goods or services were received in exchange for the donation. |

Finally, a thank you message goes a long way. Acknowledge the donor’s contribution and express gratitude for their support. This small gesture helps maintain a positive relationship for future donations.

Adjust the donation receipt template to accommodate different donation amounts by setting dynamic placeholders for the amount field. This allows flexibility in generating receipts for any sum. For each donation tier, update the template to reflect the accurate contribution and any specific instructions regarding tax deductions, if applicable. A simple approach is to include a numeric field in the template that automatically populates with the donor’s contribution when the receipt is generated.

Consideration for Multiple Donation Levels

If your church receives varying amounts, create separate fields for small, medium, and large donations. For example, receipts for donations above a specific amount may need extra acknowledgment or a more detailed breakdown. By tailoring the wording or layout, you ensure each donor feels valued and that the receipt serves as a clear record for them.

Automating the Donation Amount

Using conditional statements, automatically adjust the formatting of the receipt based on the donation amount. For instance, a larger donation might trigger the addition of a personalized thank-you message or a more prominent display of the amount. This can also be useful for tracking and reporting donations in bulk, as it avoids manual updates to each receipt.

How to Provide Tax-Deductible Information on the Receipt

Include a clear statement that the donation is tax-deductible under the applicable law. This statement should mention the status of your organization as a tax-exempt entity, such as 501(c)(3) in the U.S. It assures the donor that their contribution is eligible for tax benefits.

Include the Amount and Date of the Donation

State the exact amount donated and the date of the donation. This information helps the donor in claiming deductions on their taxes. Ensure this is accurate and clearly listed to avoid confusion.

State No Goods or Services Were Provided (if applicable)

If the donation was purely charitable and the donor received no goods or services in return, specify that on the receipt. The IRS requires this declaration for tax-deductibility. If there were any goods or services provided, their fair market value must be noted as well.

Ensure clear and accurate donation information on each receipt. Include the donor’s name, donation date, amount, and your organization’s details. For tax purposes, specify whether the donation was monetary or in-kind.

Printing the Receipts

- Use high-quality paper to create a professional look and feel for your receipts.

- Consider using pre-designed templates for consistency and ease. Make sure they are compatible with your printer settings.

- Test prints before running a large batch to confirm clarity and legibility.

- If your organization handles a high volume of donations, investing in a dedicated printer for receipts can save time and reduce errors.

Distributing the Acknowledgments

- Send receipts promptly after a donation is made. This shows appreciation and ensures the donor has the paperwork needed for tax filing.

- Offer electronic copies of receipts when possible. This saves on printing costs and speeds up distribution.

- For physical receipts, use envelopes with appropriate labels, and ensure they are delivered securely. Consider sending them via certified mail for larger contributions.

- Track sent receipts in a database to follow up on any that remain undelivered or unanswered.

To ensure your church’s donation receipts meet IRS regulations, include specific information that verifies the donation is tax-deductible. The IRS requires churches to provide a written acknowledgment for donations of $250 or more, stating the amount of the gift and whether anything of value was received in return. This prevents potential issues with tax deductions and maintains transparency with donors.

Key Details to Include

Each receipt must contain the church’s name, address, and tax-exempt status. A clear description of the donation, including the date and amount, must be included. If the donor received goods or services in exchange for their contribution, the receipt must specify the fair market value of those items. These elements demonstrate compliance with IRS guidelines and ensure donors can claim deductions appropriately.

Additional Considerations

For non-cash donations, provide a description of the donated items. If the donor does not request a valuation, make it clear that the IRS does not require the church to appraise the items. Maintaining accurate records of all donations and issuing timely receipts will reduce the risk of IRS audits and contribute to a trustworthy donation process.

Creating a church donation receipt template requires attention to detail to ensure both clarity and legal compliance. The receipt must include specific information to make it useful for both the donor and the church. Here’s how to craft an effective template:

- Include Donor Information: Collect the donor’s full name and address. This is important for tax purposes and to ensure the donation is properly recorded.

- Detail the Donation Amount: Clearly specify the amount donated. If it’s a non-monetary gift, include a description of the item and its fair market value.

- Provide the Date of Donation: Record the exact date of the donation to avoid any discrepancies later on.

- Include a Statement of Non-Refundability: Clarify that the donation is non-refundable. This protects both parties.

- Tax-exempt Status: Make sure to mention the church’s tax-exempt status and IRS designation to ensure the donor can use the receipt for tax deductions.

- Receipt Number: Assign a unique receipt number to each donation. This helps with tracking and organizing records.

Additional Details

For transparency, it’s a good idea to note if the donation was in exchange for any goods or services. This will help the donor understand what portion of the gift may be tax-deductible. If the donation is monetary, there’s no need to provide goods or services in return, but it’s useful to include a brief description of any special funds the donation may support, such as mission work or capital campaigns.

Template Example

Here’s a simple example of what your receipt could look like:

Church Name Address Phone Number Receipt Number: [#] Date: [MM/DD/YYYY] Donor Name: [Full Name] Address: [Address] Donation: [Amount] Type of Donation: [Monetary/Item Description] Thank you for your generous contribution. [Church Name] is a 501(c)(3) tax-exempt organization. Signature: _____________________