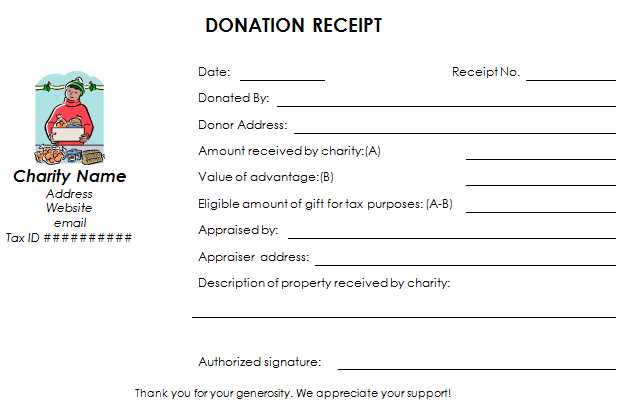

If you’re looking for a way to create a donation tax receipt, using a free template can save time and ensure accuracy. A tax receipt serves as proof of charitable contributions for your donors, which they can use when filing taxes. With a well-designed template, you can provide the necessary details quickly and professionally.

The template should include key information such as the donor’s name, donation amount, date, and a statement confirming that no goods or services were provided in exchange for the donation. Having this format ready makes it easier to manage multiple donations and stay organized during tax season.

To make the process smooth, choose a template that suits your organization’s needs. Many free templates are customizable and easy to use. Once completed, you can send the receipts directly to donors or keep them on file for future reference.

Sure, here’s the revised version with minimized repetition:

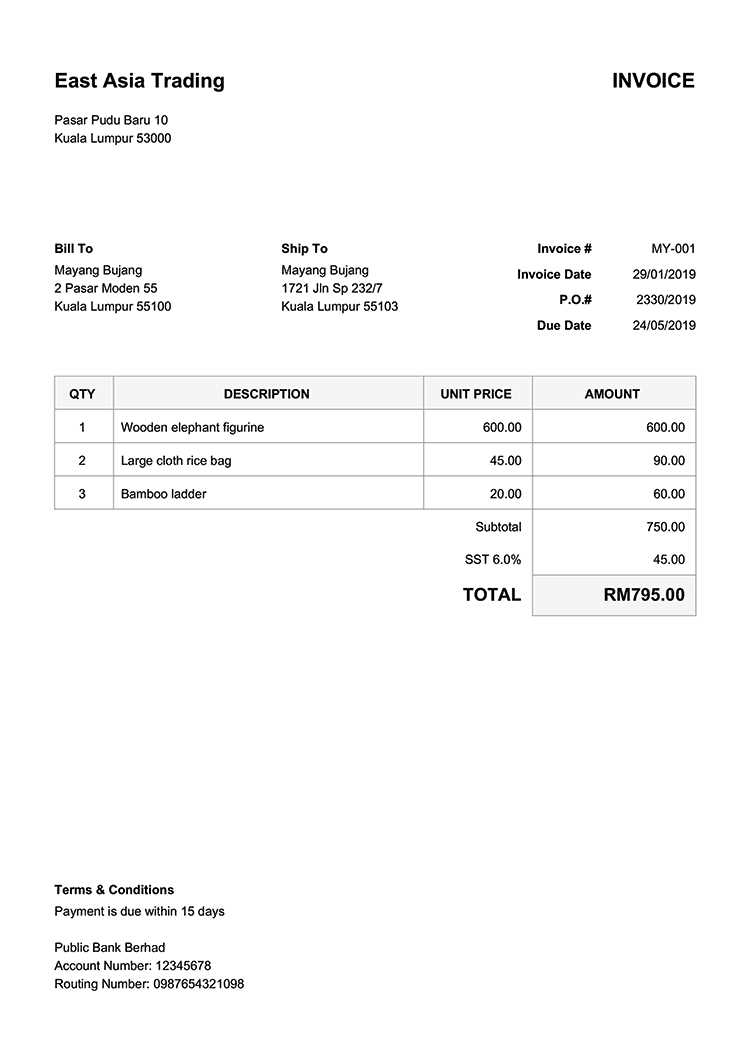

To create a free donation tax receipt, start with the required details: the donor’s name, donation amount, and date of contribution. Clearly specify if the donation was cash or non-cash (like goods or services). Include the organization’s name and address, along with your tax-exempt status. This ensures the donor can claim the tax deduction. Make sure to include a statement confirming no goods or services were exchanged for the donation unless applicable, as this can impact the deduction.

Key Sections for Your Template

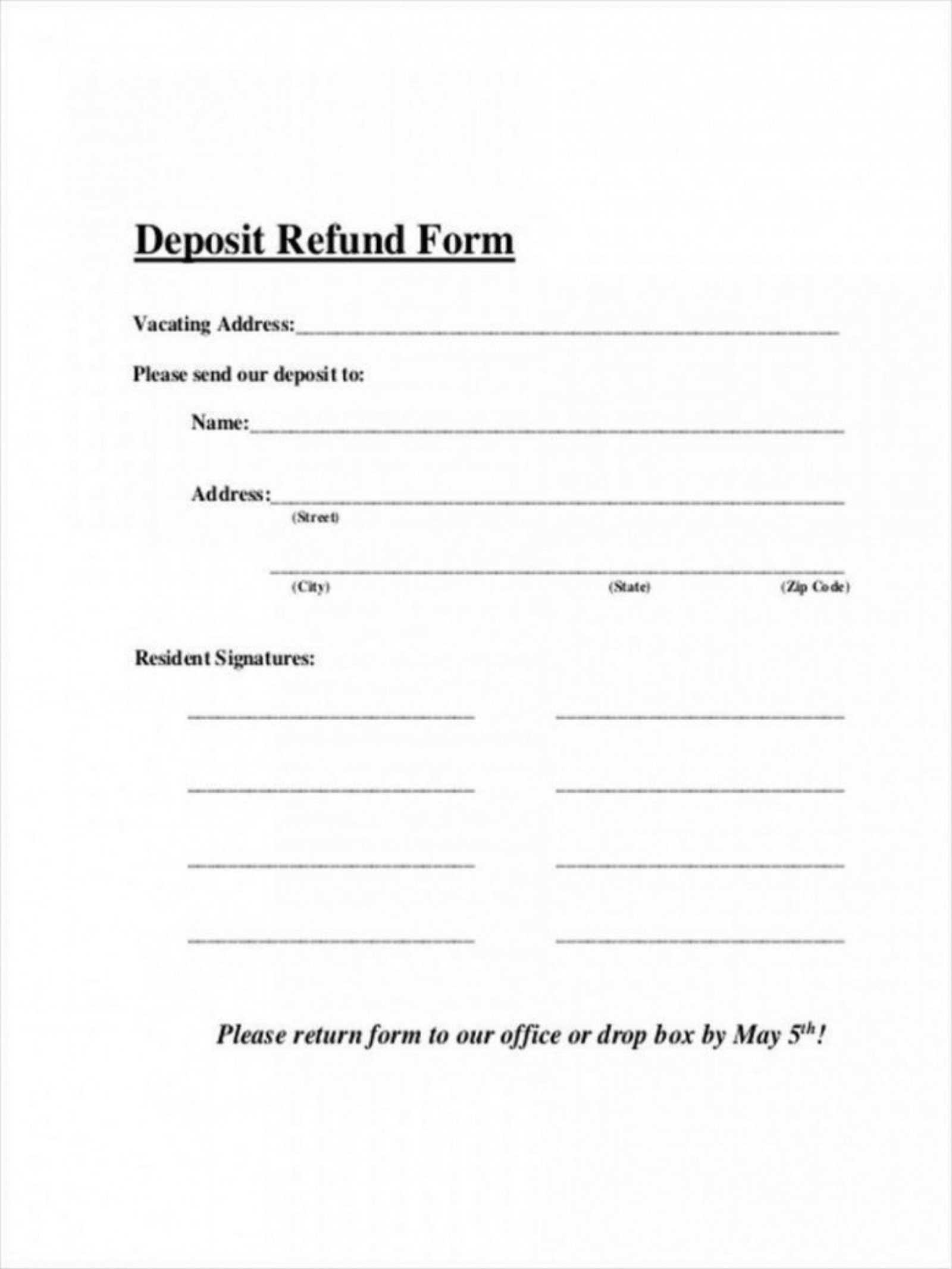

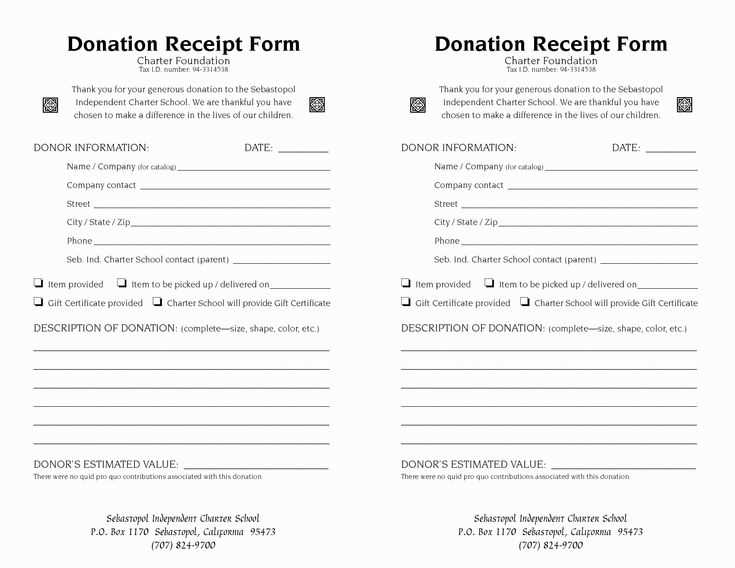

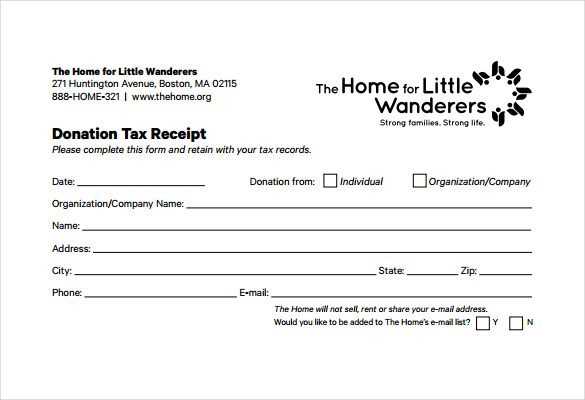

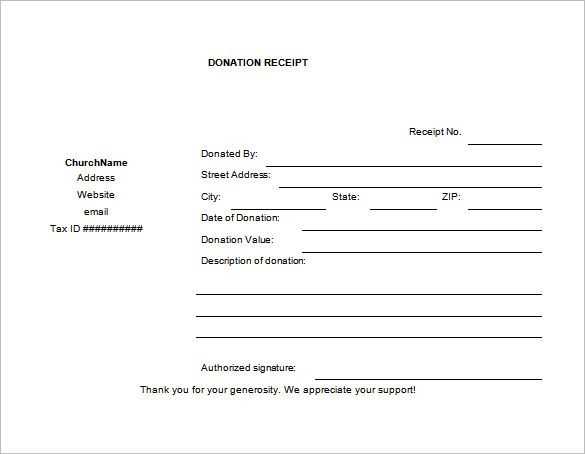

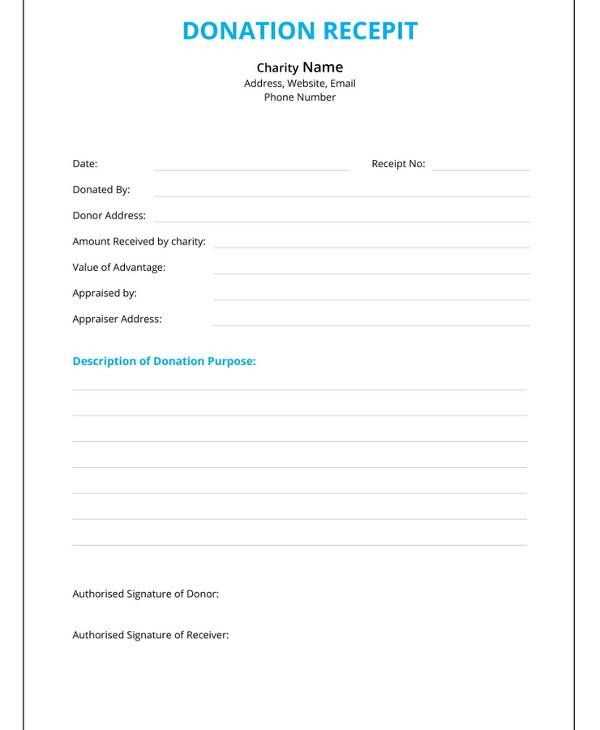

For simplicity, break your receipt into three key sections: donor information, donation details, and legal disclaimers. The donor’s information should include their name, address, and contact info. Donation details should list the donation date, amount, and type. Finally, include a legal disclaimer confirming your organization’s non-profit status, which grants the donor the right to claim tax deductions.

Additional Tips

Keep the design clean and straightforward, with enough space for the key details. Avoid unnecessary text and focus only on the information required by tax authorities. Also, consider providing a unique receipt number to track donations easily, especially for large organizations.

Free Donation Tax Receipt Template: How to Customize a Donation Receipt for Your Nonprofit

To create a donation receipt for your nonprofit, start with a template that includes key information: the donor’s name, donation date, amount, and the nonprofit’s details. Add a clear statement confirming that no goods or services were provided in exchange for the donation, unless applicable. This ensures transparency and meets IRS guidelines. Customize the layout with your organization’s logo and contact information, and consider including a thank-you note to encourage future support.

Legal Requirements for Tax Receipts: What to Include

Tax receipts must meet specific legal criteria to be valid for charitable donations. The IRS requires that receipts include the name of the nonprofit, the donation amount, the date, and a statement of whether the donor received any goods or services in return. For non-cash donations, a description of the item must be provided. If the value exceeds $500, additional documentation is necessary. Make sure your receipt complies with these rules to avoid complications during tax filing.

Where to Find Reliable Free Receipt Templates for Donations

Several online platforms offer free donation receipt templates, such as Canva, Google Docs, and Microsoft Office. Search for templates specifically tailored for nonprofit organizations to ensure they include all required fields. You can also find customizable templates from nonprofit associations or charity software providers. Using a reliable template saves time and ensures compliance with tax regulations while maintaining a professional look for your nonprofit.