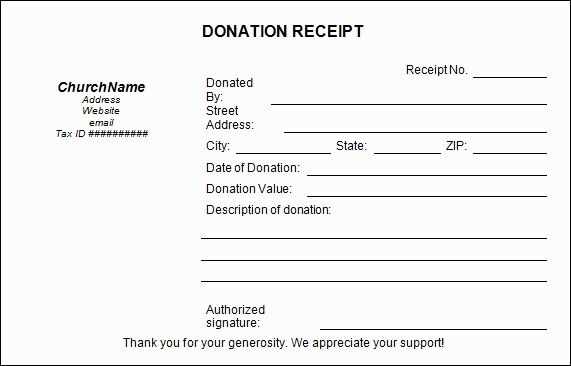

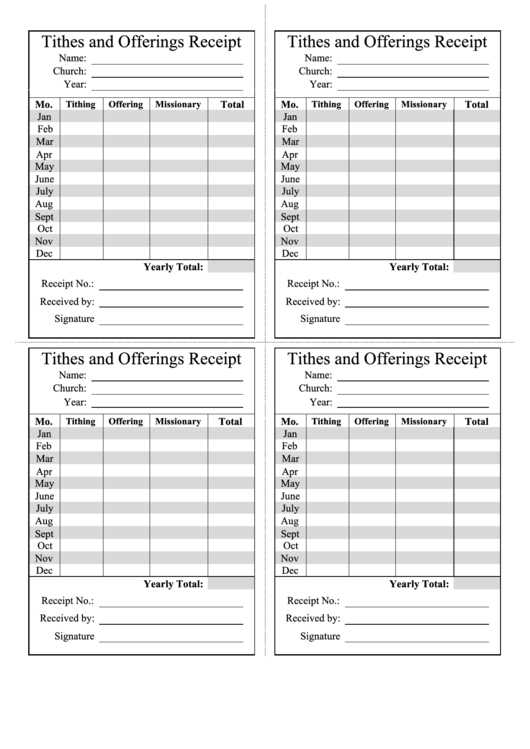

If you need a simple and clear donation receipt for your church, consider using a free template to save time and ensure accuracy. This template includes the key elements necessary to meet tax requirements and provide donors with confirmation of their contributions. The receipt should include the donor’s name, the date of the donation, the amount donated, and a statement confirming whether any goods or services were provided in exchange for the donation.

The template should be easy to customize with your church’s name and address. Ensure that it includes a section for any applicable tax-exempt status information, as this is essential for your donors’ tax filings. A straightforward and professional layout will make it easy for both the church and the donor to keep track of contributions.

By using a free template, you can focus more on the mission and less on paperwork. There are several resources available online offering downloadable templates that can be adapted to your church’s specific needs. These templates are user-friendly, allowing you to quickly issue receipts for donations throughout the year.

With a free church donation receipt template, you make the donation process smoother and more transparent for everyone involved, while also ensuring that your church maintains accurate records for tax purposes.

Free Church Donation Receipt Template

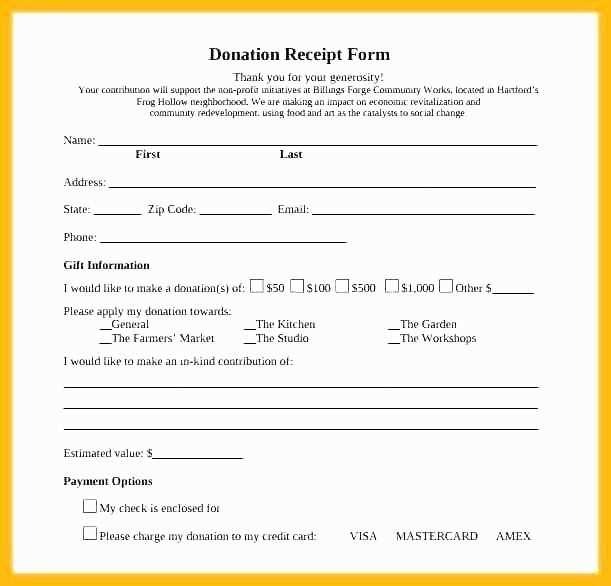

A simple donation receipt template for churches should include the donor’s name, the date of donation, and the amount or description of the donated item. Clearly state whether the donation is monetary or in-kind. Make sure to mention the church’s name, address, and a statement confirming that no goods or services were provided in exchange for the contribution, which is necessary for tax purposes.

Key Elements to Include

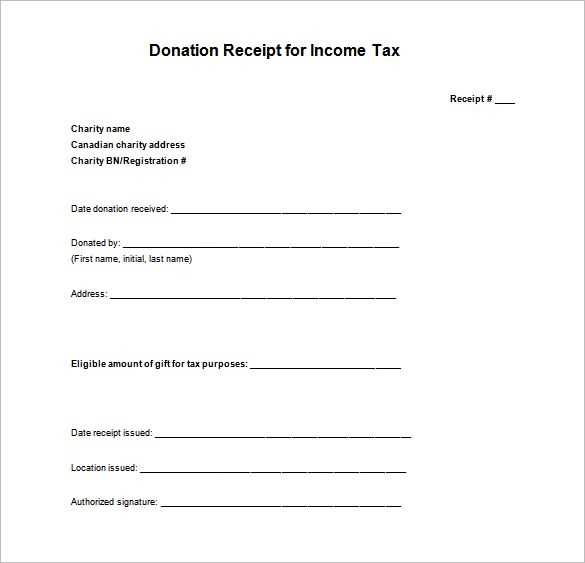

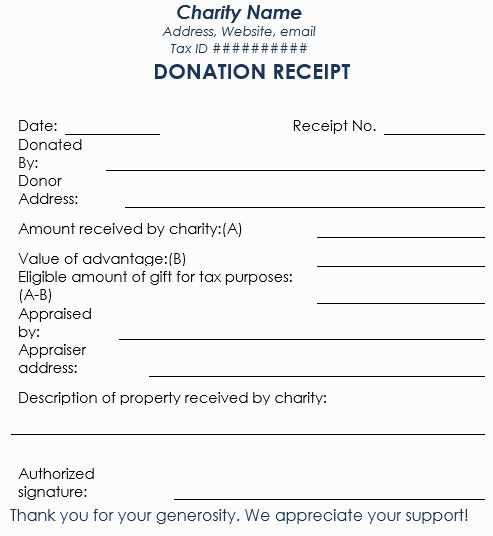

Ensure the receipt contains the donor’s full name and address, along with the exact date of the donation. For monetary donations, list the dollar amount; for in-kind donations, provide a description of the items along with their estimated value. The receipt should also clearly indicate that no goods or services were provided in exchange for the donation, to comply with IRS rules.

How to Use the Template

Customize the template by filling in the necessary details, and save a copy for your records. Issue the receipt promptly after receiving the donation, ensuring transparency and helping your donors keep accurate records for tax deductions.

How to Customize a Church Donation Receipt Template

Adjust the template’s header to reflect your church’s name, address, and contact details. This ensures donors know exactly who is receiving their contribution. Place these details at the top for visibility.

Include a unique receipt number to track donations. This number helps both your church and the donor keep records organized.

Modify the date format based on your local convention. For consistency, choose a clear date style that aligns with your accounting system.

Ensure the donor’s full name and address are accurately captured. This is key for tax purposes and ensures all information is properly attributed.

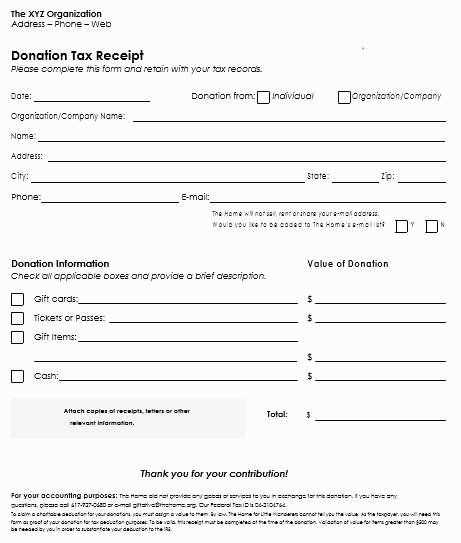

Specify the donation amount clearly. You can break down the donation into categories (e.g., cash, check, online) to provide a detailed record. If the donation includes goods or services, list them separately.

Provide a description of the purpose of the donation. If the donor has specified a particular fund or project, reflect that in the template. This creates transparency for both parties.

Finally, add a thank you note at the end. A simple sentence like “Thank you for your generous support” adds a personal touch and acknowledges their contribution.

Steps to Ensure Compliance with Tax Regulations

Begin by confirming that your church is recognized as a tax-exempt organization under IRS guidelines. This status ensures donations are eligible for tax deductions. Make sure to maintain accurate and detailed records of all donations received, including donor names, dates, amounts, and the value of non-cash donations.

Issue Receipts for Donations

Always provide donation receipts to contributors, including the church’s name, the date of donation, and the amount. For non-cash donations, include a description of the items donated and a statement confirming no goods or services were provided in exchange for the donation.

Monitor Donation Limits and Deductions

Track the value of donations to ensure they stay within permissible limits for tax deductions. Keep an eye on annual limits set by tax authorities and remind donors of their responsibility to report their donations on their tax returns.

Review IRS guidelines regularly to ensure your procedures align with tax regulations and that receipts are issued in compliance with these requirements.

Best Practices for Distributing Donation Receipts

Distribute donation receipts promptly after receiving a contribution. This builds trust and ensures that donors have the necessary documentation for tax purposes. Try to send receipts within a few days to avoid any delays.

Use Clear and Accurate Information

Ensure that each receipt includes the donor’s name, the donation amount, and the date of the contribution. This information must be accurate and match the donor’s records to avoid confusion or errors during tax filing.

- Include the church’s name and tax identification number (TIN) for verification.

- Specify whether the donation was monetary or in-kind, and provide an itemized list if applicable.

- State if any goods or services were provided in exchange for the donation, as this affects the deductible amount.

Choose the Right Format

Offering receipts in both digital and paper formats increases convenience. Some donors may prefer email receipts, while others may require physical copies. Ensure the format is easy to read and compatible with the donor’s preferences.

- Digital receipts can be emailed instantly, reducing the time between donation and acknowledgment.

- For paper receipts, ensure legibility and accuracy of all printed details.

Keep track of all receipts distributed for record-keeping and future reference. Use a database or spreadsheet to store records, making it easier to provide duplicates if requested.