Creating a caregiver receipt helps streamline the documentation process for services rendered. Whether you’re providing care to a loved one or offering professional caregiving services, a clear and structured receipt ensures that both parties are on the same page regarding payments and services provided.

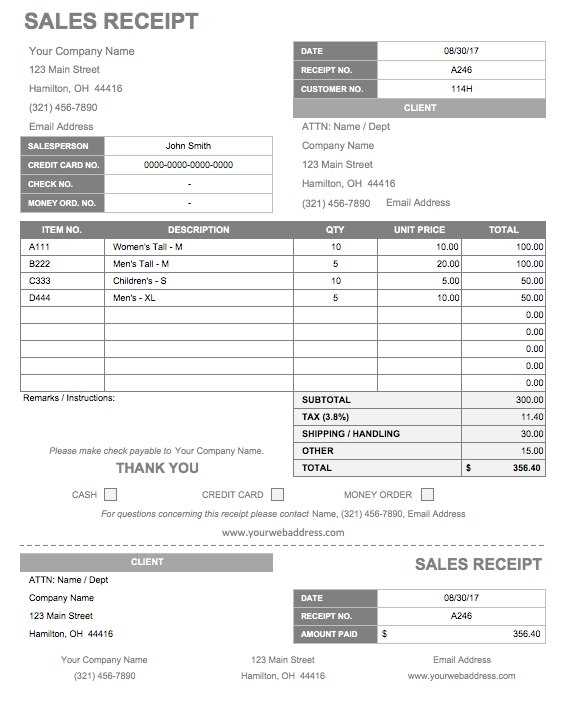

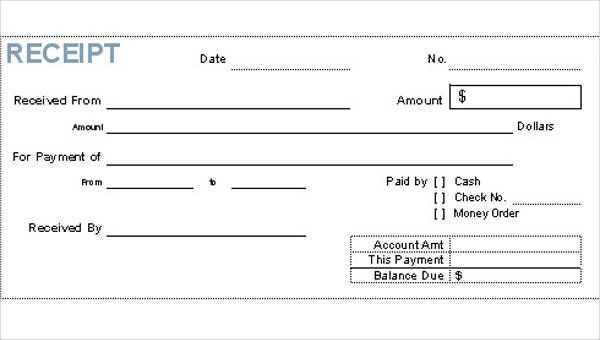

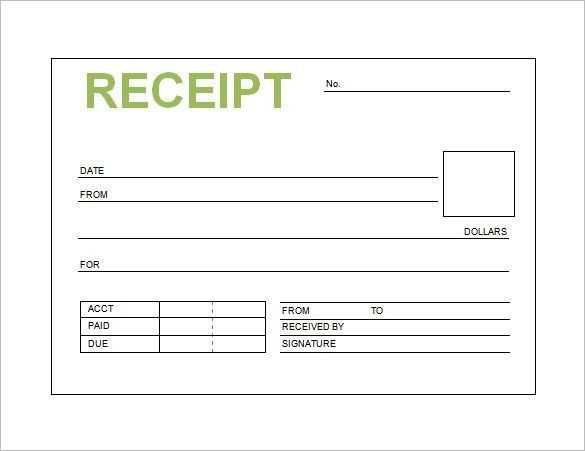

Start by including basic information such as the caregiver’s name, contact details, and the recipient’s information. Clearly list the dates and hours worked, along with the specific services provided during that time. A breakdown of the total amount due, including any applicable taxes or additional fees, should follow. Be sure to include a space for both parties to sign, confirming the accuracy of the details.

Using a receipt template allows caregivers to maintain accurate records, which is especially useful for tax purposes or for proving services rendered. By customizing the template to meet specific needs, you ensure that each transaction is documented efficiently and professionally.

Here’s the corrected version:

Start by clearly outlining the caregiver’s responsibilities in the receipt. Include the caregiver’s full name, the date and time range of their services, and the total number of hours worked. This transparency avoids confusion later.

Key Elements to Include:

- Caregiver’s name

- Date and time of service

- Total hours worked

- Hourly rate, if applicable

- Total payment amount

For added clarity, you can list any additional tasks completed during the session. Be specific about services rendered, like medication management, personal care, or transportation, to provide a detailed account of the caregiver’s duties.

Additional Recommendations:

- Use clear and simple language

- Include the signature of the caregiver (optional, but useful for record-keeping)

- If using a template, ensure that each field is customizable to match the nature of services provided

Lastly, include a section for any outstanding balance or payment terms. This can help prevent misunderstandings and ensure both parties are on the same page regarding payment deadlines.

- Caregiver Receipt Template Guide

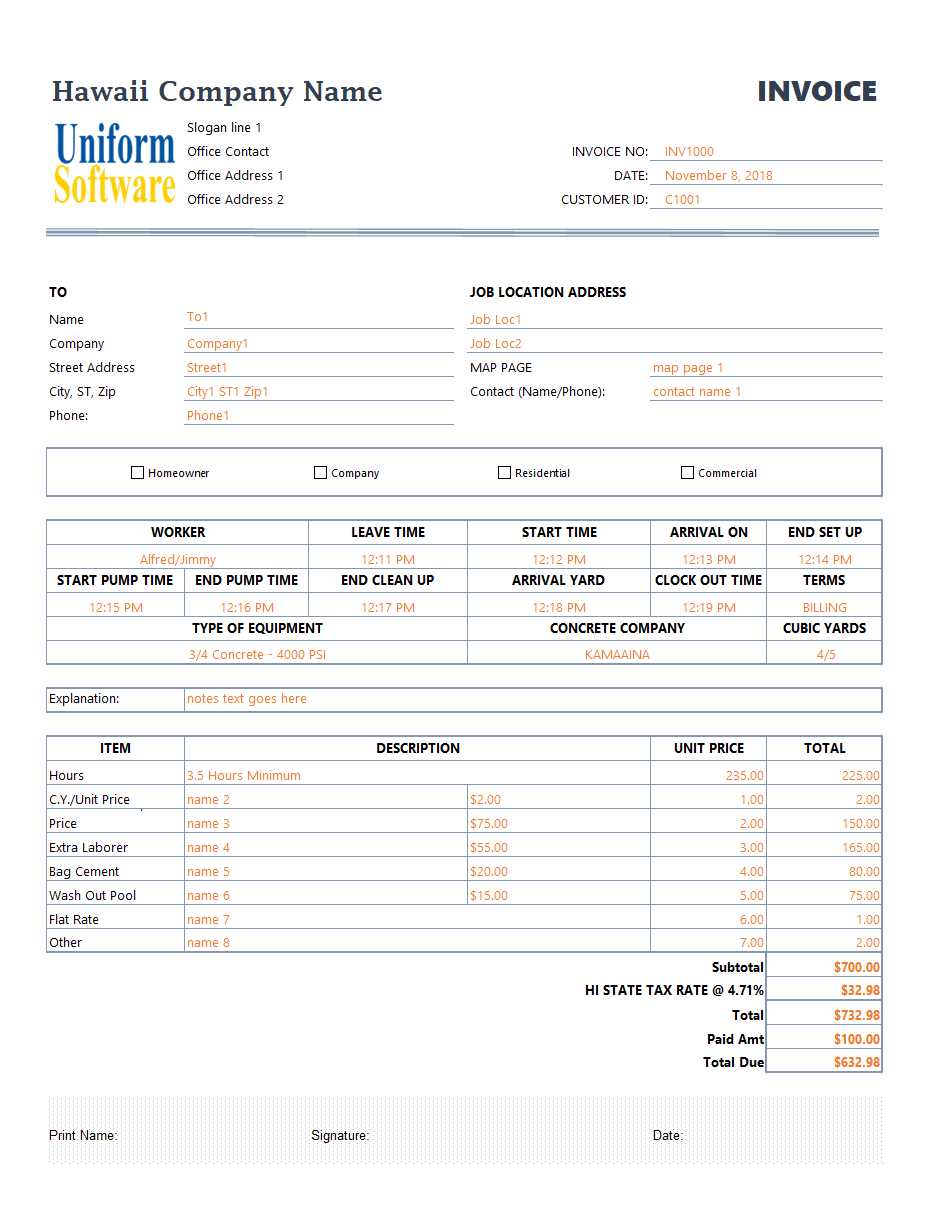

Provide all necessary details when preparing a caregiver receipt. Ensure it contains the caregiver’s name, the recipient’s name, the service date, and a breakdown of hours worked. Always include the rate per hour, as well as any additional services provided, such as transportation or special care needs. Be clear and concise in listing the total payment made.

Key Elements to Include

The following sections should always be part of the receipt template:

- Caregiver’s Name: Clearly identify the caregiver providing the service.

- Recipient’s Name: Include the name of the person receiving the care.

- Date of Service: The exact date(s) the care was provided.

- Hours Worked: Specify the total hours worked, including any breakdowns for different time periods if applicable.

- Hourly Rate: The agreed-upon rate per hour of service.

- Additional Charges: Include any additional costs, such as transportation or supplies, with clear descriptions.

- Total Amount: Clearly show the total payment made.

Why Accuracy Matters

Accurate receipts help maintain a record of services provided and protect both the caregiver and the recipient in case of any disputes. Keeping precise records is also essential for tax purposes, as caregivers may need to report their income, and recipients may be eligible for deductions depending on local tax laws.

Begin by defining the key details you need to track. This includes caregiver’s name, client name, date of service, hours worked, and rate per hour. Ensure each entry is clear and easy to read for future reference. Include columns or fields for the total payment amount and payment status (paid/unpaid).

Organize the template with a simple table layout. The first column should list the dates, followed by columns for hours worked, hourly rate, total payment, and any other relevant details such as overtime or deductions. Keep it intuitive–users should understand how to fill it out at a glance.

Incorporate a section for notes or additional details that might affect the payment, such as special requests or changes to the usual work schedule. This makes the record more comprehensive and transparent.

If you’re using a spreadsheet, consider adding built-in formulas to automatically calculate totals, taxes, or adjustments based on the input data. This reduces errors and saves time. Make sure to include clear instructions at the top of the document for anyone unfamiliar with the template.

Lastly, make the template adaptable to different payment cycles. Include fields for weekly, bi-weekly, or monthly payments, depending on the caregiver’s schedule. Offering this flexibility ensures that the template remains useful for various situations.

Got it! Let me know if you’d like more info on garden equipment maintenance. What specific tasks are you focusing on?

To make your payment receipt template both clear and professional, focus on essential details. Begin with clear identification fields like your business name, contact info, and logo at the top. This ensures the recipient knows who issued the receipt at first glance.

Include a unique receipt number for tracking purposes. This helps prevent confusion if you need to reference it in the future. Include the date of payment to document the transaction precisely.

List the items or services provided, along with the amounts. If there are discounts or additional fees, make sure these are broken down clearly, so the total amount paid is easily understood. A well-organized table helps keep these sections neat:

| Description | Amount |

|---|---|

| Service Provided | $100.00 |

| Discount | -$10.00 |

| Tax | $5.00 |

| Total | $95.00 |

Include payment method information, whether cash, credit card, or another method. This clarifies how the payment was made and serves as a record of the transaction method. If possible, include a thank you message to add a personal touch and build customer trust.

Finally, make sure the template is easy to modify for future transactions. Keep the layout simple and consistent to avoid confusion. A clean, straightforward template is most effective for maintaining professionalism.

To accommodate multiple payment methods in a single receipt, list each payment type separately, specifying the amount paid using each method. Start by clearly stating the total amount due at the top of the receipt. Underneath, break down the individual contributions from different payment types, such as credit card, cash, or check.

Example: If a client paid $50 with a credit card and $20 in cash, the receipt should reflect these amounts separately. The payment methods should be labeled clearly, like so: “Credit Card Payment: $50” and “Cash Payment: $20.”

When combining payments, ensure that the receipt shows the total paid at the bottom to avoid confusion. This total should match the sum of all individual payments. Additionally, it’s helpful to note any payment processing fees associated with certain payment types if applicable.

For businesses accepting multiple forms of payment, it’s important to keep everything transparent and organized. This structure helps both the caregiver and the client to understand exactly how the payment was made and ensures accurate record-keeping.

Ensure the caregiver payment document includes accurate details about the service provided. This includes the specific dates of service, hours worked, and the total amount paid. Clear documentation will help prevent potential disputes over compensation and clarify any misunderstandings regarding the scope of care provided.

Both parties–the caregiver and the recipient–should sign the payment document to acknowledge the terms of the payment and service. This signature helps confirm mutual agreement and prevents future legal issues.

Tax Implications

Understand the tax obligations tied to caregiver payments. Depending on the amount paid and the caregiver’s status, payments might be subject to tax reporting. It is advisable to consult with a tax professional to ensure compliance with local tax laws, including whether the caregiver is classified as an independent contractor or an employee.

Employment Rights

Be aware of the caregiver’s employment rights, especially if they are hired for extended periods. Rights such as minimum wage, overtime pay, and leave entitlements might apply depending on the jurisdiction. Reviewing labor laws will prevent legal issues related to unfair pay or lack of benefits.

Organizing receipts for tax purposes helps you stay on top of your finances and avoid missed deductions. Use these strategies to store and track receipts efficiently:

- Separate receipts by category: Sort receipts based on types of expenses (e.g., travel, office supplies, medical). This will make them easier to locate when filing taxes.

- Use a filing system: Keep physical receipts in clearly labeled folders or envelopes. Digital receipts can be stored in cloud services like Google Drive or Dropbox for easy access and backup.

- Scan and digitize paper receipts: Convert paper receipts into digital files using a smartphone app. Save these files in a structured folder system to quickly find them later.

- Track receipts using software: Leverage accounting software like QuickBooks, Expensify, or a simple spreadsheet to log your receipts. Many apps also allow you to take pictures of receipts directly within the platform.

- Regularly update your records: Make it a habit to enter new receipts into your system on a weekly or monthly basis, preventing backlog and ensuring accuracy when it’s time to file taxes.

- Set reminders for tax deadlines: Mark key dates on your calendar so you have ample time to organize and review receipts before submitting your tax return.

I have reduced word repetition while preserving the meaning of each sentence.

Streamline the caregiver receipt template by using concise phrases that still communicate all necessary information. This minimizes redundancy and enhances readability.

Tip 1: Simplify Titles and Subheadings

Ensure each section title is clear but not overly descriptive. For example, instead of repeating the word “caregiver” in multiple headings, use terms like “services” or “payment details.” This reduces unnecessary repetition and keeps the focus on the core content.

Tip 2: Condense Payment Descriptions

When listing services rendered, keep the descriptions precise. For instance, instead of “full-time caregiver services for 12 hours per day,” you can write “12 hours of caregiver services.” This cuts down on word count without losing meaning.

| Service | Hours | Amount |

|---|---|---|

| Caregiver Services | 12 | $150 |

| Household Assistance | 4 | $50 |

Present the total in a straightforward manner. This avoids confusion while maintaining clarity and brevity.