Creating a cash transaction receipt template ensures clear and accurate records for all cash transactions. This document helps both parties involved in the transaction to confirm the details of the exchange, fostering transparency and accountability.

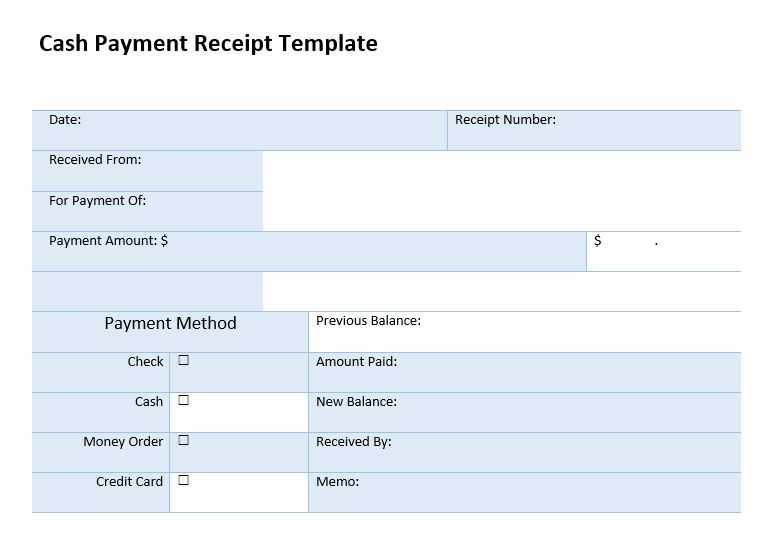

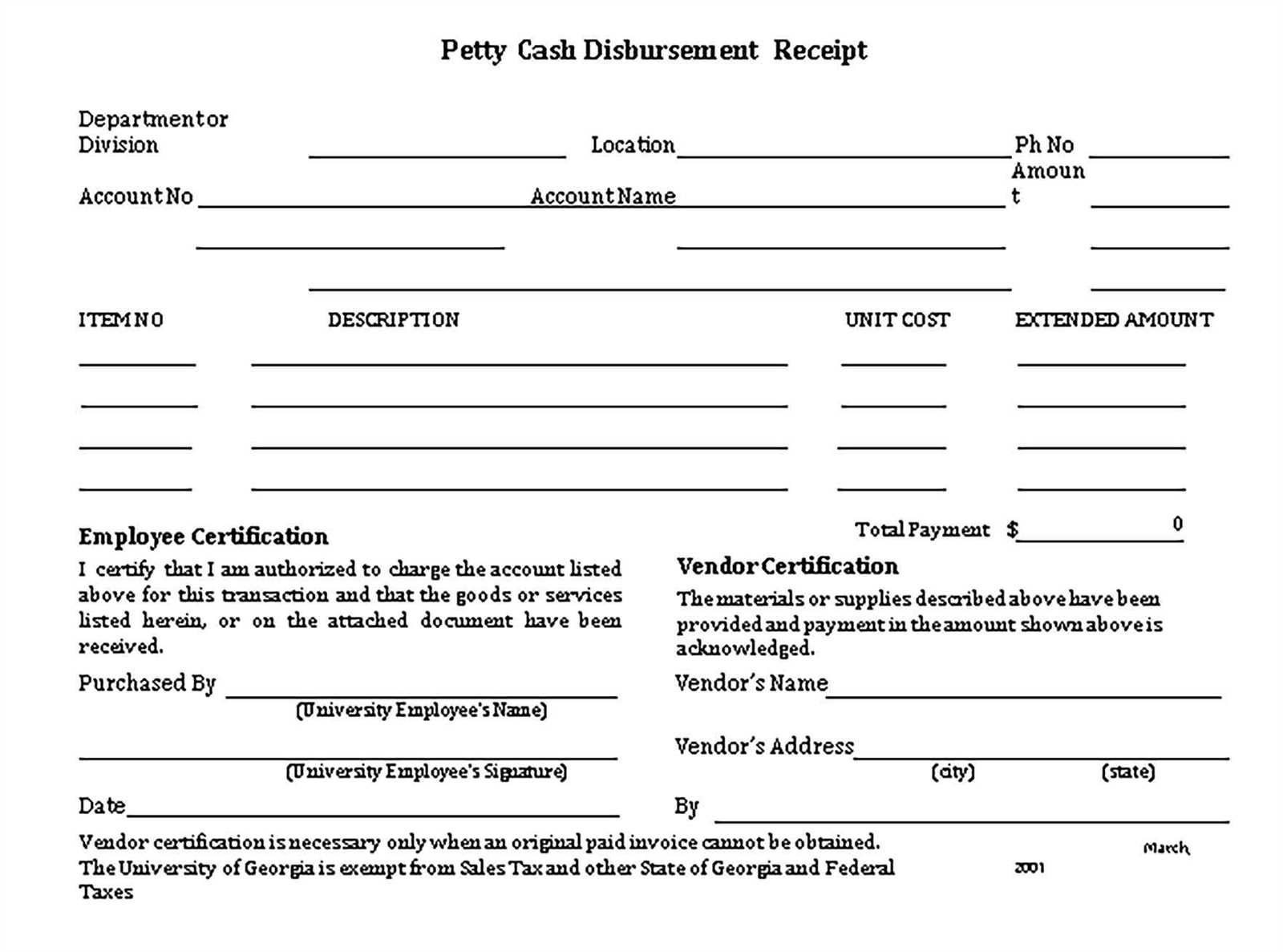

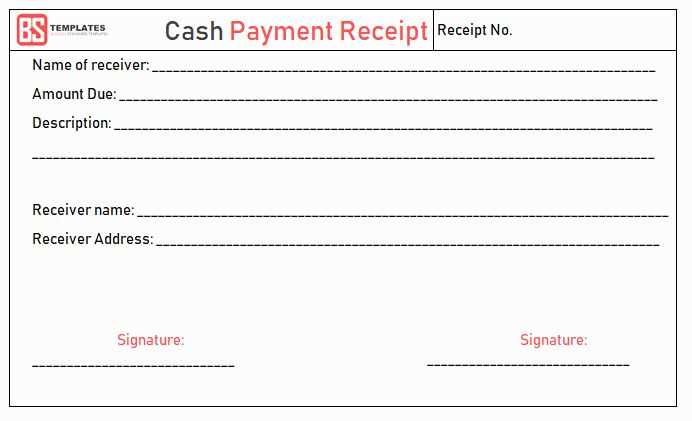

Start by including basic information such as the date, time, and location of the transaction. Specify the amount paid, and include a brief description of the goods or services provided. Make sure to include the names or identifiers of both the payer and the recipient to avoid confusion later.

Incorporating a unique receipt number can enhance tracking, especially when managing multiple transactions. This helps in organizing records for future reference or audits. A section for the payer’s signature or initials can also be added to confirm their acknowledgment of the transaction.

When designing your template, keep it simple yet comprehensive. A clear structure with organized fields will make it easy for both parties to fill in the necessary information. Consistency in format will also help in the long-term management of cash transactions.

Here are the corrected lines with repeated words removed:

Review the following suggestions to streamline your cash transaction receipt template:

- Ensure the receipt includes only necessary fields such as date, amount, and payment method.

- Remove redundant wording by combining similar descriptions into one clear sentence.

- Check for repetitive terms like “cash” and “transaction,” and remove unnecessary repetitions.

- Use concise language for the transaction description, avoiding lengthy explanations or redundant details.

- Double-check numbers and details to ensure there are no repeated entries that can confuse the user.

These small adjustments will make the template clearer and more user-friendly.

- Cash Transaction Receipt Format

Ensure the receipt includes these key elements: the date and time of the transaction, the amount paid, the method of payment, and the name or ID of the business or individual receiving the payment. Clearly indicate whether the transaction was completed in cash.

Details of the Format

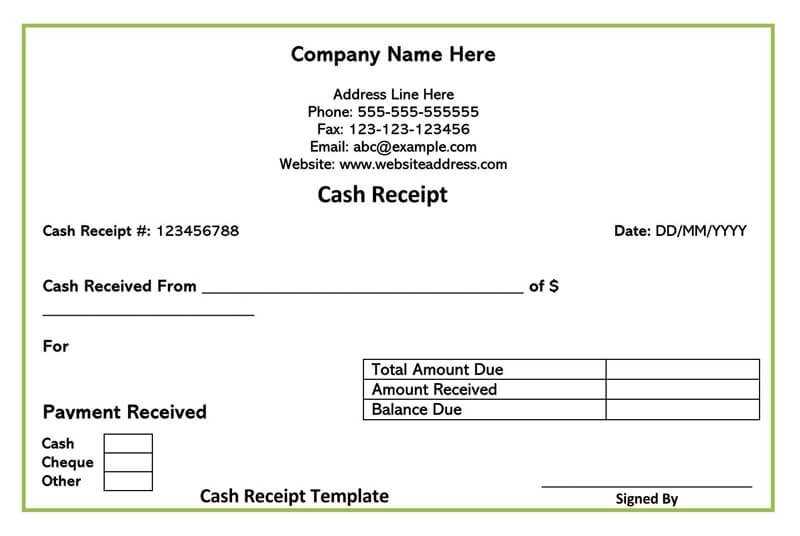

The receipt should be simple and easy to read. Include a header with the title “Cash Transaction Receipt” to immediately indicate the purpose. Below the header, list the transaction details: buyer’s name or ID, transaction number, and any additional notes such as payment references or item details. At the bottom, provide the total amount received and include a space for signatures if required.

Additional Considerations

Ensure the formatting is consistent, with clear divisions between each section for easy understanding. Use legible font sizes and spacing. It’s also helpful to include contact information for inquiries, as well as any applicable tax or fee details, depending on the nature of the transaction.

Begin with the date and time of the transaction. This detail helps both the issuer and the recipient to keep track of the payment accurately. Next, list the payment amount, making sure to specify the currency. This ensures clarity on the total amount being exchanged.

Include a unique receipt number to help identify the transaction for future reference. It is also useful to note the payment method used–whether cash, check, or another method. This distinction aids in reconciling payments and understanding the transaction type.

Provide a description of the goods or services purchased, along with any quantities or other relevant details. If taxes were applied, clearly state the tax rate and amount for transparency. Don’t forget to include the payer’s and payee’s names, addresses, and contact information, as this allows easy identification of both parties.

If applicable, add any terms or notes regarding the payment, such as refund policies or warranties, which can prevent misunderstandings later. Finally, ensure there is space for both parties to sign or initial the receipt, if necessary, confirming agreement to the transaction.

Include your business name, logo, and contact information at the top of the receipt for easy identification. Add a unique transaction ID and the date to help both you and the customer track the transaction later.

Clearly list the purchased items, including their names, quantities, and individual prices. Display any discounts applied, followed by a subtotal and the tax amount, showing them separately for transparency.

For cash payments, specify the amount received and the change given to avoid any confusion. If the payment was made by card, note the last four digits of the card number and any relevant authorization information.

Make the receipt more useful by adding a thank-you message or a promotional offer at the bottom. Ensure the layout is clear and easy to follow, and include any return or exchange policies if applicable.

Start by checking the structure of the template. Overcomplicating the design with unnecessary elements or complex layouts can confuse the user. Keep the template simple, focusing on the most important details, such as transaction date, amount, and method of payment.

1. Missing Required Fields

Ensure that all necessary fields are included, such as buyer information, transaction details, and signatures. Missing fields can create confusion or legal issues. Cross-check against your requirements before finalizing the template.

2. Inconsistent Formatting

Use consistent fonts, colors, and spacing. Inconsistency makes the receipt look unprofessional and can make important details hard to find. Choose a clear and readable font and apply it throughout the template.

3. Inaccurate or Outdated Information

Regularly update your template to reflect any changes in the business’s legal or financial obligations. This includes tax rates, company details, and payment terms. Double-check for accuracy before each use.

Another common mistake is leaving placeholders in the template. Don’t forget to replace placeholder text with actual information before issuing receipts.

To create a clear and professional cash transaction receipt template, ensure it includes the following key elements:

Basic Details

Include the date, time, and location of the transaction. This provides context and helps both parties track the transaction accurately.

Transaction Breakdown

Specify the items or services purchased, the amount paid for each, and the total. This ensures transparency and helps the buyer and seller keep a record of the transaction.

| Item | Price |

|---|---|

| Service 1 | $50 |

| Service 2 | $30 |

| Total | $80 |

By including these details, both the buyer and the seller will have a clear understanding of the financial exchange. Always ensure the receipt is easy to read and includes all necessary information for future reference.