A security deposit receipt provides a formal record of the deposit made by a tenant. It protects both the landlord and tenant by ensuring clear communication about the amount and terms involved. By using a security deposit receipt template, you make the process transparent and legally sound.

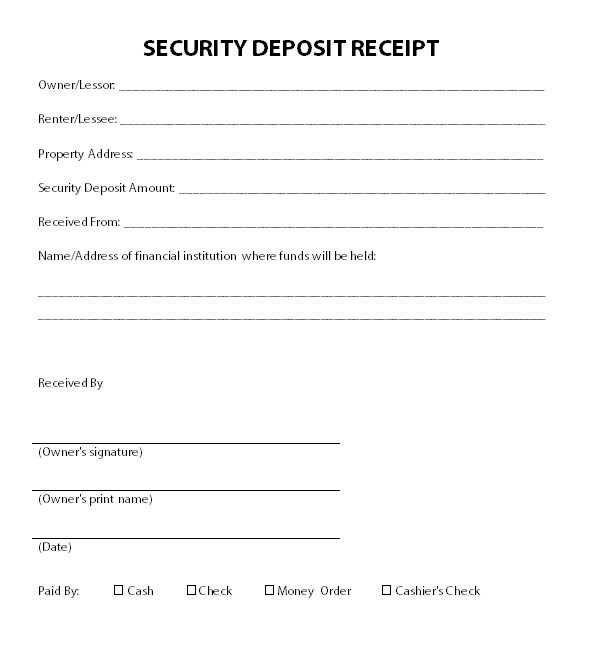

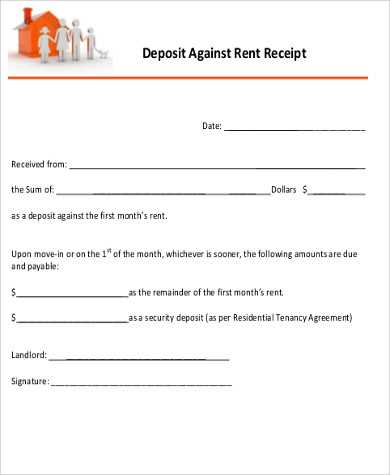

When creating this receipt, be sure to include key details such as the tenant’s name, the amount of the deposit, the rental property address, and the date it was received. This documentation helps prevent disputes over the deposit, ensuring both parties are on the same page when it’s time for the deposit to be returned or applied towards repairs.

Along with these basics, consider noting the conditions under which deductions may be made from the deposit, like damage repairs or unpaid rent. This clarity builds trust with your tenants and reduces the likelihood of misunderstandings down the line.

Using a reliable template can save you time and ensure you don’t miss any important details. Always keep a copy of the signed receipt for your records, and provide a copy to the tenant for their reference. This simple step will safeguard your rental business and avoid legal complications.

Here are the revised lines with redundant words removed:

Ensure the receipt includes the tenant’s full name, rental property address, and the amount of the security deposit. Specify the date the deposit is paid and outline the conditions under which it may be withheld, such as damages or unpaid rent.

Security Deposit Breakdown

Clearly list any deductions made from the deposit, with a brief description of the reason for each charge. Include a final balance, reflecting the total amount refunded or retained. Make sure all information is accurate to avoid disputes later.

Receipt Confirmation

Both landlord and tenant should sign the receipt. This confirms the deposit amount and acknowledges the agreement on terms of return or deductions. Keep a copy for both parties.

- Landlord Security Deposit Receipt Template

A security deposit receipt confirms the amount a tenant has paid to the landlord for potential damages or unpaid rent. It is crucial to provide a clear, accurate record of the transaction to avoid disputes later. Use the following points as a guide for creating a detailed receipt:

Key Elements to Include

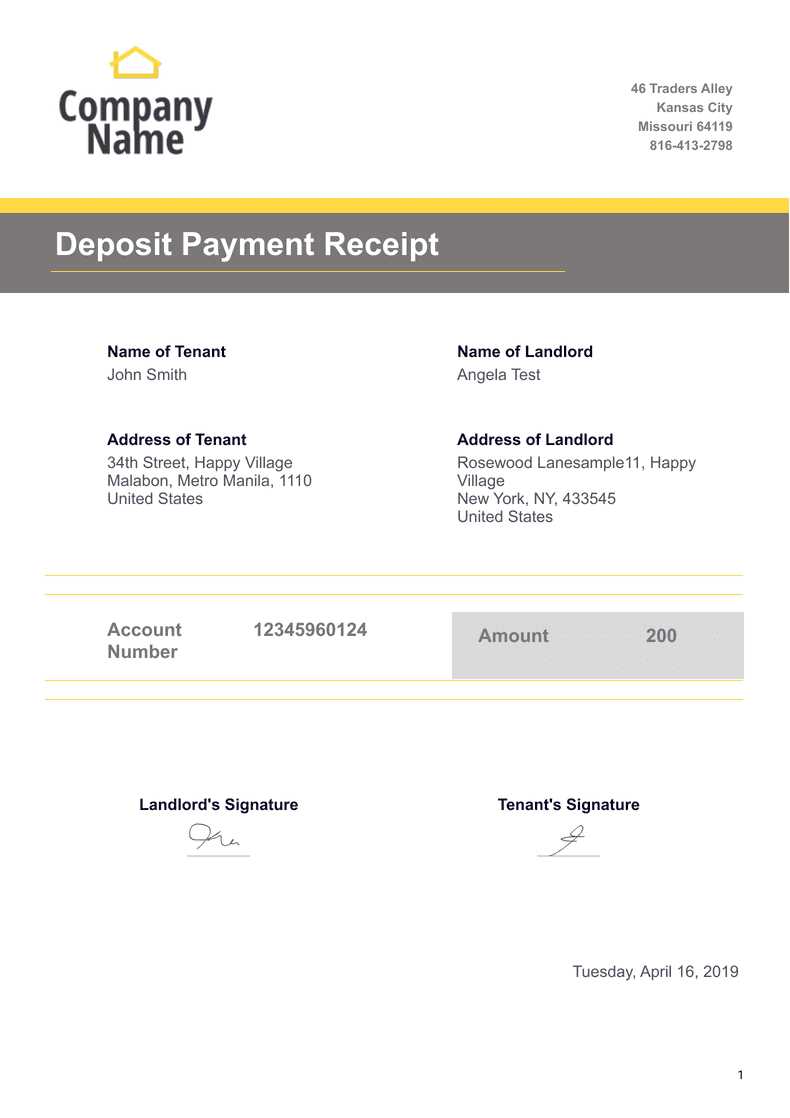

- Tenant’s Name and Contact Information: Ensure the tenant’s full name, phone number, and email are listed.

- Landlord’s Name and Contact Information: Provide your full name, phone number, and email.

- Amount Paid: Specify the exact sum of the security deposit received, in both numerical and written form.

- Date of Payment: Clearly state the date the payment was made.

- Property Address: Include the address of the rental property to which the deposit applies.

- Purpose of the Deposit: Describe the reason for the deposit (e.g., damages, unpaid rent). This helps avoid future confusion.

- Signature: Both landlord and tenant should sign and date the receipt to confirm the transaction.

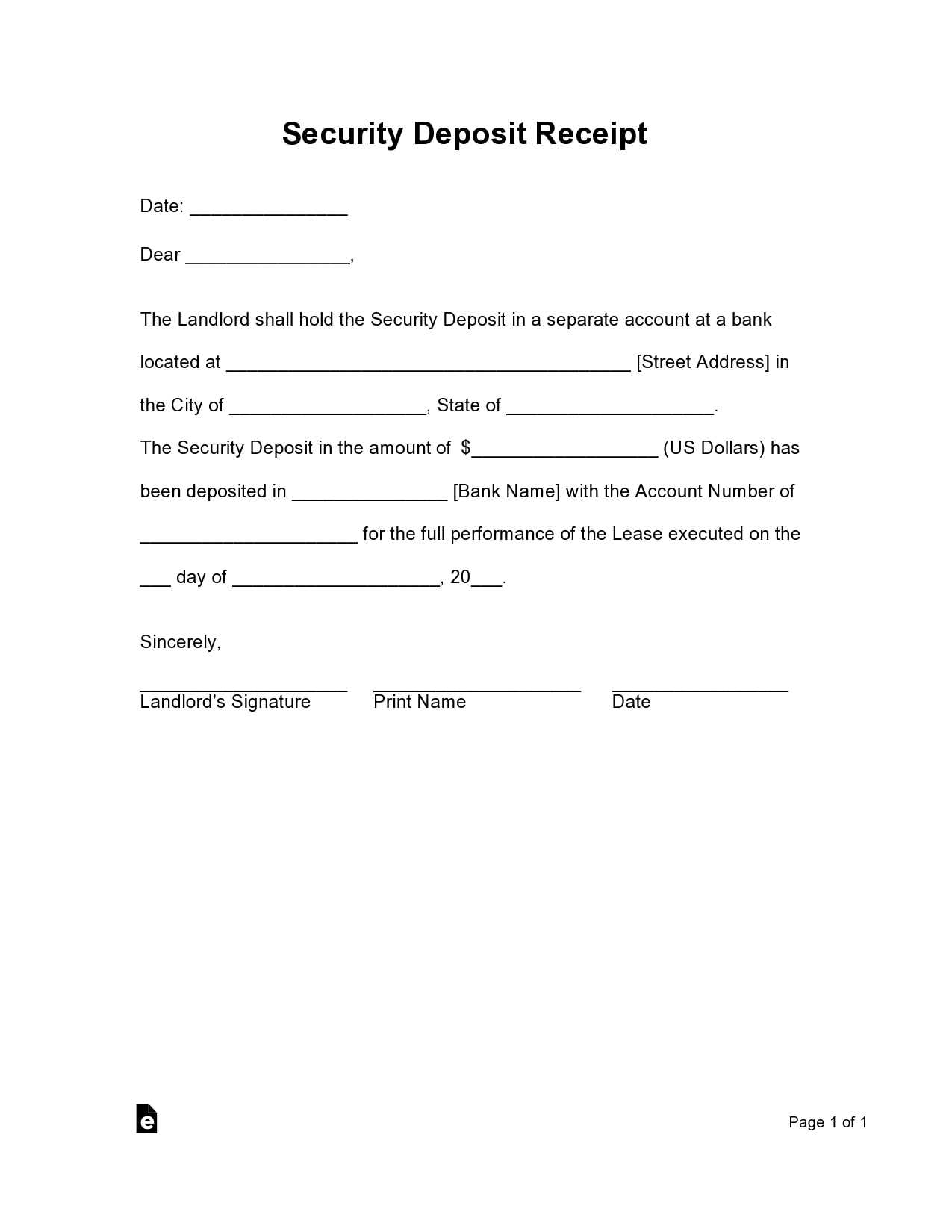

Template Example

Here is a simple template you can adapt:

Security Deposit Receipt Tenant Name: ___________________________ Landlord Name: ___________________________ Date of Payment: _______________________ Amount Paid: ___________________________ (____ dollars) Property Address: ________________________ Purpose of Deposit: _______________________ _____________________________________ Landlord Signature: _______________________ Tenant Signature: _______________________ Date: _______________________

By filling in these details, you protect both parties and ensure transparency throughout the rental process. Keep a copy of the receipt for your records and provide one to the tenant immediately after payment is received.

Include the tenant’s full name and rental property address at the top. Ensure the date of payment is clearly stated to avoid any confusion about the timing of the transaction.

List the exact amount paid by the tenant. This should match the security deposit agreed upon in the rental agreement. If the deposit is broken into multiple payments, list each amount along with the corresponding date paid.

Provide a brief description of the purpose of the security deposit. For example, note that it is held to cover potential damages, unpaid rent, or other charges as specified in the lease agreement.

If there are any deductions from the deposit, such as for cleaning fees or repairs, list these amounts individually. Clearly state the reason for each deduction, referencing specific clauses in the lease agreement where applicable. This transparency helps avoid disputes later.

Ensure the total amount of the deposit is listed both before and after any deductions. The final amount should reflect any remaining balance owed to the tenant after these deductions, if applicable.

Include your contact details, including your name or the property management company’s name, address, and phone number, so the tenant can reach you if there are any questions or issues regarding the deposit.

Have the tenant sign the receipt to acknowledge they have received it and understand the details. Provide them with a copy for their records, ensuring both parties have clear documentation of the transaction.

Each state has unique legal requirements for security deposit receipts. However, several common elements apply in most jurisdictions:

- Timeframe for Providing Receipts: Many states require landlords to provide a receipt immediately upon receiving the deposit or within a specified number of days (e.g., 7 days). Be sure to confirm the specific timeframe for your state.

- Deposit Amount Limits: Some states set a maximum amount a landlord can collect for the security deposit. It may not exceed a certain number of months’ rent. Verify the limit for your state to avoid violations.

- Detailed Accounting for Deductions: Several states mandate that landlords provide a breakdown of any deductions from the security deposit. This includes repairs or cleaning costs, with a specified period for returning the remaining balance to the tenant, typically 30 days.

- Interest on Deposits: In certain states, landlords must pay interest on the security deposit, especially if it is held for extended periods. Know if this applies in your state and the required interest rate.

- Itemized Receipt Requirements: Some states require a specific format for deposit receipts. This may include listing the tenant’s name, rental property address, deposit amount, and any deductions, along with the date of receipt and landlord details.

Confirm state-specific laws regarding security deposit receipts by consulting local landlord-tenant regulations or a legal professional. Adhering to these rules will help avoid disputes and potential penalties.

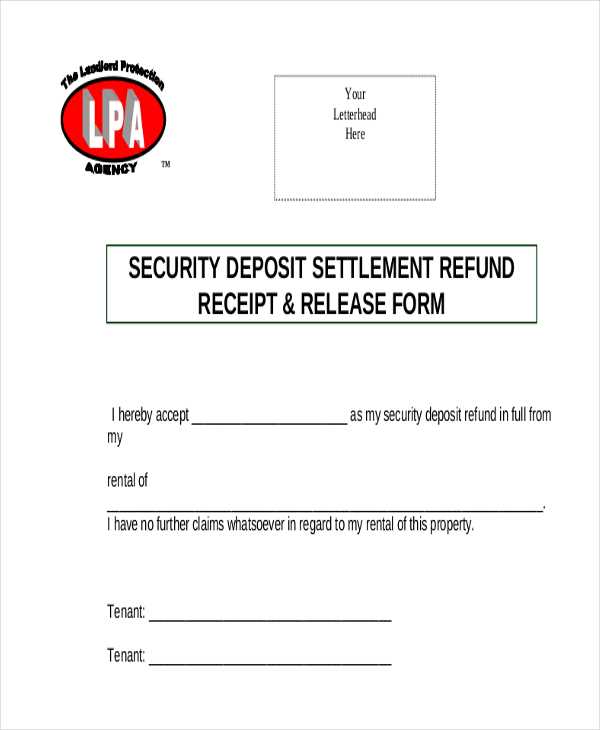

To resolve disputes effectively, keep the security deposit receipt as a key reference. It acts as proof of the initial agreement on the deposit amount and any terms related to its use. When disagreements arise, this receipt clarifies expectations, ensuring both parties are on the same page.

If a tenant disputes the return of the deposit, the receipt can be used to show the original condition of the rental property and itemize any deductions. In case of damage claims, refer to the condition report or photos taken at move-in, cross-referenced with the receipt. Always keep accurate records of deductions and repair costs, as these will support your case in any formal dispute process.

| Step | Action |

|---|---|

| 1 | Review the security receipt for specific deposit terms and conditions. |

| 2 | Gather documentation, such as move-in inspection reports and photos. |

| 3 | Document any repairs or cleaning costs with receipts or invoices. |

| 4 | Communicate with the tenant clearly, referencing the receipt and documentation. |

| 5 | If necessary, use the receipt in mediation or small claims court to resolve the issue. |

Having a well-organized security receipt can streamline the resolution process. In situations where formal dispute resolution is necessary, both parties will have a clear, documented foundation to rely on.

Include all relevant details in the receipt. This helps both parties clearly understand the terms of the deposit. Include the amount of the deposit, the property address, the date the payment was made, and the names of both the landlord and tenant.

Itemize Deductions

Provide a breakdown of any deductions from the security deposit. If there are damages or unpaid rent, list each item with its corresponding cost. This increases transparency and avoids misunderstandings later on.

Include Signatures

Both the landlord and tenant should sign the receipt. This confirms that both parties agree to the details listed. Having signatures on the document strengthens its validity in case of disputes.

Consider adding a clause that outlines the timeline for returning the deposit or the procedures for resolving any disputes. This ensures that both parties are on the same page about the expectations moving forward.