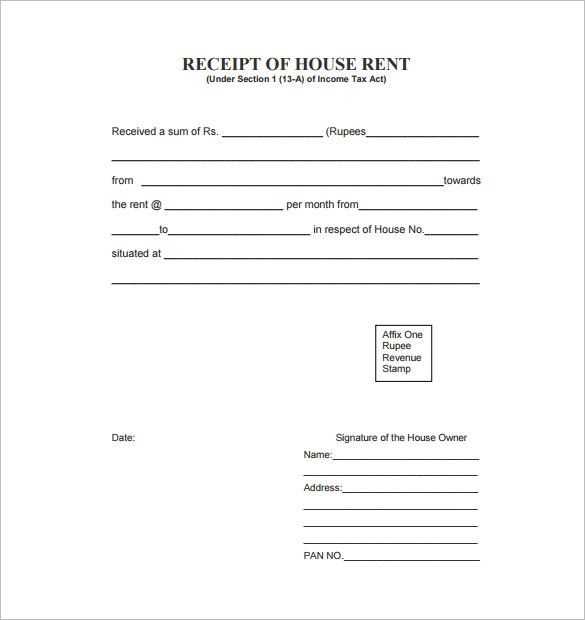

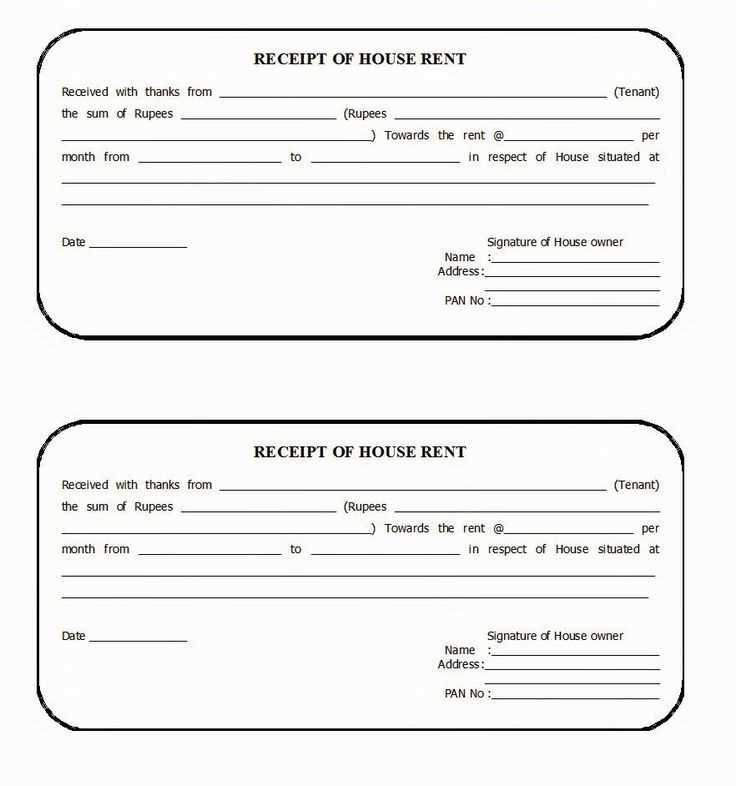

For landlords in India, providing a rent receipt is a crucial task to ensure smooth rental transactions. A well-structured receipt helps maintain transparency and can be used for tax purposes. Use a simple template that includes key information like tenant details, rental amount, payment date, and the rental period covered.

Ensure the receipt has a clear breakdown of the payment, especially if the rent includes utilities or other additional charges. The template should list all these components separately, giving both parties an easy reference for their records.

Important details to include: tenant name, property address, rent amount, payment date, and both landlord and tenant signatures. Providing a receipt immediately after receiving payment is a good practice, making the transaction officially recognized.

Tips for landlords: Keep a copy of each receipt for your records. This documentation is vital during tax filing or any legal disputes regarding rent payments. A consistent method for issuing receipts can also help in building trust and fostering a positive relationship with tenants.

Here are the corrected lines without repetitions:

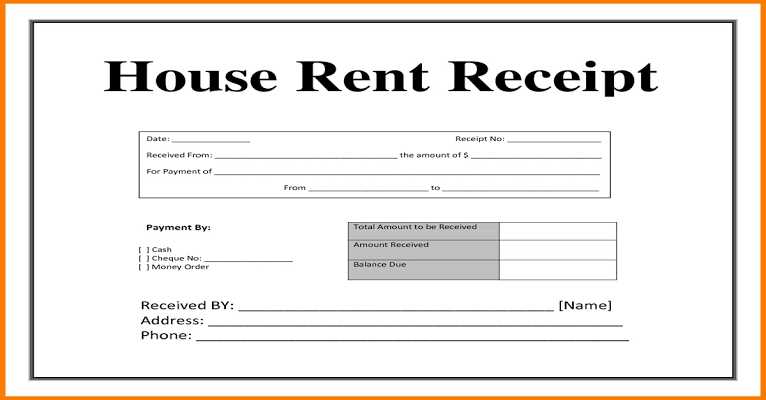

Ensure the rent receipt clearly states the rental period, with the exact dates mentioned. This should be in the form of a monthly or yearly span, depending on the agreement.

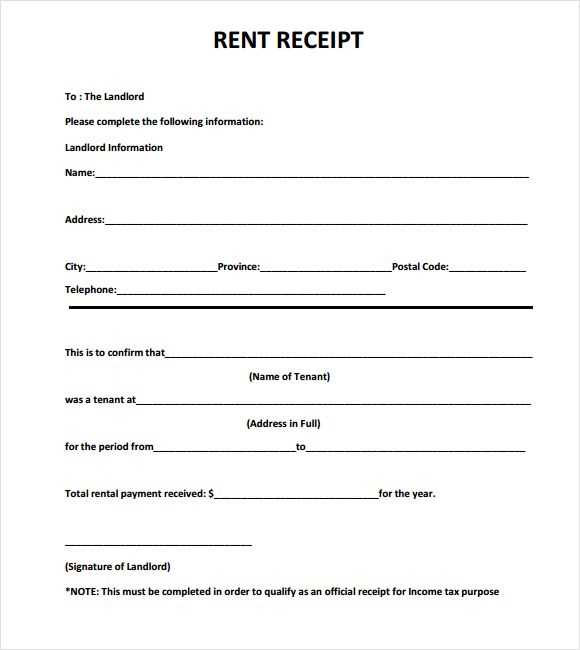

Include the full name and address of both the landlord and tenant. This eliminates any ambiguity and ensures both parties are clearly identified.

The receipt should contain the total rent amount paid. Avoid using terms like “approximate” or “estimated” as these can cause confusion in legal contexts.

List any additional charges separately, like maintenance fees or security deposits. Break these down in clear terms to prevent misunderstandings later.

Ensure the payment method is mentioned, whether it’s through bank transfer, cheque, or cash. Providing this detail creates a transparent record for both parties.

The receipt should be signed by the landlord, confirming the transaction is complete. An electronic or physical signature adds legitimacy to the document.

- Landlord Rent Receipt Template in India

To create a rent receipt template for landlords in India, ensure it includes specific details to make it valid and reliable for both parties. Start with the landlord’s name, address, and contact information, followed by the tenant’s details. Clearly mention the rent amount, due date, and payment method used. Include the rental property’s address and the period the payment covers.

Important Elements to Include

Ensure the template has the following sections:

- Landlord’s full name and contact information

- Tenant’s name and contact information

- Property address

- Amount paid and currency

- Payment method (bank transfer, cheque, etc.)

- Payment date

- Rent period (e.g., January 1 – January 31)

- Signature of the landlord

Legal Considerations

In India, a rent receipt is a legal document. Make sure it includes all required details for legal protection. Both parties should keep a copy for future reference. If the tenant requires it for tax purposes, the receipt can also act as proof of rent paid. A clear and accurate template helps avoid disputes and ensures transparency.

To create a clear and accurate rent receipt, ensure these details are included:

- Receipt Number: A unique number for each transaction helps with tracking.

- Tenant’s Full Name: Clearly mention the tenant receiving the receipt.

- Landlord’s Full Name: The property owner’s name must be listed as the issuer.

- Property Address: Specify the full address of the rented property.

- Payment Date: Include the exact date of payment.

- Rent Amount: Clearly mention the total rent paid for the rental period.

- Payment Method: State whether the payment was made by cheque, cash, or bank transfer.

- Rental Period: Define the period for which rent has been paid (e.g., month, quarter).

- Late Fees: If applicable, note any late payment fees.

- Signature: Both landlord and tenant should sign the receipt to acknowledge the transaction.

Rent receipts play a key role in legal matters related to property leasing in India. Landlords must issue rent receipts to tenants to comply with tax regulations and safeguard their interests. These receipts serve as proof of payment and can be used for legal purposes such as claims in court or tax deductions.

Income Tax and Rent Receipts

Rent receipts help both parties in tax-related matters. The tenant can use the receipt to claim deductions under Section 80GG of the Income Tax Act. Landlords are required to report rental income and maintain proper records of rent receipts for accurate tax filing.

Format and Information on Rent Receipts

The rent receipt should clearly mention the landlord’s name, tenant’s name, rent amount, date of payment, rental period, and property address. It is also advisable to mention whether the rent includes any additional charges, such as maintenance fees. A properly structured receipt ensures transparency and can protect both parties in case of legal disputes.

Include the full names of the landlord and tenant at the top of the receipt. This will clearly identify both parties.

State the property address to link the payment to the specific rental location.

List the rent amount in both numbers and words for accuracy and clarity.

Mention the rental period covered by the payment, specifying the start and end dates.

Indicate the payment method used (cash, bank transfer, etc.) for record-keeping purposes.

Assign a unique receipt number to each transaction for easy reference.

Include any additional details such as late fees or advance payments, if applicable.

Conclude with the landlord’s signature or an official sign-off to validate the receipt.

Clearly mention the rental amount and its breakdown in the receipt. Specify whether the rent includes any utilities or additional charges, such as maintenance or service fees. Indicate the payment frequency, whether monthly, quarterly, or annually. Always provide a clear description of the rental agreement’s terms and include any applicable late fees or penalties. Ensure both parties have copies of the receipt, and update it if any changes to the rent amount or payment terms occur. Keep records of all receipts for future reference and dispute resolution.