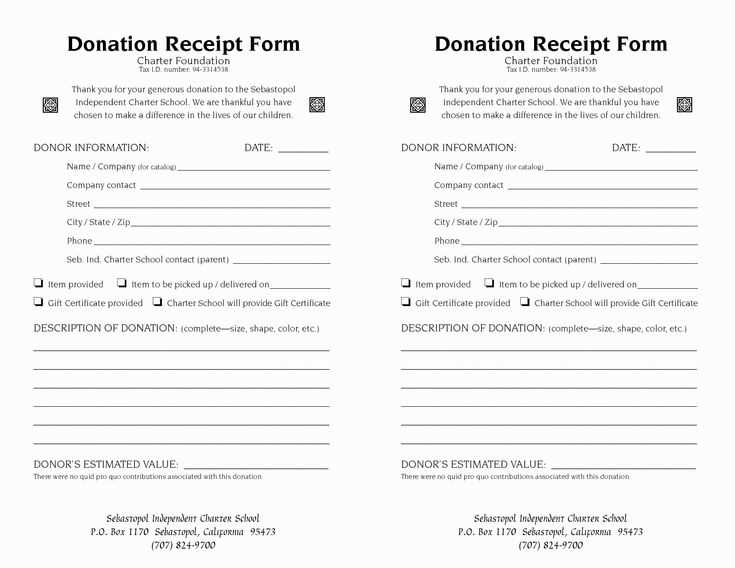

Provide donors with a clear and organized receipt that reflects their generosity. A well-structured receipt template includes key details such as the donor’s name, donation amount, date of donation, and the nonprofit’s information. Make sure the receipt is easy to understand and complies with legal standards, as this helps build trust with your supporters.

Donor Details: Always include the full name of the donor and contact information. This personalizes the receipt and ensures proper record-keeping for both the donor and the organization.

Donation Information: List the exact amount donated, specifying whether it was a one-time contribution or recurring. If the donation is in-kind, clearly state the item and its value, following IRS guidelines or other applicable laws. For cash donations, ensure that the organization’s name and tax-exempt status are also included.

Tax Information: Mention the tax-exempt status of the organization, if applicable. This gives donors the necessary information to claim deductions, creating a transparent and trustworthy environment.

Signature and Acknowledgement: Include space for a signature or electronic acknowledgment, confirming that the donation was received and processed correctly. This final step ensures both parties are on the same page regarding the donation.

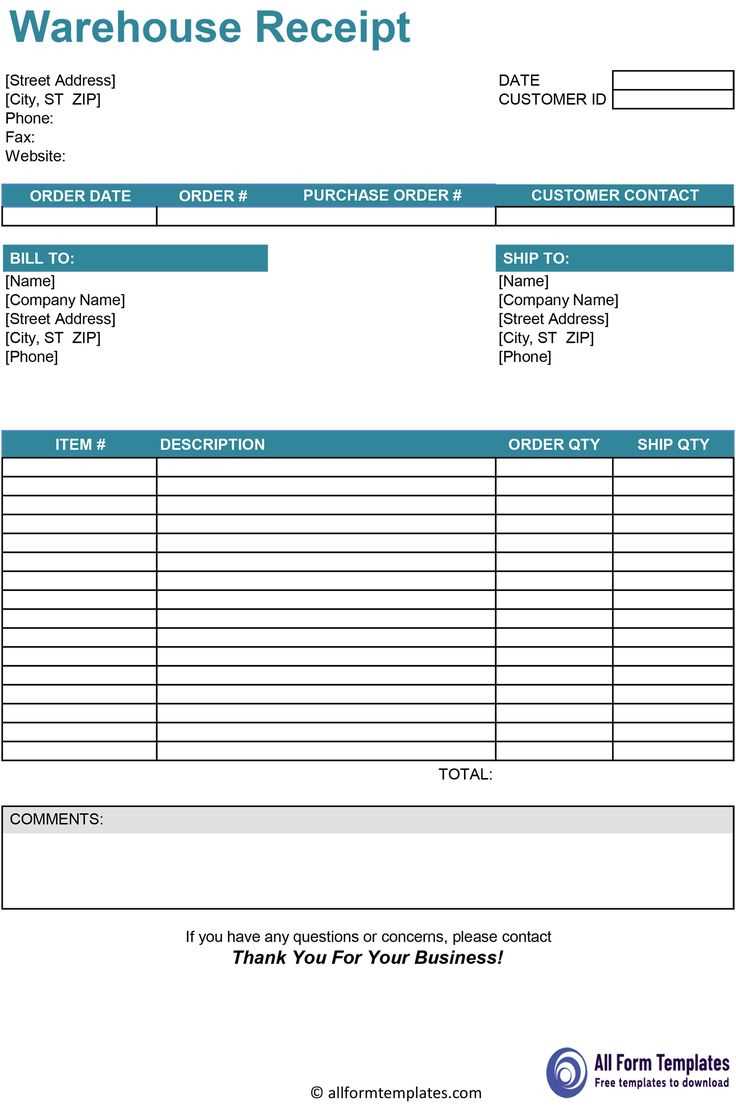

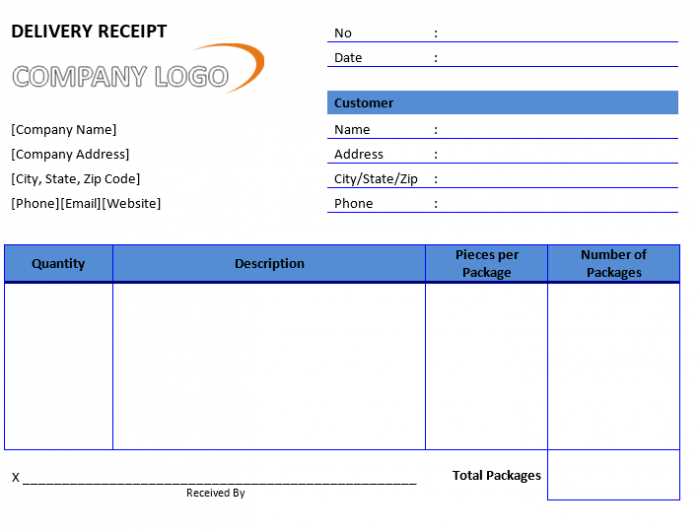

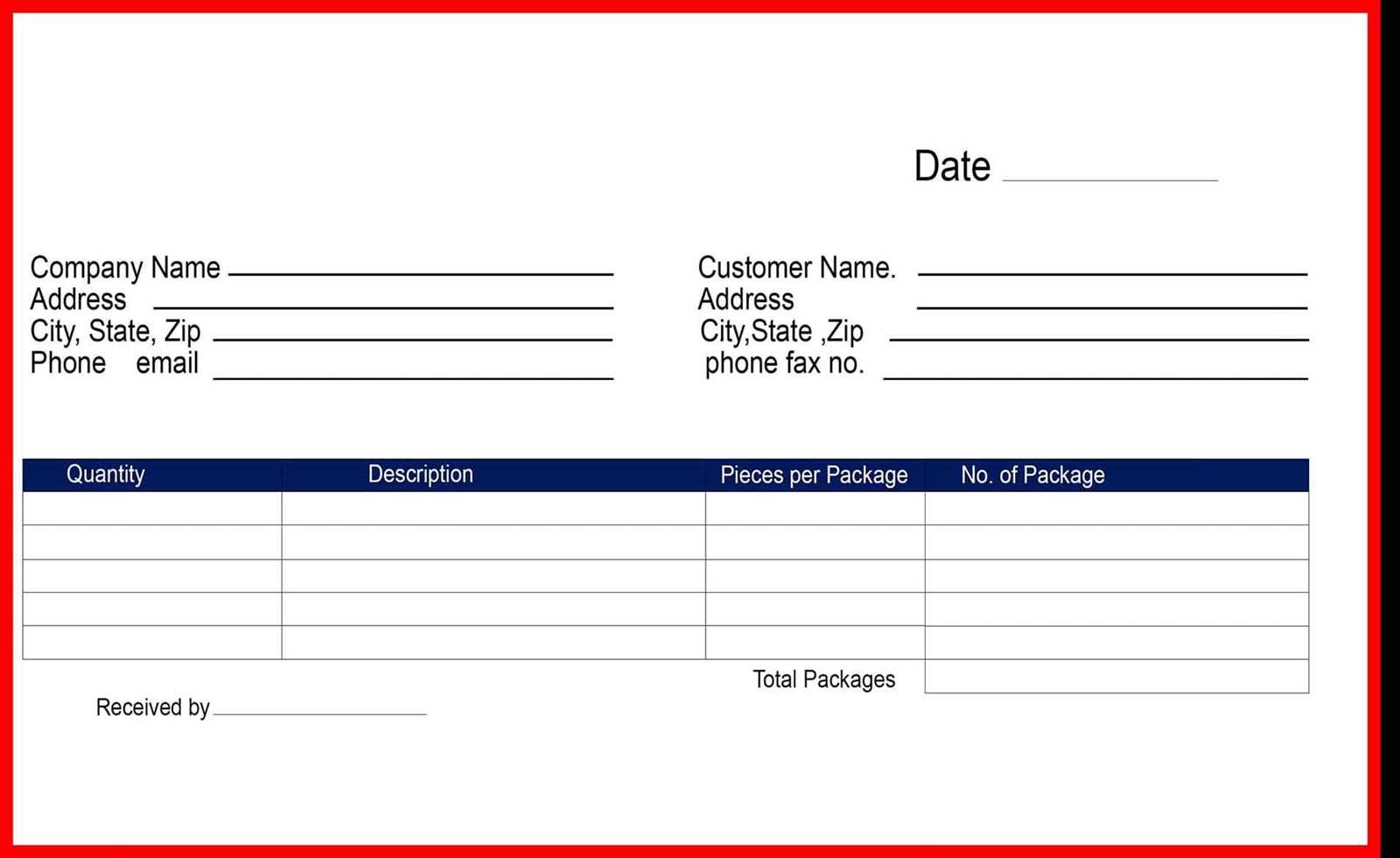

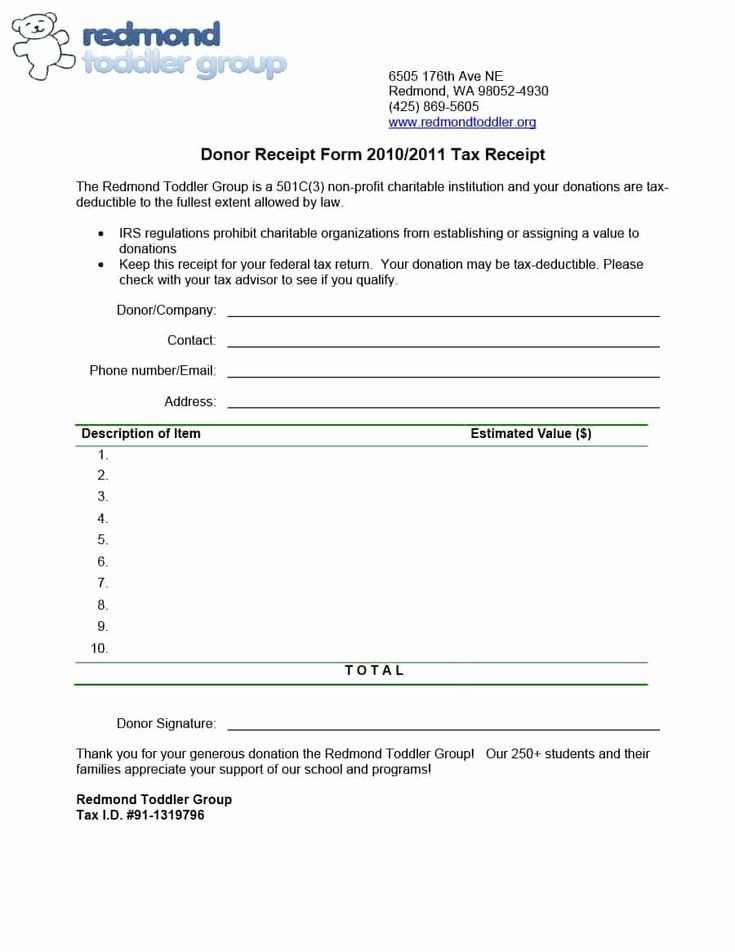

Template Form for Donors Receipt

For creating a donor receipt, the template should include all necessary details to ensure compliance with tax regulations. Make sure the form clearly lists the donor’s information, donation amount, and the date of the contribution.

Key Elements of a Donor Receipt

Include the donor’s full name, address, and contact information. Specify the amount or value of the donation, as well as the method of payment. If the donation is non-monetary, provide an accurate description of the item donated and its estimated value.

Additional Notes

If the donation is tax-deductible, indicate this on the receipt. Include a statement that the organization did not provide any goods or services in exchange for the donation, unless applicable. Always ensure that the receipt is signed by an authorized representative of the organization for authenticity.

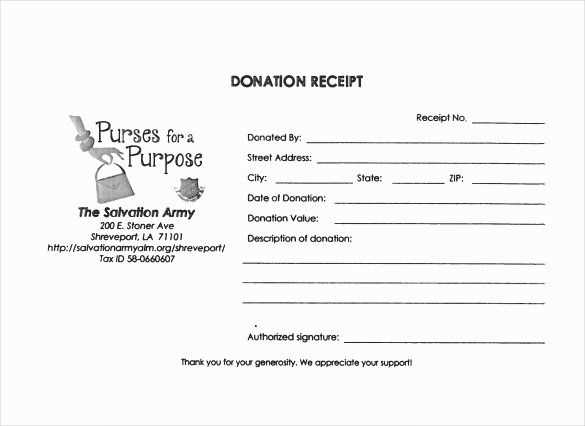

How to Structure a Donation Receipt Template

Begin with the organization’s name and contact information, including the address, phone number, and email. This helps the donor identify the source of the receipt and reach out if needed.

Clearly state the donation’s amount, specifying the currency. If the donor contributed items instead of money, include a description of the items with estimated values.

Include a brief statement confirming the tax-deductibility of the donation. This should reflect the nonprofit’s tax status and whether any goods or services were exchanged in return for the donation.

List the date of the donation. This is crucial for both the donor and the organization for record-keeping purposes and tax filing.

If applicable, provide a unique receipt number for tracking and reference.

Provide space for the donor’s name and address to ensure the receipt can be correctly matched to the individual for acknowledgment and tax purposes.

For easy reference, offer a section at the bottom for the signature of the authorized representative from the organization.

Key Legal Requirements for Donation Receipts

Donation receipts must include specific information to comply with tax laws and ensure transparency. A valid receipt should clearly state the donor’s name, the organization’s name, and the date of the donation. The receipt must describe the nature of the donation, specifying whether it is money or goods, and the value of donated items. For non-cash donations, it’s important to note that donors may need to provide an independent appraisal for tax deductions.

Include the organization’s tax-exempt status or EIN (Employer Identification Number) on the receipt. This allows donors to verify the legitimacy of the organization and ensures that the donation is tax-deductible. If the donor receives any goods or services in exchange for their contribution, the receipt should state the fair market value of those items, along with a disclaimer that the deductible amount is reduced by the value of the benefit received.

Some jurisdictions may require receipts for donations over a certain amount, so it’s important to know the thresholds in your area. Make sure the receipt is issued within the required timeframe to be valid for tax purposes. For example, many organizations must issue receipts by the end of the calendar year or within a certain number of days following the donation.

Customizing Donation Receipt Templates for Different Contributions

Tailor donation receipt templates to fit the type of contribution made. For monetary donations, highlight the total amount and date. Include the donor’s name and contact details, followed by a thank-you note. Ensure you mention whether the contribution is a one-time or recurring donation, as this information can affect tax deductions.

For In-Kind Contributions

Incorporate a description of the donated items, along with their fair market value, where applicable. If the donor provides multiple items, list each separately with an estimated value. This ensures transparency and supports the donor’s ability to claim deductions.

For Pledges and Fundraising Events

For pledges, outline the payment schedule and amount committed. If the donation is tied to an event, specify the event name, date, and ticket price, if relevant. Recognizing the donor’s participation in the event and noting any special recognition can further personalize the receipt.