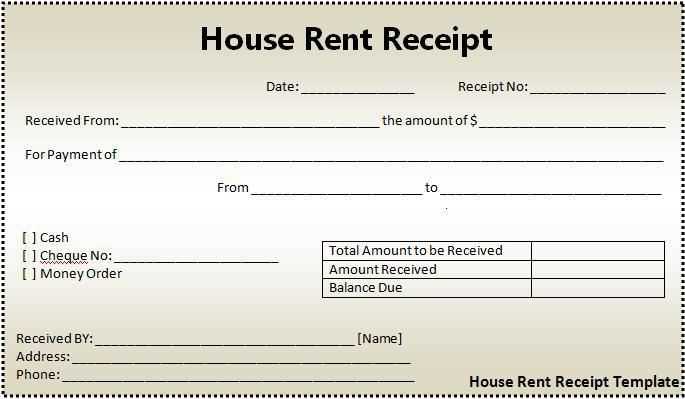

To create a tax receipt letter, begin by clearly stating the purpose of the document. Indicate the exact amount paid, the nature of the transaction, and any related details such as the date and recipient’s information. This ensures the letter serves as a proper record for tax purposes and simplifies future audits or tax filing processes.

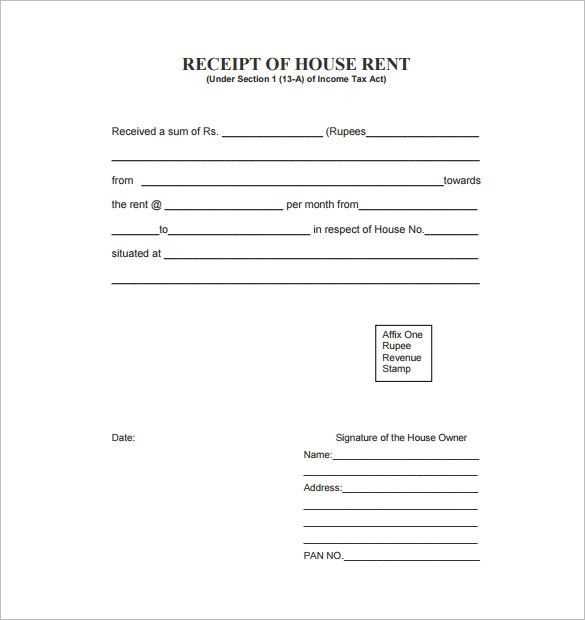

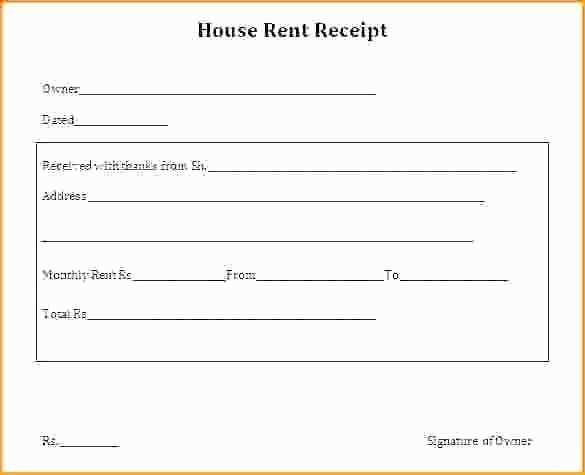

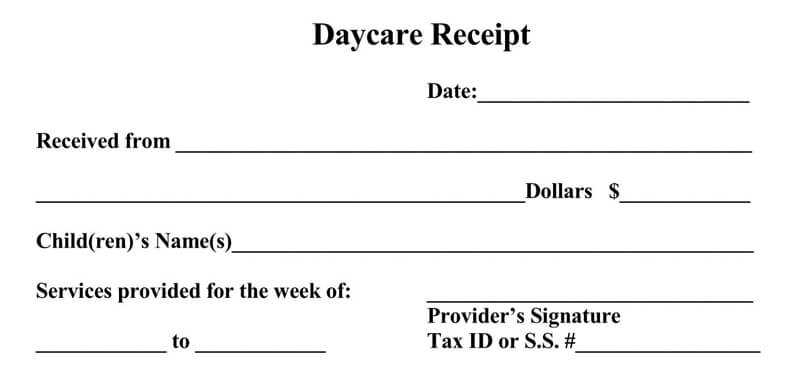

Include the payer’s and recipient’s details. Provide full names, addresses, and any relevant identification numbers. For businesses, the company’s name and registration number might also be necessary. This helps confirm the legitimacy of the transaction and link it to the correct entities.

State the payment details concisely. Mention the exact amount paid, the method of payment (e.g., cheque, bank transfer, cash), and the purpose of the payment. Include the transaction date to avoid any confusion. These specifics help the recipient trace the transaction back to their financial records.

Finalize with a professional closing. Ensure the letter ends with a polite note and provides any additional instructions or information for follow-up. Offer your contact details for clarification if needed. A well-structured tax receipt letter leaves no room for confusion and strengthens financial record-keeping.

Here’s the corrected version:

Ensure the recipient’s full name, address, and contact details are clearly presented at the top of the letter. Include the specific date of the transaction, payment method, and a breakdown of the tax amounts involved. Make sure the amounts are accurate, reflecting the correct tax rate for the service or goods provided. Always include a reference number for easy identification of the transaction.

Key elements to include

Include the company name, address, and tax identification number at the beginning of the letter. This ensures it meets official requirements and avoids confusion. Double-check the details of the goods or services to confirm they match the amounts recorded in your accounting system.

Formatting tips

Use clear and concise language. Break down the payment information into categories: total amount, tax percentage, and other relevant charges. This makes the letter easier to understand and reduces the likelihood of errors. Ensure your letter is neat and well-organized, with each section clearly marked.

Tax Receipt Letter Template: A Practical Guide

Key Elements to Include in a Receipt Letter

How to Format Your Receipt for Professional Use

When to Issue a Letter for Donations

Legal Requirements for Receipts in Different Regions

Common Mistakes to Avoid When Writing a Receipt Letter

How to Customize a Receipt Letter for Specific Purposes

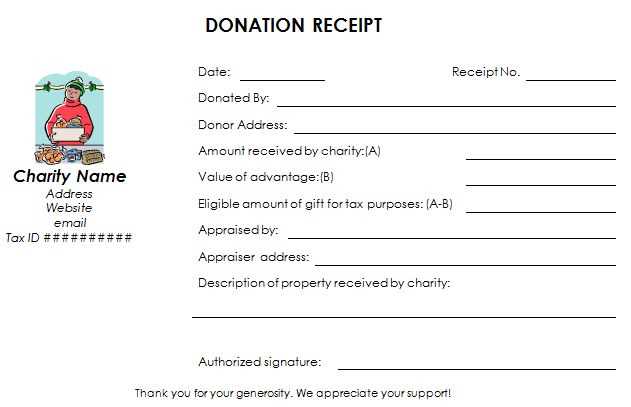

A tax receipt letter must include specific details to ensure clarity and compliance. The key elements include:

- Donor’s Information: Name, address, and contact details of the person or organization donating.

- Donation Details: A clear description of the donation, including the value, type (cash, goods, services), and date of the donation.

- Organization Information: The name, address, and registration number of the nonprofit or charity receiving the donation.

- Statement of No Goods or Services Provided: A declaration that no goods or services were exchanged for the donation, or if they were, the fair market value of the goods/services must be stated.

- Signature: The signature of an authorized individual from the organization, along with their title and the date.

How to Format Your Receipt for Professional Use

For a professional appearance, ensure that your receipt has a clean, easy-to-read layout. Use your organization’s letterhead at the top, and format the content clearly with sufficient spacing between sections. Be concise but thorough in the information you provide. Avoid unnecessary jargon or excessive wording. Make sure that the donation amount and the purpose are clearly marked, especially for large or multiple donations.

When to Issue a Letter for Donations

Issue a receipt immediately after receiving a donation. For tax purposes, ensure the letter is given within the year of the donation, typically before the tax season for individuals or businesses. If the donation was made at a special event or fundraiser, issue a receipt no later than 30 days after the event.

Legal Requirements for Receipts in Different Regions

Requirements vary by region, so it’s important to familiarize yourself with local tax laws. In some areas, nonprofit organizations must issue receipts for donations above a certain amount, while others may require more detailed reporting for tax-exempt status verification. Always check with your local tax authority to ensure compliance.

Common Mistakes to Avoid When Writing a Receipt Letter

Avoid vague or incomplete information. Ensure that the donor’s name, donation amount, and date are accurate. Double-check that the statement about goods or services is correct. Leaving out the donor’s tax information or the organization’s details can result in confusion or issues during tax filing. Keep the language clear and to the point.

How to Customize a Receipt Letter for Specific Purposes

When tailoring a receipt letter for specific situations, such as a major gift or a memorial donation, be sure to include any special instructions or notes that may apply. For example, for a memorial donation, you may include information about the memorial or the intended purpose of the funds. Customizing the letter shows your attention to detail and ensures it fits the needs of both parties.