Creating a vehicle donation receipt is a straightforward process. This document serves as proof of donation and is important for both the donor and the receiving organization. It should clearly indicate the vehicle’s details, the donation date, and any agreed-upon value.

Include Vehicle Information: Begin with the vehicle’s make, model, year, and VIN (Vehicle Identification Number). This ensures the donation is correctly attributed to the right car and helps the donor claim the appropriate tax deduction.

State the Donation Date: The date of the donation should be clearly marked on the receipt. This helps avoid confusion regarding the timing of the transfer, which can be crucial for tax purposes.

Describe the Condition of the Vehicle: Indicate whether the vehicle was in working condition or requires repairs. This helps provide an accurate reflection of its value. If the vehicle is sold by the charity, note that the donor may only claim the sale price, not the estimated market value.

Value of the Vehicle: If the vehicle is valued at over $500, the receipt must reflect this value. Donors should include any appraisal or estimates to substantiate the value, which can be helpful if questioned by tax authorities.

Signature and Acknowledgment: The charity should sign and date the receipt, acknowledging the donation. This confirms that the organization received the vehicle and will use it for its charitable purpose.

Here’s the revised version where repetitive words are minimized while retaining the meaning and structure:

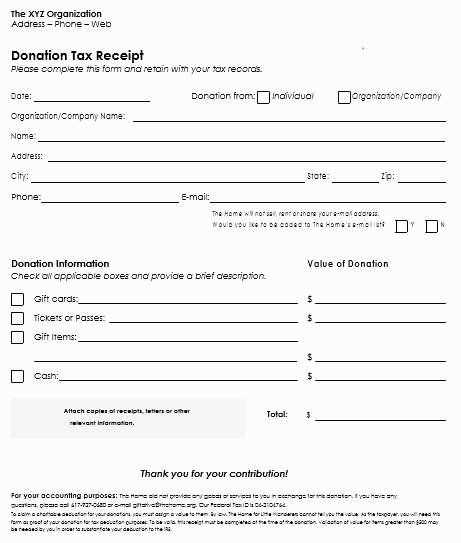

For a vehicle donation receipt, it’s crucial to include specific details that make the document clear and legally valid. Ensure the recipient’s name, donation date, and vehicle details are correctly listed. Specify whether the vehicle was donated as a complete unit or in parts. Include the donor’s full contact information, including address and phone number.

Key Sections to Include:

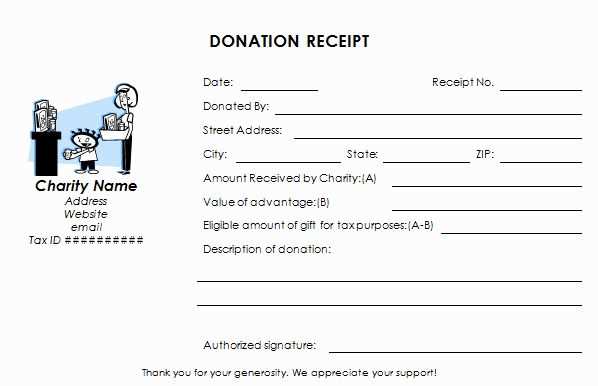

1. Donor’s Information: Clearly state the name, address, and phone number of the donor.

2. Vehicle Description: Include the make, model, year, and VIN (Vehicle Identification Number) of the donated vehicle.

3. Donation Details: Note the date of donation and whether any compensation was received in exchange for the donation.

Remember to add a statement confirming the vehicle’s condition and whether it was in running condition or not. This helps clarify the donation’s value for tax purposes.

- Vehicle Donation Receipt Template

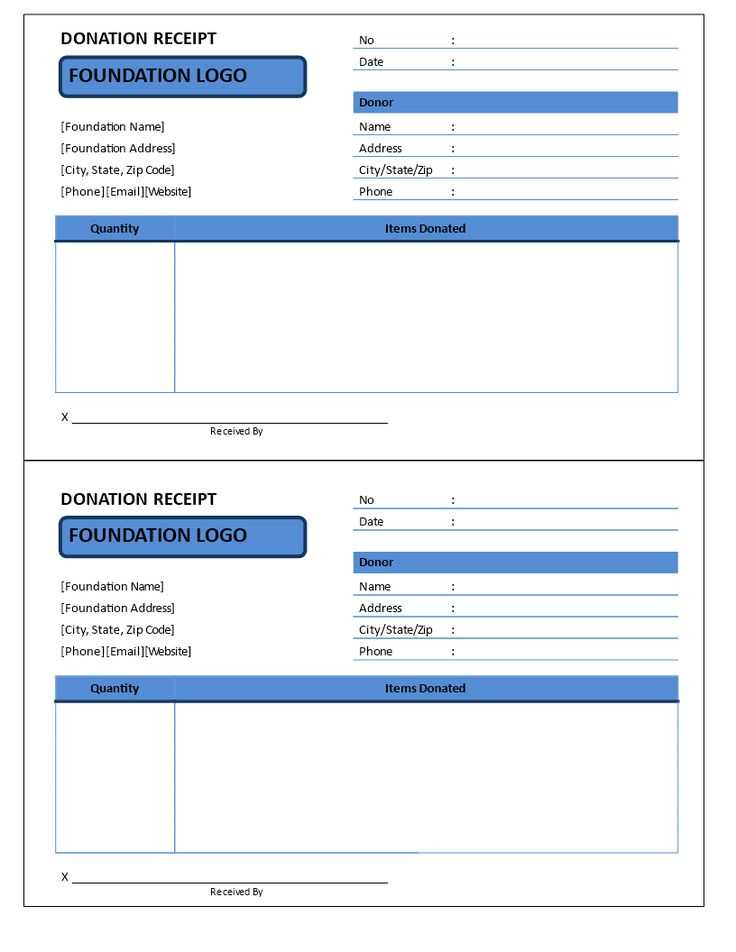

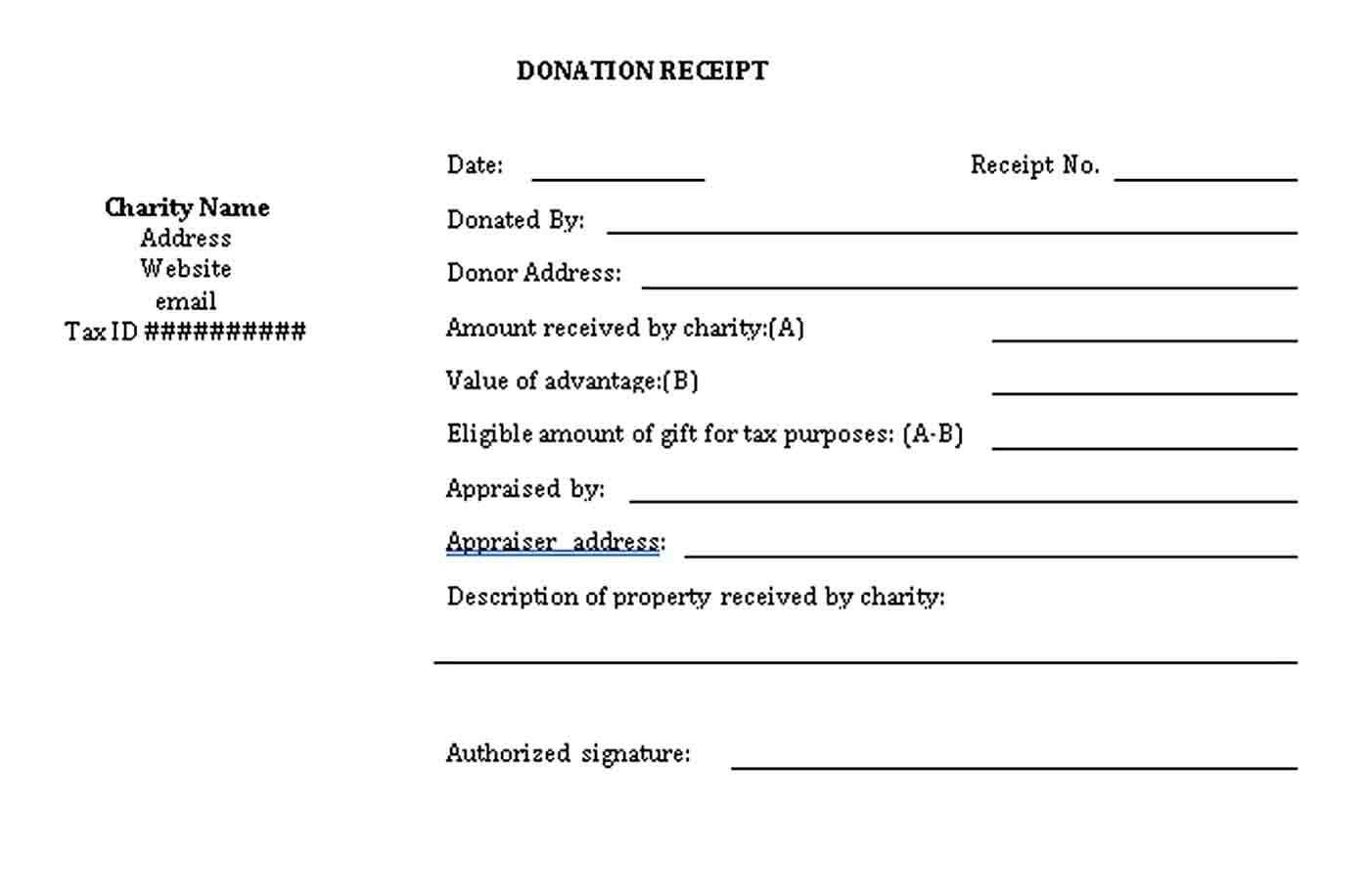

A well-organized vehicle donation receipt helps both the donor and the recipient. It serves as a legal acknowledgment of the transfer and can be useful for tax purposes. Here’s how to structure a vehicle donation receipt template:

- Donor Information: Include the full name, address, phone number, and email of the person donating the vehicle.

- Vehicle Details: List the make, model, year, Vehicle Identification Number (VIN), and mileage of the donated vehicle.

- Date of Donation: Clearly mention the exact date when the donation took place.

- Condition of the Vehicle: Specify whether the vehicle is donated in working condition, for parts, or as a non-functional vehicle.

- Donor’s Statement: Include a line where the donor acknowledges that the vehicle is being donated voluntarily without any payment or exchange.

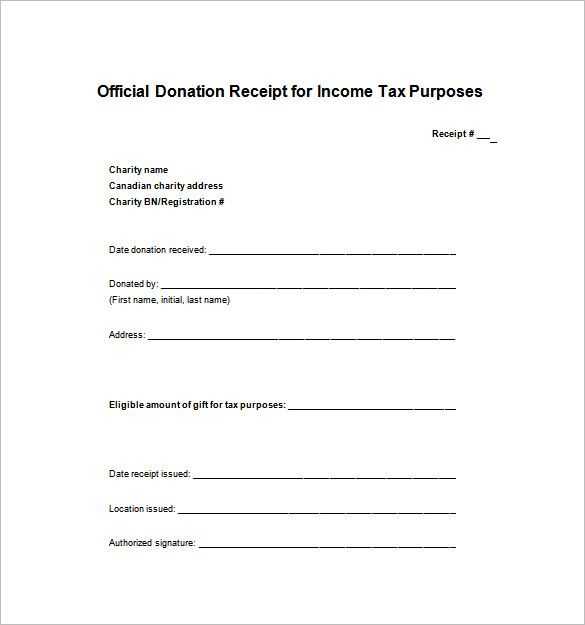

- Tax-Exempt Status: Indicate if the recipient organization is tax-exempt and provide any relevant identification numbers or information.

- Receipt Number: Include a unique receipt number for record-keeping.

- Signature of Authorized Representative: Include space for the recipient organization’s representative to sign and date the receipt, confirming the vehicle donation.

Ensure that both the donor and the recipient retain a copy for their records. This template helps keep the donation process clear and organized for all parties involved.

To create a valid donation receipt for a vehicle, begin by including clear details about the donation. The recipient organization’s name, address, and tax identification number should be included. Specify that the vehicle was donated, not sold, and include the vehicle’s make, model, year, and VIN (Vehicle Identification Number). This information ensures the document is legally sound for tax purposes.

Include the Date and Donor Information

Next, note the donation date and the donor’s full name and address. This helps confirm both the time of transfer and the individual who made the donation. For tax deductions, a donor needs to prove that the vehicle was donated within the given tax year, so accuracy in these details is key.

Determine the Vehicle’s Value

If the vehicle is valued over a certain amount (typically $500), the IRS requires that the donor receive a written acknowledgment of the donation. The receipt should state whether the donor received any goods or services in return. If the vehicle is valued at more than $5,000, an independent appraisal is generally needed. In these cases, the receipt must include the donor’s signed acknowledgment and the appraised value.

Be sure to include a clear statement about the condition of the vehicle at the time of donation. If it was donated “as-is,” make that clear in the receipt. If the organization offers any compensation or intended use for the vehicle, those terms should also be mentioned.

Include the full name and address of the organization receiving the vehicle. This ensures the donor knows where their donation is going and can verify the legitimacy of the organization. It’s important to clearly state the date of the vehicle donation, as this is required for tax purposes.

Provide a description of the donated vehicle, including its make, model, year, and VIN (vehicle identification number). This detail helps the donor establish proof of donation and assists with valuation.

State whether the vehicle was sold, used, or given away. If sold, mention the sale price. If it wasn’t sold, include the estimated fair market value of the vehicle at the time of donation. Be transparent about how the vehicle was handled after donation.

Include a statement clarifying that the donor did not receive any goods or services in exchange for the donation, unless that is the case. This will help the donor when claiming their tax deduction.

Finally, ensure that the acknowledgment includes the signature of an authorized representative from the organization. This provides an additional level of authenticity and trust to the document.

Ensure that the donor’s name is spelled correctly. A small typo can lead to confusion and affect the professionalism of your acknowledgment.

Accurate vehicle information is a must. Always verify that the make, model, year, and VIN of the donated vehicle are correct. Mistakes in these details could invalidate the receipt.

Inaccurate Donation Value

Providing an inaccurate estimated value of the vehicle can lead to issues with tax deductions for the donor. While you cannot assign a precise value, providing a reasonable estimate based on industry standards is key. Refer to trusted sources like Kelley Blue Book or NADA for valuation guidelines.

Omitting the Organization’s Tax ID Number

Every tax-exempt organization should include its official tax ID number. This is required for IRS purposes and ensures that the donation is recognized as tax-deductible.

Be clear about whether goods or services were provided. If the donor received any compensation for the vehicle (e.g., a tax deduction was matched with a service or good), make sure it is noted in the acknowledgment. This helps avoid any misunderstandings later on.

Failing to include a date on the acknowledgment could cause issues for both the donor and the organization when claiming the donation on tax returns. Be sure to list the exact date the vehicle was received.

Lastly, make sure the acknowledgment is signed by someone from your organization who is authorized to do so. This adds legitimacy to the receipt and avoids confusion about its authenticity.

Key Information for Your Vehicle Donation Receipt Template

Ensure that your vehicle donation receipt includes the donor’s name, address, and contact information. This will help with proper record-keeping and potential future communication. Include the vehicle’s make, model, year, and VIN (Vehicle Identification Number) to accurately identify the donation.

Details on the Donation Value

Clearly state whether the vehicle is donated as a whole or for parts. If the vehicle’s value exceeds a certain amount, ensure that the donor receives a written acknowledgment of the donation. For donations of over $500, include an estimate of the vehicle’s market value or mention if the vehicle was sold by the charity and the amount for which it was sold.

Tax Deduction Information

Include a statement that specifies whether the donation is eligible for a tax deduction. If applicable, remind the donor to consult a tax professional for accurate reporting and filing. Make sure the receipt contains the charity’s tax-exempt status number and details about how the donor can use the donation for tax benefits.