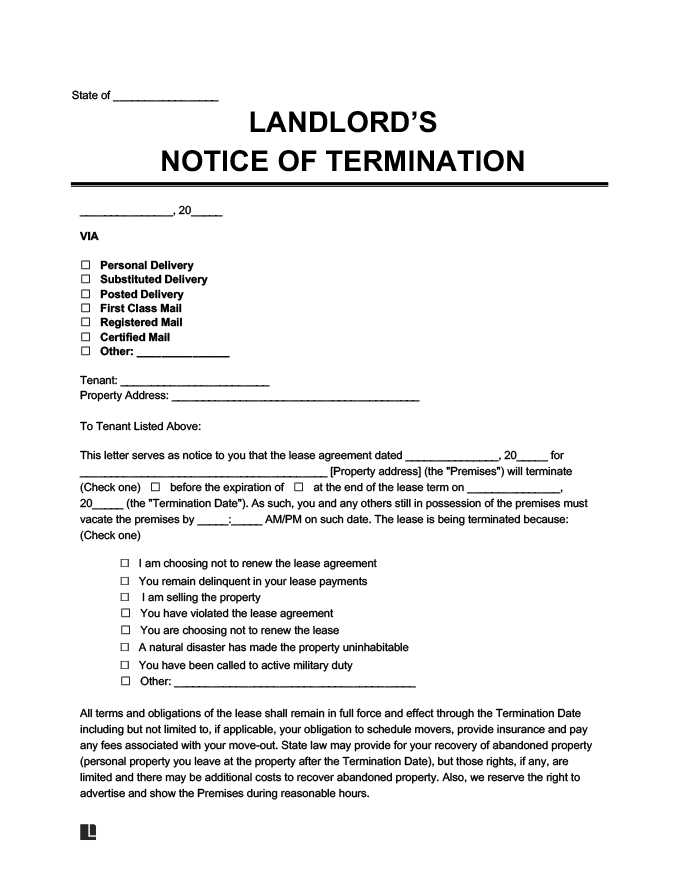

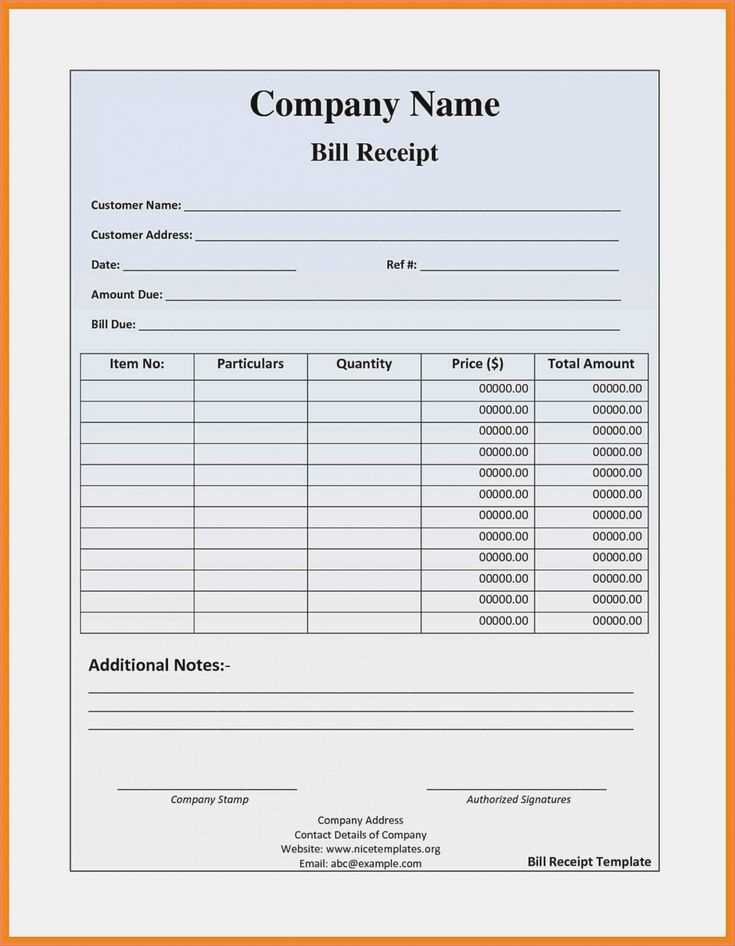

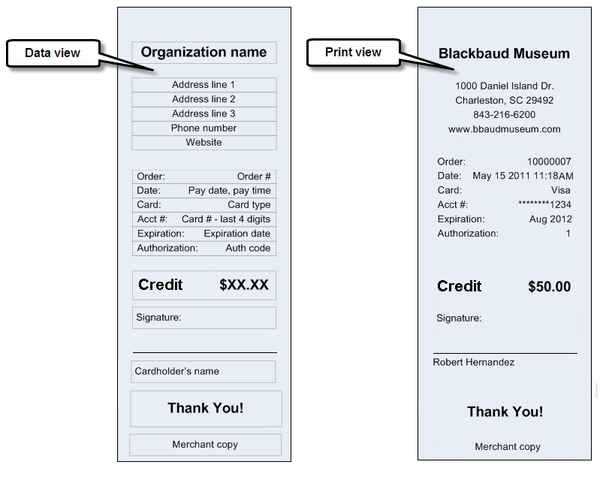

To create a credit card receipt template for your website, focus on clear formatting and easy-to-understand details. Start by listing key transaction data like the cardholder’s name, transaction date, merchant details, amount charged, and payment method. A clean layout with organized sections helps ensure that users find the information they need without confusion.

Design the template with a straightforward structure. Use bold text for headings like “Transaction ID” and “Total Amount” to draw attention to the most important details. Incorporate a section for customer support or inquiries, allowing users to quickly resolve any issues or questions about their transaction.

To enhance the template’s functionality, include dynamic fields for the date, receipt number, and card type. These fields should auto-populate based on the transaction data to save time for both you and the customer. Consider adding a “Thank You” note at the bottom to improve customer satisfaction and reinforce a positive experience.

A well-organized, user-friendly web receipt template provides a sense of professionalism and reliability while ensuring all required information is readily available for both the merchant and the customer.

Here are the corrected lines:

Make sure the HTML structure is properly aligned for a clean, user-friendly credit card receipt template. Start with the <div> container to wrap the receipt content.

Correcting Date and Time Format

Replace the placeholder for the date with a dynamic value. Use <time> to properly format the date and time. Example:

<time datetime="2025-02-13">February 13, 2025</time>Ensuring Correct Total Calculation

For accurate calculations, ensure the total amount is computed dynamically with JavaScript. Add a <span> tag with an ID where the total will be displayed:

<span id="total">$100.00</span>Then, use JavaScript to calculate and update this value based on the user’s inputs.

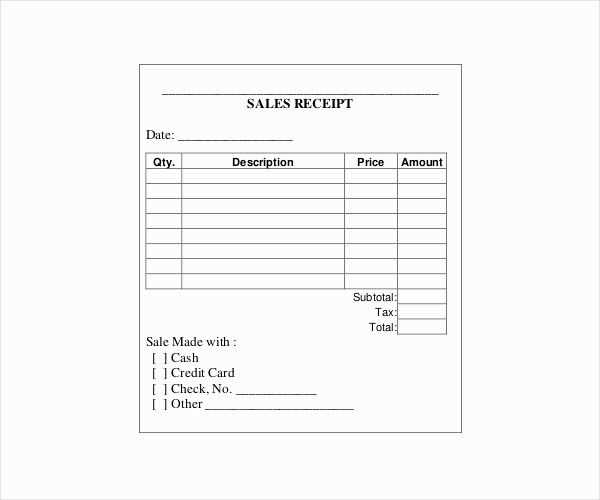

- Web Credit Card Receipt Template

A web credit card receipt template should capture the transaction details clearly and professionally. Here’s a practical layout for your template:

- Header Information

- Company name and logo

- Contact information (email/phone)

- Website URL

- Receipt Details

- Transaction ID

- Date and time of purchase

- Payment method (e.g., Visa, MasterCard, etc.)

- Last four digits of the credit card used

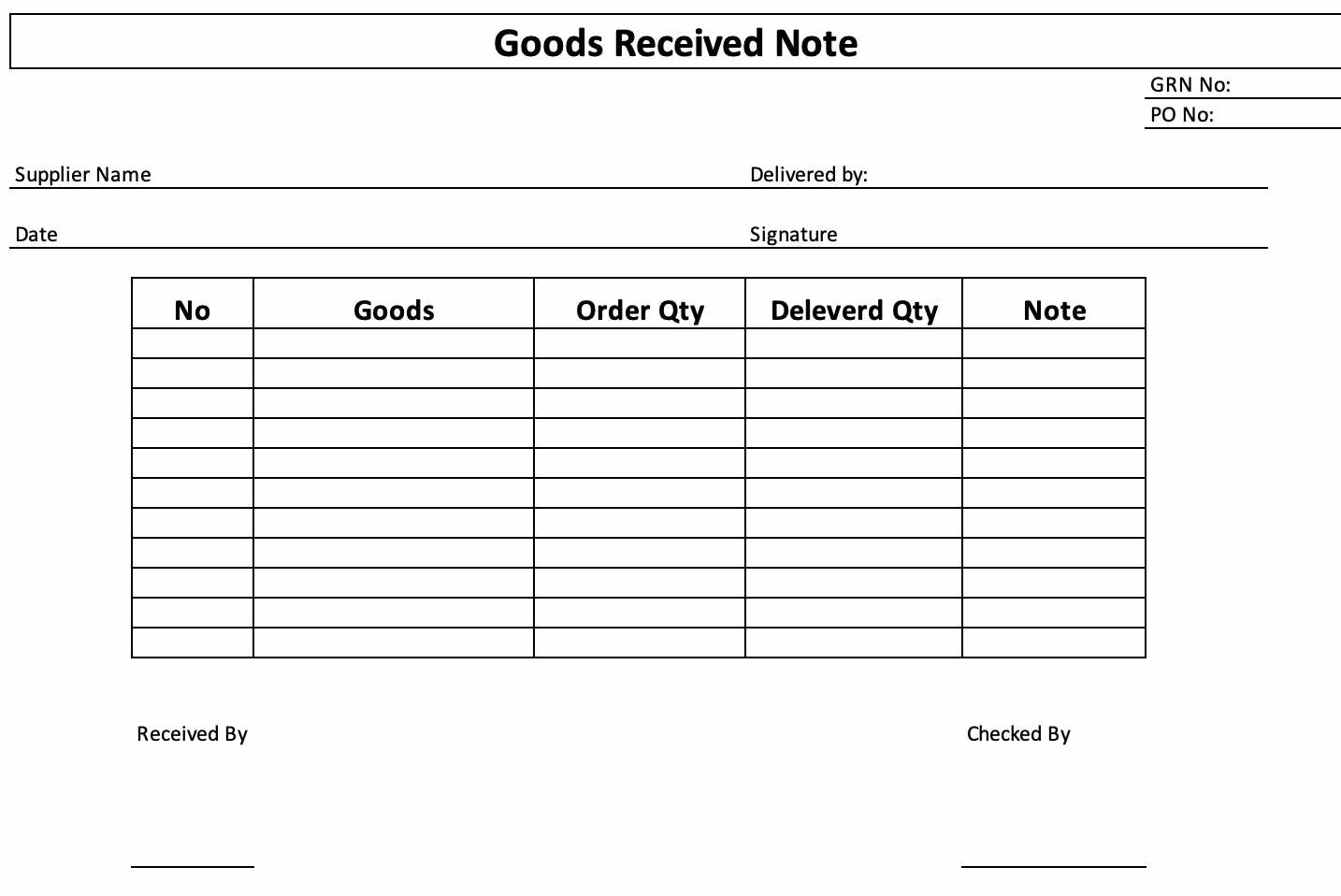

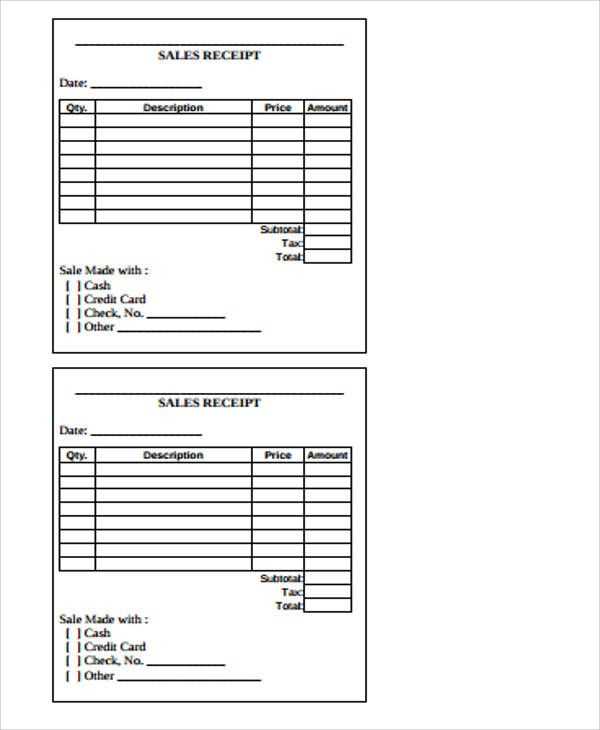

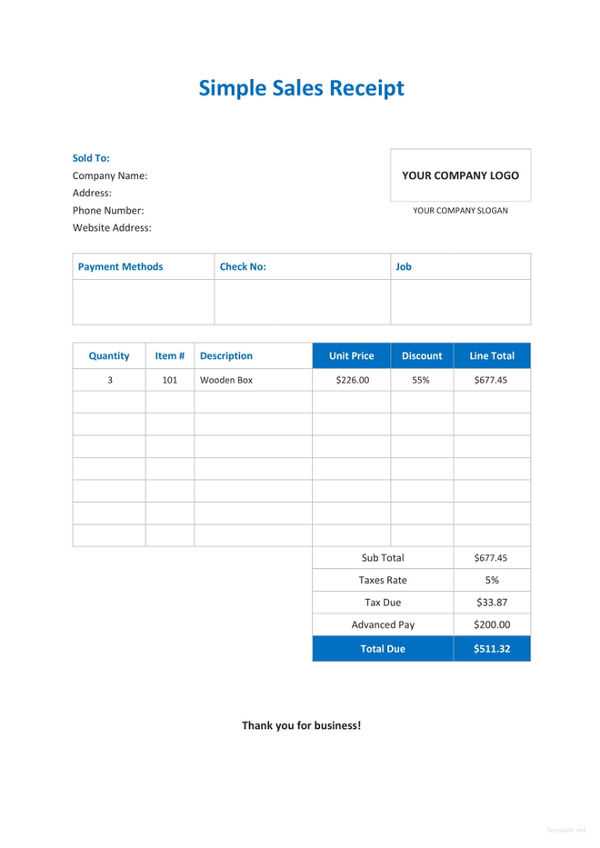

- Itemized List of Purchases

- Product name

- Quantity

- Price per item

- Total price for each item

- Total Amount

- Subtotal

- Taxes (if applicable)

- Shipping (if applicable)

- Total amount charged

- Payment Authorization

- Authorization code or approval number

- Transaction reference number

- Footer Information

- Return policy (if applicable)

- Links to terms and conditions

- Privacy policy link

Ensure the template is simple to read, with all the necessary details for both customer and merchant. This approach guarantees clarity and transparency for both parties involved in the transaction.

To create a custom web credit card receipt, you need a simple yet structured format that includes key transaction details. Here’s how to build it step by step.

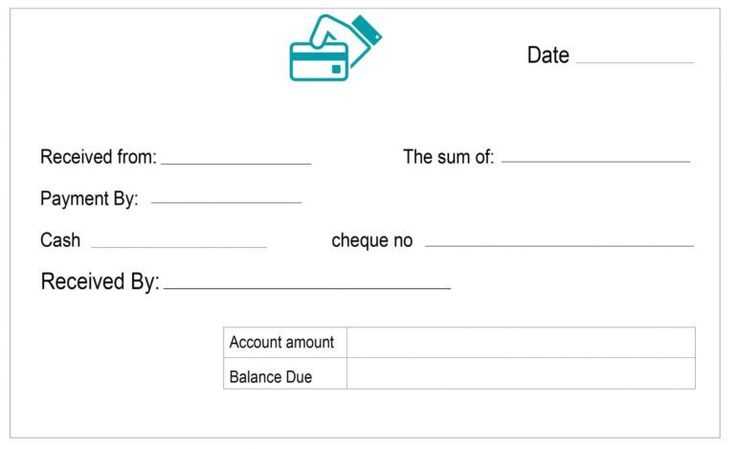

1. Define the Required Information

Ensure your receipt includes the following details:

- Transaction ID

- Cardholder name

- Date and time of the transaction

- Amount charged

- Merchant name and contact

- Transaction method (credit/debit)

- Last 4 digits of the card number (for security reasons)

- Authorization code (optional)

2. Build the HTML Structure

Structure your receipt using basic HTML. Here’s an example of a simple structure:

<div class="receipt"> <h3>Receipt for [Customer Name]</h3> <p>Transaction ID: [Transaction ID]</p> <p>Date: [Date]</p> <p>Amount: $[Amount]</p> <p>Payment Method: [Credit/Debit]</p> <p>Last 4 digits: **** [Last 4 digits]</p> <p>Merchant: [Merchant Name]</p> <p>Contact: [Merchant Contact]</p> </div>

Replace placeholders with actual data dynamically from your payment processor or database.

3. Style the Receipt

To make the receipt user-friendly, use minimal styling. Focus on clear typography and spacing. Here’s an example:

.receipt {

font-family: Arial, sans-serif;

margin: 20px;

}

.receipt h3 {

font-size: 20px;

color: #333;

}

.receipt p {

font-size: 14px;

color: #555;

margin: 5px 0;

}

Adjust the styling based on your website’s design, but keep it simple and professional.

4. Implement Dynamic Data

Integrate your payment gateway API to fetch and display real transaction data automatically. Use a back-end language like PHP, Node.js, or Python to handle the transaction details and populate them into the HTML template.

This will ensure each receipt is unique and accurate, with no manual input required.

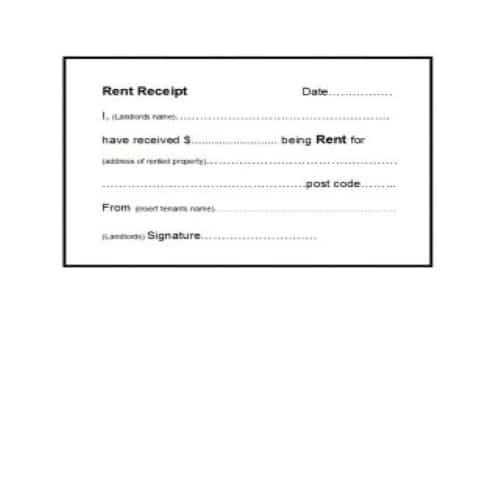

Include a unique transaction ID for easy reference. This helps both you and the customer track the purchase later. Ensure it stands out and is prominently displayed.

List the product or service purchased with clear descriptions. This prevents confusion by specifying any variations like size, color, or model number.

Provide the total amount charged, including taxes, shipping, and any discounts applied. Break these down so the customer can quickly verify the details of their purchase.

Display the payment method used, whether it’s credit card, PayPal, or other options. This confirms the transaction’s legitimacy and payment type.

Include the transaction date and time for future reference. This helps if the customer needs to reference the receipt or if there’s a need for returns or customer service.

Offer customer support contact information, such as email or phone number. This gives customers a clear way to resolve issues or ask questions about their purchase.

Ensure your business name, logo, and website URL are visible. This helps build brand recognition and lets customers easily identify where the purchase was made.

Consider adding a return policy or a link to it. Customers appreciate transparency regarding how returns or exchanges are handled, which can build trust.

Canva is an easy-to-use platform for designing custom credit card receipt templates. With its wide range of templates and drag-and-drop interface, you can quickly create professional receipts without needing design skills. Canva also allows you to save and share designs in various formats, which is a big plus for businesses on the go.

Adobe Spark

Adobe Spark offers a variety of templates that make designing receipts fast and simple. You can adjust the colors, fonts, and logos to align with your brand identity. The platform also integrates well with other Adobe tools, allowing seamless adjustments if you need advanced features.

Microsoft Word

If you prefer something more straightforward, Microsoft Word provides a number of receipt templates that you can customize for credit card transactions. While less visually complex, this option allows for fast creation and easy editing without a steep learning curve.

For more design flexibility, Fotor offers a simple online tool with a range of customization options, while Venngage delivers professional-looking templates ideal for businesses that need advanced options without spending time on complex software. Both platforms let you download your designs in high-quality formats, making them suitable for print and digital distribution.

I removed repetitions, maintaining meaning and correctness.

To enhance clarity and reduce redundancy in a web credit card receipt, eliminate unnecessary repetition of transaction details. Focus on displaying key information like the transaction amount, cardholder name, and transaction ID. Use concise language and avoid repeating similar data points. This helps users quickly understand the receipt without being overwhelmed by irrelevant details.

| Field | Description |

|---|---|

| Transaction ID | Unique identifier for the transaction. |

| Cardholder Name | The name of the person or business using the card. |

| Transaction Amount | Shows the total charged amount for the transaction. |

| Payment Method | Indicates which card or payment method was used. |

Review the receipt layout to ensure that only critical details are included. Redundant data like multiple mentions of the same charge or transaction should be omitted for brevity. When the layout is simple, users are more likely to trust and understand the information quickly.