Keep your auto detailing business organized with a clear, easy-to-use receipt template. A well-structured receipt helps clients understand the services provided and the charges incurred. It also simplifies your record-keeping and helps build trust with customers. Start by ensuring that the template includes the basic elements: date, client information, service details, and payment breakdown.

Service Details: Specify the exact services performed, such as exterior washing, interior detailing, waxing, and any additional add-ons. Use simple descriptions to avoid confusion. A clear service list ensures both you and your client know exactly what was delivered.

Pricing Breakdown: Include individual service charges along with any applicable taxes or discounts. If multiple services are provided, clearly separate the costs so the client can easily understand how the total was calculated. This transparency helps avoid disputes later on.

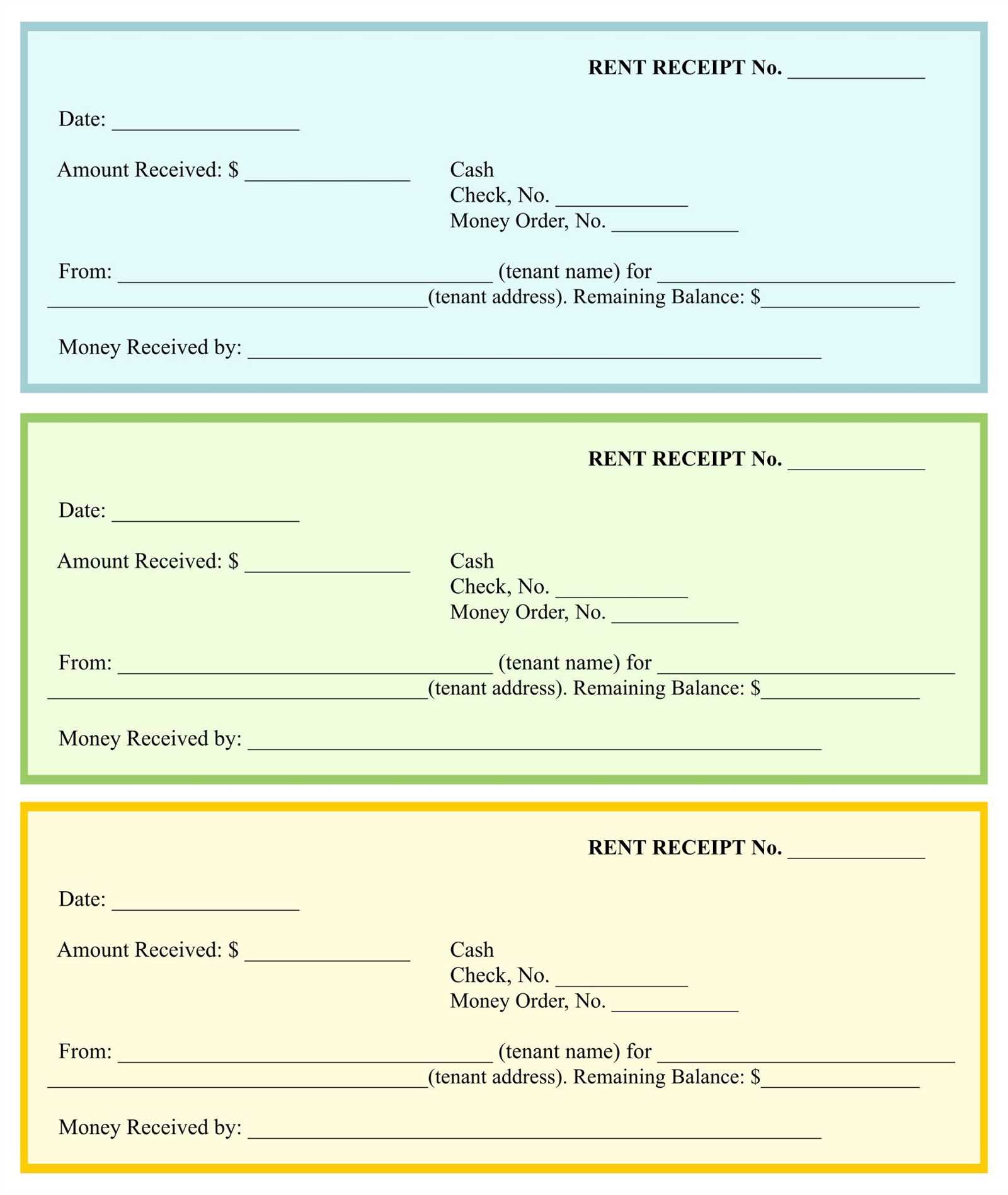

Payment Method: Make sure to include a section for payment method, whether it’s cash, card, or another form of payment. This section can help track your cash flow and avoid future misunderstandings with clients regarding payment status.

Having a consistent, professional receipt template doesn’t just improve organization, it enhances customer satisfaction by providing clear and honest documentation for services rendered.

Receipt Template for Auto Detailing Services

Provide clear itemization of services and costs on your receipt. Each section should be labeled with a brief description of the service, the unit price, and the quantity or hours worked. For example, under “Interior Detailing,” list services like vacuuming, upholstery cleaning, and dashboard polishing separately, followed by their corresponding prices. This will ensure customers understand exactly what they are paying for and can easily verify the services rendered.

Include a subtotal to summarize the total cost of the listed services before applying taxes. The tax rate should be clearly indicated and calculated based on the subtotal. For instance, if your state has a 7% sales tax, display this as a separate line item to avoid confusion.

Don’t forget to include payment information at the bottom of the receipt. Specify if the payment was made in cash, by card, or through another method, and include any relevant transaction details or receipt numbers. This provides transparency and helps in case of any future inquiries or returns.

Finally, add your business name, contact information, and service date at the top or bottom of the receipt. This allows customers to reach out for any follow-up questions or concerns and gives the receipt a professional look. Keep the layout simple and clean to ensure all information is easy to read.

Customizing Fields for Auto Detailing Receipts

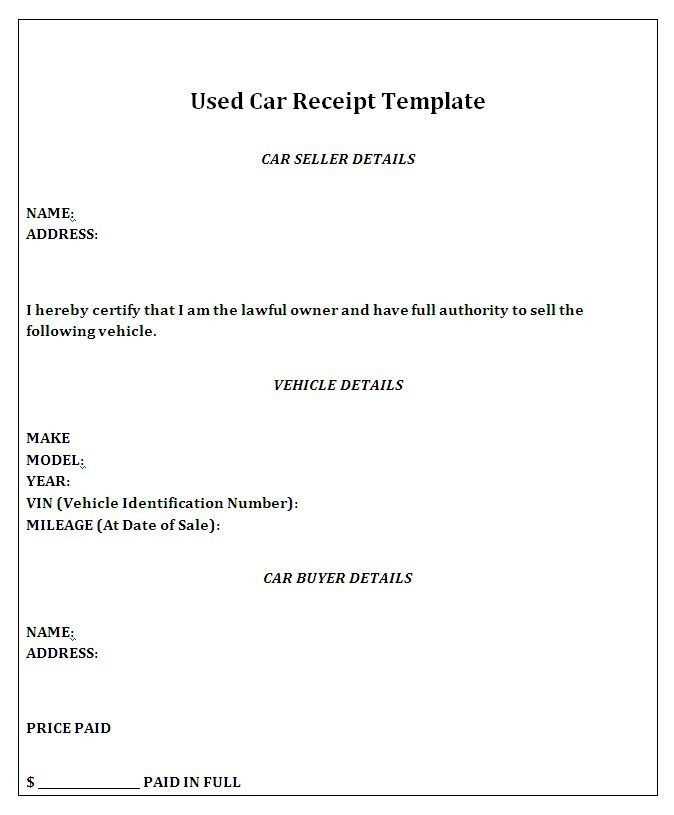

Adjust your receipt template by tailoring fields that meet the specific needs of auto detailing services. Begin with basic customer details: name, address, and contact information. Ensure that space is available for vehicle information, such as make, model, and year, so clients can quickly verify the service applies to their car.

Service Breakdown

Include a section for detailing services rendered, where each individual task, like exterior wash, interior vacuum, or waxing, is listed. Include both the time spent on each service and its associated cost. Allow space for optional add-ons, like headlight restoration or paint protection.

Payment Details

Ensure there is a clear area for total charges, with itemized services and taxes listed separately. Providing payment method options, including cash, card, or online payment, streamlines customer experience and ensures transparency.

Lastly, leave space for additional notes, whether for client feedback or reminders for next service dates. Customizing these fields helps track client preferences and ensures clarity in every transaction.

Incorporating Payment Methods and Discounts

Include a section in your receipt for various payment methods. List options like credit cards, debit cards, cash, mobile payments, and checks. Clearly state the transaction amount for each method used. This adds transparency and clarity for both the customer and business.

Discounts should be outlined with clear labels to avoid confusion. If a customer is using a promotional code, display the discount amount next to the code used. Ensure that the discount is deducted from the total before taxes. This way, the final amount paid reflects all adjustments accurately.

For recurring customers or loyalty programs, you can show accumulated discounts or points on the receipt. This encourages repeat business and creates a positive customer experience.

Don’t forget to mention any applicable tax calculations after discounts are applied. Always display the pre-tax amount, the discount amount, the tax rate, and the total due after all deductions to avoid errors or misunderstandings.

Clear and precise breakdowns help customers understand the value they are receiving, which builds trust and enhances satisfaction.

Legal Requirements for Auto Detailing Receipts

Auto detailing businesses must comply with specific legal requirements when issuing receipts. These receipts serve as formal records of transactions and help ensure transparency in business practices.

- Business Identification: Receipts must clearly state the business name, address, and contact details. This ensures that the customer can easily identify the service provider.

- Date and Time: Each receipt should include the date and time of the service. This provides a clear timeline of when the work was completed.

- Description of Services: A detailed list of services provided is necessary. This includes any specific auto detailing services, such as exterior wash, waxing, or upholstery cleaning.

- Pricing Information: All charges must be clearly itemized. This includes the cost for each service, any additional fees, taxes, and total amount paid. Transparency in pricing helps avoid misunderstandings.

- Payment Method: It is required to specify the method of payment, whether it’s cash, credit card, or another form. This ensures that both parties have a clear record of the payment transaction.

- Refund Policy: If applicable, the receipt should reference the business’s refund or cancellation policy. This helps customers understand their rights regarding service dissatisfaction or changes.

By meeting these legal requirements, auto detailing businesses can build trust with customers while protecting themselves from potential disputes.